Blockware Intelligence Newsletter: Week 131

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/4/24 - 5/10/24

🚨Buy The Latest-Generation of Bitcoin Mining Hardware🚨

Blockware has partnered with a world-class immersion mining facility to bring you the opportunity to mine using the Whatsminer M66s.

288 TH/s (up to 330 EH/s when in “high performance mode”)

19.5 W/Th

Immersion has a few notable advantages over air-cooled mining:

Heat Resistance

Greater Up-Time

Longer Machine Lifespan

Superior Hashrate & Efficiency

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

Bitcoin: News, ETFs, On-Chain, etc.

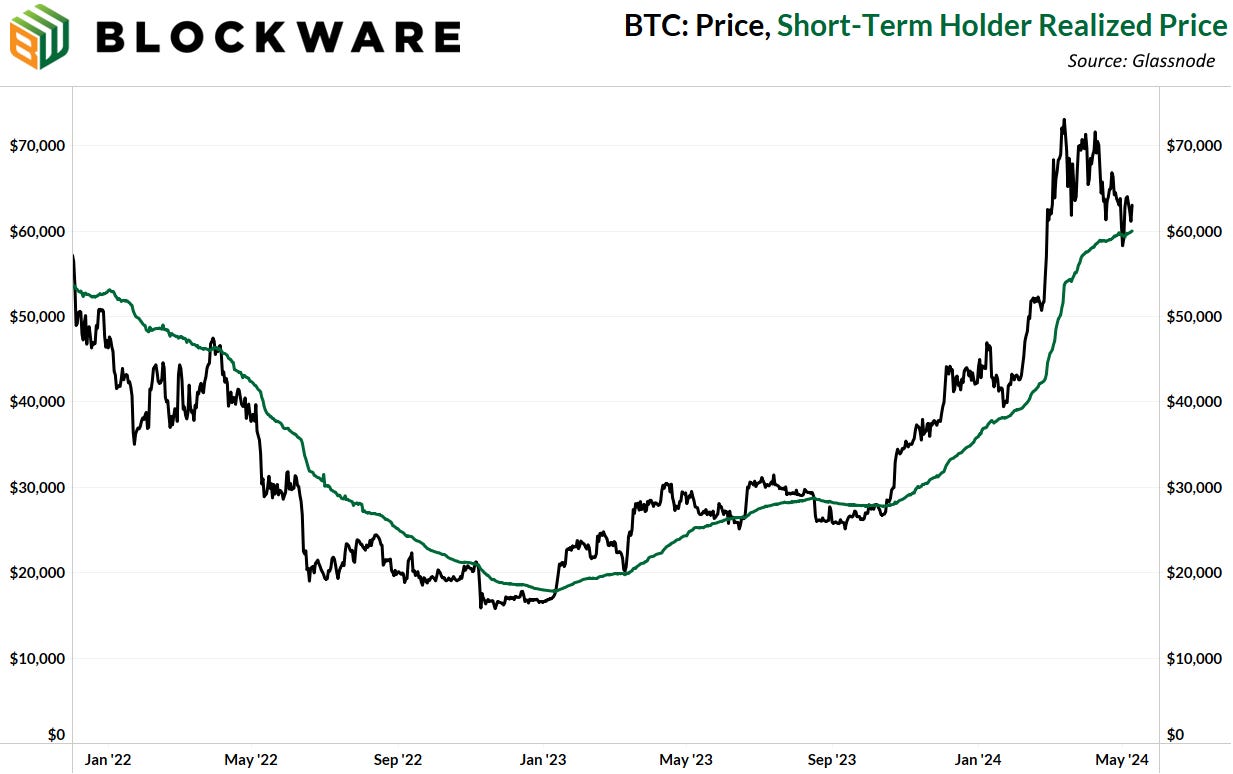

1. Short Term Holder Realized Price

After yet another week of sideways price action, bitcoin finds itself neatly nestled atop short-term holder realized price; the primary on-chain support/resistance metric. BTC has been trading range bound between $60k and $70k for what feels like forever, even though it's only been a couple months. But a lack of price action does not equate to a lack of news. There’s plenty to discuss this week in terms of Bitcoin, let's dive in! 👇

2. Donald Trump Endorses Crypto

A twitter user by the name of @macdegods asked 2024 US Presidential Candidate Donald Trump about regulatory hostility driving crypto businesses off US soil, and what he plans to do about it should he return to the Oval Office.

With federal agencies currently demonstrating hostility towards Bitcoin and crypto, it is clear, whether you like it or not, that this has become a partisan issue. That’s not necessarily a bad thing. Obviously, it would be ideal if there was universal support for Bitcoin, but that’s unfortunately not the case. The fact that a former US president is positioning himself as pro-Bitcoin shows that Bitcoiners have become an unignorable voting block within the United States. This is game theory in action. Bitcoiners are forcing political actors to appeal to our demands; we possess enough capital and economic pull that it would be imprudent to drive us off-shore, and one of the presidential front runners understands this.

