Blockware Intelligence Newsletter: Week 22

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 1/14/22-1/21/22

Summary:

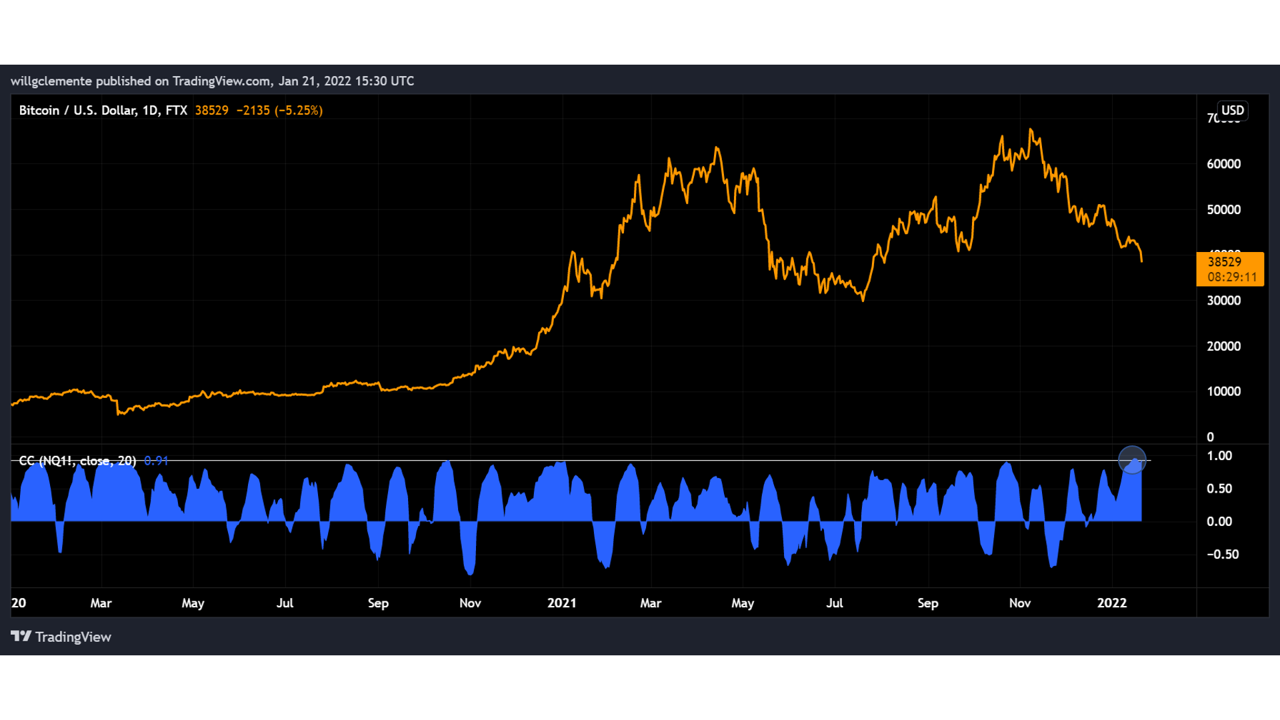

Bitcoin’s correlation to the Nasdaq reaches an all-time high

Stock market sentiment is low to neutral, meaning we’re headed in the right direction but likely not quite there for a true bottom.

Despite the current sentiment, many indicators are predicting a short-term bounce in Nasdaq stock prices in the near term.

Bond prices and interest rates have an inverse relationship, which helps to explain the current environment we’re seeing in the equity market.

Silvergate Capital actually had a solid quarter of growth despite an earnings miss and shares cut down by 25% on Tuesday.

Bitcoin difficulty hit a new all-time high last night, indicating full network recovery from the China mining ban in the summer of 2021.

This week Bitcoin’s correlation to the Nasdaq reached an all-time high. With no catalyst to cause idiosyncratic flows to Bitcoin, it is trading in tandem with risk-off behavior from equities with a high beta. Without a catalyst to trigger idiosyncratic flows, Bitcoin is at the mercy of risk-off assets for the time being.

