Blockware Intelligence Newsletter: Week 98

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 7/29/23-8/4/23

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide.

1. Blockware Intelligence Podcast. Joe Burnett is joined by Daniel Batten, Co-Founder of CH4 Capital, to talk about how Bitcoin is actually an ESG-friendly asset, contrary to narratives pushed by traditional media.

General Market

2. 10 Year Treasury Yield. We’ve continued to see a sell off on the longer end of the curve for US Treasuries. This is stemming from a few main factors, mainly the Treasury increasing its issuance size to refill their general account but also investors being fearful after Fitch downgrading the US government’s credit (FUD), and the market’s reaction to an aggressive Fed.

3. Initial Jobless Claims. Jobless claims ticked higher this week, up to 227,000. That being said, the more important 4-week moving average of claims is now back to its lowest level in 4 months.

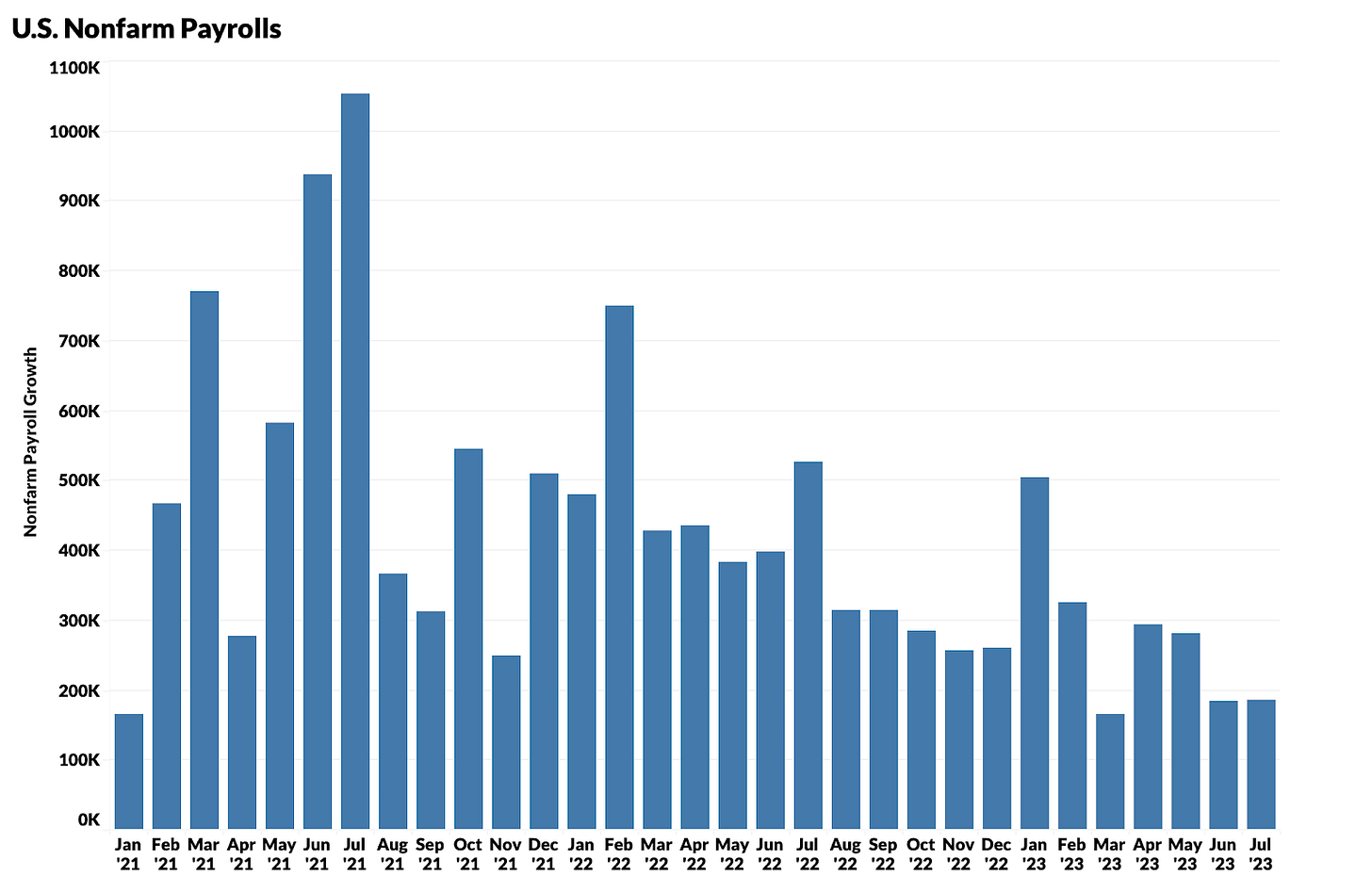

4. Nonfarm Payrolls. In the month of July, the US added 187,000 non-farming jobs and the unemployment rate was 3.5% (down slightly from 3.6% in June). Sectors with above average growth included healthcare (+63,000) and finance (+19,000).