Trump used the word “crypto” and not Bitcoin, which may irritate Bitcoin maximalists. But it’s not surprising that a 77-year-old doesn’t understand the difference between Bitcoin and Crypto. Nor is it surprising that a politician would rather appeal to the broader group than to ostracize non-bitcoin maximalists. It’s better for crypto to be thrown into the same bucket as Bitcoin than for there to be hostile legislation towards both. If Bitcoin maximalists are right about the distinction between these two asset classes, then the market will figure that out for themselves without the state having to make a distinction. And this is already happening; there’s only one digital asset that has billions of dollars worth of ETF inflows and the backing of Wall Street.

3. Susquehanna International Group, LLP (SIG)

Speaking of institutional backing, Susquehanna International Group (SIG) disclosed in SEC filings that they hold a $1.8 billion dollar position across a handful of different Bitcoin ETFs. Their largest position is a $1 billion allocation to the Grayscale Bitcoin ETF.

It’s been said before but it’s worth repeating: the ease at which the ETF allows institutions to gain exposure to BTC is truly game changing. It’s simply not possible for Bitcoin to reach the stratospheric levels we anticipate without institutional capital; $10 trillion, $50 trillion, or $100 trillion market cap, in real terms, we don’t get there without the suits. The ETF allows for them to deploy with minimal friction. That being said, the ETF is not real Bitcoin. Not your keys, not your coins.

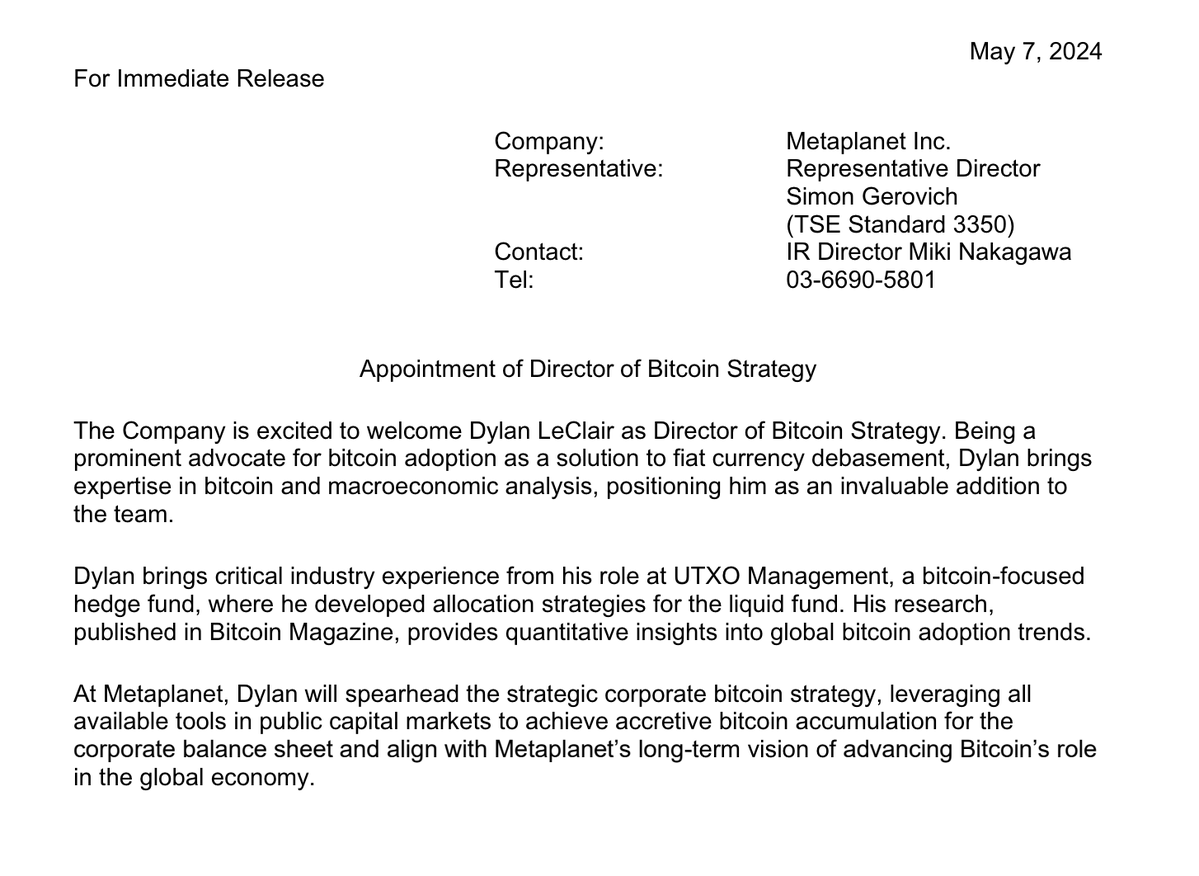

4. Metaplanet: The MicroStrategy of Japan

A Japanese company called Metaplanet, which is publicly traded on the Tokyo Stock Exchange, announced this week that they are adopting the corporate Bitcoin strategy. In their own words, Metaplanet describes the corporate Bitcoin strategy as: “leveraging all available tools in public capital markets to achieve accretive bitcoin accumulation for the corporate balance sheet and align with Metaplanet’s long-term vision of advancing Bitcoin’s role in the global economy.”

