Blockware Intelligence Newsletter: Week 111

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/04/23 - 11/10/23

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Blockware Intelligence Podcast. Peter is a Ph.D. Economist at the Heritage Foundation & Mises Institute. Mitch & Peter dive deep into Austrian Economic theory, the problems with government spending, zombie economies, the sovereign debt crisis, Bitcoin, and more!

General Market Update

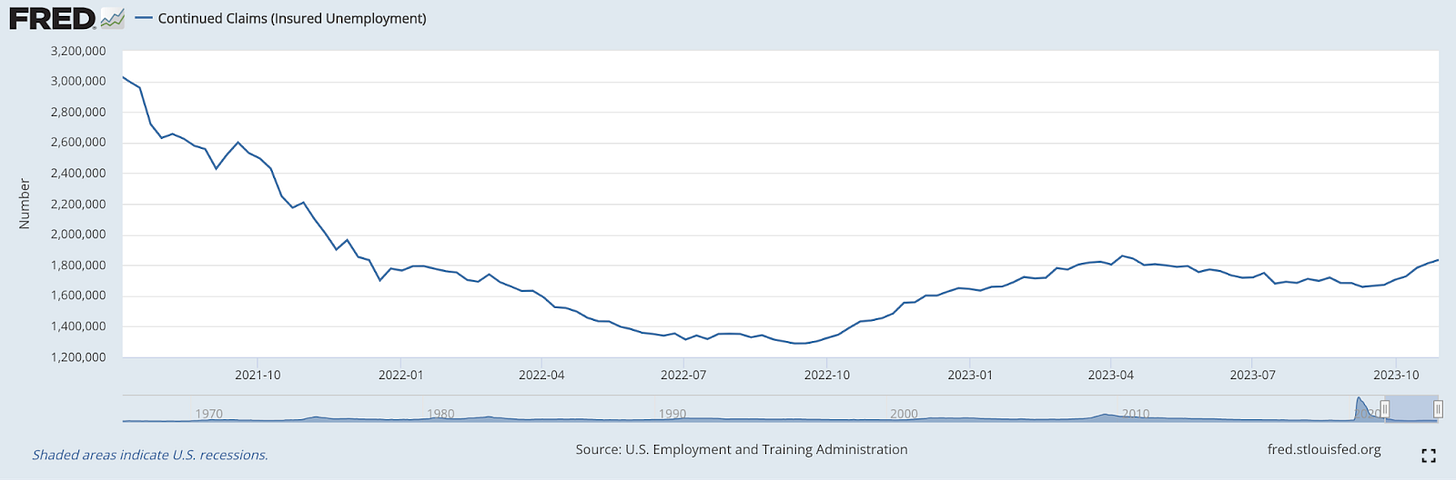

2. Continuing Claims. Continuing Claims (CC) tracks the number of individuals who are being covered by ongoing insured unemployment benefits. Initial Jobless Claims (IJC), in contrast, measures the amount of people filing for benefits for the first time following job loss. CC’s have tracked steadily higher over recent weeks, despite IJC’s being essentially flat for the last ~2 years. The combination of these metrics indicates to us a softening labor market. Individuals who have lost their jobs seem to be struggling to find new employment, as Continuing Claims is nearing new YTD highs.

3. US 30-Year Treasury Yield (1H). Probably the most significant macro event this week was the disastrous Treasury auction on Thursday. This $24B round of bond issuance by the United States government saw cratering demand for long-duration debt. This auction had the largest tail on record, meaning the Treasury had to offer the most significant premium on yield to attract any level of buyer. In the end, Primary Dealers were forced to buy nearly 25% of that debt, as the designated buyers of last resort in the event investor demand was too weak. The US Treasury simply can’t afford for Fed policy to kill more demand, it’s hard to imagine any scenario where the Fed continues QT much longer or hikes again.