5. ISM Manufacturing PMI. In July, ISM’s Manufacturing Purchasing Managers Index (PMI) ticked slightly higher to 46.4%. This measure of broader economic activity has been in contractionary territory (below 50%) for 9 straight months.

6. iShares Russell 2000 ETF (IWM). Stocks have seen a fairly broad-based pullback this week on the back of rising yields and a strong dollar. The Russell 2000 small-cap index has, as of the time of writing, held up fairly well, finding buyers at the 21-day EMA.

Bitcoin-Exposed Equities

7. Riot Platforms (RIOT). Public miners have also seen a period of sideways/downwards price action this week. Two names have stood out against the crowd, RIOT and MARA. These names have consolidated sideways this week, while smaller names have broken down below key moving averages.

8. Comparing Bitcoin-Exposed Equities. The table below breaks down the Monday-Thursday price action of several Bitcoin-Exposed equities. The average Bitcoin exposed equity was down nearly 7% this week.

Bitcoin Technical Analysis

9. Bitcoin / USD. It’s been a fairly volatile week for Bitcoin, as price broke below this downward channel and then reversed back higher on Tuesday. BTC found strong buyers around $28.5K and has so far held this level. We’ve also confirmed a bearish crossover of the 21-day and 50-day moving averages. Heading into next week, keep an eye on the 50-day looming overhead.

Bitcoin On-Chain / Derivatives

10. Supply Liquidity: The amount of liquid and highly liquid supply is at its lowest levels since 2018. Meanwhile, the amount of illiquid supply continues to reach new all-time highs. Traders are exchanging a shrinking supply of coins back and forth while long-term holders steadily stash away into cold-storage.

