Blockware Intelligence Newsletter: Week 110

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/28/23 - 11/03/23

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

2. Blockware Intelligence Podcast. Peter is notorious for his bullish rhetoric and seemingly absurd Bitcoin price predictions, this episode lives up to the hype. Peter & Mitch dive deep into the challenges and solutions of Bitcoin self-custody, the Bitcoin Spot ETF, why investing is so difficult in the current macro environment, and more!

3. Blockware Intelligence Podcast. Mitch & Eric discuss the problems with having a career in corporate America, what it's like working for Bitcoin start-ups, why Bitcoin knowledge is a monetizable skillset, maintaining a healthy work/life balance, and more!

General Market Update

4. Effective Fed Funds Rate. Powell spoke with a slightly dovish tone after the Fed paused rates for their 2nd consecutive meeting on Wednesday. Of course, the Fed Chair attempted to leave the door open for further hikes, but after declining several opportunities to be more hawkish, it appears to us that the hikes are over. With disinflation inarguably underway and some weakness from the jobs market proven this week, the shot clock has started for a rate cut. Will the cut come in Q2, Q3, or Q4? Only time will tell.

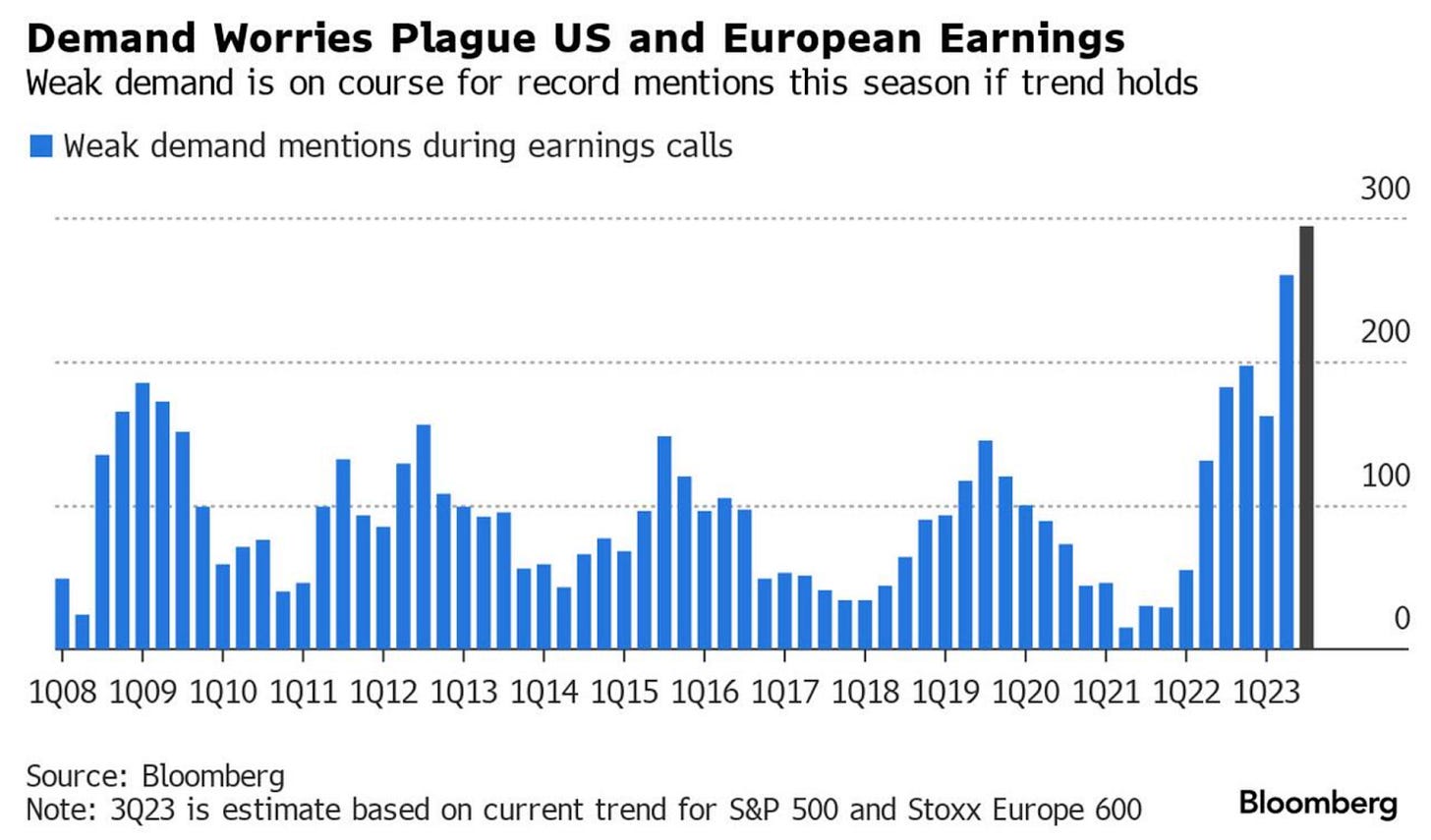

5. Mentions of “Weak Demand”. If you’re looking for evidence that global rate hikes are having their intended effect on the consumer, check out this chart from Zero Hedge, which counts the mentions of “weak demand” in US and European earnings calls. With Non-Farm Payrolls coming in much weaker than expected this morning, the global economy is seemingly headed towards recession, with Canada and the EU already there.

6. ISM Manufacturing PMI. The ISM Manufacturing PMI also came in lower than expected this week at 46.7%. As you may know, 50.0% is considered the line in the sand between economic growth and contraction. The manufacturing industry has now spent the last 12 months in contractionary territory. This index asks manufacturing purchasing managers to give their outlook on their industry, and these decision makers are clearly pretty uncertain about what's to come for this immensely important piece of the American economy.

7. US 1-Year Treasury Yield. This week we’re finally beginning to see a sustained decline in Treasury yield on the back of weaker economic data and the more dovish postering from Chairman Powell. The market seems to be looking ahead to rate cuts in the next ~9-12 months which has driven a resurgence in bond and equity demand.