4. Nasdaq Composite. Over the last couple of weeks, we’ve seen a countertrend rally trigger short covering and a flip in sentiment as the market potentially looks ahead to rate cuts and dissipation of WW3 worries. The Nasdaq was able to clear through both its 50-day SMA and this downtrend line. Yesterday’s Treasury auction triggered a sell-off in congruence with a spike in yields, but as of the time of writing, the Nasdaq is positive for Friday. Heading into next week, keep an eye on the 4 key resistance levels overhead for the index.

Bitcoin Exposed Equities

5. Valkyrie Mining ETF. WGMI has continued to struggle to attract buyers around the 200-day SMA this week. Relative to spot-BTC, mining stocks have struggled in recent weeks. There are a few likely explanations for this price action, the first being the Halving, which is quickly approaching. The second is the prospect of a Spot-ETF offering a better solution for securitized BTC exposure.

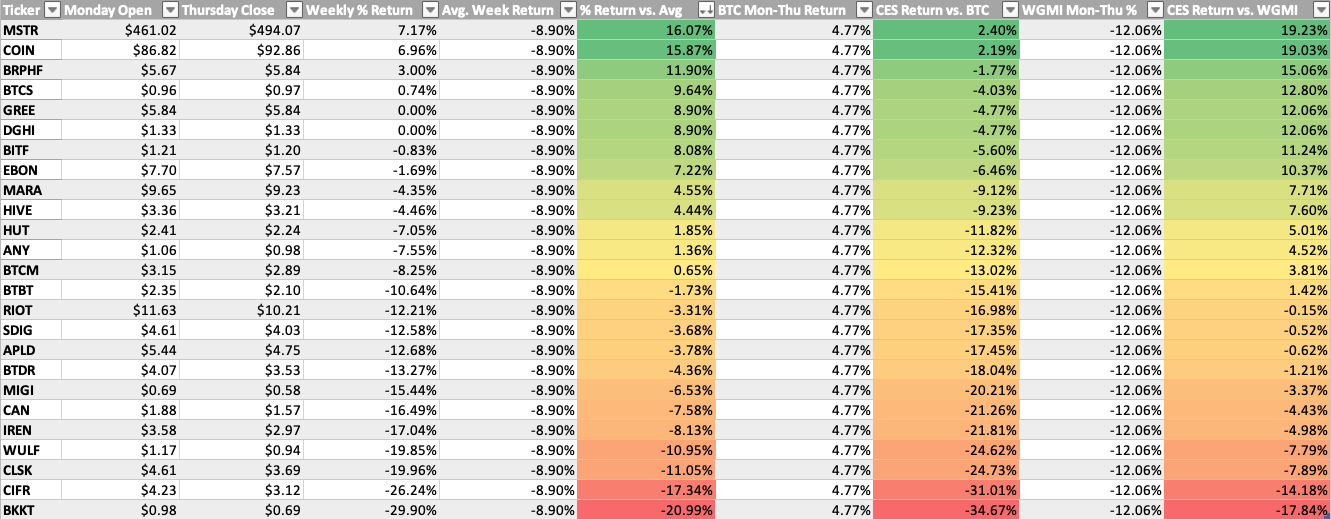

6. BEE Comparison Sheet. Per usual, the table below compares the Monday-Thursday performance of several BEEs in comparison to Spot BTC and WGMI. As just discussed, these stocks have largely struggled this week, with the average name down 8.9%. Two names have stood out recently, COIN and MSTR, as they offer exposure to the digital asset space without the block subsidy exposure of miners.

Bitcoin Technical Analysis

7. Bitcoin/USD. In case you somehow missed it, Bitcoin has managed to break out above the channel price consolidated in for the last couple of weeks. The current volume profile is proving what you might find obvious, institutions are building significant positions in Bitcoin. Spot bidding is relentless as the retail crowd begins moving back into Bitcoin, but we’re still very early in this rally. $38,000 showed early indications of being another brick wall, but if price can breach this level, $40,000 would be the next logical zone to attract sellers. To learn more about how institutional investors are likely trading these levels and driving current price action, check out this tweet by BWI Analyst and Account Executive, Blake Davis.

