Blockware Intelligence Newsletter: Week 122

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 2/24/24 - 3/1/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Bitcoin All-Time High

BTC has clocked its highest monthly close EVER, finishing the month of February at ~$61,000. We’ve been vocally bullish about the ETFs' impact on the price of BTC, but admittedly, we are impressed/surprised by the velocity at which these inflows have pushed the price higher.

2. Bitcoin ETF Flows:

This has been an absolute monster of a week for ETF inflows; with Monday, Tuesday, and Wednesday each posting north of $500,000,000 in daily inflows. No doubt this was a driving force behind this week’s BTC price action. The institutions are here, and they’ve arrived with a vengeance.

Diamond-handed Bitcoiners that HODL’d through the bear market have proved immovable thus far. With supply constrained and demand increasing, the price discovery phase is going to get very interesting.

Source: https://heyapollo.com/bitcoin-etf

General Market Update

3. PCE:

The personal consumption expenditure, a Fed favorite in terms of gauging inflation, posted a 2.4% year-over-year change for the month of January. YoY values are steadily disinflating, leading credence to the idea that the Fed’s war against inflation will soon be over (for now), and that the Fed Funds Rate will almost certainly be cut at some point in 2024.

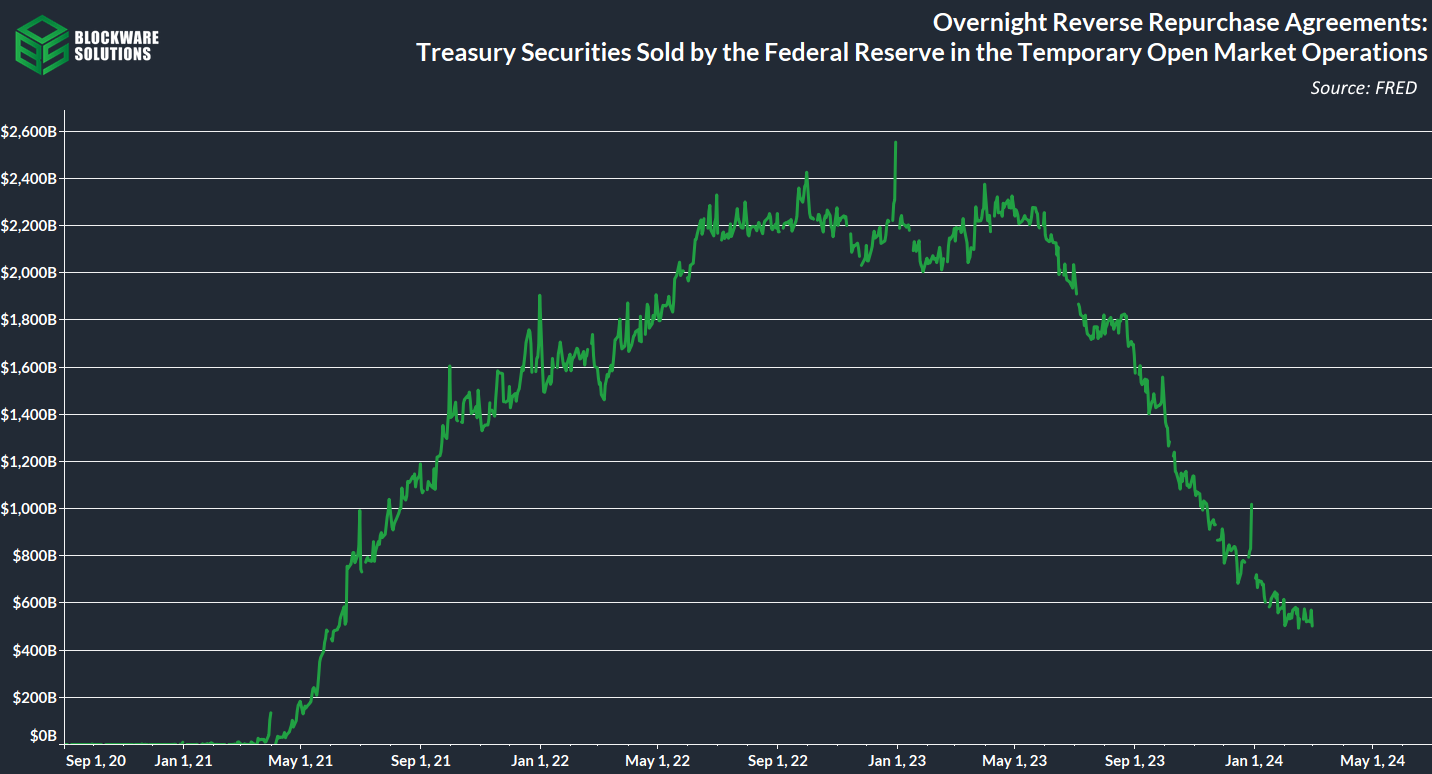

4. Reverse Repo:

The Overnight Revere Repo facility has been steadily drained of liquidity throughout the past twelve months. It is now on-pace to dry up by May of this year. Liquidity fleeing this facility to enter other assets has provided a significant source of demand for other assets, namely treasuries but also equities. The absence of these flows could pose trouble for treasury markets, and general liquidity conditions in the near future.

5. M2 Year-over-Year % Change:

