Blockware Intelligence Newsletter: Week 154

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/9/24 - 11/15/24

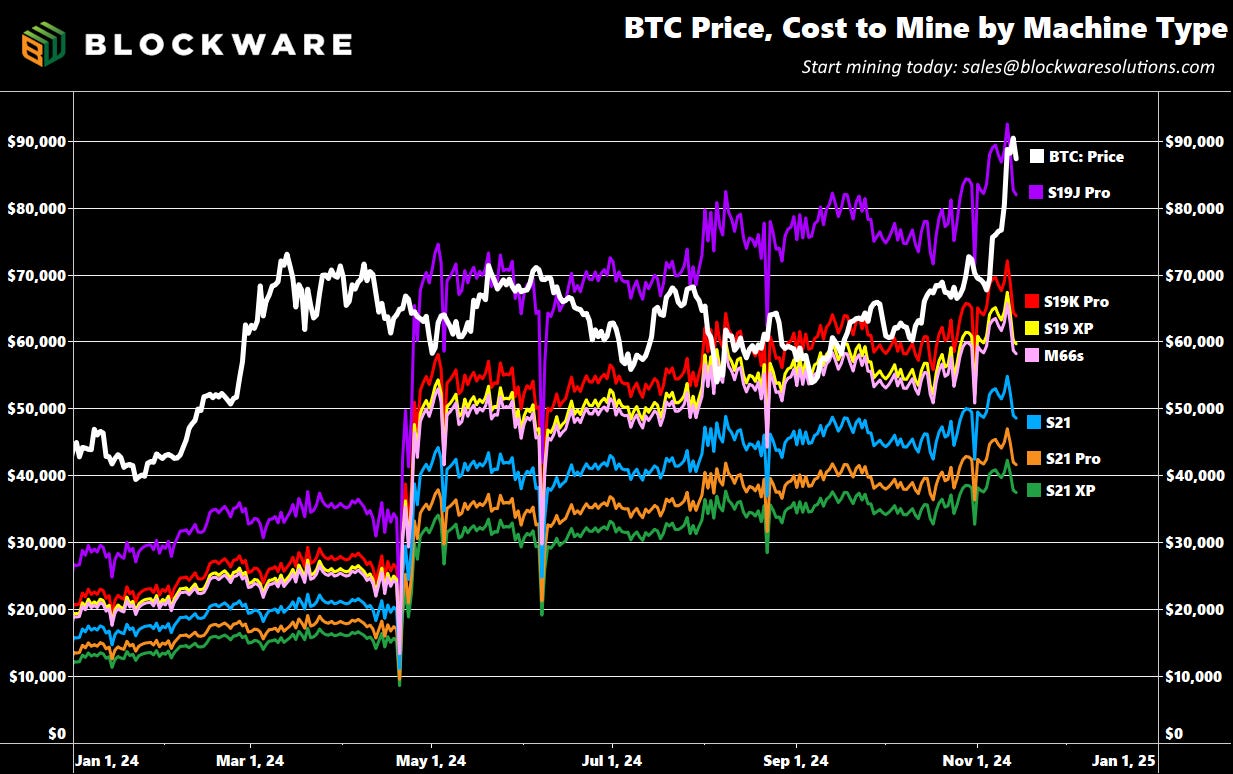

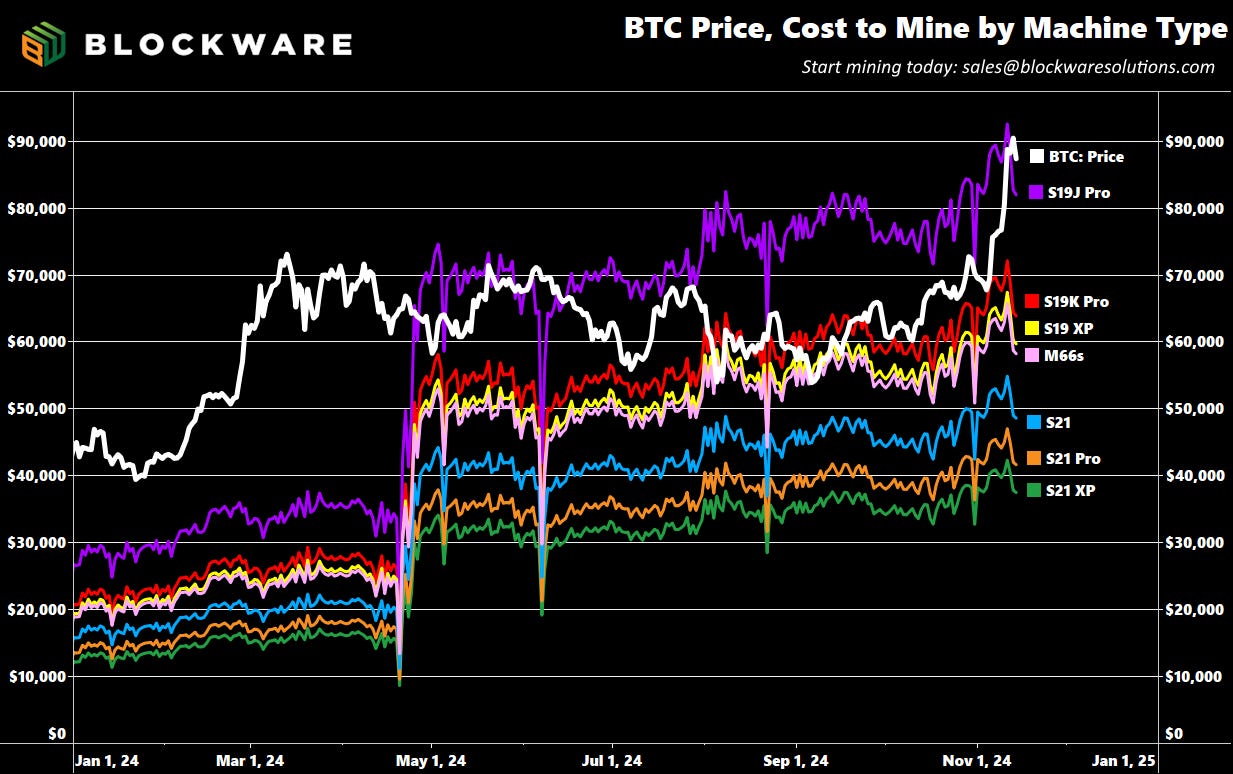

It costs $90,000 to buy 1 Bitcoin.

It costs $40,000 to mine 1 Bitcoin.

🚨Join Blockware for a Live Webinar to Learn About Bitcoin Mining🚨

If you want to learn more about Bitcoin mining, Blockware, and meet the authors of this newsletter…

…then join us Wednesday, November 20th, at 1pm EST!

We will be hosting a live webinar to discuss all things Bitcoin mining! We will dedicate the entire second half of the webinar for a Q&A, so bring your questions! We hope to see you there!

Bitcoin: News, ETFs, On-Chain, etc.

1. BTC Breaks $90,000

+136% year over year

+100% year-to-date

+36% in the past month

…when Bitcoin goes up, it goes up FAST.

A majority of Bitcoin’s gains have been made during a small handful of days. That’s why it's important to make sure you are long Bitcoin at all times – nobody can be exactly sure when these days are coming, and if you miss them, you miss out on most of Bitcoin’s returns.