Capitulation seems to be slowing for now, meaning a decreasing amount of losses are being realized. This is shown by net realized profit/loss.

This comes as supply in profit is down below 70%, nearing levels at the bottom of the summer correction.

Still a lack of large buyers, or what we refer to as “whales” on-chain. This looks at entities with over 1,000 BTC and then filters out exchanges and other known on-chain entities.

Futures 3M basis is down to roughly 6%. This means you can long spot and short 3 month Bitcoin futures contracts to capture a 6% annualized yield. Far from 45% last spring, but it sure beats 0.6% that you can get from a 1-year treasury bond.

There are still 3 days left before this weekly close, but a weekly close below 40K leaves no clear levels of support before the 30K area.

General Market Update

We saw another tough week in the markets. At this point, it’s no secret that this harsh environment is a culmination of the expansion of the Fed’s balance sheet and M1 money supply over the last year and a half. Currently, I’m on the lookout for a bounce, sentiment isn’t that negative yet, but we’re quite oversold on many metrics.

CNN’s Fear & Greed metric puts us at a 52, a surprisingly neutral value. The Nasdaq’s put/call ratio, which essentially compares the amount of bearish vs. bullish options bets is around 1.

This tells us that currently roughly the same amount of money is betting on the Nasdaq to fall as it is to rise. A value of >1 would tell us that there are more long puts (bearish bets) than long calls (bullish bets).

While this may sound good, we would like to see the put/call ratio rise to an extreme at a bottom. This is so there’s the possibility of a short squeeze with many folks left to flip long.

Bottoms come when sentiment is at its most negative. A great example of how this works was the 2020 COVID crash in the stock market.

We bottomed on March 23rd, right around the peak of fear and uncertainty about the virus. When sentiment is extremely low, everyone who is going to capitulate has already sold, so there’s nobody left to sell. This makes prices start rising again and form a bottom.

Currently, sentiment is low to neutral, but not at an extreme like we would expect to see at a bottom. On the flip side, there are many indicators telling us that we are due for a bounce.

Nasdaq Daily Indicators (Marketsmith)

Above, we can see 3 technical indicators provided by Marketsmith. The top pane is the price action of the Nasdaq. Second is the short term overbought/oversold oscillator, when it is below the red median line, we can say that price is oversold.

At this point, we are more oversold than we’ve been in over a year. The two other indicators are moving averages of up vs. down volume and stocks making new highs vs. new lows.

When the two moving averages in the third and fourth indicators are far from one another, we can say that we’re oversold or breadth is extremely low. Which means we’re likely due for a bounce. Currently, these two metrics are giving us those indications.

But in the end, these three indicators still have room to run. Meaning while they are currently oversold, they could always be more oversold.

This is why I personally don’t use indicators like RSI, MACD etc. for trading. Things can look oversold, but if you have studied historic price action you would know that prices often go from oversold to even more oversold.

So overall, we could expect a short-term bounce in the next week or two for the prices of tech stocks, but it’s most likely that the bottom is yet to be put in. (if I’m wrong that’s a testament to the previous sentiment discussion)

In an environment like this, it’s helpful to have a decent understanding of the relationship between bond yields and equities. It’s important to know the basic economic law that interest rates and bond prices have an inverse relationship.

SQQQ vs. US10Y 1D (Tradingview)

So when interest rates rise, bond prices fall. Since bonds have a guaranteed payout, if prices fall, then yields (returns) must rise.

Basically, when yields are rising, bonds are becoming more profitable to own. This means capital will flow out of higher beta (riskier) tech stocks and into bonds. This relationship is shown above, SQQQ is the ProShares Inverse Nasdaq ETF shown in blue/pink candlesticks at the bottom. (When the Nasdaq falls, SQQQ rises.)

The yield of the US 10 year treasury bond is shown with the orange line above. You can see that generally, there’s a positive correlation between SQQQ and the yield of the 10 year.

This means that there’s a negative relationship between tech stock prices and the US10Y bond yields. I thought using the inverse Nasdaq would make the relationship easier to visualise.