Given the fact that liquidity conditions are still relatively constrained, as indicated by negative YoY M2 growth, BTC’s performance is astounding, and it’s a testament to the bullish catalysts in play: ETF demand & supply illiquidity. When the fiat liquidity tides inevitably revert to the mean (up forever), BTC is poised to take off.

6. BTC vs Nasdaq & S&P 500:

Bitcoin continues to be the fastest horse in the race; significantly outperforming both $NDX & $SPX this week; with the latter two posting relatively unimpressive performances. The juxtaposition paints a detailed picture of Bitcoin’s extreme upside potential. When liquidity conditions become more lax in the future, BTC, especially given the ETF plumbing to service demand, will be the sponge that absorbs most of that liquidity.

7. Russell 2000 ETF (Weekly). The last few weeks have been a great run for equities. We’re seeing leadership in names like Nvidia (NVDA), Abercrombie (ANF) and Chipotle (CMG). This week we’ve seen a divergence in small to mid-cap names. While many names have continued their runs, we’re also seeing some distribution under the hood. March and April tend to be poor months of equity price action during the 4th year of the US Presidential cycle. This combined with widely extended names and profit taking raises our guard for potential pullbacks.

Bitcoin Technical Analysis

8. Bitcoin/USD (Weekly). No need to beat a dead horse here, Bitcoin has obviously had a great week of price action and is now back to prices unseen since the week the market topped in November 2021. It’s important to note that it’s highly, highly unlikely that BTC is going to take a straight path to whatever your price target is. As this week has proved, with ETF products available to funds, BTC is now subject to regular profit-taking and portfolio balancing. The main focus for us here, assuming BTC isn’t going to tear straight into ATHs, is a clean consolidation above ~$59k on lighter volume before heading higher.

