Blockware Intelligence Newsletter: Week 119

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 1/27/23 - 2/2/23

🚨S21 Giveaway🚨

We have selected the winner for our S21 giveaway, and this person has been notified via Twitter DMs!

Thank you to all who participated!

Stay tuned to Blockware Intelligence so you can find out about future promotions and giveaways!

🚨Blockware Marketplace Update🚨

Every day our dev team is hard at work making the Blockware Marketplace the No. 1 platform to buy and sell hosted #Bitcoin mining rigs.

Users can now buy & sell up to 10 ASICs at a time.

No more buying machines 1 at a time.

Since launching Version 0.1 in May 2023, over 1,000 ASICs have been transacted on the Blockware Marketplace. The secondary market for ASICs is alive and well, and the Blockware Marketplace is at the heart of it all.

This is a 100% Bitcoin-native platform, built by Bitcoiners, for Bitcoiners. All transactions are done using the Bitcoin network.

This is the fourth major update to the marketplace. Previously we launched:

- Bids

- Seamless Onboarding

- Improved Search Function

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

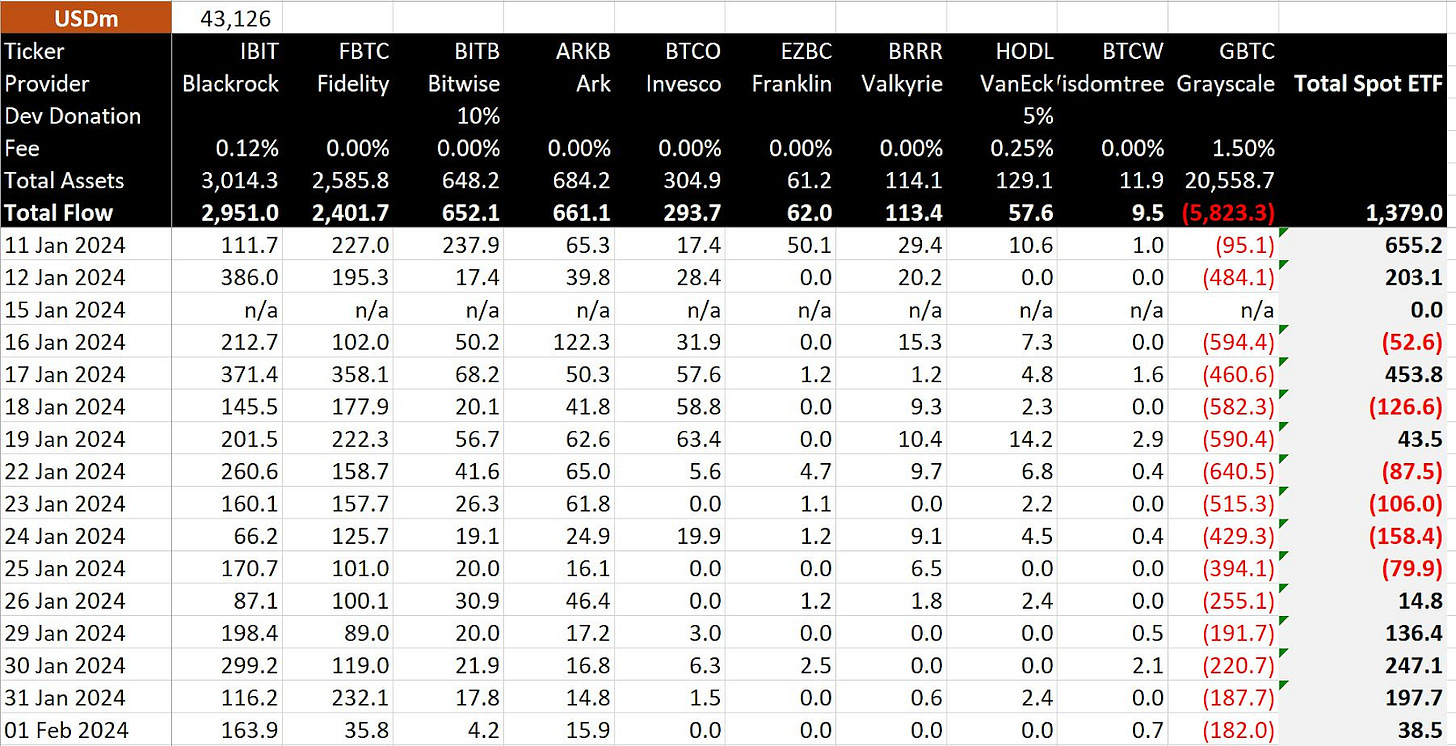

Bitcoin ETFs Update

Total ETF flows are now up to ~$1.3 billion. Each day this week had positive net inflows despite continued net outflows from GBTC. Moreover, daily outflows from GBTC are noticeably slowing down. At this rate, it is unlikely that BTC stays in the $42k range for much longer.

Source: @BitMEXResearch

Don’t get lulled to sleep by the relatively uneventful price action during January. All of the bullish factors we’ve discussed are still intact:

New Demand from ETFs

Supply Illiquidity from Long-Term Holders

2024 Halving

2024 Rate Cuts

General Market Update

1. May FOMC Probabilities. On Wednesday, the Fed Open Market Committee elected to leave the Fed Funds Rate unchanged for the fourth meeting in a row. Powell cited the idea that they’d like more evidence of inflation returning to their 2% target before they consider cutting, and that this would be very unlikely to occur by the next meeting on March 20th. The Fed believes that their policy is having its intended effect, as inflation has come down without sacrificing many jobs, but we’re apparently not quite there yet to pivot. The market sees the May meeting bringing the first cut.