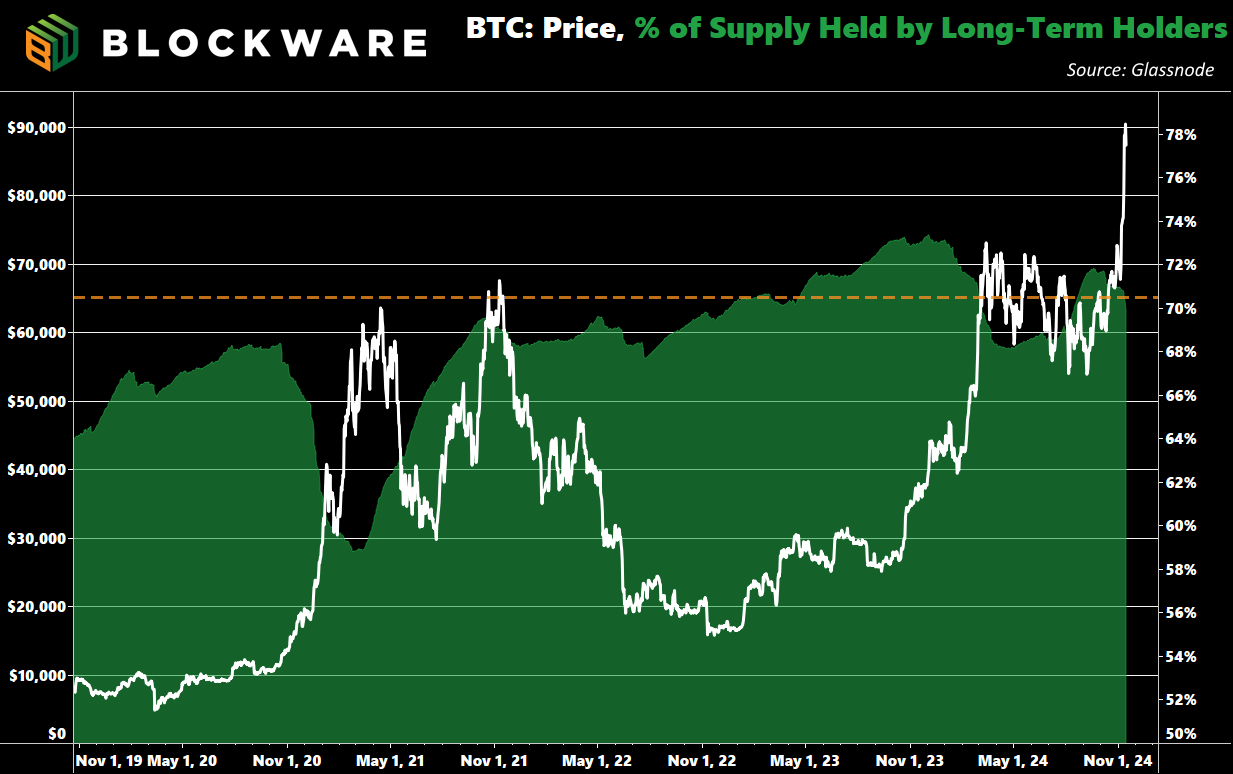

2. Long Term Holder Supply

Despite rapid growth in the Bitcoin price, roughly 70% of the circulating supply (13.8 million BTC) has not moved in at least six months. For reference, at the START of the 2020/21 bull market, that number was at 68%.

The signal here is that the vast majority of Bitcoin holders are still unwilling to part with their coins at $90,000. With demand vastly outweighing the new supply entering circulation via mining, the only other way for demand to find supply is to bid the price higher.

So long as “long term holder supply” remains elevated, there’s still plenty of fuel left in the tank for BTC to continue trekking higher.

