Blockware Intelligence Newsletter: Week 114

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 12/09/23 - 12/15/23

1. Blockware Intelligence Podcast. Luke Mikic predicts that Bitcoin could reach a price of $64,000,000 per coin by the year 2030. In this episode of the Blockware Podcast, Mitch & Luke dive into the math behind that. They also discuss different ways to measure Bitcoin adoption, the upcoming bull market, Javier Milei, and more!

General Market Update

2. November Consumer Price Index (YoY). Headline CPI for November came in line with projections of 3.1% YoY and 0.1% MoM. Core CPI, or headline minus food and energy, also came in at expectations of 4.0% YoY and 0.3% MoM. As we’ve seen throughout this year, and will continue to examine below, it appears that the effect of higher borrowing costs is effectively working to lower the magnitude of price increases. This is likely a general theme we’ll see continue in 2024 to some extent.

3. November Producer Price Index (YoY). PPI numbers were also in line with economist projections in November, coming in at 0.9% YoY and unchanged MoM. PPI is often referred to as a leading indicator of CPI, as changes to the pricing for producers impact consumer pricing with a lagged effect. The combination of CPI and PPI disinflation, as well as PCE coming in at expectations for October, had a large impact on the dovish rhetoric that we heard from Powell on Wednesday.

4. December FOMC Dot Plot. The Fed Open Market Committee elected to leave rates unchanged on Wednesday for the 3rd consecutive meeting. There were a few things that stood out from this meeting, compared to previous pauses. One was an adjustment seen on the dot plot, indicating that Fed officials currently see ~75bps of rate cuts for 2024. This notion, combined with Powell’s very dovish posturing, is the clearest signal we’ve seen that the Fed is done hiking rates.

5. US 2-year Treasury Yield. On the news just described above, US Treasury yields moved lower across the curve. The most policy-sensitive note, the 2-year, saw its yield drop 0.3% on Wednesday, the best day for 2-year prices since March’s regional banking crisis. In case you don’t remember, bond yield and bond price have an inverse relationship, and bond prices and interest rates also have an inverse relationship. That means when the market sees lower future rates, yields generally fall. Falling yields generally bode well for risk-asset price action, as we’ve seen in recent months.

6. iShares Russell 2000 ETF (Weekly). With yields moving decisively lower, and the market firmly believing that rate hikes are over this cycle, we’ve seen a large capital rotation into small-cap equities this week. As we’ve discussed continuously in this newsletter throughout 2023, breadth is a very key piece of the equation for the general market to maintain a sustained bull market. The Russell is indicating that institutions are bidding on small-cap equities, which should provide the foundation needed for the other indexes to make new all-time highs.

Bitcoin Exposed Equities

7. Bitfarms (BITF). With the bullish tailwinds for the general market, we’ve seen continuous positive price action for many publicly traded Bitcoin miners. The most high-quality names, like CLSK, RIOT, MARA, BITF, etc. have had a massive 4th quarter. BITF, for example, is currently up nearly 200% in just 3-weeks. At some point, these names are likely going to correct, or at least cool off, but things appear strong for now.

8. BEE Comparison Sheet. Interestingly, both the average individual BEE return and that of the Valkyrie Bitcoin Miners ETF have outperformed spot BTC price action this week. While Bitcoin consolidates recent gains, it’s certainly encouraging to see capital continuing to flow into these names. CAN and BITF were outliers this week, both being up over 20% this week as of yesterday’s close.

Bitcoin Technical Analysis

9. Bitcoin / USD. As we just alluded to, BTC has seen a volatile consolidation this week, with price largely ranging between $40,200-43,500. This is a hard environment for traders, as we move closer to previous bull market price action and price could easily move 10%+ in either direction very quickly. Heading into next week, keep a close eye on the 21-day EMA, currently sitting at ~$41,100. Price has respected this moving average recently, but a break below it could take us back down to that ~$38,00 range.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

Bitcoin On-Chain / Derivatives

10. FASB Rule Change: The Financial Accounting Standards Board published an update confirming that effective December 15th, 2024, they are changing the rule for how companies are to mark Bitcoin and other “digital assets” on their balance sheet. The shift from indefinite intangible accounting, which forced businesses to mark BTC on their balance sheet according to its lowest trading price since their acquisition rather than the current market value of BTC, to the fair value method, is a significant development. For example, a company that acquired BTC in 2021 would have to mark it on their balance sheet at ~$16,000 per BTC, because that was the lowest price it traded at, rather than its present value of ~$43,000 per BTC.

According to Michael Saylor, the status-quo accounting requirements for Bitcoin are the number one roadblock for companies considering adding BTC to their balance sheet. The removal of this unnecessary barrier will pave the way for more institutions to begin accumulating a BTC treasury.

11. Bull Market Drawdowns: This week’s dip in the Bitcoin price to ~$42,000 is hardly a blip on the radar of historic bull market drawdowns, coming in at a ~6% drawdown. Nothing has changed structurally as far as the bullish catalysts that have propelled BTC up 160% throughout the year; supply illiquidity, increasing demand, elimination of “crypto fraud”, anticipation of the ETFs, and anticipation of dovish Fed policy. All of these factors are still intact, and this dip is simply nothing more than BTC’s notorious volatility; which is a feature, not a bug.

