Blockware Intelligence Newsletter: Week 143

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/10/24 - 8/16/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

General Market Update

1. Initial Jobless Claims

News cycles are quick and sentiment shifts on a dime. The doomsday macro sentiment of last week has seemingly faded from memory on the back of one decent jobs report. Initial jobless claims came in at ~227,000. Despite declining for two weeks in a row, the broader trend for the year is still up. Unless lower lows are made here and a reversal is made in the trend of rising unemployment, our base case for the labor market will remain the same: steady but cracking.

2. Consumer Price Index

Year-over-year CPI change came in at 2.92%. While this is the 4th consecutive month of declining CPI values (disinflation), it’s not exactly a value worth celebrating. The Fed has already taken their victory lap in their battle against inflation - and they’ve shifted focus towards cutting rates to prevent a recession.

2% CPI used to be the target - if a value nearly 50% higher (2.92%) is now considered “normal”, that is evidence that we are now in an environment of structurally higher inflation. The net effect of this over the long term is bullish for asset prices - and destructive for individuals that save in fiat currency.

3. S&P 500

The market responded positively to the relatively good economic data this week. $SPX is up ~4% this week, retracing much of its drawdown, and is now on the cusp of new highs. $NDQ and $QQQ behaved similarly.

Previously, such data points resulted in sell-offs in assets. The primary driving forces for markets are liquidity and expectations about future liquidity. Positive news like this previously resulted in delayed expectations on Fed rate cuts, bearish for future liquidity expectations, and thus a sell off. But now that the market is entirely set on Fed cuts at the next meeting (because the Fed has made this very apparent), a week of decently positive economic data isn’t pushing back the expectations of a cut.

4. Fed Funds Futures

While the market is still expecting ~a~ rate cut, the prospect of a 50bip cut at the next meeting and/or an “emergency cut” beforehand has been quelled. The odds of 50bips worth of cuts at the next meeting dropped from 51% to 25% over the past week. End-of-year rate expectations are still pricing in multiple cuts - with a 43% chance of 75bips worth and a 42% chance of 100bips worth.

For secure and easy-to-use self-custody, we recommend Theya:

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

Bitcoin: News, ETFs, On-Chain, etc.

5. South Korea National Pension Service Buys $MSTR

The trend of institutional Bitcoin adoption took yet another step forward. The South Korea National Pension Service (~$775 Billion AUM) disclosed a ~$34,000,000 position in MicroStrategy. South Korea does not have spot Bitcoin ETFs, so in regards to gaining Bitcoin exposure, MicroStrategy is far and away the best vehicle for an institution such as this one.

6. Short-Term Holder Realized Price

After being support for much of the past two years, the cost-basis (realized price) of short-term holders has turned into resistance. If BTC gets a convincing breakout above short-term holder realized price then it is likely off to the races. This metric currently sits at ~$64,000 - expect some resistance in that area.