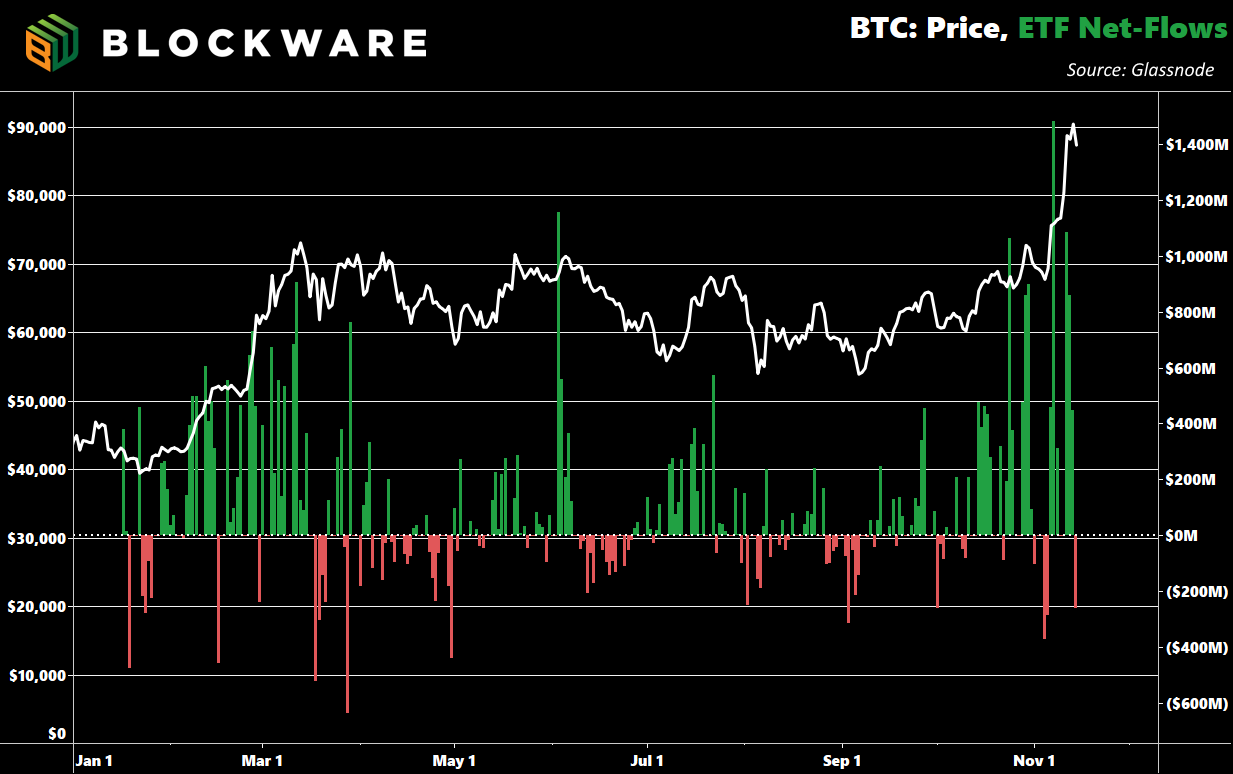

3. Spot Bitcoin ETFs

Unsurprisingly, this was yet another week with historically high inflows into the spot Bitcoin ETFs. As of Thursday’s close, the ETFs had net-inflows of $2.12 billion for the week. This is the 5th largest week of total inflows since the ETF’s launched, and it very well could reach the number 1 slot depending on the Friday data.

4. Pennsylvania to Adopt a Strategic Bitcoin Reserve

Game Theory: The study of how competitive strategies and participant actions can influence the outcome of a situation.

Pennsylvania is now the second state (Florida) within the United States of America to introduce legislation pursuant of adding Bitcoin to the state balance sheet. With Trump promising to do this at the Federal level, it is not surprising to see states begin to follow suit.

It’s amazing how quickly the narrative went from “Governments are going to ban Bitcoin” to “Governments are racing to accumulate Bitcoin.”

It’s looking as if nation-state Bitcoin adoption is going to be one of the primary themes in 2025. Given this development, our thesis and expectations for the Bitcoin price are evolving accordingly. To be specific: it is unlikely that Bitcoin experiences another >50% drawdown now that nation states are involved.

Bitcoin’s bear markets have historically been the result of mass panic from short-term speculators. However, there’s a new cohort of Bitcoin buyers and they are far more sophisticated. Nation-states and Wall Street investment funds aren’t buying Bitcoin in hopes of making a quick return. These entities are net-buyers of assets, and they acquire with a long-term strategy. Passive flows from these entities will provide a base-line level of support for the Bitcoin price. Moreover, BTC on the balance sheet of the United States Government will likely make Bitcoin “too big to fail” – and any major price corrections would be quickly met with stimulus.

5. Futures Short Liquidations

Looking at the total amount of short liquidations helps us quantify the newly sophisticated market participants. The bull market of 2021 was fueled by hundreds of millions of $ worth of short-liquidations on a daily basis, while we are seeing nothing of the sort this time around. Degenerate retail is gone and institutional investors have taken their place.

Moreover,on a market-cap adjusted basis, the little amount of short-liquidations that we are seeing have much less of an impact on price. The price action is now being driven by a surge of demand hitting a market with very little supply available. This is far more sustainable than price appreciation resulting from short squeezes.

Theya - Simplified Bitcoin Self-Custody

For secure, intuitive self-custody that fits seamlessly into your life, we recommend Theya.

Theya is the simplest way to safeguard your bitcoin, whether you're using their mobile app or their new web app. With flexible multi-sig and cold storage options, you choose how to hold your keys securely. Experience the ease of a true multisig solution, on your terms.

Ready to secure your bitcoin? Click here to get started and enjoy 10% off an annual subscription!

Click here to download the app and get 10% off an annual subscription!

