Blockware Intelligence Newsletter: Week 99

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/5/23-8/11/23

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Joe Burnett is joined by Tuur Demeester, a Bitcoin OG, to discuss the early days of Bitcoin, Adam Back's $100k bet, Nostr, and the future of Bitcoin!

General Market

2. Headline vs. Core CPI. Headline CPI for July ticked higher to 3.2%, compared to 3.0% last month. That being said, this was below expectations of 3.3% and Core CPI fell to 4.7% from 4.8% in June. When removing shelter from the equation, prices have essentially stopped increasing compared to last year.

3. Global Supply Chain Pressure Index (GSCPI). The SCPI has been an accurate forward indication of inflation dynamics over the last 2 years. Currently, this index is indicating that deflation is to come in the US. China is already there, as their CPI fell by -0.3% last month.

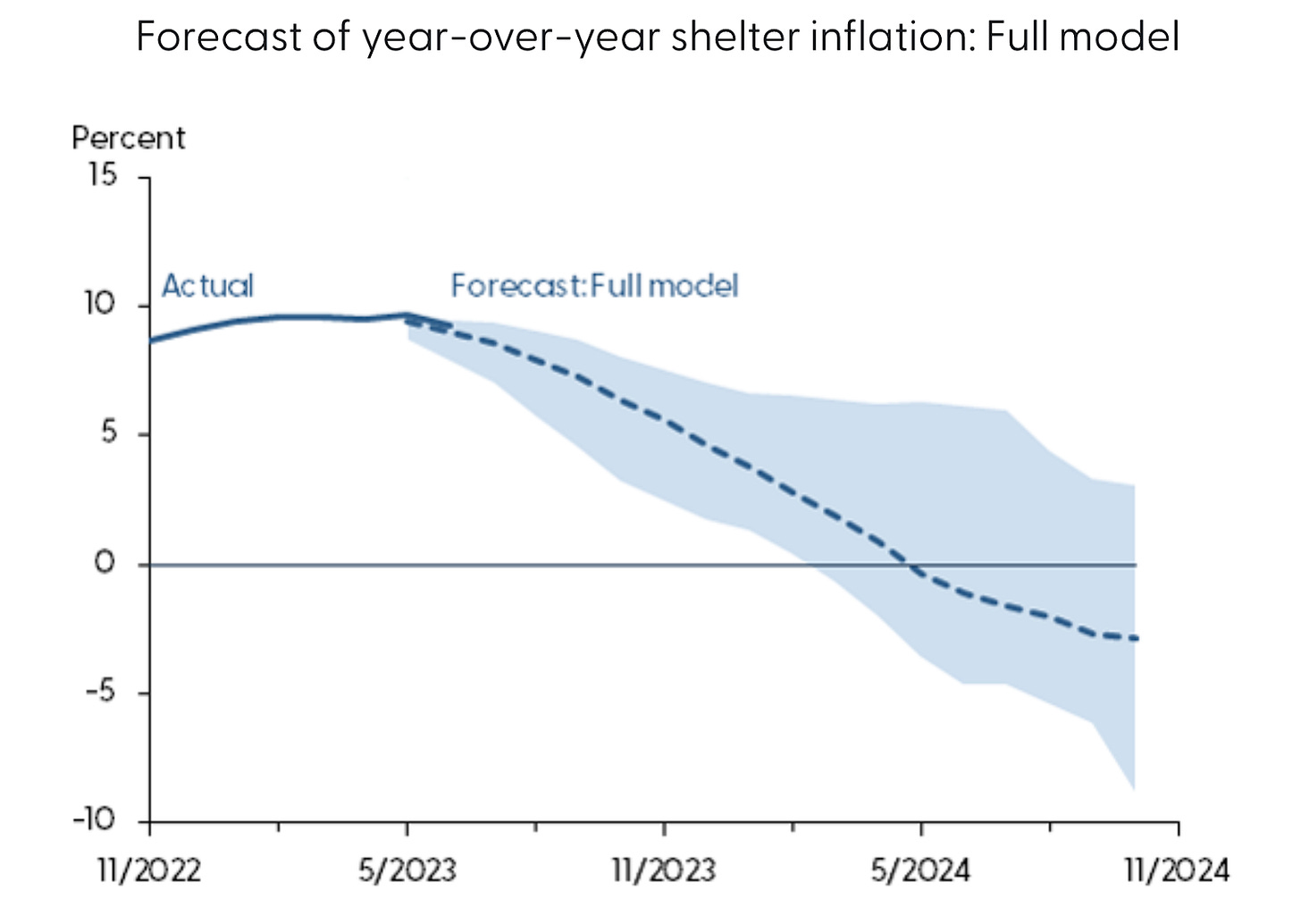

4. San Francisco Fed Shelter Inflation Forecast. The SF Fed is now forecasting a continued breakdown from the shelter component of CPI, which accounted for roughly 90% of last month’s inflation. This projection points towards the most severe contraction in shelter prices since 2007-09, and is further evidence of deflation coming for the US.