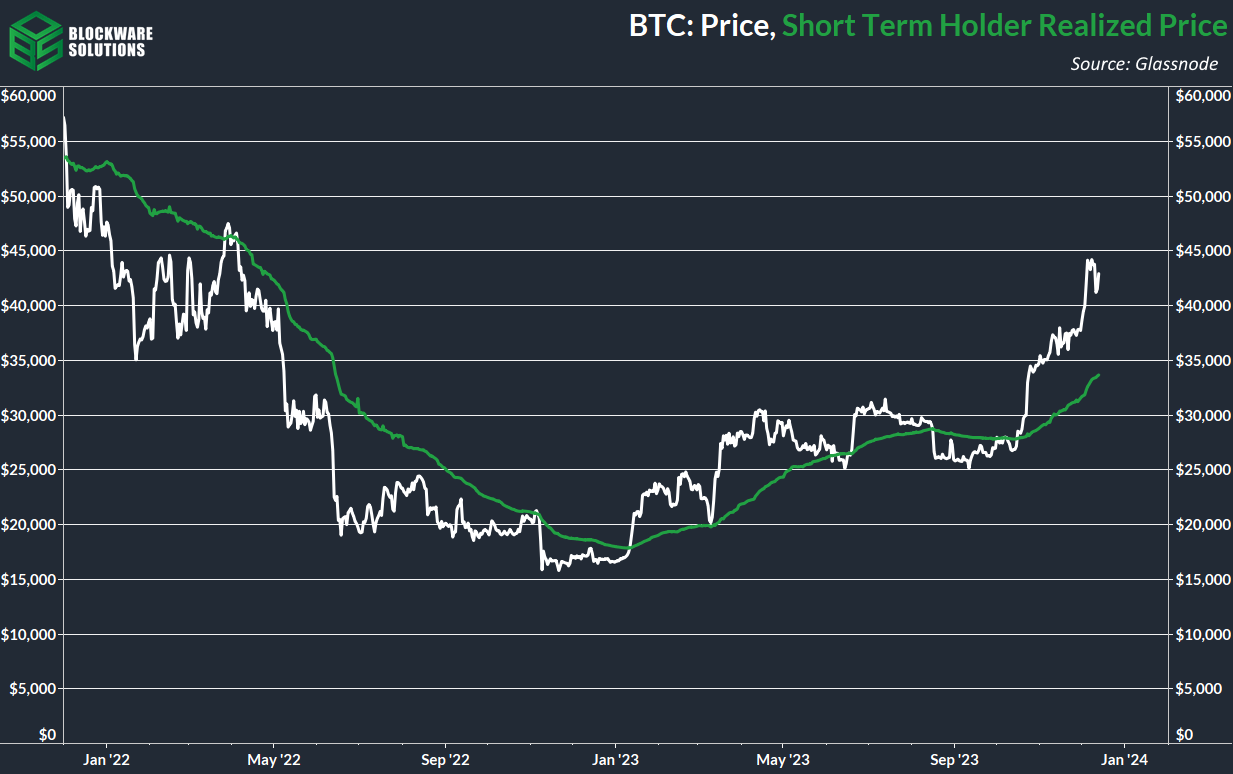

12. Short-Term Holder Realized Price: The cost basis of short-term holders (less than 155 days) is steadily climbing as BTC hovers in the $42k-$44k range. This metric has served as support twice in 2023. A re-test in the short term is unlikely, but we’ll continue to keep an eye out as STH RP slowly creeps up.

13. Perpetual Futures Open Interest: A few longs were liquidated during the wick down. By now, if you haven’t learned to avoid using leverage with BTC, you are positioning yourself to learn the hard way. Even if you are directionally accurate, BTC’s volatility can wipe your position regardless. Open interest as a % of market cap continues to decline, which, as we’ve mentioned before, decreases the strength of leverage-liquidation-induced volatility. This bout of long liquidations is evidence of that fact. Previous liquidation events, back when OI as a % of market cap was high, resulted in a cascade of liquidations where forced selling resulted in further price declination.

14. Exchange Balances: Exchange balances are still teetering around the 2.3 million mark, with no real change over the past few months. The signal provided by this metric may diminish when the ETFs are launched as the majority plan to use Coinbase as the custodian, so even when they purchase those coins to back their ETF, effectively taking them off the liquid market, they may not move on-chain or they may simply bet shuffled from one Coinbase address to another. However, the downward trend witnessed during this epoch likely continues as Bitcoin education breeds a new cohort of HODL’ers that will purchase coins and move them to self-custody.

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

Bitcoin Mining

15. % Miner Revenue from Transaction Fees: You’re likely sick of hearing about transaction fees, but this remains the brightest signal in the Bitcoin mining ecosystem at the moment. Another week of high fees has pushed the 30-day moving average of % of miner revenue from fees north of 15%. On average miners are snagging an extra 1.1 BTC each block from transaction fees.

16. Miner Revenue: Total miner revenue in USD terms is over $45 million. This translates to ~$1.35 billion in miner revenue per month. Using energy gravity (below) to estimate the average cost of production, and assuming miners are selling enough BTC to cover their operating costs and nothing more, then miners are selling roughly ~41% of the BTC they mine per month. This translates to ~$554 million of sell pressure per month. The 2024 halving won’t provide immediate relief to this, but as the unprofitable miners begin to unplug, and difficulty adjusts down, surviving miners will need to sell even less BTC.

17. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$17,700 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

"The Financial Accounting Standards Board published an update confirming that effective December 15th, 2024, they are changing the rule for how companies are to mark Bitcoin and other “digital assets” on their balance sheet."

Do you mean 2024 or 2023?