Blockware Intelligence Newsletter: Week 138

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/29/24 - 7/5/24

🚨Limited Time Offer: Discounted Bitcoin Mining🚨

To celebrate American independence, Blockware is offering the ability to mine Bitcoin with an electricity rate of $0.074 per kWh!

- 268 Th/s (up to 15% more when in high-performance mode)

- 19.5 W/Th

- $128 Estimated Monthly Profit

This offer is valid for all Whatsminer M66s's purchased through the Blockware Marketplace between now and July 12th, 2024.

This is your chance to mine Bitcoin with a high efficiency ASIC and low cost power! An M66s at $0.074/kWh has BTC breakeven cost more than $3,000 less than one mining at the typical Blockware hosting rate of $0.078/kWh.

Bitcoin: News, ETFs, On-Chain, etc.

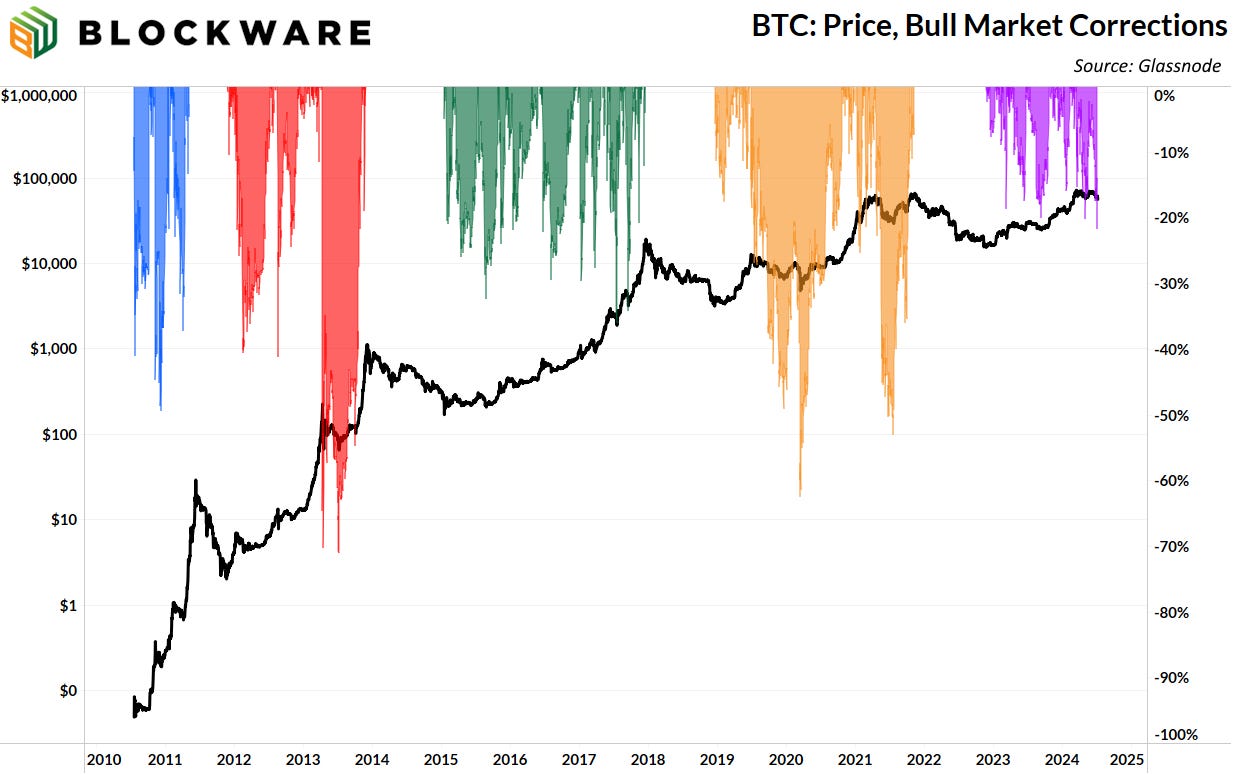

1. BTC Drawdown Deepens

While American’s celebrated freedom and independence, Bitcoin took a dive to levels not seen since February of this year. Various forms of sell pressure have compounded over recent weeks sending BTC to ~$55,000; 25% below its all-time high. Retrospectively, Bitcoin bull markets are filled with drawdowns of equal or greater magnitude. These drawdowns provide the opportunity for convicted Bitcoin holders to add to their positions at a significant discount. However, during the moment it can be rattling, especially for newer, less convicted market participants. Let’s breakdown some of the catalysts for the recent price drop:

2. Germany Selling Coins

Foolishly, the German Government has transferred more than $390 million worth of BTC to exchanges over the past few weeks to be sold for fiat currency. From a geopolitical perspective, it is a strategic blunder for any nation-state to sell Bitcoin holdings for fiat currency given that they can simply print the latter out of thin air. Comparatively, Bitcoin is much more difficult to acquire given the immense amount of physical energy necessary to mine it and its limited supply of 21,000,000. According to Bitcoin Magazine, these BTC holdings were seized by German authorities from a movie piracy website, and the coins recently moved on-chain represent approximately 20% of their total holdings, with ~40,000 more BTC remaining in their possession.