In other words, Metaplanet is going to be the MicroStrategy of Japan. This is the first of many future MicroStrategy copy cats. The playbook is simple, open-source, and it’s proven to work. MicroStrategy’s stock is up roughly 1000% since they incorporated the Bitcoin strategy nearly four years ago.

To help implement this strategy, Metaplanet hired popular Bitcoin analyst and thought leader Dylan LeClair. Dylan has been incredibly vocal about his admiration for MicroStrategy and their approach to Bitcoin. In the past he’s produced in-depth content breaking down just how clever the corporate Bitcoin strategy is, and he’s described it as “The Biggest Story in Corporate Finance.” Metaplanet definitely hired the right man for the role, and it will be fun to watch how things unfold for the company going forward. The race to secure a share of the 21,000,000 is heating up.

5. Ohio State Grads “Boo” Bitcoin Speaker

On Monday a clip went viral in which one of the speakers at the Ohio State University commencement, a man named Chris Pan, gave praise to Bitcoin. Before mentioning Bitcoin, Pan presented startling statistics on the rapid debasement of the US dollar, and how this is disproportionately damaging younger generations; of which Bitcoin is the solution. However, the audience of college graduates did not see it the same way, responding with boos upon the utterance of the word Bitcoin. In case you thought we were no longer early to Bitcoin, this occurrence makes it quite clear that we are, in fact, still early.

The Ohio State class of 2024 might not get it yet, but Bitcoin offers hope to Generation-Z. In a world in which homes are becoming increasingly unaffordable for first-time buyers, a university education is often accompanied by six figures of debt, and the average income is barely enough to pay the bills, Bitcoin offers an opt-out. Bitcoin is a way for anyone, young or old, rich or poor, to store the fruits of their labor in an asset that cannot be debased or censored. Without Bitcoin, it would be impossible to save for the future and know with confidence that your wealth will retain purchasing power over time.

