Blockware Intelligence 2023 Forecast - Revisited

Revisiting our 2023 predictions for Macro, Bitcoin, and Bitcoin Mining

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Blockware Intelligence Podcast. Mitch Askew interviews Terence Michael. Terence is an Emmy-nominated producer from Hollywood, Real Estate investor, and Bitcoiner. Mitch & Terence discuss Real Estate vs Bitcoin as savings vehicles, the diminishing trust of Hollywood and other mainstream institutions, why the Bitcoin Spot-ETF solves the unit bias problem, and more!

2023 Market Forecast - Revisited by Blockware Intelligence

At the end of 2022, we published the above report which outlined our 2023 market projections for Macro, Bitcoin, and Bitcoin mining.

In lieu of our regularly scheduled newsletter, we have decided to revisit our predictions, examining what we got right and what we got wrong.

We are grateful to all of you for making Blockware Intelligence part of your Bitcoin and Macro content diet. We look forward to providing more valuable insights throughout 2024 and beyond!

Without further ado, let’s dive in!

Click here to read our original 2023 forecast.

Key Predictions:

Macro

Year-over-year CPI value will come down throughout 2023, despite inflation remaining an issue.

Lingering inflation will likely result in the Fed holding rates elevated throughout 2023.

Lower housing prices and slightly higher unemployment

Markets bottom in 2023

Bitcoin On-Chain

BTC will likely break the short-term holder and long-term holder realized price resistance levels.

We expect a continued decline in exchange balances as more users self-custody their BTC

Data suggests the number of on-chain entities will grow tremendously.

Mining, Energy, and Geopolitics

The S19XP is expected to retain its market value longer than its predecessors.

Bitcoin mining difficulty growth rate will likely slow in 2023.

The United States will prone to be the best jurisdiction for Bitcoin mining.

Macro Prediction 1: Disinflation

Result: ✅

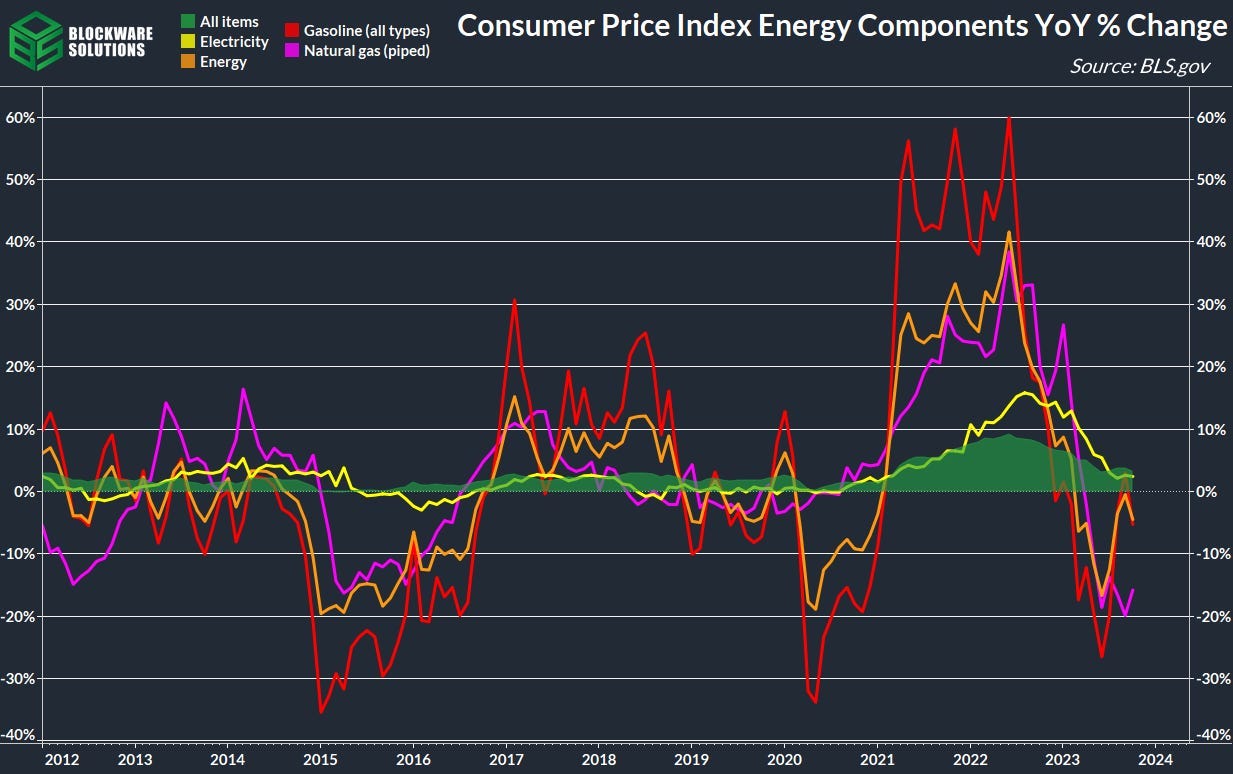

Of course, inflation has remained above its long-term average throughout 2023. As predicted, we saw declining year-over-year CPI values as high-interest expense took its toll on the energy market and consumers. That’s without mentioning that high month-over-month values in 2022 create an environment where YoY values should’ve declined, as they did.