3. Inefficient Bitcoin Miners

Frequent newsletter readers are familiar with the dynamic of miner capitulations. In the wake of April’s halving in which the amount of newly issued Bitcoin dropped to 3.125, Bitcoin miners with inefficient hardware and high electricity rates have been struggling to turn a profit. The net result is increased sell-pressure on Bitcoin as these miners deplete their BTC treasuries in an attempt to subsidize their operations while they are unprofitable. The struggles of “weak” miners has resulted in the lengthiest miners capitulation in nearly two years, as indicated by hash ribbons.

After the 2020 halving, there was a 2-months long miner capitulation. After which BTC’s price began to increase dramatically due to the relief in sell-pressure. Miners who survived the initial decline in revenue were able to profit significantly as BTC’s price increased by many multiples in the 12-18 months post-halving.

4. Declining Mining Difficulty

The Bitcoin network has a feature known as “the difficulty adjustment” which ensures Bitcoin blocks are mined every ~10 minutes regardless of how much computational power is being dedicated towards mining at any given moment. Inefficient miners unplugging their ASICs has resulted in the second largest negative difficulty adjustment in more than a year and a half. While negative difficulty adjustments are typically a sign of trying times for Bitcoin miners, they are highly beneficial for surviving miners. Miners that are still in operation are able to earn more BTC than they were previously, benefiting at the expense of those who unplugged. This is ruthless, free-market competition.

The post-2020 halving miner capitulation saw two consecutive negative difficulty adjustments of 6 and 9%. It’s possible that difficulty continues to push lower from here. Only the strong survive.

5. US Spot Bitcoin ETF Flows

The signal within the noise is that ETF flows, which were a driving force behind BTC’s rise earlier this year, remained net-positive for the week despite the bearish price action. The most important buying cohort is relatively unfazed by the recent volatility. A common concern echoed surrounding the introduction of Bitcoin ETFs would be how these investors respond to BTC price drops. Would they panic sell or buy the dip? They haven’t aggressively smash bought the dip, but they haven’t taken their ball and gone home either.

This is a testament to the power of passive flows, which likely represents a significant portion of ETF buyers. An increase in the amount of investors/capital that is price agnostic, and simply buys Bitcoin consistently, will decrease the magnitude of price drawdowns going forward.

6. Energy Gravity:

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$52,800 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

General Market Update

7. Job Openings and Labor Turnover Summary (JOLTS)

JOLTS for May was released on Tuesday, reflecting little structural change in the state of the labor market from the month prior. Overall, the labor market has remained resilient, despite restrictive monetary policy from the Fed, but it is in somewhat of a stalemate and is showing preliminary signs of deterioration.

Here are some key labor market data points for the month of May:

8.1 million job openings, unchanged from the previous month but down by 1.2 million over the year. Hires remained steady at 5.8 million, while total separations were also stable at 5.4 million. The quits rate stayed unchanged at 2.2% but has been in a steady decline for the past year. A declining quits rate is telling of worker sentiment; a decreased willingness to quit is consistent with concerns about future employment opportunities. Stability in key metrics like job openings, hires, and separations suggests a cautious outlook among employers and employees.

Large establishments saw an increase in layoffs which makes sense in a high-interest rate environment as these types of businesses received the most growth-lubricant from the low-interest rate environment; restrictive monetary policy is forcing a more prudent allocation of capital.

8. Initial Jobless Claims

Jobless claims for the week ending 6/29 rose to 238,000. This is by no means an alarming amount of jobless claims, but the steady rise in claims throughout 2024 is worth paying attention to. The Fed, which admittedly was late when it came to raising interest rates, is aiming to get ahead of the curve when it comes to lowering interest rates. The Fed will be eyeing for cracks in the labor market to begin lowering rates, rather than waiting for a full-blown employment crisis/recession; which would be especially disastrous for the Fed during an election year. While rate expectations are certainly less dovish than they were at the beginning of the year, small cuts of 25bips are certainly not off the table for 2024.

