Blockware Intelligence Newsletter: Week 42

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/10/22-6/17/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

FTX US - Buy Bitcoin, crypto, and now US stocks with lower fees on FTX. Use our referral code (Blockware1) and get 5% off trading fees.

Blockware Solutions (Mining) - It is difficult to buy ASICs, build large mining facilities, and source cheap scalable electricity all on your own. Work with a trusted partner like Blockware to deploy capital into Bitcoin mining.

Blockware Solutions (Staking) - Ethereum 2.0 is almost here, now is the time to stake your ETH with Blockware Solutions Staking as a Service to take advantage of 10-15% APR when the Ethereum network switches over to Proof of Stake.

Summary

Following the highest CPI value of the last 41 years announced last Friday, the market began pricing in more aggressive monetary policy from the Fed.

Higher interest rates have an adverse effect on the prices for equities and cryptoassets, we explain exactly why this is the case.

Bitcoin is likely to experience an old-generation miner capitulation if the price doesn’t rise to higher levels over the next few weeks.

Updated Miner Network Distribution Breakeven table reveals that a majority of S9s running at the beginning of 2022 are now either unprofitable or turned off.

Why miner capitulations mark Bitcoin bottoms, benefit efficient miners, and strengthen the network.

General Market Update

From a macro perspective, this week has been the most significant we’ve seen in quite some time. Now, that’s a fairly bold statement to make, so allow me to lay some foundation before we talk about what went down with the Fed this week.

A lot of the crazy price action this week came at the behest of interest rate speculation from institutional investors. So to preface that, let’s recap some of what we’ve discussed in this newsletter in weeks past.

Last week we discussed the announcement of the newest, and highest, CPI number of recent, at 8.6%. This puts CPI at its highest value since December 1981’s 8.9%.

A week ago, we discussed the impacts that higher CPI values can have on markets. Let’s expand on that a bit for this week.

Higher prices for goods has massive effects on the spending behavior of everyday citizens and thus, has an even larger effect on the economy. The vast majority of people aren’t growing their cash flows at the rate of inflation. Simply put, the erosion of purchasing power is much greater than the growth in income.

CPI & YoY Hourly Earnings Growth (Bloomberg)

Above you can see CPI (white) overlaid with the year-over-year change in hourly wages (blue). The average American isn’t able to keep up with the degradation of purchasing power as wages are growing slower than inflation.

The effects of this are fairly obvious, American’s are growing poorer in real terms. Inflation is a tax on everyday citizens that is hardly recognized by most, until it's too late.

When people have to spend more at the gas pump, grocery stores, on their energy bill, and ultimately, interest payments, there’s less money out there to be spent on non-essential goods. These decreased expenditures can cause a retraction in economic activity commonly referred to as a recession.

This current inflationary environment comes at the result of the easy money policy put forth by the Fed and US Government over the course of the last 2 years. There are many reasons as to why we’re seeing extremely high inflation.

The main fault lies in the expansionary strategy of 2020-2022 which combined 0% interest rates, aggressive QE, PPP loans, stimulus packages, and COVID relief packages into a “get out of COVID” free card who’s side effects would be paid for later (AKA now).

Now to be fair, the effects that COVID was to have on the economy were unknown in mid-2020 and the reaction of the Fed to aid economic conditions wasn’t the wrong decision, in my opinion. The issue arose when the expansionary monetary policy lasted over 2 years, after the medical threat had been fully assessed, and was actively being dealt with.

M2 Money Supply (Bloomberg)

As a result, the US’ M2 money supply expanded by 41.1% from February 2020 to March 2022. When the amount of currency grows exponentially while the amount of goods in circulation stays relatively stagnant, you simply have more dollars competing for goods. It shouldn’t be too much of a shock that it causes nominal prices to increase.

This, of course, is not to mention the ongoing supply chain and oil supply issues.

But generally speaking, the current inflation issue largely comes down to the misjudgment made by the Fed to aggressively, and unnecessarily, expand economic conditions for 2 years. For that reason, they have lost a lot of credibility and faith from US citizens to always do the right thing.

But this doesn’t just make Powell and the other Fed officials look bad, this judgment is also reflected on the Biden administration. It’s likely that Powell is facing extreme pressure from the White House to get inflation under control going into midterm elections this fall.

The Fed had said repeatedly over 2021 that they believed this inflation is only transitory.