We also made the important distinction that despite declining YoY CPI values, inflation would remain an issue and at the forefront of the monetary policy conversation throughout the year. Unlike the 2023 Fed pivot that many other analysts had predicted.

What we failed to foresee was the broad-based net decline in energy pricing, which we thought would take more time to play out. This played a major role in the disinflation that defined 2023.

Macro Prediction 2: No cuts for the Fed Funds Rate

Result: ✅

Throughout 2023, the Fed remained contractionary in its stance, as they allowed for higher interest rates to have their intended effect on the broader macro-economy. We predicted that lingering inflation would cause the Fed Funds Rate to peak at 5.25% in 2023, which is looking to be a hair short, with the FFR seemingly peaking here at 5.25-5.50%.

As previously mentioned, we did not foresee any cuts to the FFR in 2023, which is not the same outlook we have for 2024. We did predict that the Fed would ultimately begin lowering the magnitude of their rate hikes, before leaving rates stagnant for a period of time. Treasury yields were accurate in their pricing in of a FFR >5.0% in the first half of 2023, but hadn’t priced in additional hikes until later in the year.

Macro Prediction 3: Lower Housing Prices and Slightly Higher Unemployment

Result: 50/50

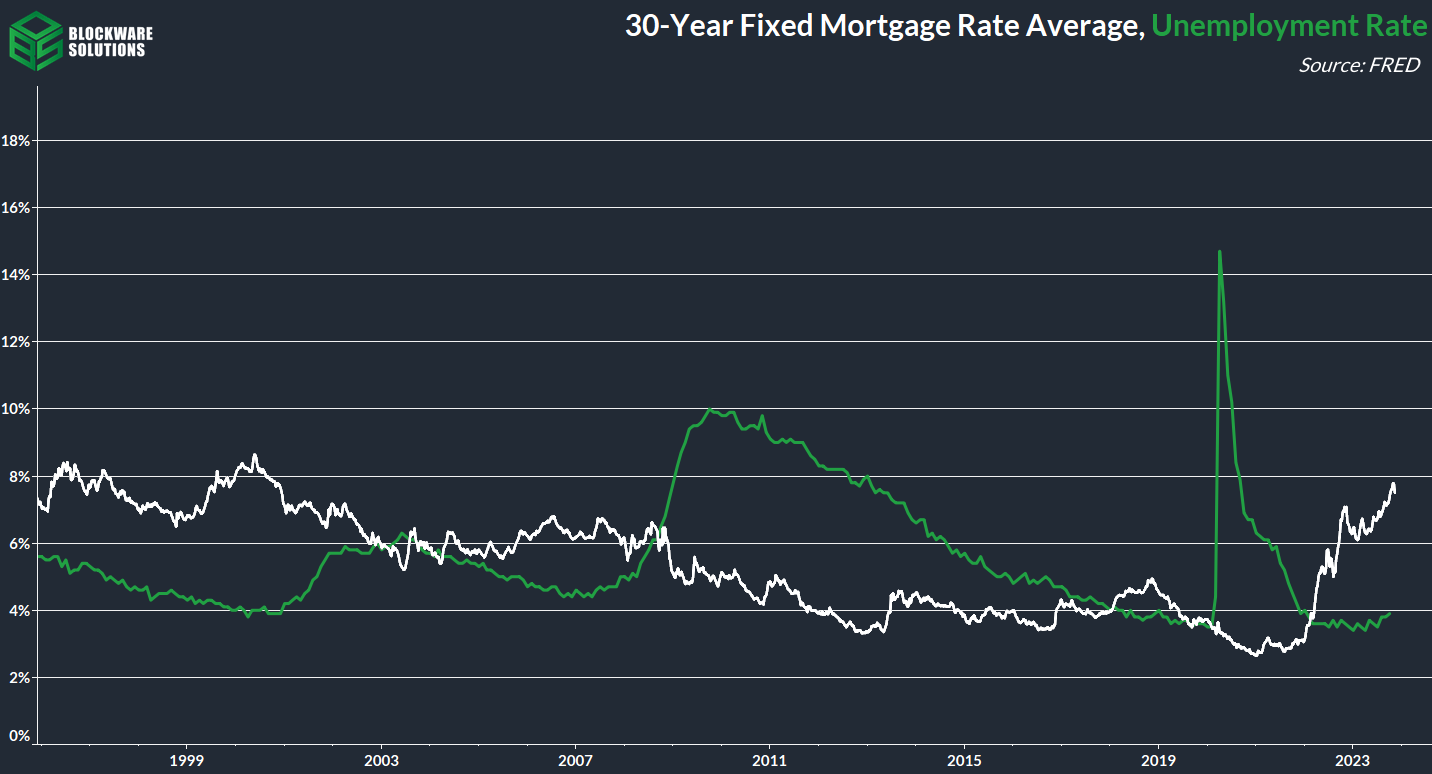

We did, in fact, see housing prices come down to start 2023, however, prices have since rebounded and the Case Shiller sits at all-time highs. What Blockware Intelligence failed to predict was the resounding strength of the American consumer. Despite mortgage rates breaching their highest national average in over 20 years, demand for mortgages has remained mostly positive.

We did see a marginal increase in unemployment in recent months. However, as we predicted, the increase in unemployment wasn’t exceptionally high. This fall in employment is usually something that comes later in recessionary cycles.

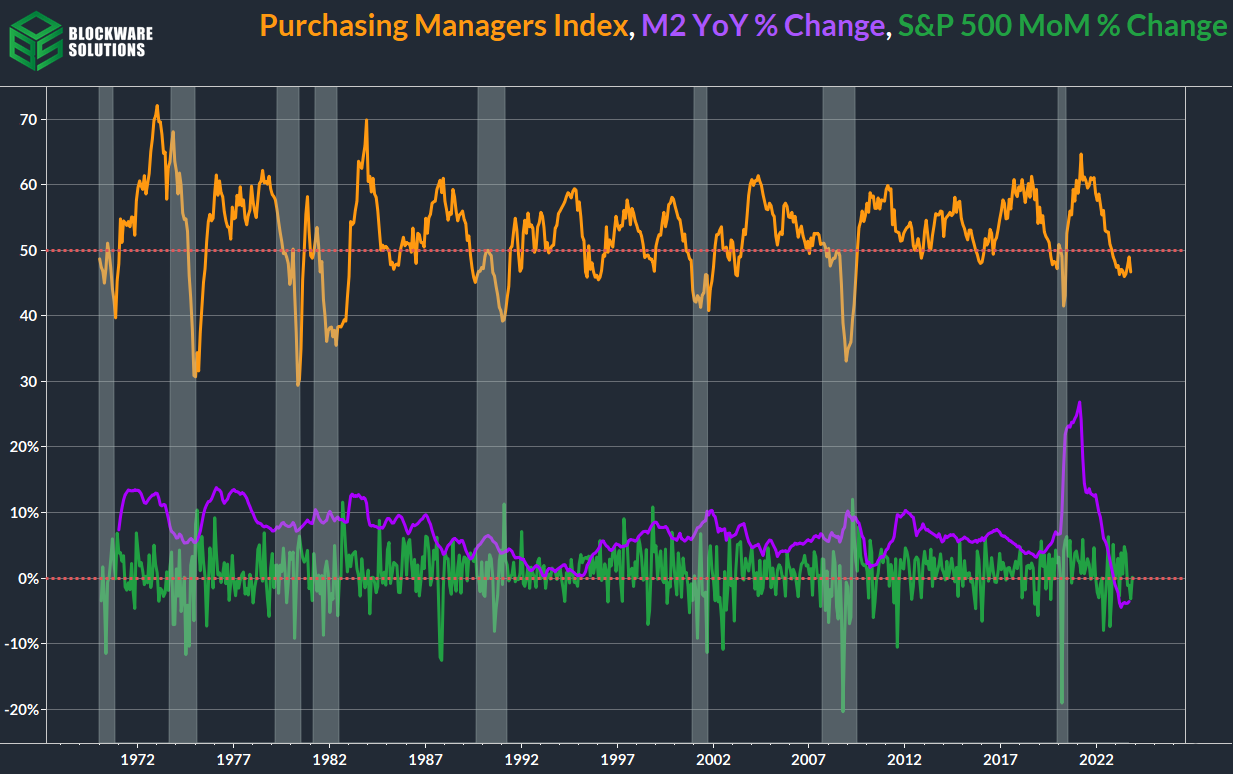

Macro Prediction 4: Bottoms in Asset Prices & M2

Our boldest prediction for 2023 was that markets would head higher, after putting in a new bottom in 2023. While whether or not the lows are in is up for debate, the stock market did not breach the lows it put in in December 2022.