Bitcoin On-Chain / Derivatives

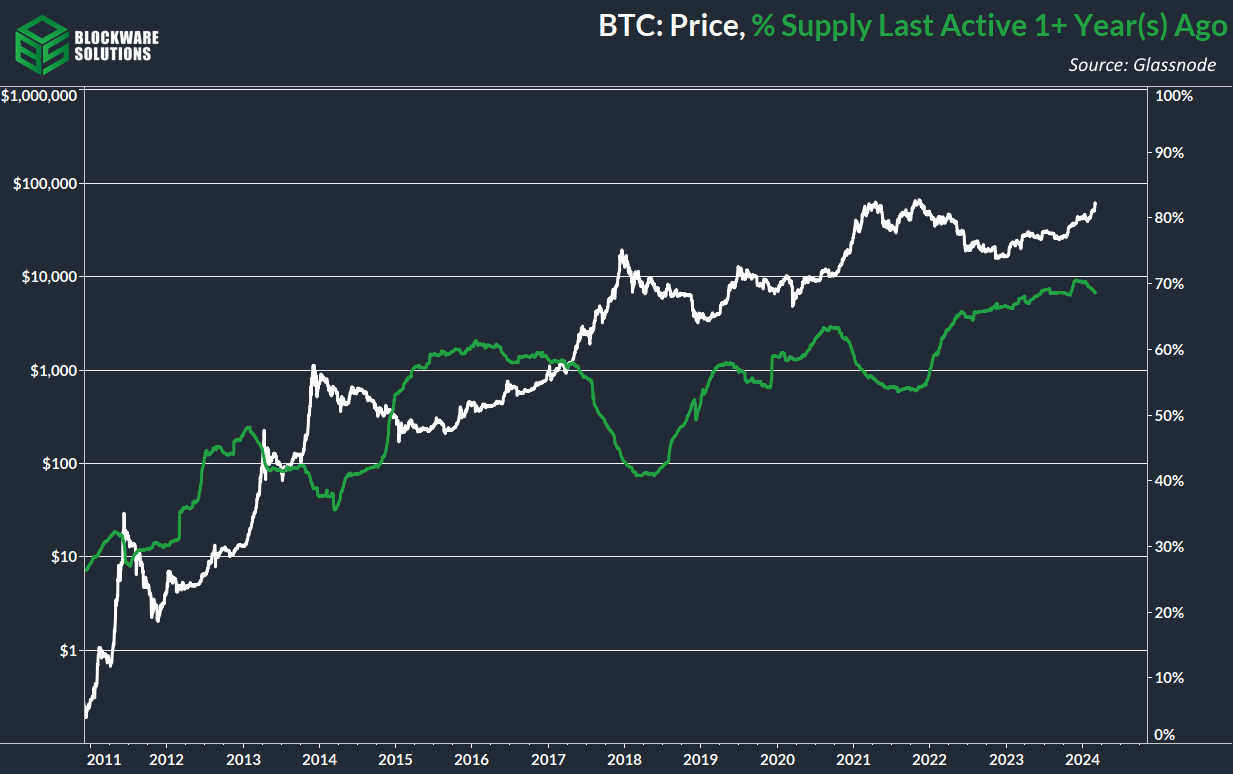

9. % of Supply Last Active 1+ Year(s) Ago:

~Some~ of BTC’s illiquid supply has begun to trickle back into the market; likely as a result of market participants who bought around the previous all-time high selling their coins at the return of their cost-basis, getting out at “breakeven.” Despite the slight tick down in illiquid coins, we are still at historically high levels. We will continue to monitor this metric for signs of supply-side liquidity. This will happen at some point, but the exact price is the million sat question.