9. CME FedWatch

CME FedWatch currently has a 96% probability of at least one 0.25% rate cut by year’s end, and there’s more than a 70% chance of at least 50bips worth of cuts. Changes in monetary policy do not immediately change liquidity conditions, but more clarity around policy expectations will likely bode well for asset performance, especially for something like Bitcoin which trades on the further end of the risk curve.

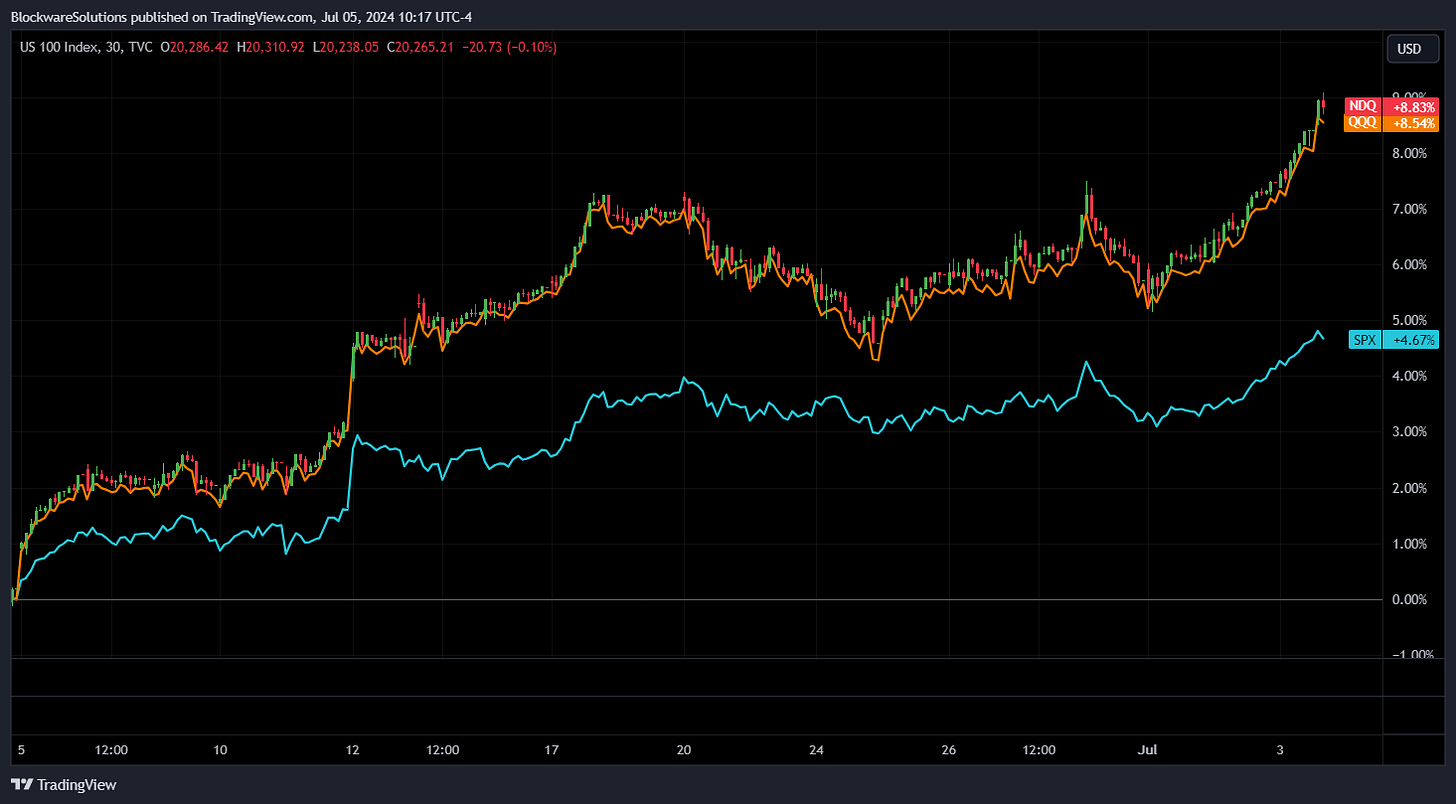

10. US Stock Market

Nasdaq, QQQ, and the S&P all continued their exceptional year-to-date performance, pushing to new all-time highs. While Bitcoin has been picking up steam the past month, bullish price action from major US equities tells a different story for risk assets. This shows that the current BTC price action is from BTC native sell pressure, and not from a declining appetite for risk across the markets. Once these various forms of BTC native sell pressure are relieved, it’s likely that the BTC will behave similar to when an inflatable ball is held underwater and then released: ie., up violently.

heya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

I liked this newsletter better when you were impartial. You are still making a great job of bringing all this information together, but please be more objective.