This strong year of equity price action came at the behest of an outlook of rate cuts for 2024, and strong earnings growth in 2023. Despite the clear issues that the economy is facing, many businesses are still performing very well with a strong consumer base.

We also got a bounce from the M2 money supply, likely as a result of the Fed’s BTFP program injecting $100+ billion of liquidity into a troubled banking sector. M2 has since begun to taper off again, and may be continuing to head lower for a period of time.

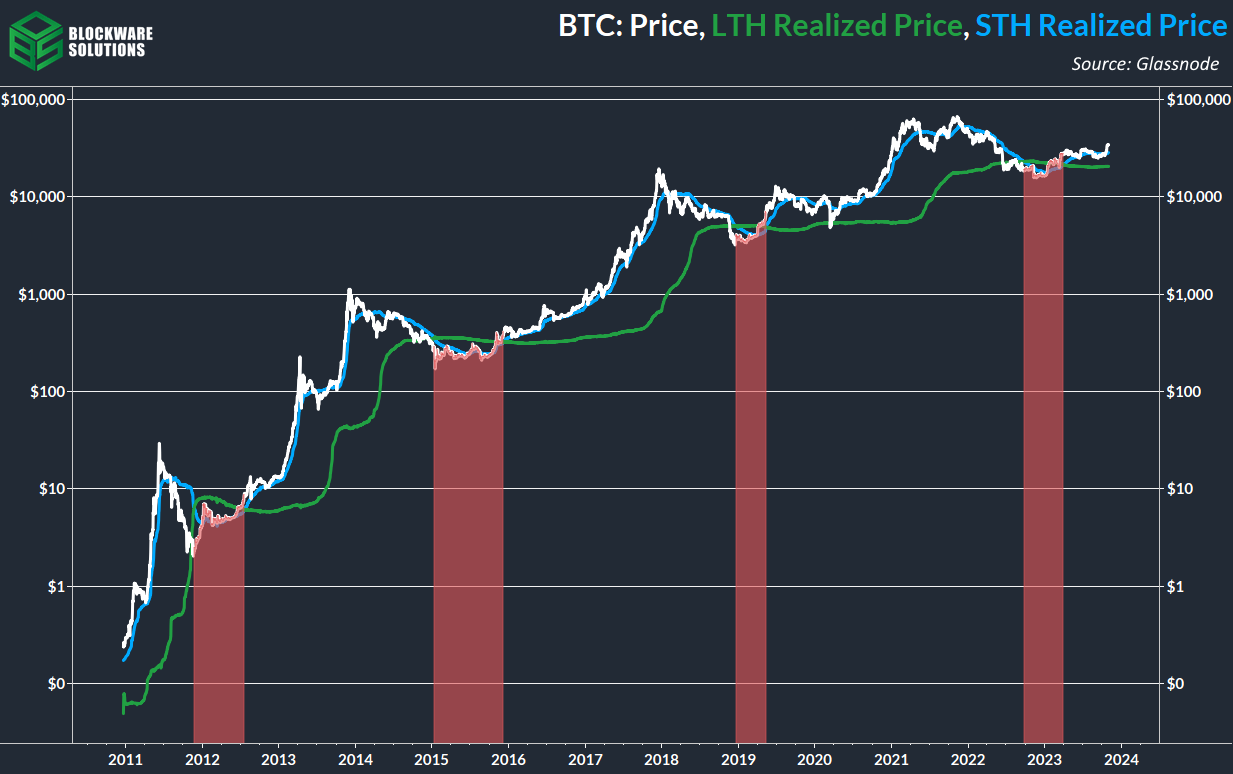

Prediction 5: Price surpassing LTH & STH Realized Price

Result: ✅

This prediction manifested as true less than a month into the year, with the post-FTX drop to $16,000 being the cycle bottom.

BTC trading beneath long-term holder realized price has marked bottoms with impeccable accuracy, this time was no different.

Throughout the year BTC has teetered back and forth with short-term holder realized price, serving as both resistance and support. During the month of October, this metric has confidently been flipped into support.

