$30,000 Bitcoin and a Free ASIC Giveaway

🚨S19 Pro (110T) GIVEAWAY🚨

🚨ASIC GIVEAWAY🚨

Complete these steps for a chance to win a FREE S19 Pro (110T).

Follow @BlockwareTeam and RT this tweet.

Sign up for the Blockware Marketplace.

Complete KYC & MPA that you will receive via email after step 2.

The winner is picked on July 4th. Good luck to all participants!

* If you refer a friend to the marketplace before July 4th, you'll receive 1 extra entry per referral that completes all entry requirements. Just be sure your referral tells us that you sent them!

$30,000 Bitcoin and the BlackRock Bitcoin Trust

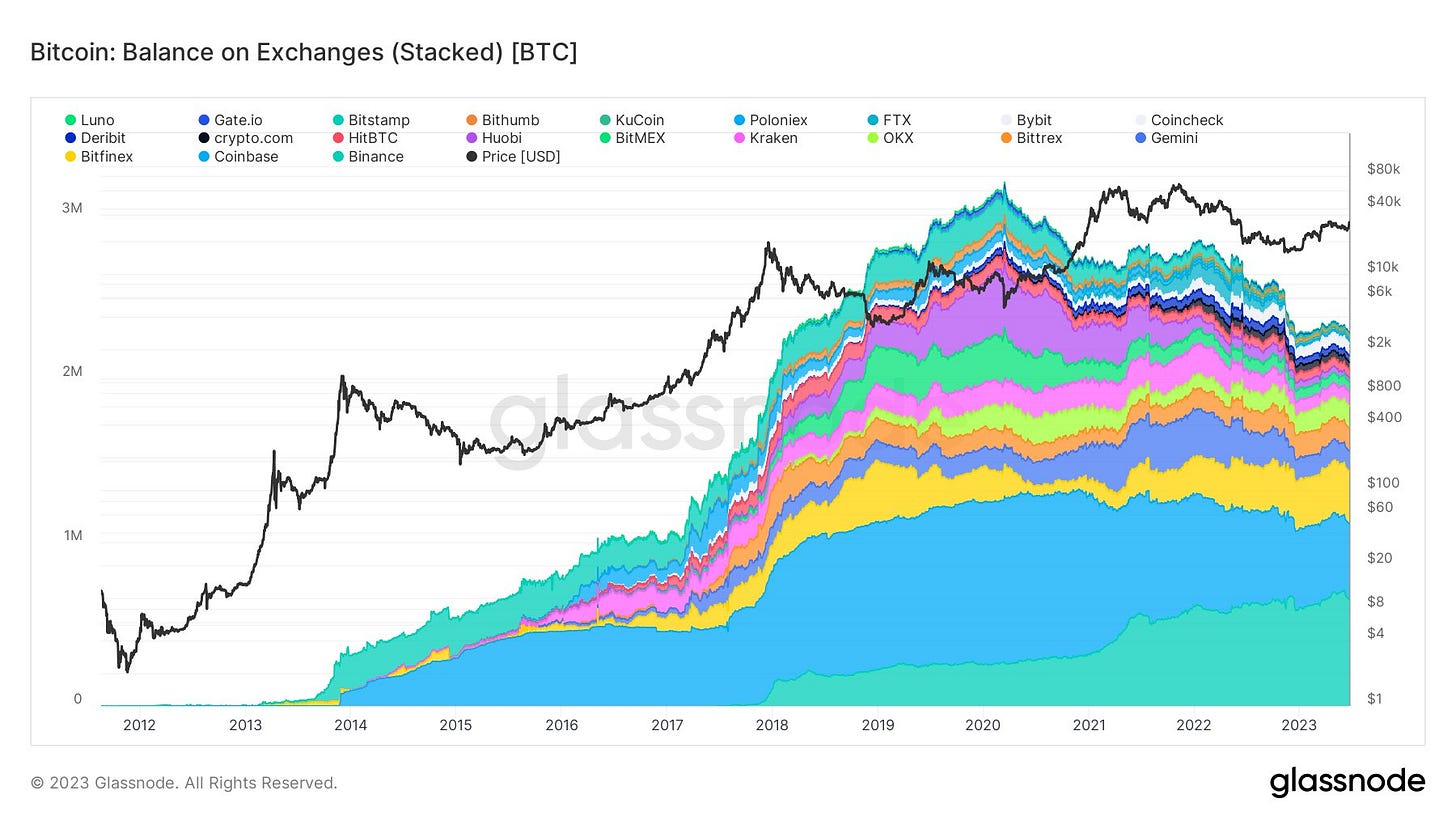

The past week has been filled with bullish developments in the Bitcoin space. BlackRock and other Wall Street giants are racing to get in line for a Bitcoin ETF, there is enhanced regulatory clarity around Bitcoin, and global exchange balances continue to make new lows.

