Blockware Intelligence Newsletter: Week 106

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/23/23 - 9/29/23

Blockware Intelligence Sponsors

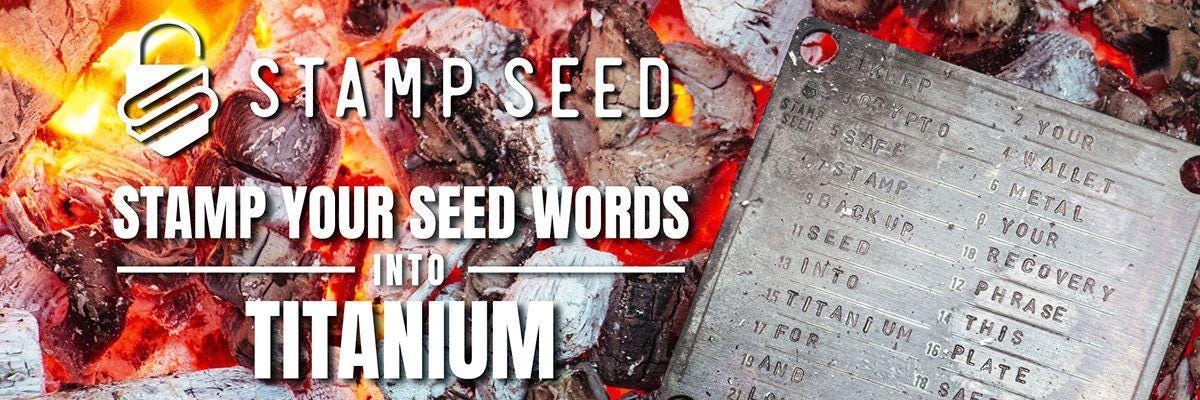

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Mitch Askew interviews Zach Bradford, CEO and President of CleanSpark ($CLSK). CleanSpark is one of the largest Bitcoin mining companies in the world, both in terms of market capitalization and fleet size. Mitch & Zach discuss the trade-offs of different energy sources, why CleanSpark loves nuclear energy, how CleanSpark prepared for the 2024 halving, what steps they’re taking to get ready for the 2028 halving, and much more!

General Market Update

2. 30-Year Average Fixed Mortgage Rate. We’re continuing to see a slow bleed from the housing market as we head into Q4. Many would argue that a housing recession is looming for 2024, as mortgage rates hit their highest since December 2000 this week. Pending new home sales also dropped to their lowest since COVID bottom (down 8.7% MoM in August).

3. CFDs on WTI Crude Oil. US oil prices hit a new YTD high this week at $94.99/barrel. As we saw in 2021, rising oil prices have the potential to drive inflationary pressures throughout the economy. We already saw rising energy costs create a net increase in headline CPI last month, which is a trend that investors clearly would not like to see continue.

4. Russell 2000 Index. Stocks have caught a bounce as Treasury yields have cooled down a bit this week. The Russell 2000 small-cap index is where much of our attention has been focused throughout 2023. For a sustained bull market, participation from small-caps provides the foundation that the rally stands on. August and September are historically poor months for stocks, so it will be interesting if we see a Q4 rally coinciding with a historically strong time of the year.

Bitcoin Exposed Equities

5. Valkyrie Bitcoin Miners ETF. Public Bitcoin miners have also caught a small bounce this week. It’s been very interesting to see how these names have followed general equity price action closer than BTC price action in recent weeks. This could be viewed as a good thing, as institutions increasingly treat these names as any other tech stocks, but the negative is obviously that tech stocks have had an ugly past ~2 months.

6. BEE Comparison Table. The average name this week was up 3.66% from Monday’s open to yesterday’s close, which was larger than BTC’s 2.97% and WGMI’s 2.38%. DGHI and APLD are the standouts here, both of which were up over 18%.

Bitcoin Technical Analysis

7. Bitcoin / USD. Bitcoin has had a standout week compared to equities and the general market. Yesterday BTC was able to close above its 50-day SMA, and as of the time of writing, has flipped the 50-day into support. Keep an eye on this moving average as we head into next week.

Bitcoin On-Chain / Derivatives

8. Short-Term Holder Realized Price: The aggregate cost-basis of coins moved within the last ~155 days sits at ~$27,700. Expect some resistance at this level. If BTC is able to break through this level it should provide a positive outlook for price action during the remainder of 2023.

9. Long-Term Holder Supply: An all-time high of nearly 15 million BTC hasn’t moved in at least 155 days. Over the past thirty days, ~163,000 coins have aged into the “long-term holder supply.” This is the fastest rate of increase in LTH supply since Q2 of this year when the coins purchased at the November 2022 bottom reached LTH status. The supply side continues to become increasingly illiquid which is setting the stage for a parabolic bull run whenever the next wave of demand enters the market.

10. New Address Momentum: On average for the past 30 days, ~550,000 new Bitcoin addresses have been created each day. This is an unprecedented amount of on-chain activity for a bear market. The only times prior in which activity was this high was during the absolute peak of the past two bull markets. If you’re looking for a bullish case for Bitcoin mining, this is it. If on-chain activity is like this during a bear market then one can only imagine how much demand for on-chain settlement there will be during a major bull market. It’s entirely possible that transaction fees will reach consistent parity with a 3.125 BTC block subsidy

11. 90-Day Coin Days Destroyed (Entity Adjusted): Despite a record amount of on-chain activity, it’s all occurring with young coins; hence why long-term holder supply is able to keep making new all-time highs. Coin days destroyed is a calculation of the number of coins moved on a day multiplied by the amount of days since each of those coins last moved; effectively measuring transaction volume with an increased weight towards older coins. This version of CDD takes the rolling sum over the past 90 days, while also adjusting for known entities such as exchanges reshuffling coins between their various addresses.

This measure is at its lowest level in over a decade. Further providing proof that the coins held for the longest amount of time, the most seasoned and experienced users of Bitcoin, are not budging an inch. Those who have been in Bitcoin the longest recognize that right now is HODL time.

12. Perpetual Futures Open Interest (Market Cap Adjusted): Open interest has ticked up slightly this week, but net-net the market still remains in a much less-leveraged position than it was two months ago.

Bitcoin Mining

13. Marathon Mines an Invalid Block: Marathon Digital inadvertently mined and broadcasted an invalid block this week. Claiming a bug in their software, the block misordered two transactions within the block, in which one transaction used an output of a transaction that occurred after it within the block. This is a wonderful reminder of how nodes, not miners, secure the Bitcoin protocol; the block was immediately rejected by nodes. As such the only party negatively impacted by this was Marathon themselves. Had they broadcasted a valid block they would have earned the 6.25 BTC block subsidy plus the transaction fees.

14. Mempool: Since the rise in popularity of ordinals and inscriptions during Q2 of this year, transactions in the mempool have remained relatively abundant and with relatively large fees. The mempool has cleared up significantly this week with the majority of transaction fees in the 5-7 sat/vByte range.

15. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$19,300 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.