5. US Average Fixed 30-Year Mortgage Rate. Mortgage rates are close to making a new YTD high (7.08%) as demand falls for new mortgages. Following this week’s CPI report, the futures market is now expecting the Fed Funds Rate to remain at 5.25-5.50% in September with ~89% confidence.

6. Nasdaq Composite Index. Stocks have largely pulled back this week. While it’s a little early to be too concerned, on Wednesday, the Nasdaq closed below its 50-day SMA for the first time since March. The Russell 2000 and S&P 500 are near their 50-day’s at the time of writing on Friday.

Bitcoin Exposed Equities

7. Cleanspark (CLSK). Cleanspark announced their Q3 (fiscal year) earnings after the close on Wednesday and institutions clearly liked what they heard. CLSK lost 12 cents per share last quarter, beating expectations of -$0.17/share. CLSK also announced that they’ve completed financing for their future 16 EH/s expansion. Their stock is up nearly 24% on the week at the time of writing.

8. Bitcoin Exposed Equities Comparison Sheet. The sheet below, as always, compares the Monday-Thursday performance of several Bitcoin exposed equities. The average name was down over 4% across that period, with BTC up over 1%.

Bitcoin Technical Analysis

9. Bitcoin / USD. Bitcoin has had another choppy week, and has continued to act like a $29,000 stablecoin. As we warned last week, the 50-day hanging overhead price became resistance as sellers stepped in around $30k. Ideally, the 10-day EMA will become support here around $29.3-29.4k.