Bitcoin On-Chain / Derivatives

8. Short-Term Holder Realized Price: BTC continues to blow past the cost-basis of short-term holders, a level which, throughout the past 12 months, has teetered back and forth between support and resistance. This metric represents the aggregate cost-basis of coins moved within the past 155 days, providing insights into important psychological price levels.

9. BTC Realized Price & Long-Term Holder Realized Price: Zooming out and looking at the realized price metrics on a longer time horizon you can see clearly where STH RP served as support throughout the 2016/17 bull market. Moreover, notice that realized price, the aggregate cost-basis of the entire market, and long-term holder realized price, the aggregate cost-basis of coins that haven’t moved in 155+ days, are currently moving in lockstep. This is because long-term holders make up the vast majority of the BTC market at the moment, which is bullish as it shows the tremendous lack of supply-side liquidity. You can see during previous bull markets where these two metrics diverge, that happens as long-term holders distribute coins and short-term holders begin taking up a larger chunk of the market. Until that happens there is little reason to expect any significant reversal in the bullish price action of 2023. Yes, there will likely continue to be drawdowns, but so long as long-term holders continue to HODL, the broader price action will be up.

10. BTC Options Open Interest: Options open interest has exploded in the past two weeks, surpassing the previous all-time high from the 2021 bull market top. This is likely due to the combination of two factors:

Heightened demand due to increased volatility

Institutional investors entering the market, using options to hedge risk

On the first point, the options market is heavily influenced by volatility in price, after months of relatively sideways price action this recent move up, coupled with the expectation of heightened volatility in the near-to-mid-term future, has churned more demand for options.

On the second point, the options market is more attractive to institutional investors as a means of hedging risk than the futures market. And while futures open interest has increased in the past two weeks, it has not done so to the same extent as the options market.

11. BTC Futures Open Interest: Here you can see how the futures open interest, while up, is still down significantly from the peak retail-mania of the bull market; contrary to options open interest which is making new all-time highs.

12. BTC Futures Open Interest: Further indicating the arrival of institutional investors is the breakdown of open interest by exchange, with the CME futures market now larger than the Binance futures market.

Bitcoin Mining

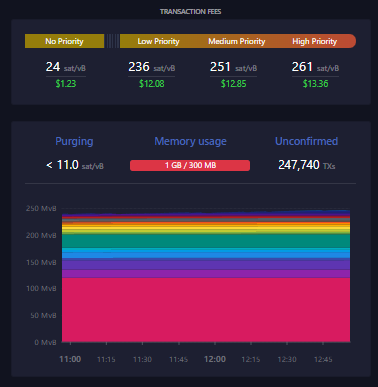

13. Transaction Fees Surge: On-chain transaction fees have gone absolutely parabolic this week, with fees for high-priority transactions reaching as high as 261 sat/vByte. For those who need a refresher, Bitcoin transaction fees work in an auction-like fashion. Users broadcasting a transaction to get picked up by miners will select a fee rate that they are willing to pay. The space within each block is limited to ~2mb so miners, for obvious reasons, include the highest fee transactions in each block they mine. Now, it’s a bit more nuanced than that at the super technical level, but that’s the elementary level of it. As demand for transactions on the Bitcoin blockchain increases, the amount of fees users will have to pay increases accordingly. For a more in-depth, technical breakdown of transaction fees, both presently and what the fee market may look like decades from now, check out this report we co-published with Riot Platforms.

In the near-to-medium term future, it is likely that on-chain fees will increase significantly as Lightning and other Layer 2’s are not yet in a position to service the high volume of demand that is soon going to penetrate the market. This will bode well for Bitcoin miners.

14. Transaction Fees % of Miner Revenue: On Thursday 21.8% of the total revenue earned by Bitcoin miners came from transaction fees. That’s an additional ~1.74 BTC per block on top of the 6.25 BTC block subsidy.