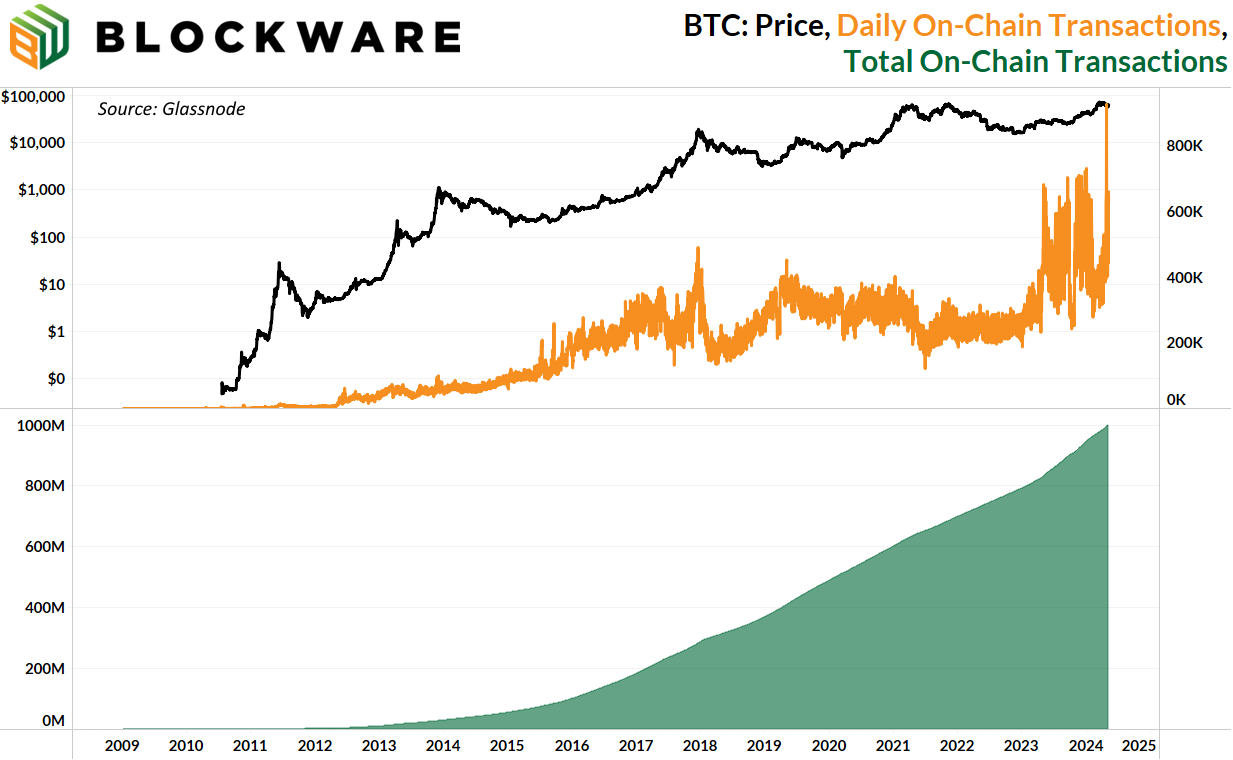

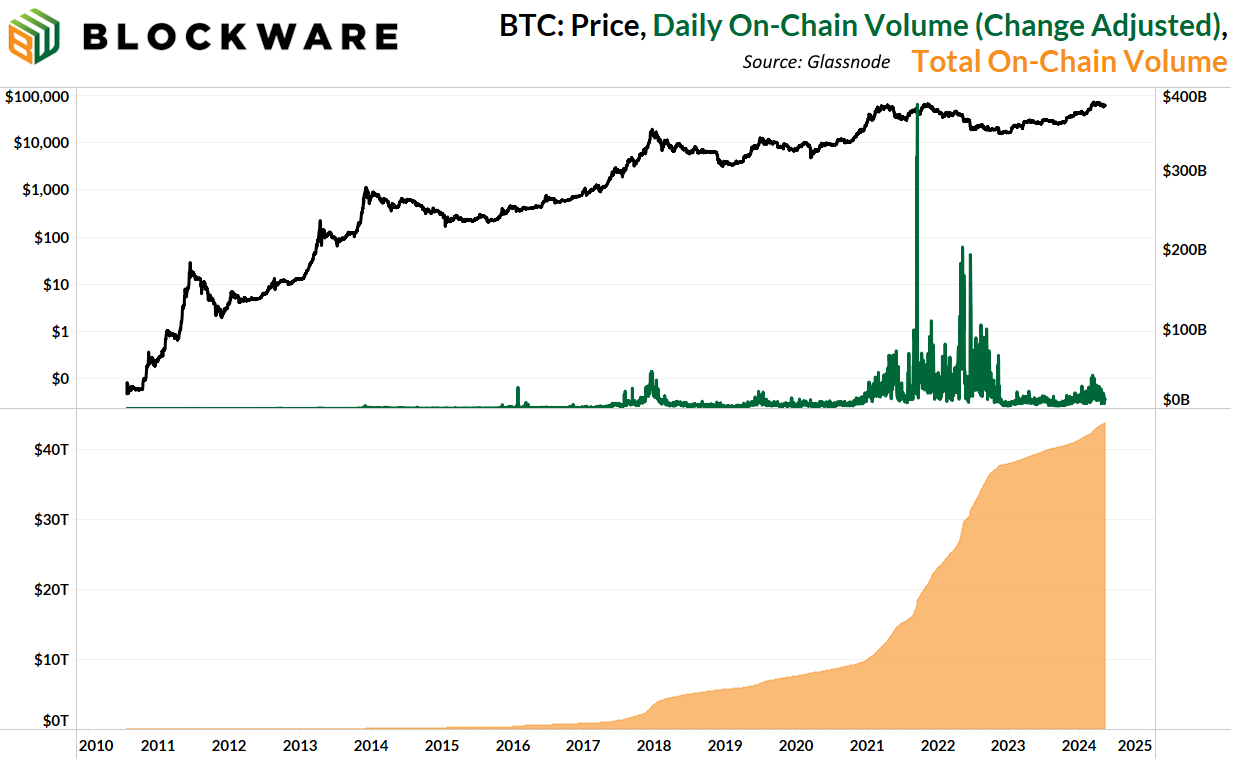

6. Bitcoin Surpasses 1 Billion On-Chain Transactions

This week Bitcoin had its 1 billionth on-chain transaction; a historic milestone. While store-of-value gets all the talk, as it is Bitcoin’s most prominent use case, it is still highly effective as a medium of exchange; at least for now given the current number of users. Some scaling will need to be done in order to service billions of users, but in its current form it works great. In fact, there’s no other network that enables you to send billions of dollars worth of value across the world, have settlement occur in about 10 minutes, and you don’t need a bank, nation-state, or any 3rd party to process the transaction. And at the current transaction fee rate, you can do this for a measly $1.30.

In total, across these 1 billion on-chain transactions, adjusting for change back UTXOs, the Bitcoin network has processed $43 trillion worth of transactions. And ¾ of that $43 trillion has come since 2021. For reference, that’s nearly on-par with Visa who processes roughly $10 - $11 trillion per year.