This means that they thought inflation would be short-lived and that by midway through 2022, it should’ve subsided. Of course, the opposite has occurred with CPI reaching its highest value in 41 years for May 2022.

Furthermore, in previous FOMC meetings this year, the Fed has repeated that a 75bps FFR hike was not something they were actively considering. This week, of course, they did it.

Fed Funds Target Rate (Bloomberg)

Above is a plot of the Fed Funds Target Rate with the pane at the bottom showing the rate of change in yellow. This tells us just how aggressively the FFR is increasing and as you can see, it is quite extreme.

So due to the escalating aggressiveness of the Fed Funds Rates’ hikes in an attempt to bring down the once-called transitory inflation, this week marked the Fed admitting to their miscalculations and taking even bigger steps to fix it.

This is why we made the statement that we did in the opening sentence of this newsletter. The Fed acknowledging their mistakes of the last two years and taking aggressive steps to fix them is why this absolutely was one of the most significant weeks in monetary policy and macroeconomics we’ve seen in quite some time.

So following the 8.6% CPI announced last Friday, it was clear that the two 50bps rate hikes that the FOMC implemented earlier in the year were not doing enough to slow inflation. Due to that, the market began to price in the likelihood that the Fed would implement even larger rate hikes on Wednesday of this week.

We’ve discussed the impact of higher interest rates on stocks, bonds and cryptoassets numerous times in this newsletter, but here’s a short summary.

These relationships essentially come down to bond pricing and stock valuations. So let’s look at the formula used by institutions to value stocks, as it will allow us to understand why higher interest rates cause selling in equities and Bitcoin.

I’ll try to keep it as simple as possible.

One of the most basic, and important, laws in finance is this: bond prices and interest rates have an inverse relationship. And because bond prices and bond yields also have an inverse relationship, higher interest rates means higher bond yields.

Above is the Present Value (PV) equation used by institutional investors to find a “fair price” or the “true value” for individual equities.

In the denominator, “i” is the discount rate. Analysts will use a bond’s yield, usually the 10-year Treasury Bond, as their discount rate. A higher discount rate lowers the PV of an equity because if the expected return of owning a bond is higher, the stock must perform better in order to justify purchasing the equity instead of the bond.

When the discount rate is higher in the PV equation, the denominator is increasing and thus, PV is decreasing.

So in short, higher bond yields means that the “true value” of a stock is now lower, and because of this, institutional investors will sell their stocks.

Bitcoin and many stocks are currently put in the “risk-asset” basket. So when interest rates are rising and funds are looking to de-risk their portfolios, Bitcoin will sell off alongside the more speculative tech/growth stocks.

This week, in order to prepare for an even more aggressive increase in the FFR, investors sold stocks, Bitcoin and bonds. This economic landscape is extremely uncommon in that bond investors have been selling alongside equity investors.

This week was a brutal one across nearly all facets of the market. On Tuesday, we saw bonds, tech stocks, energy stocks, oil, gold and Bitcoin all selling off together. A screaming signal that if the Fed was indeed going to raise interest rates by 75bps, they would be admitting that the economy is in very poor shape.

US 10Y Yield & Nasdaq Composite Index (Bloomberg)

Above you can see the US 10-year Treasury Bond’s Yield (white) overlaid with the Nasdaq Composite (blue). With speculation of higher interest rates earlier in the week, the yield of the 10-year spiked to 3.47% on Tuesday. As we now know, this tends to cause a sell-off in equities, as seen on the Nasdaq.

But this week's price action speaks for itself on the Nasdaq Composite, which was down 6.12% as of Thursday’s close. If the market closed for the week on Thursday, it would put the index at its 48th worst week since 1980.

Of course, anything could happen on Friday, but the index is on track for its worst week since January 18, 2022 when the Nasdaq was down 7.55%.

The worst week before that was the week of March 16th, 2020 where the index was down 12.64%.

Nasdaq Composite Index 1W (Tradingview)

For the week, the Nasdaq has thus far been able to hold a relatively key support level from the low of the first correction following the COVID bottoms at $10,519.49.

If the index is unable to hold this level, the next major level of support could come around the pre-COVID highs at $9,838.37.

ARKK 1W (Tradingview)

The Ark Innovation Fund ETF, ARKK, can be used to gauge the price action of the more speculative growth and tech names. As you can see above, ARKK has nearly given up all of its 384% gain from March 2020 to February 2021.