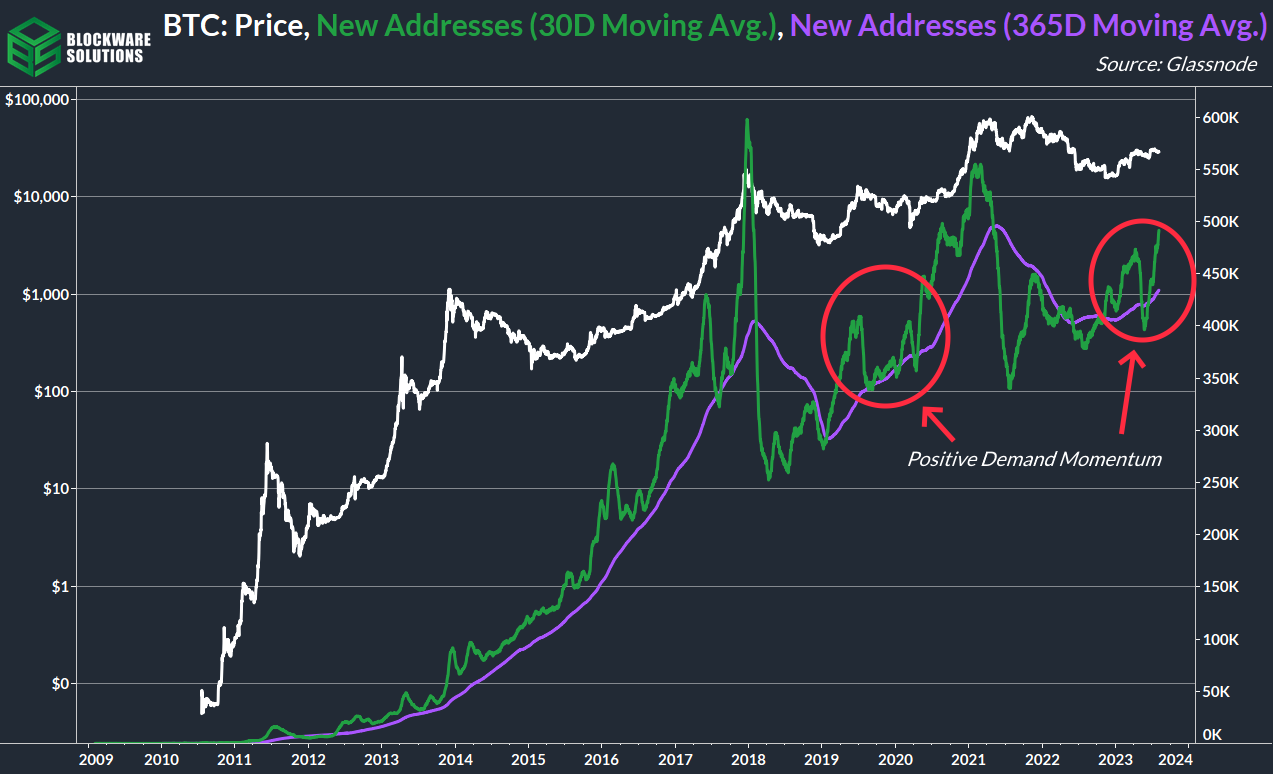

11. New Address Momentum: There’s significant positive momentum in the number of new addresses being created. Earlier this year that could partially be accredited to the ordinal craze, but as that has faded off, this is evidence of a general increase in on-chain demand. We experienced a similar regime back in 2019 as we exited the preceding bear market. This indicates growing demand for BTC.

12. Realized Volatility: Bitcoin price action continues to be uneventful as it spends another week being at stablecoin around $29,000. This lack of volatility is abnormal, so it's likely we get a decent move sometime in August.

13. US Government BTC Balance: The US government quietly sold ~10,000 BTC (roughly $300m worth) during the month of July. This sell pressure is potentially the reason BTC has not surpassed the $30k headwinds.

14. Perpetual Futures Open Interest has moved in accordance with price for all of 2023, and right now is no different. As these are non-expiring futures contracts, this indicates that traders are continuing to take a cautious approach. An increase in open-interest relative to market cap would be a sign of greater risk-taking within the market; note the build-up that occurred late last year.