SPY vs. IWO Chart

The chart of IWO (Russell 2000 Growth ETF) gives us a slightly better idea of what’s going on for most growth/tech stocks. Above are these charts compared to each other.

Currently, the market for tech stocks looks quite abysmal despite the S&P only down a mere ~7% off its highs. Currently, IWO is roughly 24% off its highs.

The S&P has been propped up by AAPL and MSFT who are down 10% and 14% respectively, but IWO doesn’t have that type of weighting. For example, the highest weighted name in the S&P is Apple, which accounts for ~7% of the S&P’s market cap. Meanwhile, IWO’s highest weighted name is SYNA which is 0.67% of IWO.

When the more equally weighted index is down, that’s a sign that most of the growth market is down. If the S&P is down, that can be chalked up to only a few names selling off.

Silvergate Capital Corp Earnings Report

Silvergate Capital reported their Q4 2021 earnings on Tuesday this week. Surprisingly, earnings were down 22% from Q3.

This was such an unexpectedly large miss that shares traded down ~25% on Tuesday. Yet despite earnings being down, there were many numbers reported that are quite bullish for SI.

The number of digital currency customers grew by 76 over the quarter to a total of 1381. Also, the dollar value of transfers on the Silvergate Exchange Network grew to $219.2 billion, a ~35% increase quarter over quarter.

Furthermore, the average deposit by digital currency customers grew by ~19% this quarter to $13.3 billion.

Above are some of the numbers from the Silvergate Q4 investors presentation. These numbers tell us that despite overall earnings being down, there has been quite a high level of demand for SI’s exchange network and services.

Also, in Q4 Silvergate announced partnerships with two new digital asset custodians and raised $1.3 billion over the course of 4 capital raising rounds.

So overall, despite earnings being down quarter over quarter, I’m impressed with the 3 months that Silergate had and am still quite bullish on their future.

Mining

Difficulty All-Time High

Last night, Bitcoin’s network difficulty adjusted to a new all-time high. This signifies that the network has fully recovered from the China mining ban in the Summer of 2021.

This adjustment was very aggressive (+9.3%), and as difficulty goes up, miners earn less BTC. However, the price of Bitcoin has still grown significantly over the past 24 months and new generation machines are so efficient that they will likely remain profitable at reasonable electricity rates for years to come.

Wall Street + Bitcoin Miners

Large-scale public Bitcoin miners are the catalyst for Wall Street to really question their skepticism towards $BTC.

Let me explain.

It’s hard for Wall Street to deny that Bitcoin mining is currently a financially attractive business. Hence the number of miners tapping into public markets.

This is because these mining companies are an exciting emerging technology, have high growth, and have high margins. Nearly all other early-stage tech companies burn $ and still have multi-billion dollar valuations. Bitcoin miners have growth AND margins.

Bitcoin miners have high margins and have clearly established “product-market fit”. Bitcoin itself is more of a commodity, and Wall Street focuses on cash flow or revenue growth. They typically don’t like physical goods or commodities.

Bitcoin miners have that cash flow and revenue growth. They’re forcing Wall Street to pay attention by being attractive in the game they usually play.

Bitcoin miners will force Wall Street to start asking real questions about $BTC.

Why is mining so profitable?

Why do these billion-dollar companies want to hold Bitcoin?

What is Bitcoin?

When demand increases, why does supply not increase?

What is money?

Most high finance types know of Bitcoin, but quickly write it off and don’t dive deep into it.

Billion-dollar Bitcoin miners trading in public markets is beginning to force them to actually pay attention.

It shows Bitcoin is real. It’s not dead.

“Maybe you should get some in case it catches on.”

The wizard has a broadened prospective that is clinical and without emotion. Great data for us without the expertise and have strong emotions. Thanks Will.

Will, the difficulty level has historically set somewhat of a price floor for bitcoin. Since its price directly affects profitability at different hash rates, do you see this trend continuing to play out into the future? Currently, price is grinding down and difficulty is at ATH... potentially something to look out for.