ARKK is now roughly 76% off its all-time highs.

Crypto-Exposed Equities

Once again, there isn’t too much to update on the crypto-equity side of things. With rising interest rates pressuring Bitcoin, it’s no surprise that this industry group has continued to get crushed.

Of course, it is always important to be on the lookout for the stocks showing the strongest relative strength in the midst of a bear market.

For more information on spotting relative strength, I’d highly recommend checking out this video I created on the Blockware Intelligence YouTube channel which discusses RS towards the end.

Some of the names that stand out to me this week have been: CORZ, COIN and CLSK.

That being said, these names are in severe Stage 4 downtrends and with strong macroeconomic headwinds, these types of names are at great value to accumulate with long time horizons, but likely not strong to trade in the short-term, in my opinion.

Above is our weekly spreadsheet comparing the Monday-Thursday performance of several crypto-exposed equities. As you can see, the average name is down 5.87% on the week in comparison to Bitcoin’s -23.20% and WGMI’s -9.92%.

Bitcoin On-Chain/Price Action/Derivatives

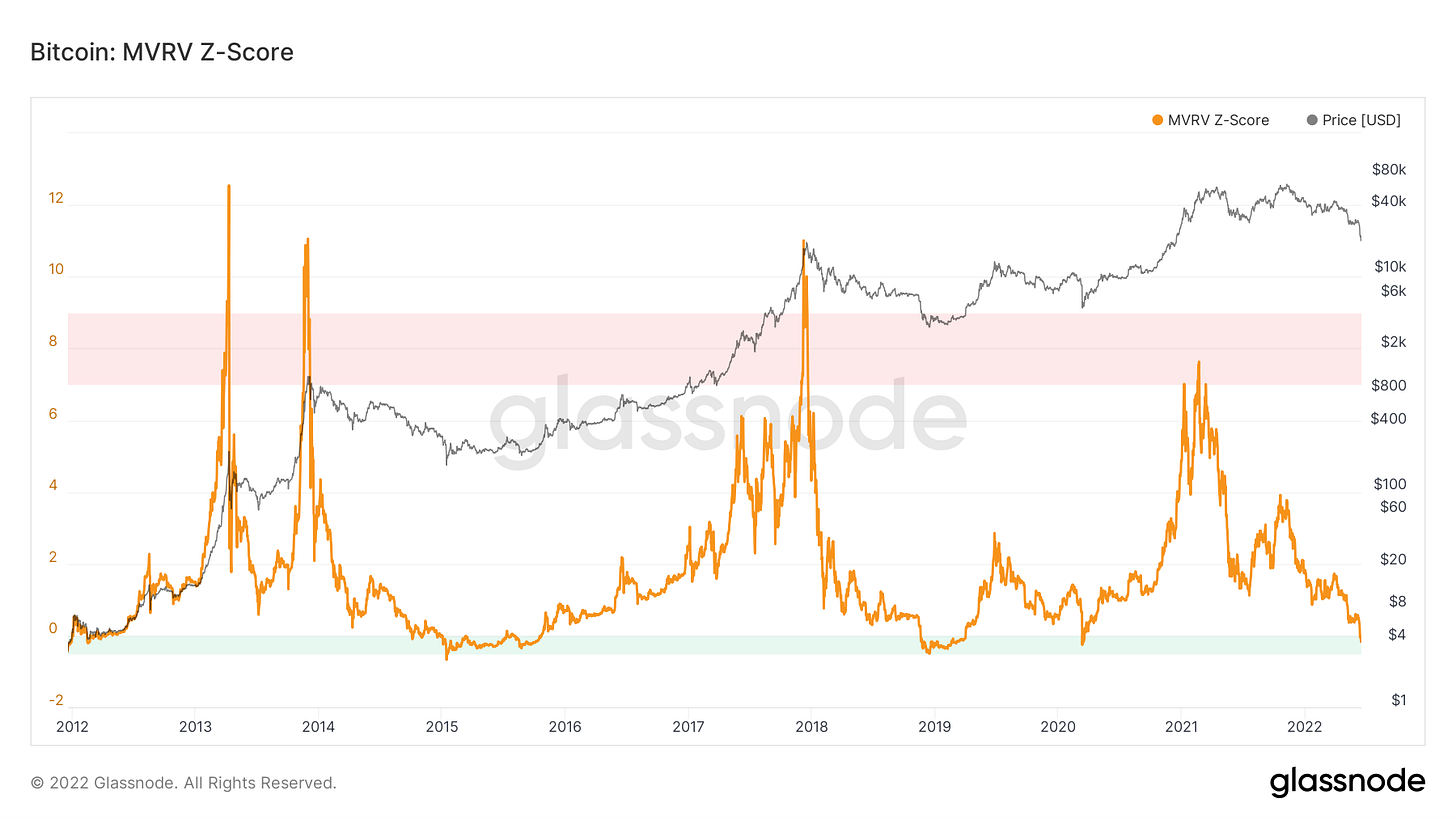

After talking about several measures of capitulation we have been watching for over the last 2-3 months in the newsletter, we’ve finally reached full reset levels on many of the oscillators and historical valuation metrics we find to be most important. We have entered the value thresholds we’ve been waiting for. The question one must ask themselves as going through these charts is “is this time different because of macro”? I don’t have the answer, but the statement that Bitcoin has never been through a broader bear market is completely valid. With that being said, being the data-driven person I try to be, I (Will) couldn’t help but pick up some spot BTC for my long-term holdings at these levels. The largest risk to the crypto market as of late has been the contagion