General Market Update

6. Jerome Powell Changing Tune

In what appears to be a countersignal from his 50 basis point cut in September, Jerome Powell reeled in his dovishness on Thursday, saying “The economy is not sending any signals that we need to be in a hurry to lower rates.” Powell referenced a flattened and historically-low unemployment rate. However, the esoteric reason the Fed may slow down on the frequency and velocity of Fed funds cut is due to:

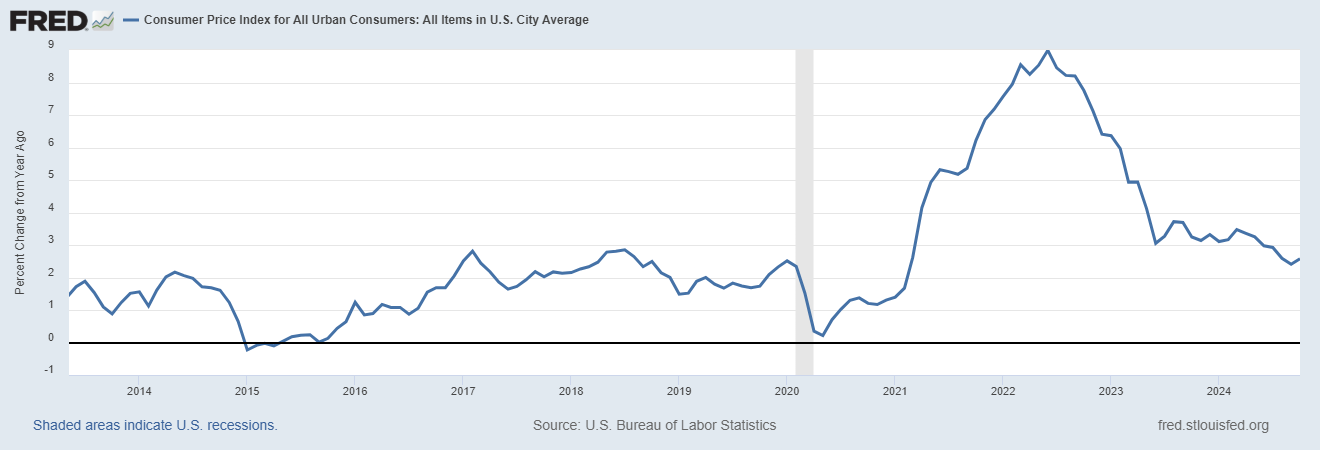

The uptick in inflation

The fact that recent cuts to Fed Funds have NOT brought rates down for long-duration treasuries

The US 10-year yield is roughly 80 basis points higher than it was when the Fed first cut the overnight rate. What does this tell us? Investors are worried about long-term inflation. Those fears became even more substantiated this week as the CPI came in above expectations at ~2.6%, breaking the trend of six consecutive months of disinflation.

7. US Equities Pull Back

The stock market did not like this and has since retraced all of the gains made after Trump’s election-night victory. All 3 major indices, the Nasdaq 100, S&P 500, and QQQ, are down on a month-over-month basis. Meanwhile, BTC is up 36% during the same time period.

BTC has historically moved in tandem with risk-on assets. This discrepancy in performance shows us just how bullish the underlying supply/demand dynamics for Bitcoin are.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

8. Cost to Mine 1 Bitcoin

The thesis of our September report, “Analyzing the Relationship of Bitcoin Price &Hashrate”, is that growth in the price of Bitcoin will outpace growth in mining difficulty, resulting in higher profit margins for incumbent Bitcoin miners.

This is exactly what is playing out.

While BTC is up 36%, difficulty is only up 10% over the past month and the next projected adjustment is zero %. As a result, the spread between the price of Bitcoin and the cost to mine Bitcoin has grown tremendously.

9. On-Chain Fees Spike

Transaction fees on-chain rose this morning to more than 100 sat/vByte. The volatility of transaction fees is a dark horse for mining profitability right now. As demand for BTC as a financial asset increases, demand to send BTC on the Bitcoin network will increase accordingly.

There’s a finite amount of room for transactions within each Bitcoin block, and so users must outbid each other in order to incentivize miners to include their transaction within blocks. This dynamic can lead to exponential surges in transaction fee revenue for Bitcoin miners, as we saw this morning.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.