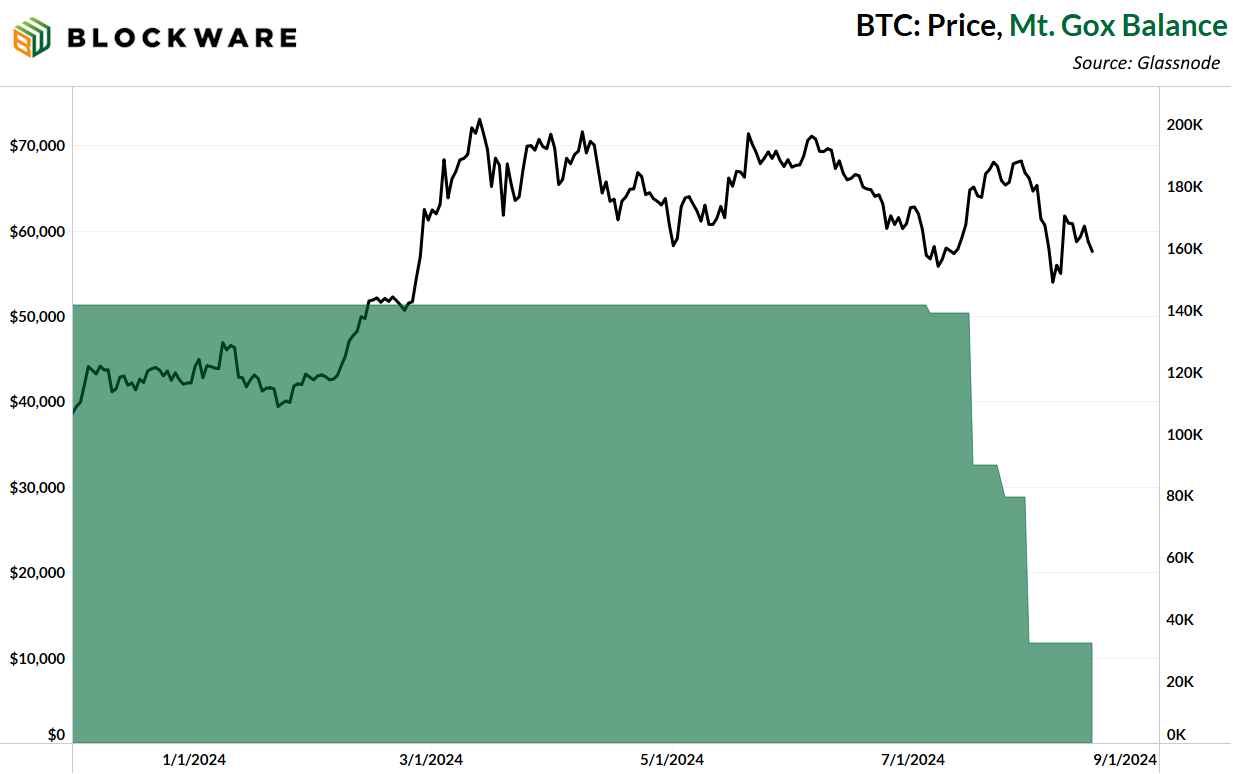

7. Mt. Gox Trustee Wallet Balance

The release of Mt. Gox coins to trustees and the subsequent selling has been a significant force of downward pressure on the BTC price this summer. However, the balance of the trustee’s wallet is quickly depleting. Roughly 32,000 coins remain in the wallet. In mid-June, this was ~141,000. The ~109,000 BTC leaving the wallet represents ~$6.5 billion of sell pressure over the past two months.

8. Presidential Elections - Bullish Bitcoin?

Correlation or causation is up for debate, but Bitcoin has performed exceptionally well during the year following US Presidential elections, rising 346% from November 2020 to November 2021.

Our base case is that risk assets continue to trade sideways between now and November due to the market’s uncertainty about the election outcome. Regardless of who wins, asset prices likely move up at the end of the year due to 1. Rising global liquidity, and 2. Removal of the uncertainty of the election.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

9. Hashrate Growth

Mining difficulty dropped ~4% this week and the total network hashrate is at ~625 EH/s. Over the past four months hashrate growth has been slightly negative. The combination of the halving, sideways BTC price action, and summer curtailments is why we haven’t seen a net-increase in hashrate despite new-generation ASICs coming onto the market during this time period.

The miners plugging in the newer, more efficient ASICs are benefiting right now as their revenues are rising while their costs lower - and difficulty isn’t rising to cut into that. Moreover, they’re positioning themselves well for the coming bull market.

10. Blockware Clients vs the Industry

Blockware’s hosted mining clients are outperforming the rest of the industry by a fairly wide margin. The average cost to mine 1 Bitcoin for the industry in the aggregate is ~$60,200 (Energy Gravity, discussed below). A Blockware client mining with an Antminer S21 pro is able to mine 1 Bitcoin for ~$40,000 in electricity; 50% cheaper than the industry average.

This chart really illustrates the importance of mining with a low electricity rate and the most efficient hardware available. Note the vast outperformance of S21’s and S21 pro’s compared to other machines.

11. Energy Gravity

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$60,200 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig.The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.