2. January Jobs Report. This morning we got a surprise from the January jobs report, as the economy added 353,000 jobs last month, the highest figure since January 2023. The fixed income market responded with higher yields, as investors suspect this news to prolong the Fed’s pivot timeline. Prolonged rising yields can have negative impacts on equity price action, but this is yet to materialize at the time of writing.

3. Russell 2000 ETF (IWM, Daily). The Russell 2000 has been a more accurate indicator of the difficult market that 2024 has been, outside of the Mag. 7 and the major indexes. The Russell has held up pretty well, however. The red line below shows the 50-day SMA, known as “the guard rail” to many traders. Price has managed to attract buyers around this level, as we coil up towards the upper trendline shown below. The key level to watch in coming weeks will be $199.50 for IWM.

Bitcoin Exposed Equities

4. Cleanspark (CLSK). While it hasn’t been the cleanest week of price action for Bitcoin Exposed Equities, it’s generally been a positive one for many of the publicly traded miners. CLSK is a good example of this, after managing to hold the 10-day EMA (green line) and moving into positive territory today. Heading into the weekend, keep a close eye on BTC price action to signal if these names can have tailwinds for higher prices.

5. BEE Comparison Sheet.

Bitcoin Technical Analysis

6. Bitcoin/USD. Despite the shakeout on Tuesday/Wednesday, price has held up fairly well between yesterday and this morning and has managed to hold the ~$42.3k level defined by the crossover of the 10 and 21-day EMAs. Our focus in the immediate term is this $42.3-43.9k range. The break above or below these bounds is expected to signal to traders the direction that price could take heading into the Halving in April.

Bitcoin On-Chain / Derivatives

7. Halving Epoch Price Performance: We’re now less than three months away from the fourth Bitcoin halving, in which the BTC block subsidy will drop from 6.25 to 3.125. So far, the returns during each halving “epoch” have declined, with the current epoch netting roughly 446% returns since May of 2020.

For the following reasons, the trend of diminishing returns may be broken during the coming 2024-2028 halving epoch:

- Supply Illiquidity

- Institutional Demand

- No FTX/GBTC shenanigans

- Fewer "FUDs" deterring newcomers

- Continued Fiat Debasement

Even if Bitcoin nets the same returns as this epoch (assuming price stays flat between now and halving), we'd still be looking at $190k per BTC in 2028.

8. BTC vs Other Asset Classes: Picking a timeframe to compare the performance of various asset, or asset classes, can be tricky. A good framework is juxtaposed performance during liquidity cycles. Most people use dollars as the measuring stick for price (asset/USD), judging across liquidity cycles accounts for changes in the denominator. Since March 2020, the onset of the current liquidity cycle, Bitcoin has significantly outperformed all major asset classes.

- BTC: +581%

- S&P: +125%

- NASDAQ: +112%

- $VNQ: +42%

- Gold: +37%

- $ARKK: +21%

- Long Bond: -41%

9. Realized Price: The first re-test of the short-term holder realized price support level (~$38k) has held. The buying and selling behavior of short-term holders, those who have been holding BTC for ~155 days or less, is far more reflexive to BTC price action than that of long-term holders. During bull markets, short-term holders tend to defend their cost-basis which is why this metric can serve as support.

10. Retail Accumulation: Users with less than 1 BTC are accumulating ~700 BTC per day over the past 14 days. Right now, 900 new BTC are mined every day. In April that number will drop to 450 per day.

The demand/inflows from the ETFs have been the dominant narrative over the past month, but entirely absent from the ETFs is the dedicated HODLer base that is what originally monetized Bitcoin to a multi-hundred-billion dollar asset. In just a few months, the demand from these price-agnostic buyers of last resort alone will be greater than the new supply hitting the market. Bullish.

Bitcoin Mining

11. Hashrate: After a brief pullback, the Bitcoin network hashrate is once again pushing new all-time highs, with it now sitting at ~535 EH/s. Hashrate will continue to climb between now and the halving as miners scramble to plug in the latest-generation, most energy-efficient ASICs.

Contrary to most people’s intuition, halving is arguably the best time to start mining Bitcoin. It provides you with a clean 4-year window to mine as much BTC as you can before the next halving. Moreover, new-generation miners hit the market at this time, which allows you to out-hash your competition. Buying the new-gen machines when we are not yet in a bull market will grant you a lower capital expense, allowing you to see Cap. Ex. appreciation if/when ASIC prices increase.

12. Hashprice: As transaction fee revenue has declined, so has hashprice, with miner revenue per terahash per day now sitting at ~$0.08. This is crunch time for miners as they prepare for one, final squeeze in revenue when the block subsidy gets cut in half.

The most successful miners historically are the ones that embrace the halving, by upgrading their hardware. Continuing to mine with mid-generation machines through the halving could pay off if the price of BTC begins to rip in the coming months, but it is a much riskier proposition than upgrading to Antminer S21s or Whatsminer M60s.

13. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$23,823 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.