Bitcoin Mining

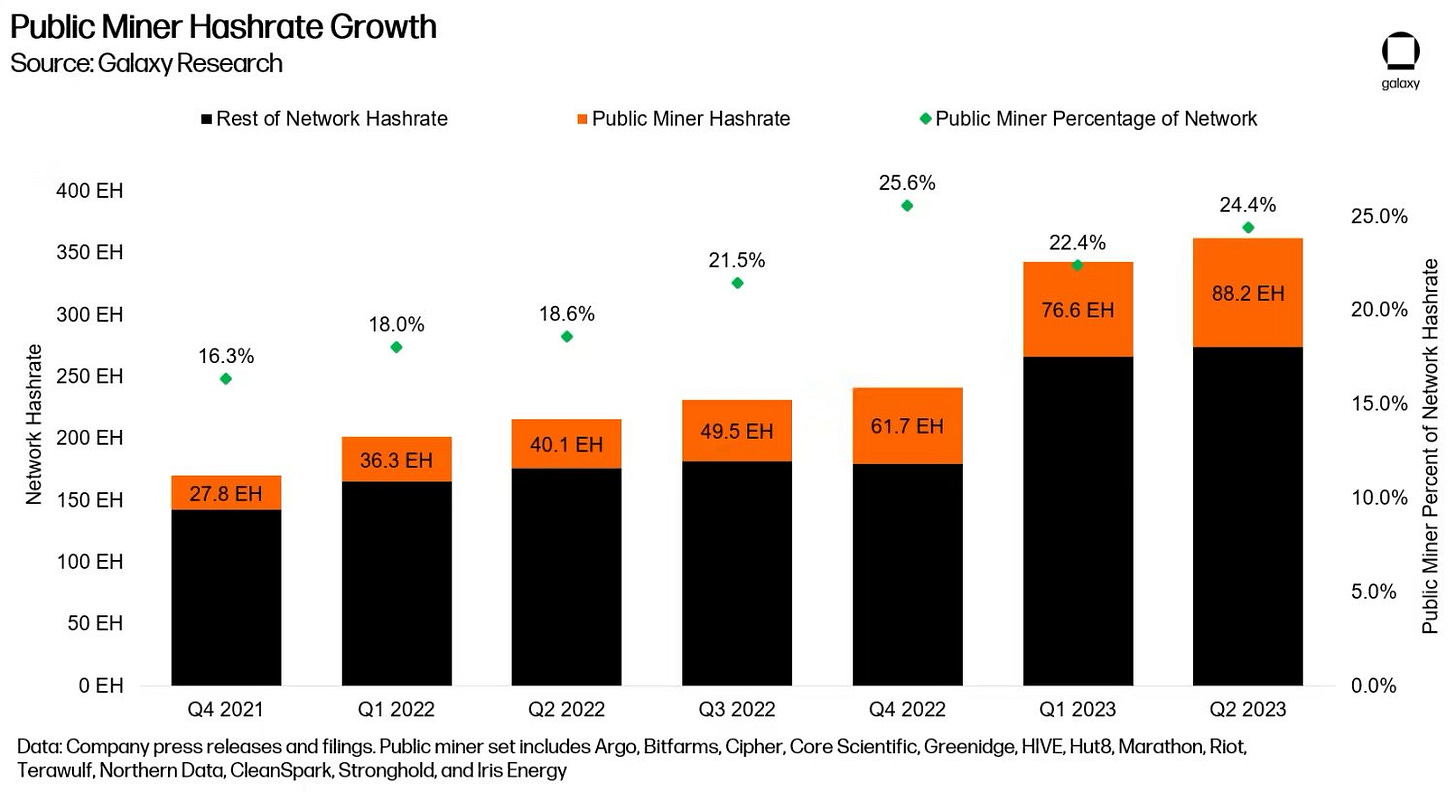

15. Galaxy Hashrate Prediction. Hashrate and difficulty are expected to increase relatively fast due to the availability of new ASICs and miners upgrading to more efficient machines before the 2024 halving. Their end of 2023 hashrate assumption base case is 465 EH.

16. Public Miners % of Network. In Q4 of 2022, Galaxy estimates that public miners as a percentage of the total network peaked, at least for now. Public miners control ~ 24.4% of the total network hashrate.

17. Next Difficulty Adjustment. Blocks this difficulty epoch have been coming in just on time so far. Currently Bitcoin is only three blocks ahead of schedule which would mean a slightly positive difficulty adjustment (less than +0.25%).

18. KPMG ESG Bitcoin Report. A big four accounting and advisory firm published a Bitcoin ESG report that identified BTC as an ESG-friendly asset due to its ability to consume wasted energy from flared gas sites and landfills.

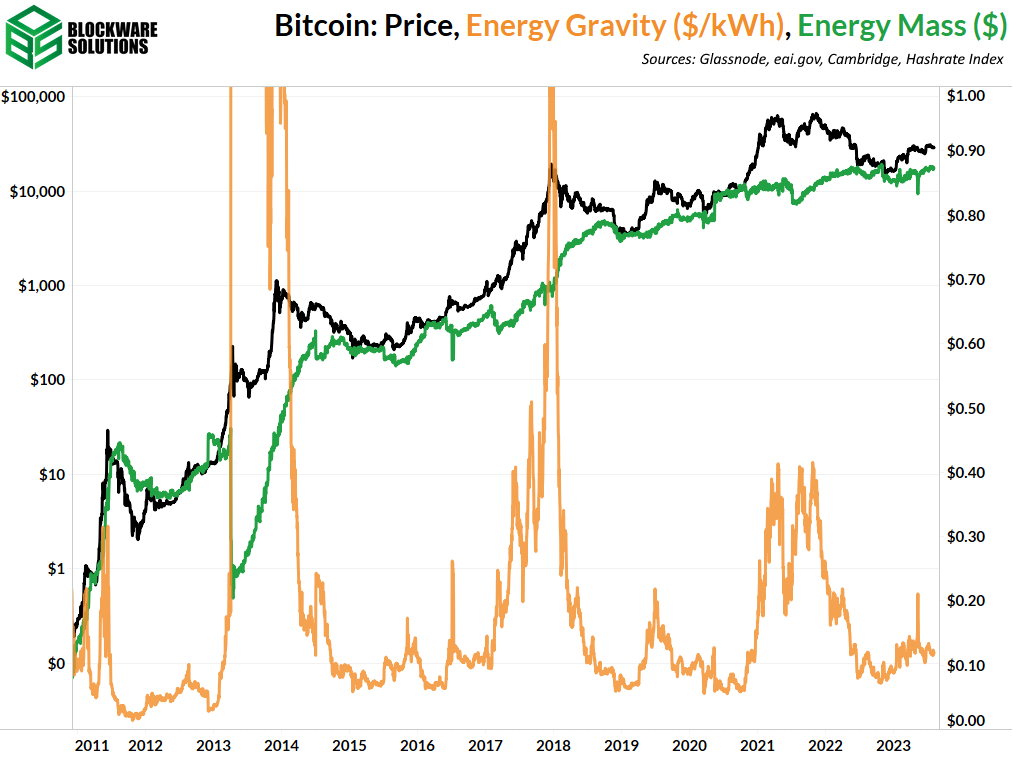

19. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$17,677 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

10,000 BTC is roughly $300 million, not $30.