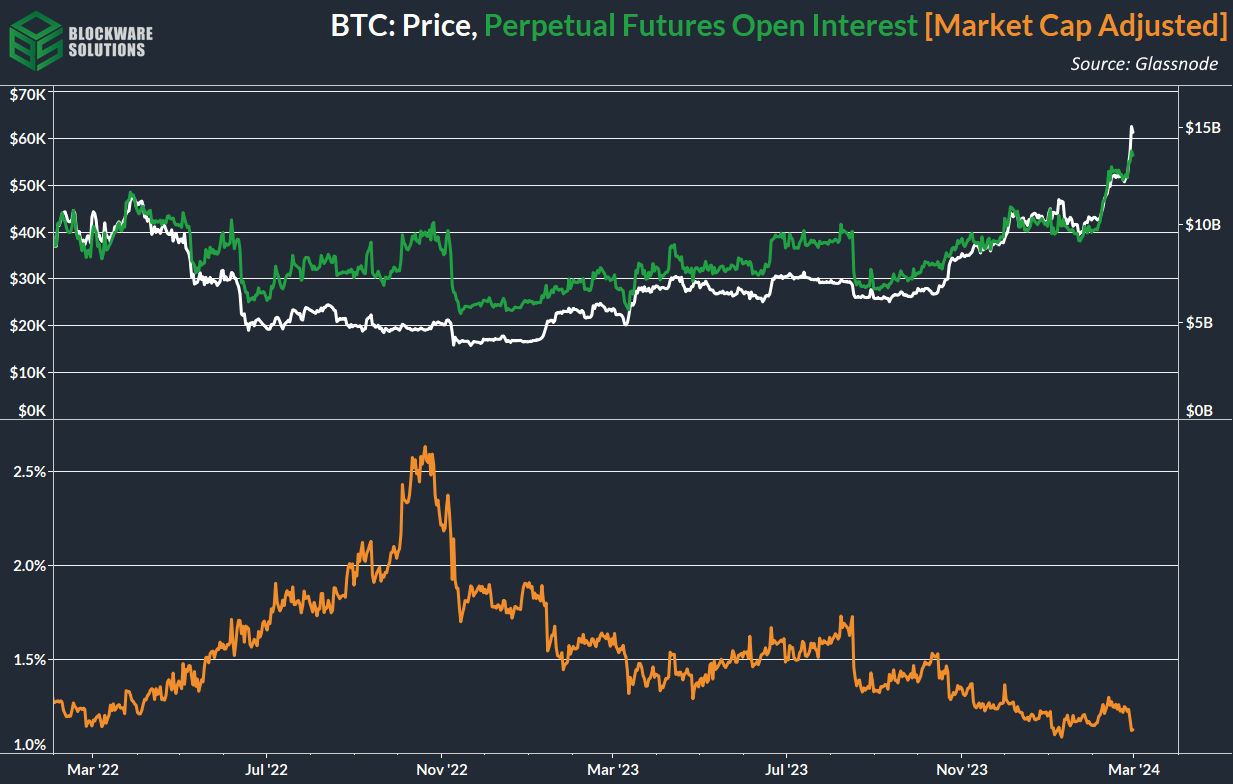

10. Perpetual Futures Open Interest:

The pump in BTC has unsurprisingly brought with it an increase in open interest. However, on a market-cap adjusted basis, open interest is at its lowest levels since the spring of 2022. Fewer open interest relative to market cap means that liquidation events (both short & long) will be less impactful on the price. That’s not to say that BTC won’t be volatile, it is and will continue to be. But we are not poised to see any obscene short squeezes or long liquidations.

11. Futures Short Liquidations:

The above being said, we did see the largest short liquidation this week with ~$150,000,000 in liquidations on Wednesday. In comparison to the previous bull market, this was a liquidation event for ants. A lack of futures trading certainly points towards the prematurity of the current bull market. Once shorts are being squeezed left and right to the tune of multiple hundreds of millions, that will be a sign of frothiness in the market.

Bitcoin Mining

12. CleanSpark Expands Operations to Mississippi: After previously operating mining facilities solely in the state of Georgia, CleanSpark has acquired multiple facilities in the state of Mississippi, bringing their total hashrate over 15 EH/s.

$CLSK has been one of the top-performing Bitcoin mining stocks since the market bottom in 2022. They have been highly calculated with each move they make; notoriously de-risking into cash during the bull market which allowed them to survive the bear market. Seeing CleanSpark expand in the face of the halving shows that they are highly bullish on BTC. Check out this podcast we recorded with their CEO Zach Bradford.

13. Bitcoin Mining Stocks: We’ve seen quite the divergence this week from spot BTC and Bitcoin mining stocks. At the time of writing (Thursday morning), $WGMI, the Valkyrie Bitcoin Mining ETF, is down ~2% on the week despite BTC being up ~22%. The most logical conclusion is that investors are weary of deploying capital into Bitcoin miners in the face of the 2024 halving. However, it’s foolish to think that these publicly traded miners will be at the risk of unprofitability post-halving. These Pub Co’s. have some of the lowest energy costs possible and have been acquiring the latest-generation hardware in preparation for the decreasing block subsidy.

Similar divergences have occurred twice in the past year: Bitcoin mining stocks crashed while BTC traded sideways. Both times turned out to be a great opportunity to acquire mining stocks at a discount. These are healthy pullbacks, especially considering the fanatical performance of Bitcoin mining stocks over the past 15 months. Corrections like this are perfectly normal, and to be expected given the volatility of these assets.

14. Cost to Mine 1 BTC Post-Halving: Here’s an updated table of the breakeven BTC price for Bitcoin miners based on machine type and electricity prices.

The average electricity cost for public miners is ~$0.06/kWh. As you can see, even with mid-generation ASICs like an S19j Pro, they will remain profitable through the halving at those rates. Miners with marginally higher electricity prices will need to upgrade to KPros, XPs, or 21s.

15. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$24,900 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Two things: 1) % Supply Last Active 1+ Year Ago seems to peak well before the price ATH, then the ATH correlates with the local % low, and 2) we seem to be making higher lows in the % metric.