Blockware Intelligence Newsletter: Week 19

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 12/10/21-12/17/21

Dear readers, hope all is well and you had a great week. Just some items to keep in mind before getting started: Michael Saylor will be on the podcast next week, Our yearly review report will be released at the end of the year, and Derivatives data will be added to the dashboard soon.

To preface: This letter has been sent out Friday morning but was written last night because I (Will) won’t have access to a computer tomorrow. Some of the information might be slightly outdated by the time of release. Thanks for understanding.

Key takeaways:

Below on-chain cost basis and several on-chain profit-related metrics suggest caution.

Bitcoin is still in a local downtrend.

Waiting for BTC to reclaim $53K on a close to become bullish again.

After the recent flush of OI/Market cap to lowest levels since May, seeing OI creep back in a bit. Aggregated funding and long/short ratio still muted.

On-chain supply dynamics look strong but doesn’t speak to the demand side of the equation.

Purpose Bitcoin ETF sees large inflows over the last 2 weeks despite the price drawdown.

Follow-through days on the S&P500 and Nasdaq Composite but likely to fail due to high distribution Thursday.

A base building period for most crypto-exposed equities, but select stocks like CUBI stand out against the general market.

Bitcoin Price Action Update:

This week has been more of the same for Bitcoin, a range-bound chop. Interestingly, BTC has been respecting its volume-weighted average price, anchored off the recent lows.

This tells us that despite price being in a downtrend, buyers still maintain a significant level of control since we hit the recent bottom of $42,333. A daily close below this line would signify sellers regaining overwhelming control and I personally would expect to see an undercut of those lows.

This indicator, paired with the downtrend line drawn off the tops of recent highs, creates the channel that BTC has been stuck in as of recent.

In my opinion, a true sign that BTC is gearing up for a run higher would be to see price above previous resistance at $53,000. We can use the current downtrend line as an early sign of a rally, but until we cross above $53K, it’s tough to get too confident.

On-Chain/Derivatives Update:

With FOMC news being a buy the news event as we were anticipating on Twitter, BTC had a nice move off range lows Wednesday. However, looking at price action, Bitcoin is still in a downtrend. Still waiting for the market to show strength, by first breaking out of this local downtrend and then above the $53K area for me to feel confident BTC is regaining some momentum. (for confluence of other reasons we will get to momentarily)

This $53K level is not only a key technical level, but is also roughly the $1T market cap threshold for BTC, and is important from an on-chain perspective. This is because $53K is where the short-term holder realised cost basis sits. This is the average price that investors paid for their coins that have been in the market for less than 155 days. For technical traders, the way to think of this is that it is an on-chain volume-weighted average price.

Remember: IF, THEN. If this level is reclaimed, then I will maintain a bullish bias. If this level is not reclaimed, then I maintain a cautious stance. If we have a failed underside retest, then I will maintain a bearish bias. For anyone who follows me on Twitter, I’m sure you’re tired of reaching the number 53 haha sorry if getting a bit redundant.

Next, we look at SOPR, but with a 30-day moving average to get a broader view. SOPR (spent output profit ratio) compares the amount of profit versus loss being realized on every given day. The idea here is that in a bull market investors aren’t willing to sell at a loss, in a bear market, investors are looking to sell at every chance they get to break even and exit the market. The 1 threshold (black line) serves as the median between a state of profit and loss. When below, market participants are realizing losses in aggregate. When above, market participants are realizing profits in aggregate. In 2017 BTC didn’t break below the 1 threshold on 30DMA of SOPR once, and once below, continually got rejected off each underside retest of 1. After getting back above 1 following covid, 1 served as support in September of last year, but never got retested until breaking below in May. After finally breaking above in early August, we saw a pretty clean retest at the end of September (which we covered closely at the time. However, we have recently broken below 1, without a bounce. Similar to short term holder cost basis, until breaking back above 1, maintaining caution.