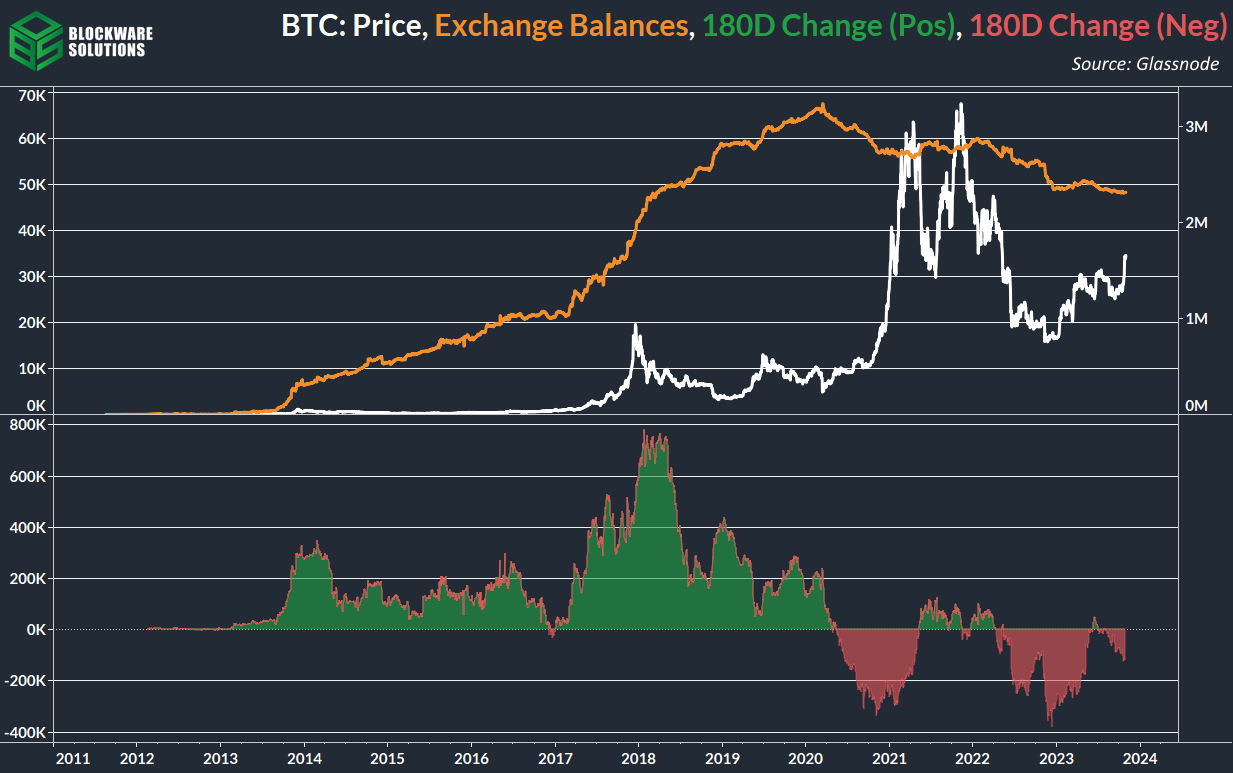

Prediction 6: Continued decline in exchange balances

Result: ✅

While exchange balances have declined year-to-date, and our prediction was directionally accurate, the magnitude at which they declined fell short of our expectations. Exchange balances started the year at 2,360,787 and are now down to ~2,311,622; a net decline of roughly 50,000 on the year. However, the silver lining is that exchange balances have dropped by ~124,000 over the past six months.

This has been the first halving epoch in which exchange balances have declined from start to finish, which presents a strong argument against the idea that future bull market returns will be diminishing. Bitcoin’s absolute scarcity is being felt by the market for the very first time.