8. Russell 2000 Small-Cap Index. If you’re a weekly reader of the Blockware Intelligence Newsletter, then you’d know that we look to the Russell 2000 as a quick signal of equity market breadth. We often say that the stock market will not be able to sustain a bull rally for too long without participation from the small-caps. This week, we’ve seen a resurgence of bidding for these names and this index is up nearly 7.5% on the week. This is, so far, the strongest week for small-caps since February 2021.

Bitcoin Exposed Equities

9. Riot Platforms. It’s been a very interesting past few months for publicly traded Bitcoin miners. With an increase in Wall Street coverage and a spotlight on performance as we gear up for ETF approvals, we’ve largely seen a rough period of price action. This week, things are seemingly different as many of these names catch a bid in the face of a BTC pullback. Portfolio Managers are seemingly using this short-term weakness from spot BTC prices to allocate capital into these names.

10. BEE Comparison Sheet. The table below, as always, compares the Monday-Thursday price action of many Bitcoin Exposed Equities, in comparison to the Mining ETF WGMI and spot BTC. This is the first week in quite awhile that we’ve seen public BTC companies significantly outperform spot BTC price action. It’s worth noting that in recent months, BEEs have tracked general market price action much closer. This is likely due to increasing institutionalization of this industry, as well as the prospect of a spot ETF being approved in the next couple of months.

Bitcoin Technical Analysis

11. Bitcoin/USD. The 3H intraday chart below shows the current channel BTC price has been traveling in. Positively traveling channels aren’t ideal after a significant increase in price, as they slowly create incentive for profit taking as price travels higher. That being said, sentiment and narratives have seemingly overtaken any major sell pressure in recent weeks. Our team has our eyes on a sustained, high volume break above $36,000 to signal the next potential move higher. The next most likely resistance zone lies between $38-40,000.

Bitcoin On-Chain / Derivatives

12. Sam-Bankman Fried Guilty Verdict: The legal system has legitimized what Bitcoiners have been shouting for the past year: SBF is a crook. He was convicted on 7 charges related to wire fraud and conspiracy. Those who have studied Bitcoin understand that it is the polar opposite of FTX. Bitcoin is a decentralized, leaderless monetary protocol; absent of counterparty risk and human intervention. FTX on the other hand was a centralized trading platform riddled with counterparty risk, fraud, and rehypothecation. While Bitcoiners understand the extreme difference, many institutions and Wall Street investors do not. This guilty verdict will go a long way in easing the concerns of institutional investors as it pertains to Bitcoin and the broader “crypto” market.