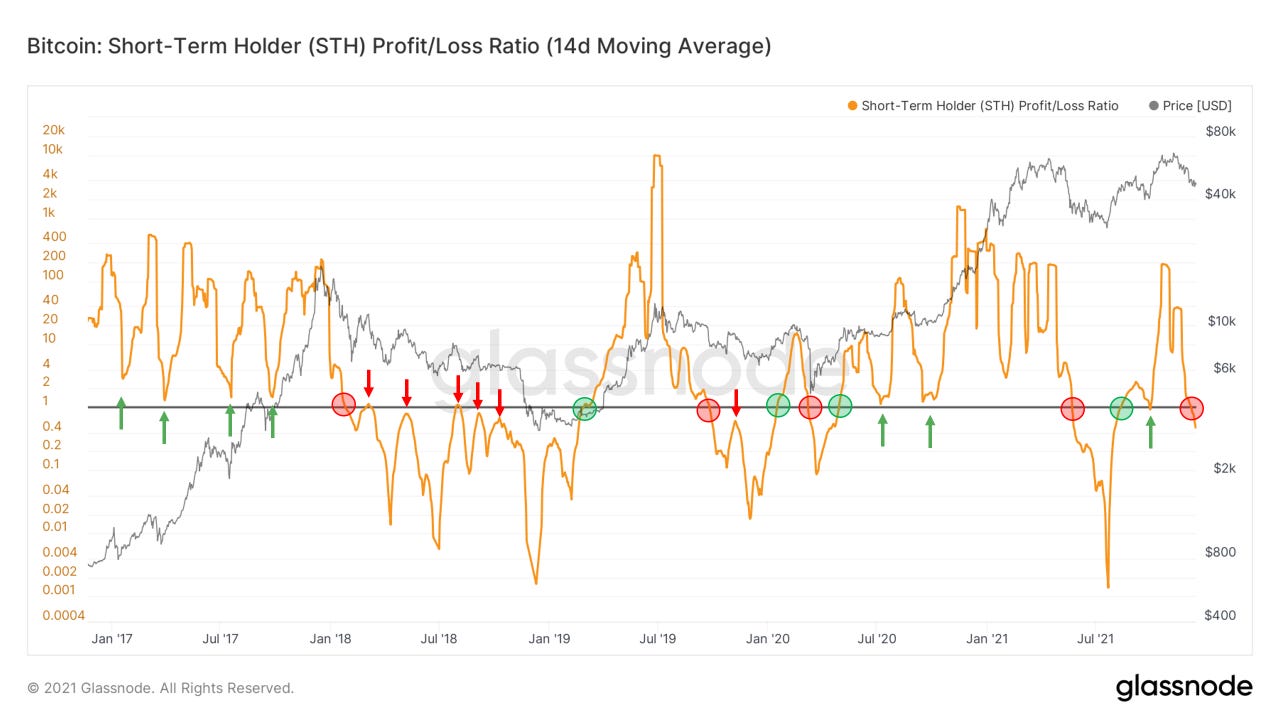

Next, we look at short term holder profit/loss ratio on a 14-day moving average. This is very similar to SOPR, the difference being SOPR looks at realized profit/loss while this looks at unrealized profit/loss; specifically short-term holders. (entities who have held their BTC for less than 155 days) The concept here is very similar to SOPR, 1 (black line) is the neutral level of profit/loss. Being above, STHs are sitting in a state of profit, when below STHs are sitting in a state of loss. In bull markets, market participants are unwilling to sell their BTC at a loss, and in bear markets, market participants are looking to sell every opportunity they get to break even and exit the market. Just like with SOPR, 1 served as support throughout 2017, once broken below served as resistance throughout 2018. In 2020 after the Covid dump recovery, BTC bounced off 1 twice and never retested until breaking below in May. Again, textbook bounce in late September. Have broken below 1 on this metric as well.

Just like we saw confluence of nearly textbook retests/resets of numerous metrics at the end of September, we are now seeing confluence of being in territory of caution for several metrics. As mentioned above, (hope I’m not getting too redundant with some of these explanations) bear confirmation would be failed underside retests on these metrics.

So we’ve talked about some of the things that have me cautious, but it’s not all doom and gloom. Here we look at some derivatives data. First, open interest dominance; which compares perpetual open interest to market cap to get a relative weighting to the importance of derivatives versus spot. We were cautious leading into the flush two weeks ago but reset the metric back to the lowest level since May earlier this year. Still overall in a healthy area, but have started to see a bit of OI build-up since the flush. Don’t think these are aggressive longs because aggregated funding has been muted and even flipped negative on Tuesday.

Continuing to see a clear bullish divergence between illiquid supply and price, meaning supply continues to move to entities with a low history of selling. Last time we saw a divergence this strong was late September. This tells us the demand side in that supply is getting locked up, but not the demand side. For confirmation that this divergence is playing out and the demand is stepping in, we can watch price action; which is why I’ve continued to talk about reclaiming that $53K level. Price levels/price action can be used to confirm what we’re seeing in the on-chain data.

On a final note, an interesting thing to note has been the inflow of BTC to the Purpose ETF, which is a spot Bitcoin ETF in Canada. The fund has seen an inflow of roughly $240M in BTC over the last 2 weeks amidst this drawdown; now holding roughly $1.5B in BTC.

General Equity Market Update:

We’re seeing yet another week of choppy price action in the general market. This environment will force feed you discipline, or punish you for not showing it.

Last week, I discussed the concept of a follow-through day (FTD). If you missed it, I’d recommend going back and reading that section. This week, on Wednesday, we got the long awaited FTD on both the S&P and the Nasdaq.

This was the signal of a potential uptrend forming in both of these indexes. This price action came alongside the highly anticipated FOMC meeting, where the Fed announced a quickening taper of their bond buying and the likelihood of 3 rate hikes in 2022.