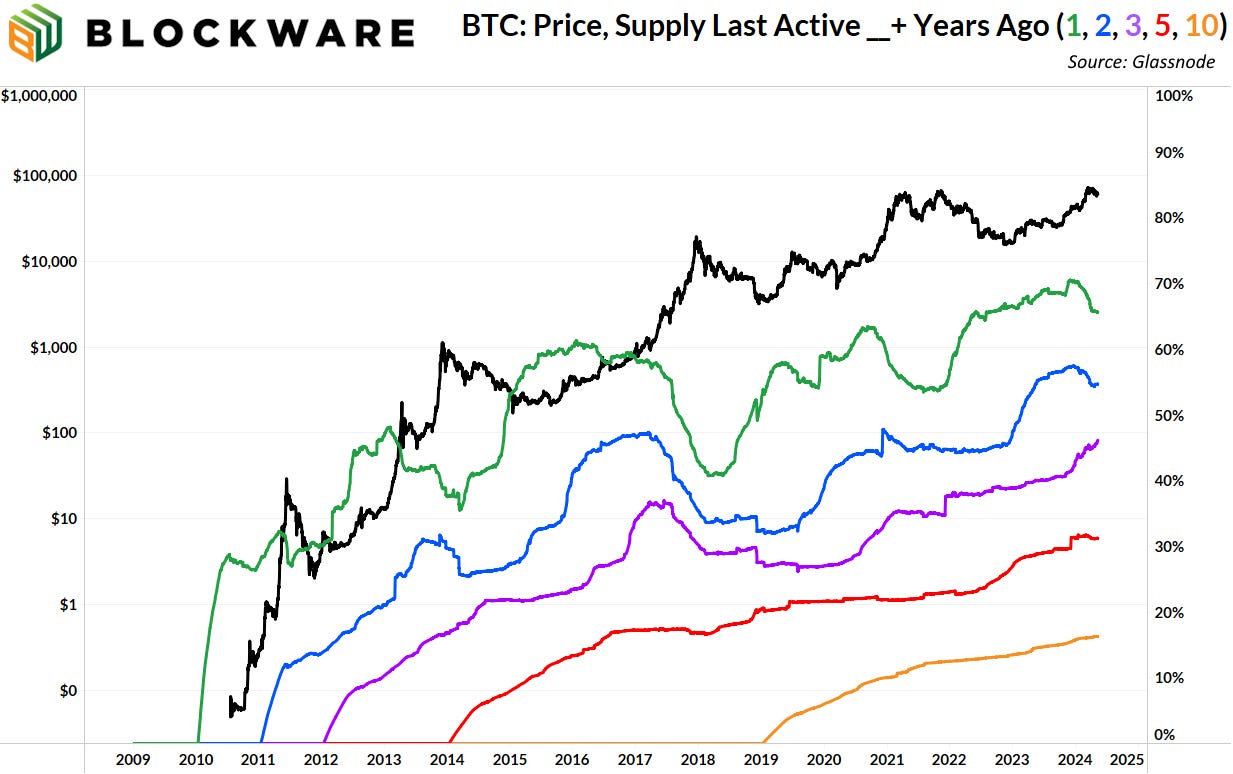

7. % Supply Last Active __ Years Ago

Each of the lines on this chart represents the % of the Bitcoin Supply that hasn’t moved in at least X amount of time. The green and blue lines (1+ years, 2+ years) can give us insight into where the price of Bitcoin may be headed in the coming months. When a high % of the supply hasn’t moved in at least a year or even two, that sets the stage for a supply squeeze. On the contrary, these metrics start to decline during bull markets as those who purchased during the bear begin to move their coins (presumably to be sold). The current levels of these metrics indicate that the bull market is still just getting started.

In terms of long-term Bitcoin adoption, the purple and red lines (3+ years, 5+ years) show us that each Bitcoin cycle breeds a new cohort of volatility-immune HODL’ers. These metrics help us to quantify the new “classes” of Bitcoiners.

Lastly, the orange line represents the % of coins that haven’t moved in at least 10 years. We can reasonably assume that the keys to most of these coins were lost, and that they'll never move again. It’s incredibly difficult to HODL for 10+ years, resisting the temptation to spend during bull markets, and having stone-cold resilience during bear markets. It’s not to say that old coins never move, that happens. But more coins are being held and aging into the 10+ year cohort than there are old coins moving, as evidenced by the fact that this line is up-only.