As the book closes on the final chapter of the bear market, the greatest lesson we can learn from everything that took place, from BlockFi to Celsius to Voyager to FTX, is that any bitcoin left with a centralized custodian is at risk of being rehypothecated; not your keys, not your bitcoin. The good news is that custodians attempting to rehypothecate Bitcoin are not able to get away with it for extended periods of time, and it's impossible for them to print more Bitcoin to cover up their fraud.

13. Federal Reserve Delivers Cease & Desist to Bitcoin Magazine: The Federal Reserve Bank of Chicago has threatened to sue Bitcoin Magazine due to a line of apparel in which they parody the “FedNow” service. FedNow, which has the potential to be used as a mechanism of financial censorship, repression, and control, stands in stark contrast to Bitcoin’s values of monetary freedom and freedom of speech. You can read Bitcoin Magazine’s response here.

14. LTH & STH Realized Price: As we confidently move towards the next bull market, we can look back in awe at how the realized price (cost basis) metrics once again timed the market bottom to a tee. When the cost basis of young coins (less than 155 days) is less than the cost basis of older coins (greater than 155 days), that’s a sign that BTC is incredibly cheap. If you revisit our newsletters from that time period, you’ll recall that we expressed strongly what a tremendous buying opportunity that was.

15. Coin Days Destroyed (90D Moving Avg): Throughout the past few months we’ve been observing the decreasing supply-side liquidity in the Bitcoin market; this metric provides another way of visualizing that. CDD is calculated by taking the number of coins moved on a certain day multiplied by the number of days since each of those coins last moved; effectively a measure of on-chain volume with increased weight given to older coins. The 90-day moving average is at near all-time lows. Despite the bullish hype of late, those who have been holding BTC the longest remain staunch in their conviction, further upward price action will be necessary for these users to begin selling coins into the market.

16. Addresses w/ >$1,000 of BTC: An all-time high of nearly 8 million on-chain addresses have at least $1,000 worth of bitcoin; at the current price this is equal to ~0.029 BTC. As Bitcoin continues to monetize this number will grow exponentially; there is zero limit to the amount of wealth that can be stored in the protocol, and even small bags of satoshis can have tremendous purchasing power. This highlights the importance of UTXO management. If there are 10s or 100s of millions of addresses that contain thousands of dollars worth of BTC, that’s a tremendous amount of purchasing power. The bidding to have transactions included in the limited block space could reach tremendous heights in terms of USD. It’s imprudent to have your entire stash scattered across small-denomination UTXOs; consolidate now while fees are low.

Bitcoin Mining

17. Marathon Digital: $MARA has announced a project in which they will mine Bitcoin using waste methane from a landfill. Bitcoin miners are continuing to innovate, finding increasingly clever sources of energy to tap into. Projects such as this will make it much more difficult for hostile regulators to frame Bitcoin as being “bad for the environment”, which it’s not. Bitcoin miner’s never-ending quest for low-cost power sources vehemently incentivizes an efficient use of energy.

18. Hashprice ($/Th/Day): Bitcoin’s surge past $34,000 has provided a significant boost to mining profitability, with hashprice eclipsing 7¢, netting a nearly 20% month-over-month increase. With further green candles likely on the horizon, the value proposition of mining is becoming increasingly clear: acquire Bitcoin for a lower variable cost than buying on the spot market. When everyone else is paying north of $40k, $50k, and potentially even $100k for BTC, miners will continue to arbitrage electricity and produce BTC for well beneath the market price.

19. Mining Difficulty: Difficulty is projected to increase yet again, with current projections at ~3.6%. We can say with a great deal of confidence that this difficulty increase is due to previously unprofitable miners turning their machines back on in the wake of the price increase. The impact % change in difficulty still pales relative to the % change in price, and further short-term price appreciation may result in an even smaller delta between price and difficulty. Machines plugging back in at $40k, $45k, $50k, etc. are inherently the less efficient, less powerful machines, which will have minimal impact on the overall network hashrate.

20. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$20,381 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.