Bitcoin On-Chain / Derivatives

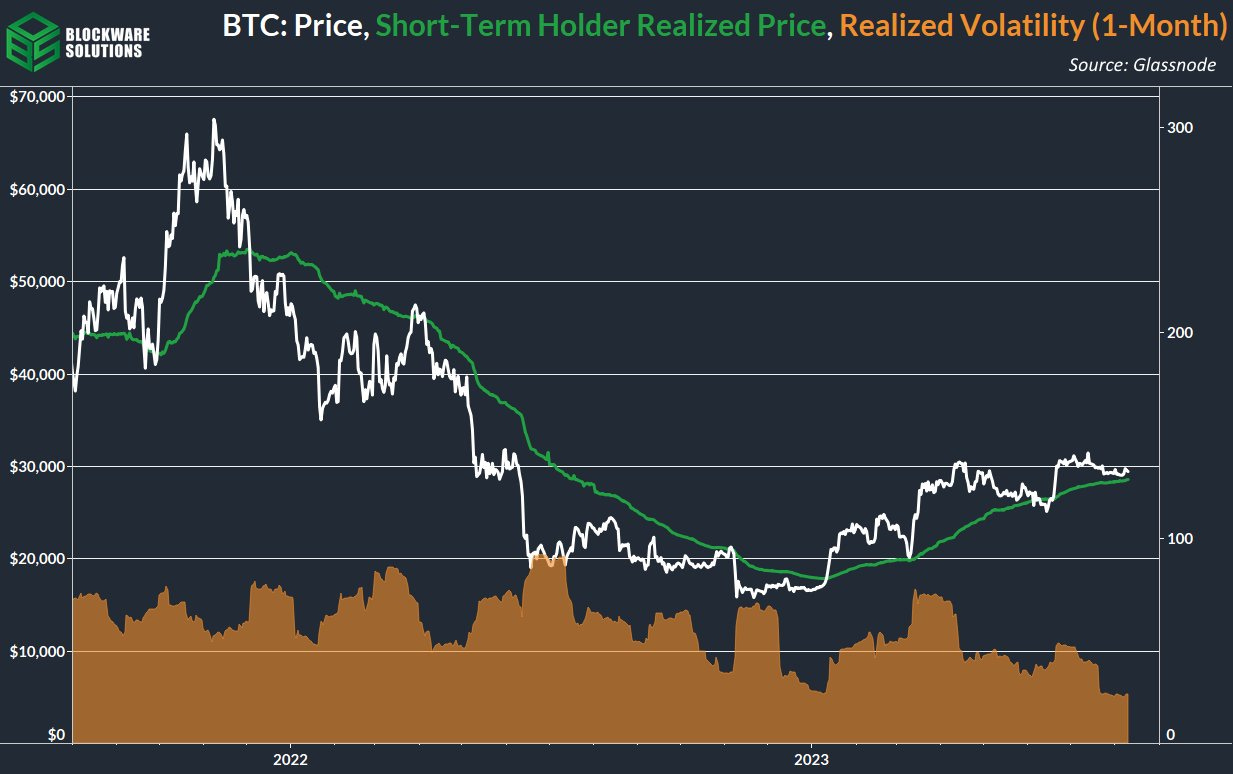

10. Short-Term Holder Realized Price & Realized Volatility: BTC is flirting with the cost-basis of short-term holders, a pivotal on-chain support level. Meanwhile, realized volatility has not been this low since prior to the run-up in late 2020. It’s unlikely that BTC sticks around at ~$29k for too much longer.

11. Realized Profit/Loss: The market in aggregate is moving coins at a loss for the first time since the choppy price action of April. This shows that the only sellers are those who accumulated Bitcoin above the current price, not the buyers of last resort from earlier in the bear market. Once these sellers are fully exhausted BTC likely makes another leg up.

12. Realized Price By Time Held: This shows the aggregate cost basis for coins based on the time frame in which they last moved on-chain. Rarely does the cost basis for the 2-3y cohort exceed that cost-basis of short term holders (6m or less). The times prior were in 2016 & 2020, right before major bull runs.

13. Realized Price by Time Held: Here’s a zoomed in version of the chart. Notice the striking difference between the 2-3 year cohort and 3-5 year cohort. It goes to show that Bitcoin is best approached with a minimum time frame of at least 4 years (1 full cycle).

14. Microstrategy BTC Holdings: Microstrategy started accumulating Bitcoin 3 years ago to the week. Their recent buy in June was their 5th largest stack of all time in BTC terms, and the largest since mid-2021; adding 12,333 BTC to their holdings. Total holdings are now 152,800 BTC.

Bitcoin Mining

15. New Bitamin S19K Pro (120T). The latest ASIC to be released by Bitmain has an efficiency of 23.0 J/TH. While this is slightly worse than the 21.5 J/TH efficiency provided by the S19XP, this is a machine that tops a large majority of ASICs operating today.

16. Next Difficulty Adjustment. Bitcoin is now at its #398 Difficulty Epoch. Last adjustment was basically flat. This epoch blocks are currently coming in slightly faster than the 10 minute average, but it is still to early to tell what the next adjustment will be.

17. Miner Capitulation? This has been a fairly stubborn relatively unexpected miner “capitulation” as determined by the hash ribbon metric. This likely has mostly been due to curtailment, but it is interesting to see the 30 day moving average of Bitcoin’s hashrate be mostly flat since mid-June.

18. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$17,444 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Always love reading the weekly newsletter. It's much easier to read now that its broken up into digestible chunks of info...