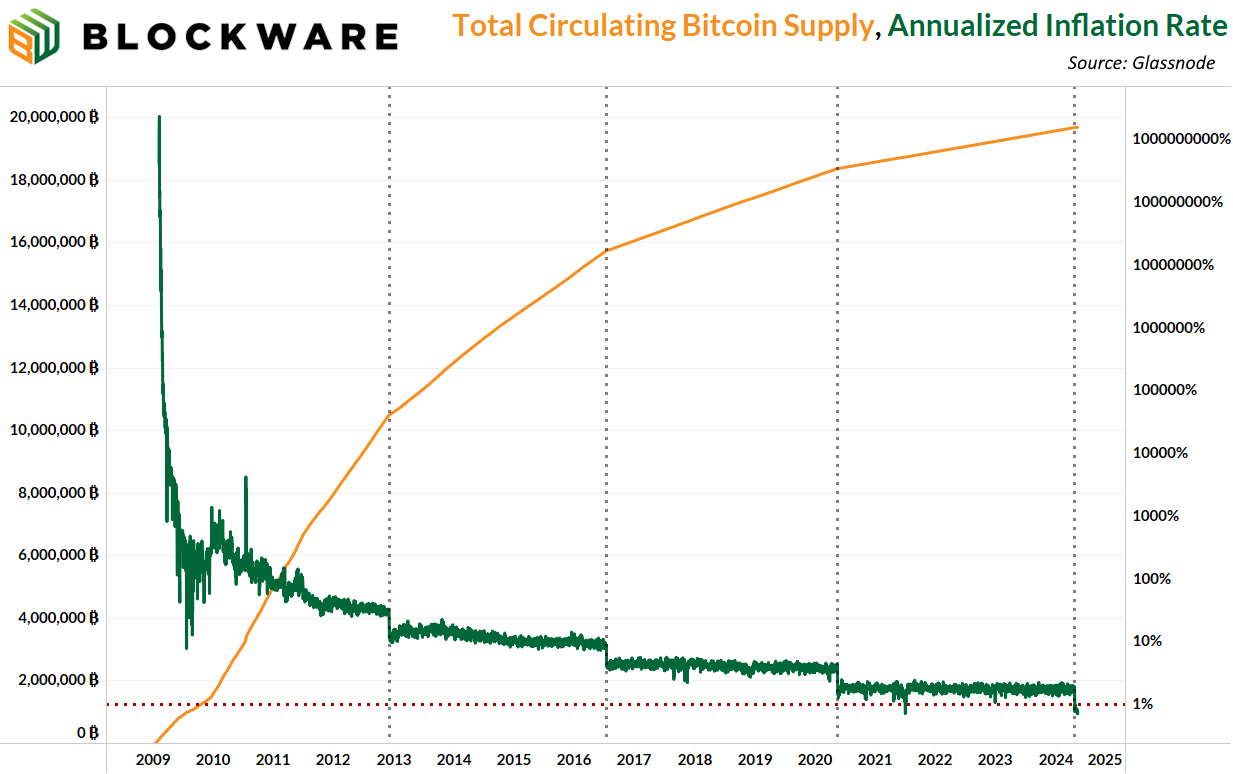

8. Bitcoin Inflation Rate is Less than 1%

Bitcoin now has an annualized inflation rate of less than 1%. Soon there will not be enough supply to satisfy demand at the current price. It is physically impossible to produce more supply to match an increase in demand. The only way for an increase in demand to find supply is by bidding the price higher in order to incentivize existing holders to part with coins.

We've never seen anything like this before. For the first time in the history of mankind, there's an asset with a limited supply. And most of the world has no idea this is happening.