effects of several large entities in the space blowing up; but as Genesis, Blockfi, and others have announced publically that they’ve been able to properly liquidate and hedge the risk of these counterparties, perhaps these contagion fears have been overblown for now. We will likely not find out the true effects of these events until the ensuing weeks pass in the same way we did not find out the full effects of the Luna blowup until some time had passed. While the dust settles, we do recommend readers take custody of their Bitcoin. There’s a reason Bitcoiners say “not your keys, not your coins”.

Let’s start with some price-related data. Bitcoin has experienced one of its further deviations below its 200-day trend in history, the third-lowest in the last 10 years. This suggests a strong likelihood of oversold conditions and mean reversion.

Bitcoin also sits below its 4-year trend for just the 3rd time ever. Previous occurrences of this took place at the bottom of the 2015 bear market and during the March 2020 liquidity crisis related to Covid-19.

Bitcoin also sits below its 200-week moving average for the second time ever, with the previous occurring during the March 2020 liquidity crisis.

Bitcoin’s price sits at the lower bound of its production cost for the first time since the March 2020 liquidity crisis as well. The idea here is that Bitcoin should at minimum be worth the cost of energy to produce it.

Bitcoin’s market price finally sits below its realized price. Realized cap multiplies the supply of BTC and the price each coin was last moved, therefore realized price is the average price investors have paid for their coins. Being below this value (green accumulation zone) means in aggregate market participants are underwater.

Reserve risk, created by Hans from Ikigai, is showing one of its lowest readings as well.

On the derivatives side, we saw a large decline in the 3M futures basis across the board, including briefly reaching backwardation on several venues including FTX and Okex.

