Blockware Intelligence Newsletter: Week 179

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/7/25 - 6/13/25

Geopolitical Tensions Rise – Bitcoin Doesn’t Care

The S&P opened 0.5% lower Friday morning following news of escalating conflict in the middle east. You wouldn’t know it from the headlines and the sentiment, but BTC has helped up exceptionally well in the wake of this bad news. Being the most liquid asset in the world (traded globally 24/7/365), BTC is always the first to react to major news events. A wick to $100,000 Thursday afternoon was quickly recovered from and now BTC is holding ground at $105,000.

We’re not going to pretend to be geopolitical experts – we’re experts on Bitcoin and financial markets. So we’ve no insights into the seriousness of the current situation or the likelihood of true, world-wide conflict. However, the dire fiscal situation of the United States and recent comments from Treasury Secretary Scott Bessent are clues that a serious shakeup in the financial world order may be around the corner.

“This remains the purpose of the Bretton Woods institutions. Yet everywhere we look across the international economic system today, we see imbalance.”

“We must enact key reforms to ensure the Bretton Woods institutions are serving their stakeholders—not the other way around.”

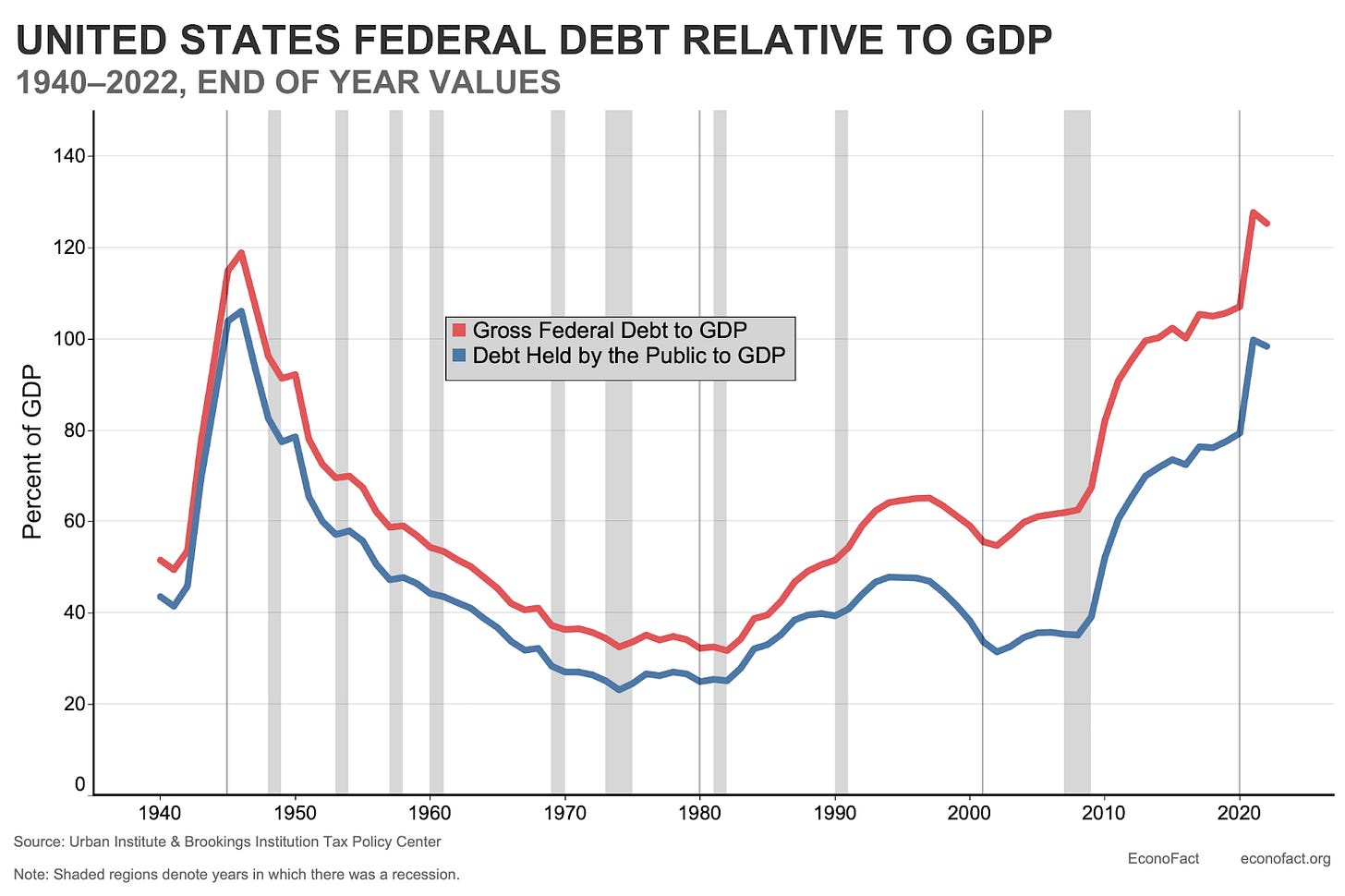

Since 2020 the United States Dept to GDP has been north of 120% – its highest level since the end of World War II. The unserviceable amounts of debt in the system forced a global restructuring (Bretton Woods Agreement). Bessent’s quotes allude to a new restructuring – perhaps involving BTC in some capacity.

“Grow the economy” is code for “nominal GDP must increase so tax revenues are high enough to service the debt.” One of two things must happen for nominal GDP to grow faster than the current interest rates of 4 to 5%:

Dollar Devaluation

Rapid Productivity Increase via AI

Both of these scenarios are insanely bullish for Bitcoin.