"It might make sense just to get some in case it catches on." - Satoshi Nakamoto

General Market Update

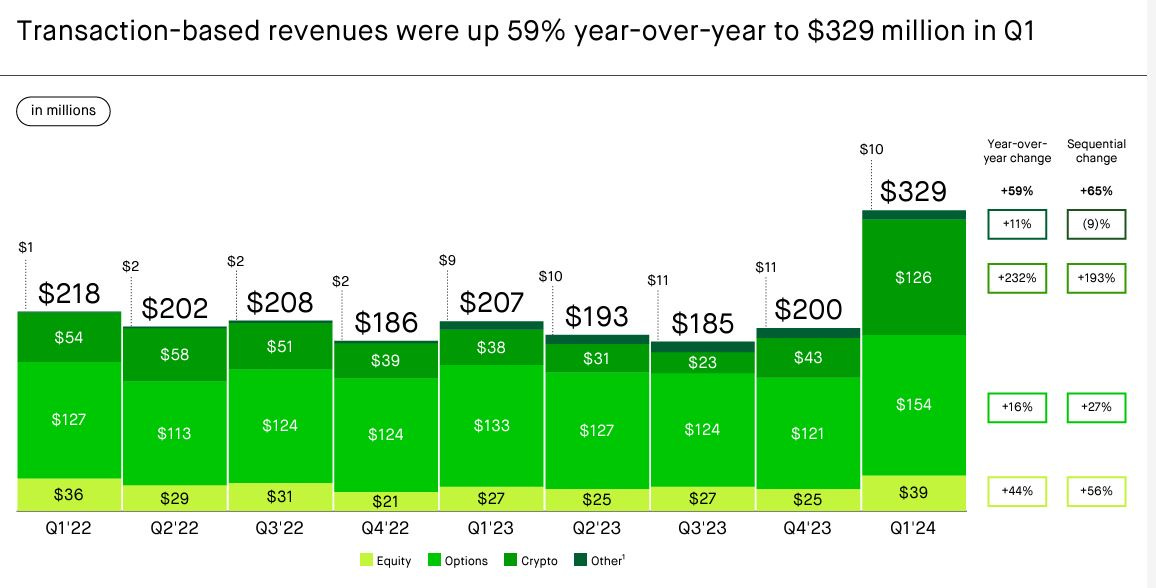

9. Robinhood Earnings

Robinhood reported $126 million in revenue generated from crypto-based transactions in Q1; a 193% increase from the quarter prior. This substantial increase in volume/revenue likely comes on the back of the ETF launch. This shows us that there is an appetite for ETFs, not just at the institutional level, but at the retail level as well.

10. S&P 500 Index

Overall, this week was relatively uneventful in terms of equities and the broader macroeconomic landscape. No Fed meetings, no important data releases. The S&P is up ~1.3% over the past five days and, like Bitcoin, it remains in a funnel of sideways price action just beneath its all-time high.

11. Japanese Yen

JPY/USD posted a few red candles this week and is headed back towards the level at which the Bank of Japan intervened. Given the rapid and seeming unstoppable devaluation of the Yen, it's not surprising that the first Microstrategy copycat came out of Japan.

A tweet went viral this week indicating that the Federal Reserve provided dollar liquidity to the Bank of Japan so that they would not sell US treasuries in order to support the Yen. However, I have not found any primary sources to support that claim. That being said, such an occurrence is not out of the question given the shaky liquidity in the treasury market right now. The last thing the Fed or the Treasury would like to see is a G7 nation dumping treasuries in rapid succession.

Bitcoin Mining

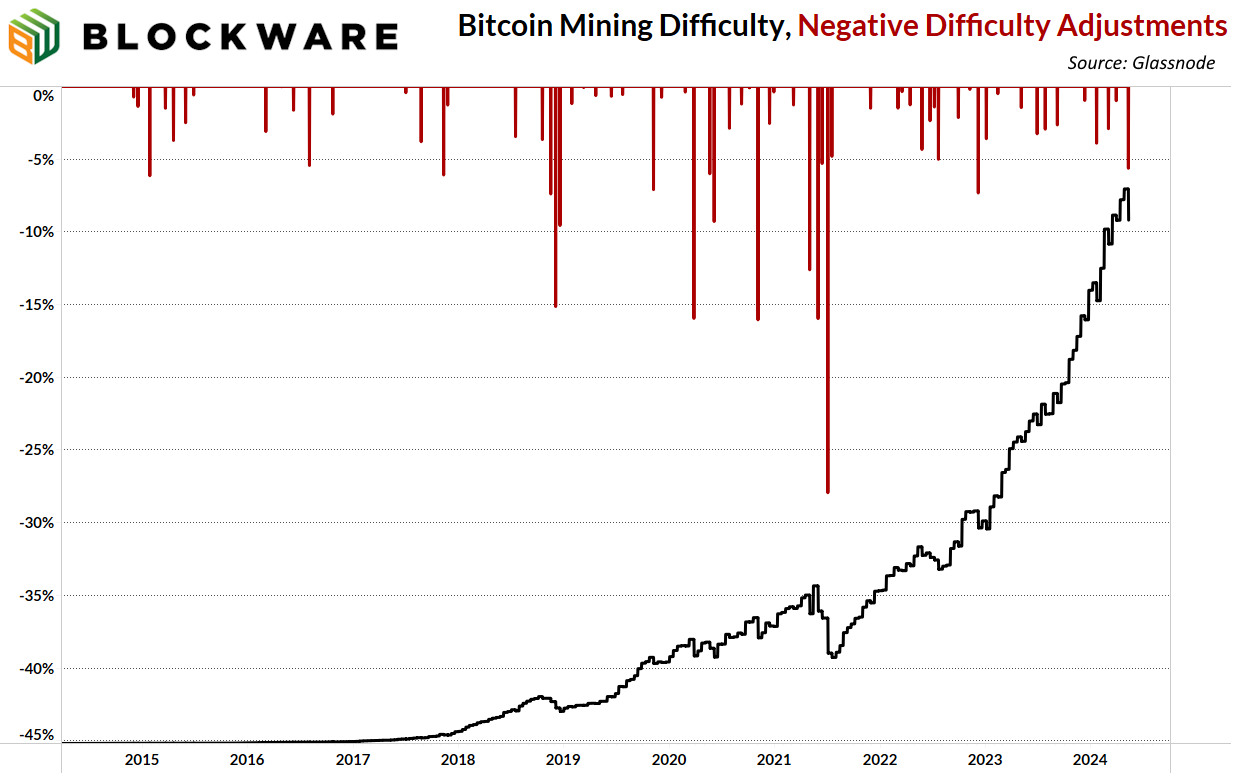

12. Mining Difficulty Drops 6%

The most exciting and bullish development this week was the six percent drop in mining difficulty. This was the largest negative difficulty adjustment since December 2022 when the price of BTC was at ~$16,000.