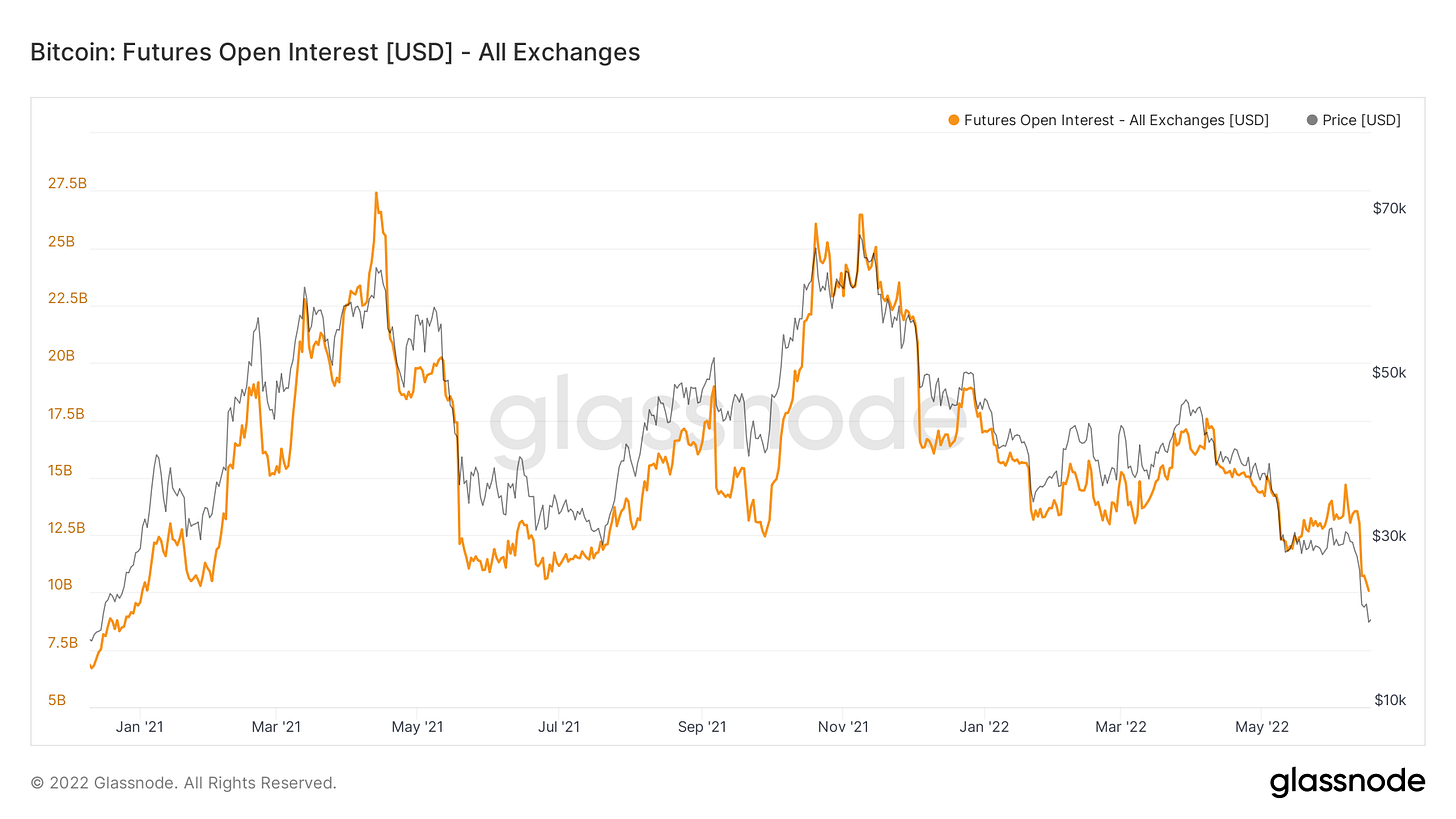

Down to just over 10 billion, futures open interest in USD has reached its lowest since December 2020. This is a reflection of recent liquidations on the move down to $20K, shorts closing at these levels, and an overall lack of speculation from the futures market.

We have started to see some negative funding rates across the board at all venues but would like to carve out a longer regime (ex: March 2020, summer 2021) to allow for a broader trend reversal.

Options implied volatility has driven dramatically as active managers and market makers seek to hedge their positions; just shy of the levels reached in mid-May 2021.

Bitcoin Mining

Old Generation Machines (S9s) Are Capitulating

From previous Blockware research on miner electricity rate distribution and Coinshares research on brand and model distribution, we updated the miner distribution table that shows how the network likely has changed since the start of 2022.

Of all the S9s running at the beginning of the year, a majority of them are now operating unprofitably or they have already turned off. At the current hash rate (~ 220 EH/s), these S9s would be 10.4% of the network, which would be a non-insignificant decrease in difficulty. The price is also approaching breakeven levels for mid-generation rigs (S17s). It’s important to note that all of these machines might not be turned off forever. Many will likely be sold for pennies on the dollar and redistributed throughout the world at a cheaper energy source.

Hashribbons is a metric that confirms that miners are capitulating.

Miner Capitulations Mark Bottoms and Strengthen Bitcoin

On Twitter yesterday, Jason Williams outlined a simple and concise explanation of miner capitulations and Bitcoin bottoms. As mentioned below, capitulations (verified by downward changes in difficulty) are signs that old inefficient miners are closing up shop. This means that old ASICs get redistributed to miners with lower energy rates and newer ASICs operating at absurdly high electricity rates also get sold off to more efficient miners.

At the end of this capitulation, weak miners are purged and the remaining miners are mining more Bitcoin and selling significantly less as a whole. This has been previously highlighted by Blockware’s 2020 Halving miner capitulation analysis.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Really like your macroeconomic economic analysis and explanation in the beginning of this article!

Can we add miner net position change to the report?