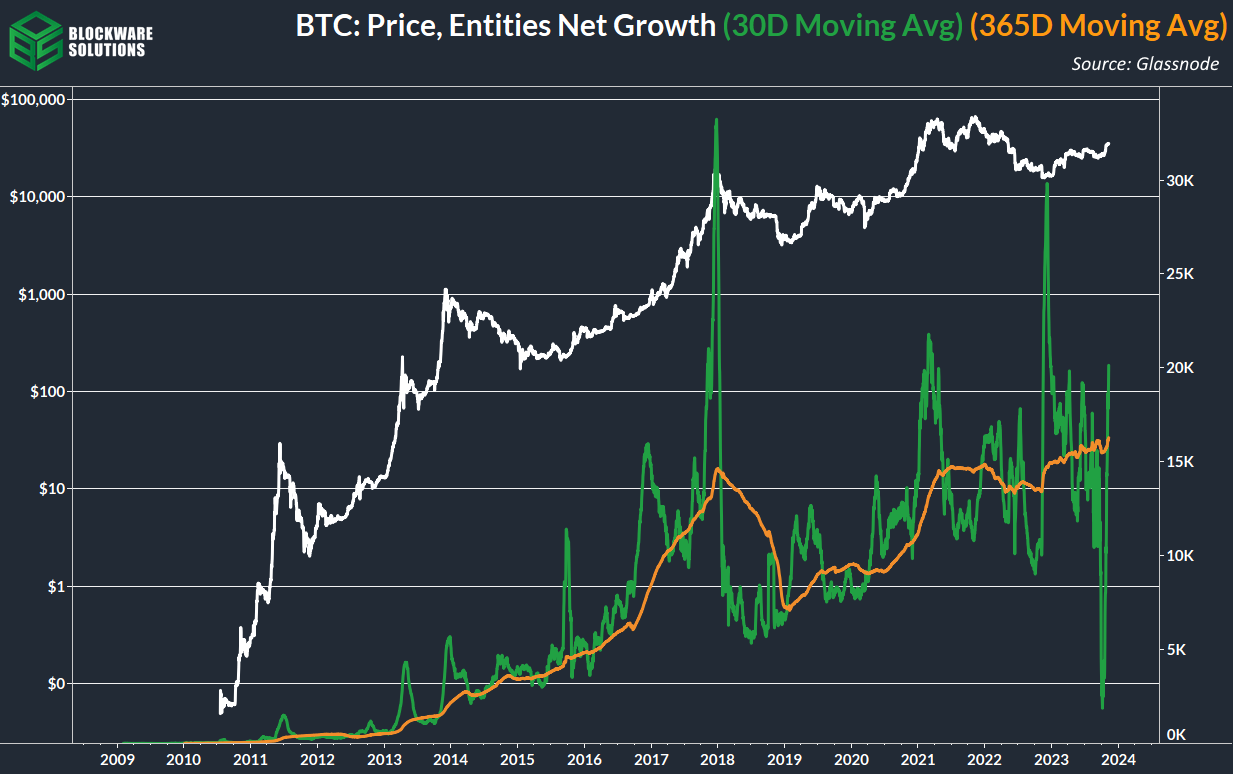

Prediction 7: Growth in on-chain entities

Result: ✅

Our analysts' views on the signal (or lack thereof) provided by this metric have changed. “Entities” is simply looking at addresses but accounting for known exchange addresses, addresses consolidating, etc. This metric is not necessarily an accurate representation of “total users”, but it does provide signal on market behavior.

In 2023 we saw major spikes during the ordinal craze, eliminating any doubt about the future of a transaction-fee-based economy for miners. If demand for wizard pictures is capable of driving fees as high as it did, then demand for Bitcoin as a means of final settlement from global financial institutions will give miners more than enough TX fees to make up for the diminishing subsidy.

Moreover, you can see users consolidating UTXOs during periods of low fees. A drop in entities/addresses coincided exactly with the time at which 1 sat/vByte TXs began making it into blocks. Present-day Bitcoiners seemingly understand the importance of UTXO management.

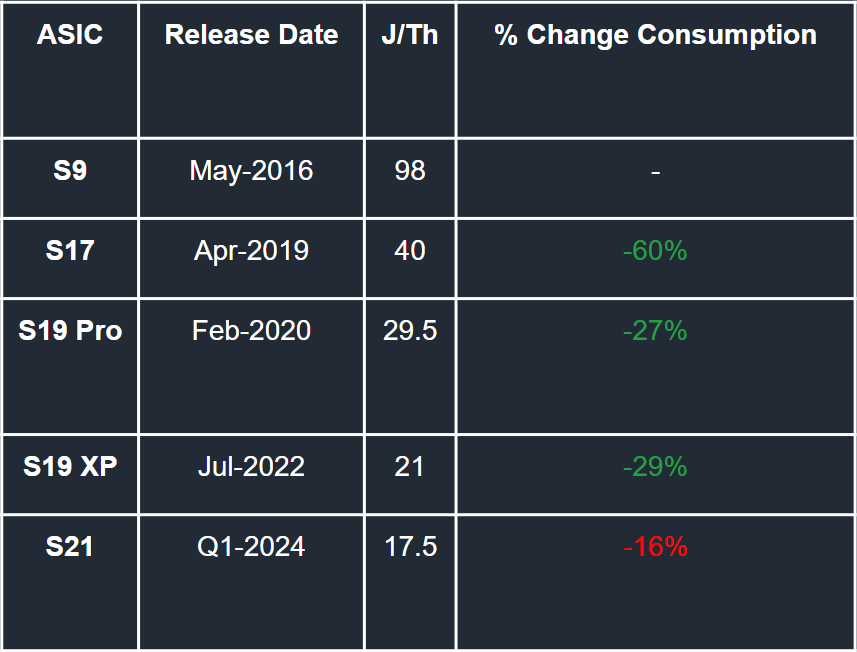

Prediction 8: The XP will retain market value longer than its predecessor.