Why did this take place? Miners with inefficient ASICs and/or high electricity costs became unprofitable after the halving and they consequently unplugged their machines.

Why does this matter? For the surviving miners, this is, of course, bullish. Six percent lower difficulty means that the miners still on the network will earn ~6% more bitcoin for the same amount of hashpower. That’s not a bad reward for surviving the halving.

What’s next? Next is that there will be less sell pressure on bitcoin going forward. Think about it, those miners that had to unplug their machines were the least profitable miners on the network. That means that they were selling a majority of the Bitcoin they mined in order to cover their operating expenses. Now that they’re no longer mining, that’s going to relieve sell pressure on bitcoin. It may take a few months before the effect is felt in terms of a rising Bitcoin price, but make no mistake, weak miners unplugging is not bearish. This is the Bitcoin network’s natural immune system, a free market response that rewards miners who allocate capital efficiently at the expense of those who do not. It’s looking like the miner capitulation is not quite done as the next difficulty adjustment is projected to be negative as well.

Right now on the Blockware Marketplace you can buy the latest-generation, most efficient ASICs on the market, and benefit from the drop in mining difficulty. We’ve got S21s, S19 XPs, S19 KPros, more!

13. The time to mine is now!

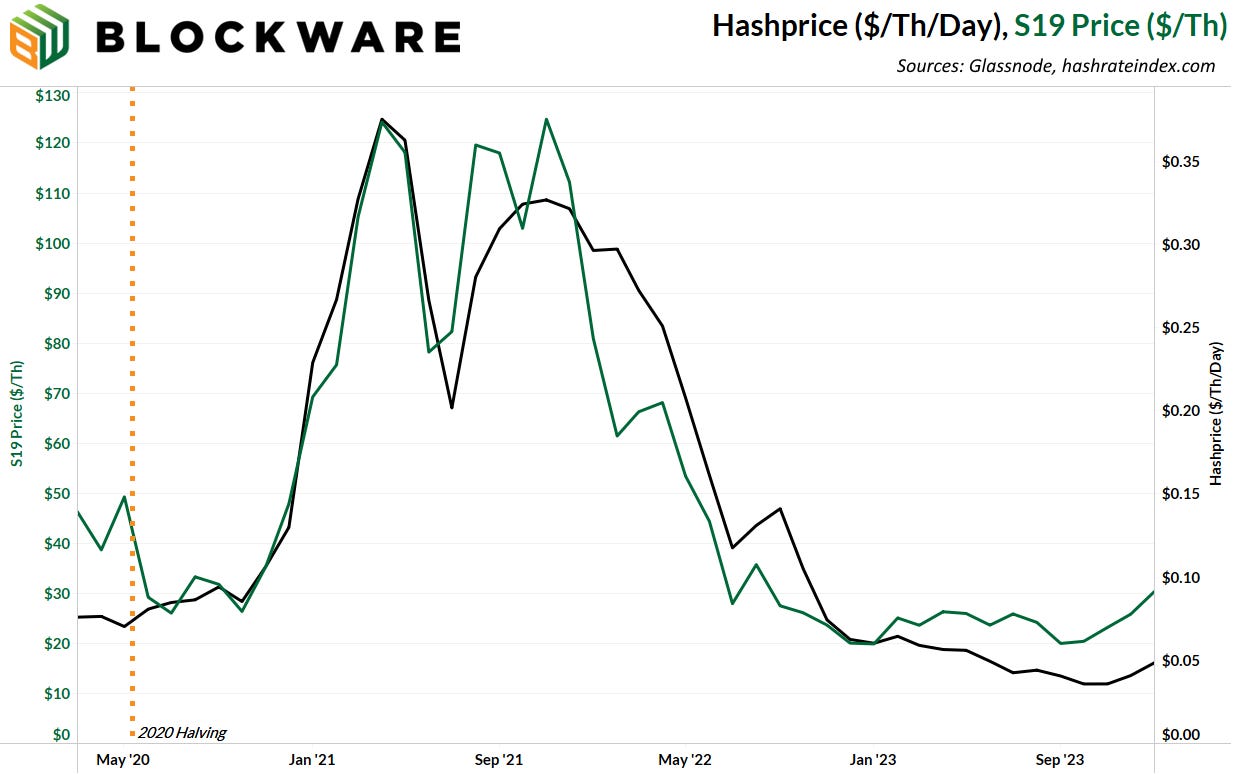

With hashprice at near all-time lows, ASICs are at historically cheap prices right now! Hashprice and ASIC prices tend to move in tandem (the chart below shows the movement of both during the last cycle). If you’re bullish on the price of BTC, then now is the time to deploy capital into mining. ASICs likely won’t be getting any cheaper.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.