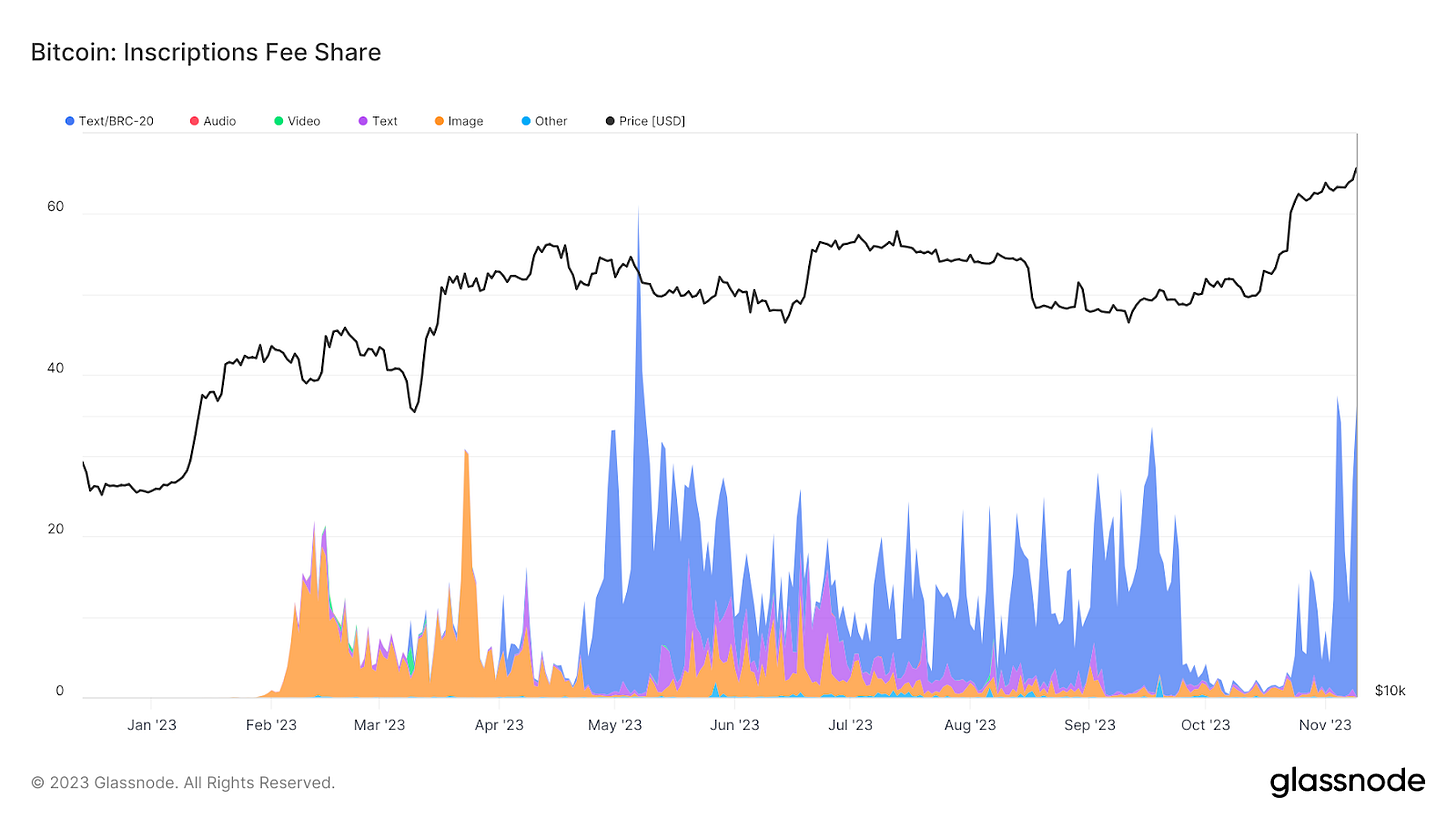

15. Inscription Fee Share: Inscriptions seem to be the main source of the surge in transaction fees, according to this new metric from Glassnode, which looks at the proportion of transaction fees that are coming from inscriptions and then further delineated based on the type of inscription.

16. Transaction Fees (Time): This is a short sample size but it appears that the largest spikes in transaction fees have occurred during US trading hours.

17. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$16,743 worth of energy to produce 1 BTC; a noticeable week-over-week jump courtesy of transaction fees boosting miner revenue.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.