In short, there’s not much Bitcoin left for sale, and a tsunami of demand is approaching.

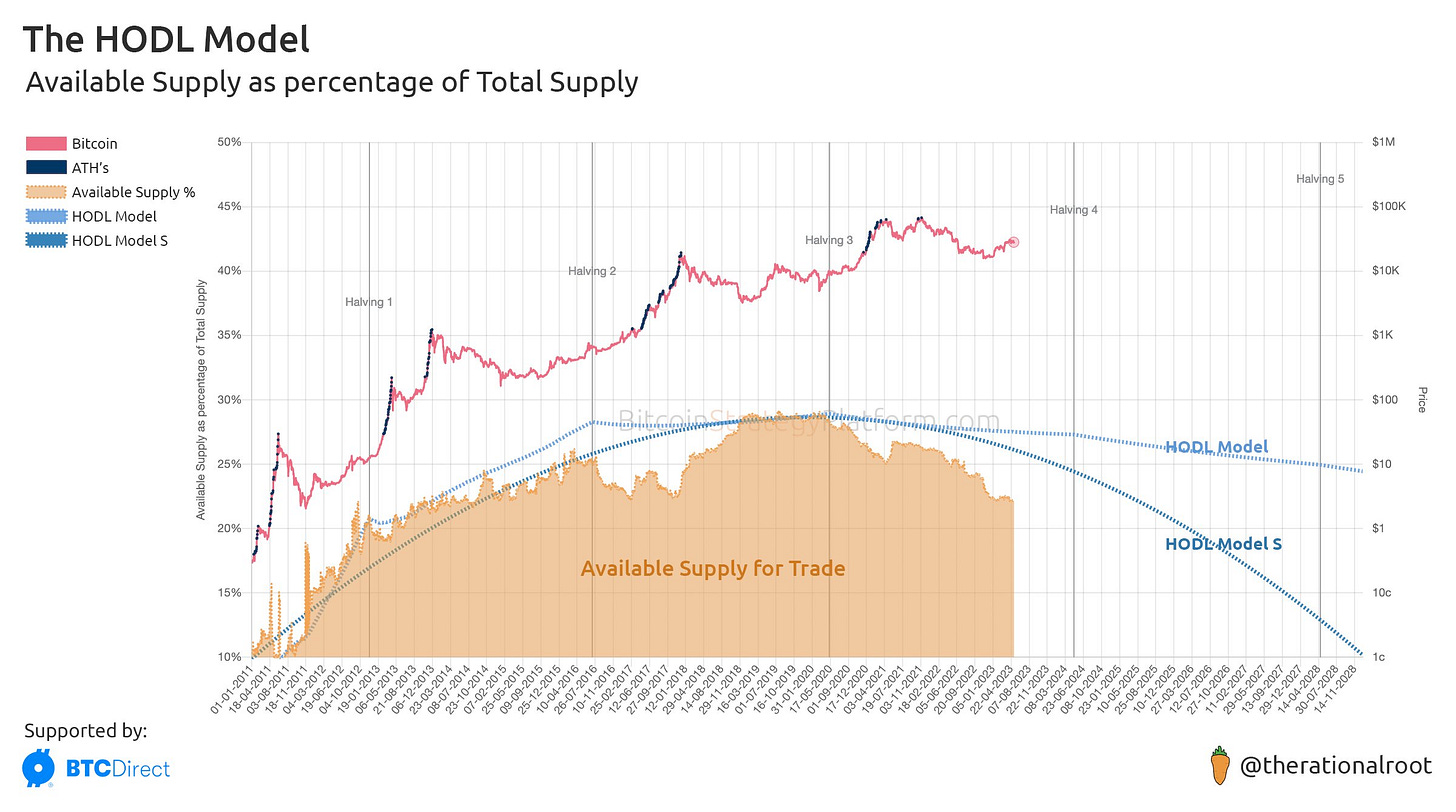

Further evidence that supply is drying up was posted by on-chain analyst @therationalroot, who also recently made an appearance on the What Bitcoin Did podcast. His “HODL model” estimates the amount of Bitcoin supply available for trade is rapidly decreasing. Most coins are locked in strong hands. This indicates the next bull run could potentially see returns greater than the 2020/2021 bull run.

Capitalize on the Next Bull Run by Mining

If Bitcoin is on the cusp of another parabolic bull run, buying Bitcoin ASICs and running them at a hosting facility is one of the best ways to accumulate a sizeable position in BTC.

You can buy the dip in ASIC prices, avoid data center build-out costs, mine Bitcoin profitably, and then ultimately sell the ASICs on the Blockware Marketplace.

It’s an advanced Bitcoin DCA strategy.

There’s no better mining partner than Blockware. Below are our current quotes for bulk ASIC purchases.

Contact sales@blockwaresolutions.com or reach out here.

Whether you are an institution, hedge fund, family office, or HNWI, let’s start mining Bitcoin together.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.