Result: TBD

While it may be too early to say this is correct, the trend of diminishing marginal efficiency gains between each generation of Bitcoin ASICs has continued. Absent the jargon, this means that while each new generation ASIC is better than the previous one, the gains in energy efficiency (W/Th) are decreasing with each generation. The S21 consumes 16% fewer Jules per hash than the S19 XP, while the S19XP consumes 29% fewer Jules per hash compared to the S19.

With S19s still alive and well almost 4 years after their release, especially amongst miners with access to dirt-cheap power, the XP is poised to stay relevant, profitable, and valuable, for years to come.

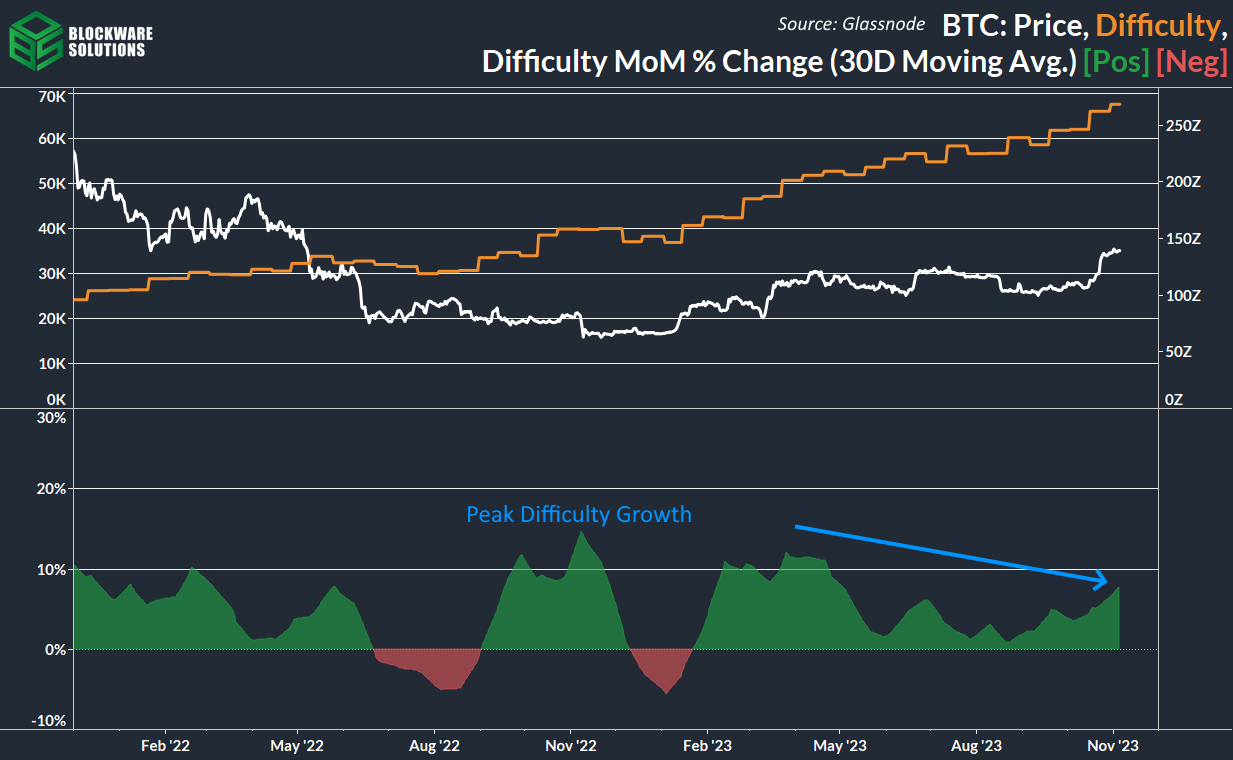

Prediction 9: Mining difficulty growth rate will slow in 2023

Result: Mostly true

Bitcoin mining difficulty and total network hashrate are correlated 1:1. If hashrate doubles, then mining difficulty doubles. Since ASICs are commoditizing, it is becoming more and more difficult to increase the network hashrate by manufacturing a new advanced ASIC. Instead, hash rate and difficulty are growing due to increased consumption of cheap and wasted energy.

While difficulty grew in 2023, the rate at which it grew was down from the peak growth rate in 2022. The reason for the slow down in difficulty growth was trifold:

ASIC Commoditization

Lack of Mining Investment Made in 2022

High global energy prices

The largest increases in difficulty came in the aftermath of increases in the price of Bitcoin as previously unprofitable miners were able to plug their machines back in.