Folks became extremely bullish after Wednesday’s price action, but one day of strength isn’t enough to declare all our worries should be gone. Many investors were punished Thursday, when technology stocks sold off hard.

Follow-through days aren’t never a guarantee and sometimes, they can fail. When there is a distribution day (DD) within a few days of the FTD, the likelihood of the FTD failing increases by a lot. A DD is a day on any index where it’s down greater than 0.20% on volume larger than the previous day.

On Thursday, tech stocks sold off hard but the Nasdaq and S&P didn’t trade enough volume to declare a distribution day. So while we didn’t see a DD on the indexes, we did see one on the Nasdaq ETF, QQQ.

This doesn’t technically count, as the distribution day came on an ETF, not the index itself. But still, a strong sell off the day after a FTD is never a good sign. This raises some big alarms for me, as it appears the selloff is likely to continue.

We can expect to see even more volatility on Friday, as it's a quad witching day. Quad witching days only happen 4 times a year. They occur when index futures, index options, stock options and stock futures all expire on the same day. Proceed with caution in this environment.

What does this mean for crypto-exposed stocks?

As I’m sure you guessed, this is not a strong environment for crypto-stocks. One look at the charts of previous leaders, like SI and COIN, can tell us that these stocks are likely going to need significant time to build out bases. In the meantime, keep an eye on the group and note which stocks are showing the most strength.

Currently, one of the strongest stocks in the market is Customers Bancorp (CUBI). CUBI is a traditional bank that has reimagined itself to begin offering crypto-related services to customers in 2021. Despite the vast majority of the tech market selling off hard on Thursday, CUBI actually broke out from its recent range.

To me, the most interesting of these services is the creation of their own stablecoin, the Customers Bancorp Instant Token (CBIT). This allows CUBI to join as one of a few banks who offer instant crypto-asset settlement.

This fight against the tide is something that should catch your eye. Thursday, CUBI gapped higher ~2.7% and trended strongly for most of the day. It closed with price up ~8.3% on volume that was ~255% greater than its 50 day average.

CUBI also showed great relative strength on Tuesday and Wednesday. On Tuesday, the Nasdaq gapped below its 50 SMA, CUBI was able to close above both its 10EMA and 21EMA with volume up ~77%.

Wednesday CUBI cleanly broke the upper trend line, riding the 10EMA higher on ~85% volume.

This current price is now too far extended from the range than I’d prefer to be buying at. But, if CUBI really is a true market leader beginning a multi-week run, there will be more opportunities to enter.

Historically, the stocks that fight the trend the hardest tend to be the strongest names once the selling pressure comes off the indexes. But Friday will be a key day as we close the weekly bar.

I should note that I started a position in CUBI on Wednesday.

Bitcoin Mining:

New Report: Why the 2020s will be a Golden Age for Bitcoin Mining

On Wednesday, Blockware Solutions published a new mining-related research report: Why the 2020s will be a Golden Age for Bitcoin Mining (summary below).

Bitcoin mining will be highly profitable for the next decade because of two simple ideas.

Price will continue to exponentially grow

Hash rate growth will continue to slow

The price of Bitcoin will continue increasing exponentially due to future mass adoption and increasing scarcity.

Price growth is accelerating due to mining firms becoming large enough to capitalize on cheap public market financing.

As more miners access public equity and debt markets, they can fund their operating expenses and hold all of the coins they mine.

Glassnode data shows this is already occurring.

As the price goes up, this becomes increasingly important (currently $18B of $BTC mined per year).

In addition to public miners, you have companies like $MSTR adopting #Bitcoin as their treasury reserve asset.

They are synthetic bitcoin miners. They have the ability to borrow money at very cheap interest rates to purchase bitcoin, removing more coins from the market.

While price is growing, hash rate growth is actually slowing. This is happening for two key reasons.

ASIC Commoditization

Lack of Scalable Cheap Energy

New machines are no longer 100x more efficient within a couple years. ASICs have become increasingly more efficient on a J/TH basis, but that marginal growth is slowing.

This means new ASICs today have the potential to last for 7+ years.

If the price of bitcoin continues to exponentially grow and ASICs continue to commoditize, then it will become clear over the next 8 years that a major bottleneck to hash rate growth is simply accessible scalable cheap energy.

The issue with energy production being a bottleneck is that companies cannot spin up energy production facilities (like a large nuclear power unit) overnight.

These facilities take a minimum of multiple years to plan and fully build.

This lack of energy and minimal marginal increases in ASIC efficiency are setting the environment for miners to perform well now and in the foreseeable future.

The point of this thread was to illustrate why I think that #Bitcoin mining is a fantastic industry to have exposure to during this phase of adoption.

After 2030, there will only be 500,000 coins left to mine. Let’s get 'em now.

Read the full report here.

Great article

What your thoughts on the end of BTC mining?