All that being said, we are surprised as to the degree to which difficulty grew this year. While the growth rate was down compared to 2022, it managed to surpass our expectations, with hashrate now north of 450 EH/s.

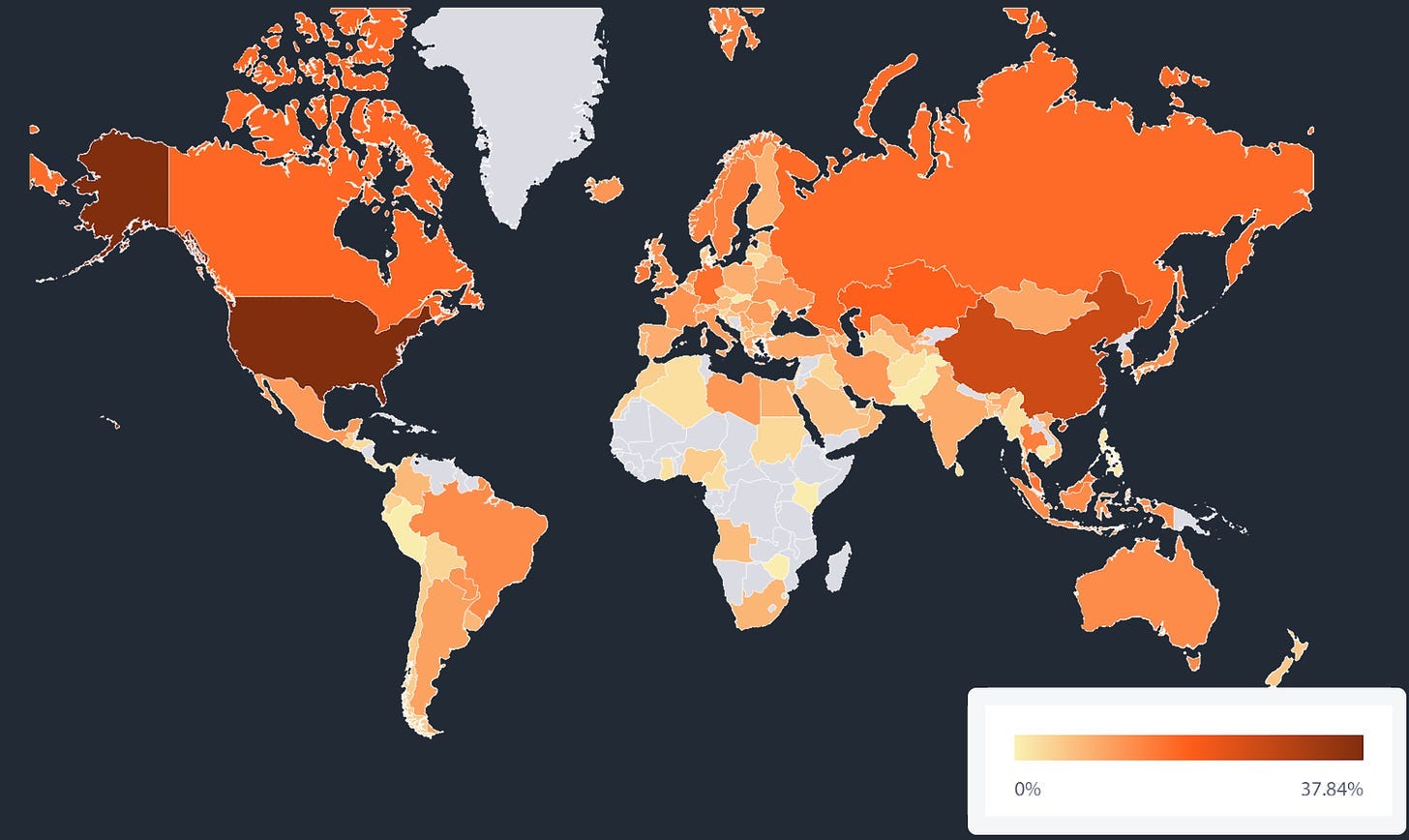

Prediction 10: The US will be the hotbed of Bitcoin mining

Result: ✅

Despite hostility from vocal, uneducated legislators such as Elizabeth Warren, The United States has continued to make itself the global hotbed of Bitcoin Mining, with a litany of states passing mining-friendly legislation. Thanks to the efforts of groups such as Satoshi Action Fund, “right to mine” bills were passed in the states of Arkansas and Montana.

Public mining companies have continued to expand their operations within the United States, and more people have been awakened to the unique value proposition of Bitcoin miners as grid balancers.

I almost didn't read this one but I'm glad I did.