Blockware Intelligence Newsletter: Week 94

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 7/1/23-7/7/23

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through July 2023.

1. Blockware CEO Interview. Blockware Solutions CEO, Mason Jappa, was the featured guest in the latest documentary of popular YouTuber Jake Tran. This documentary explores the SEC lawsuits against Coinbase and Binance, and how the regulatory clarity of Bitcoin vs “Crypto” is bullish for Bitcoin and Bitcoin mining.

General Market

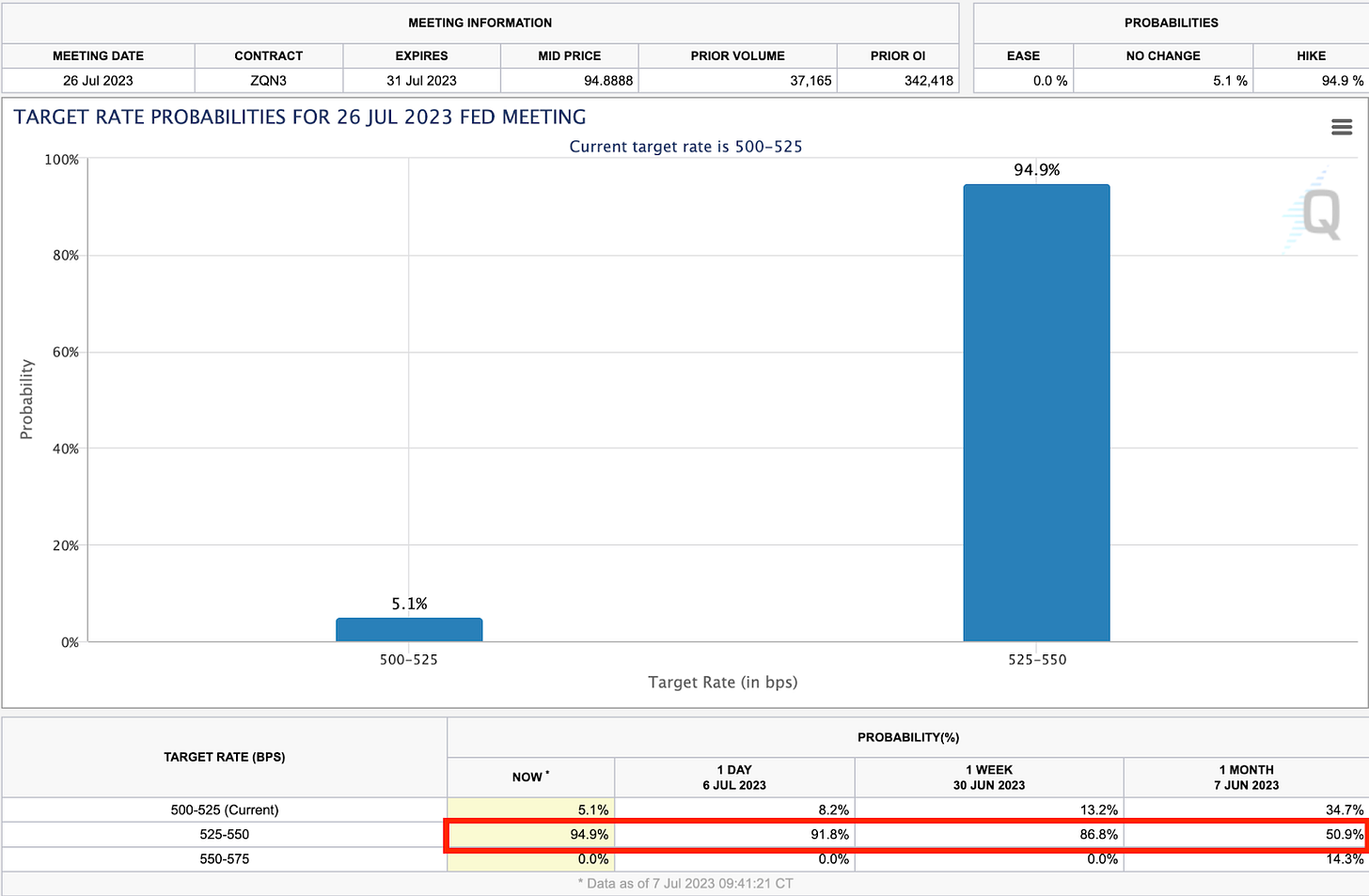

2. Fed Minutes. Released on Tuesday, showed that the debate to pause rates in June was a close one. The market is continuing to price in higher rates. As shown below, the probability of a 25bps hike on July 26th has moved up to ~95% from 51% just a month ago.

3. NASDAQ. The NASDAQ Composite attempted to pull back this week with the sell-off occurring in the bond market. But the bulls are strong, the index wasn’t even able to make it down to the 21-day, at the time of writing.

4. 10Y Treasury. The yield of the 10-year Treasury hit a new YTD high Friday morning after the Fed Minutes points towards higher rates to come for 2023. While yields have reversed at the time of writing, the new high for the 10-year in 2023 is now 4.094%.

5. $MOVE. To further visualize the spike in bond yields, check out MOVE, the VIX of the bond market. This effectively measures the supply of bonds on the market.

Bitcoin-Exposed Equities

6. $WGMI. It’s been a massive week for Bitcoin-related stocks, despite the sideways consolidation underway for spot BTC. For context, check out a chart of the Valkyrie Bitcoin Miners ETF, WGMI. This chart is nearing 11-month highs!

7. $IREN. One monster name of recent has been Iris Energy (IREN). Iris is up ~140% in just 5 weeks. This comes after they announced plans to increase their operational hashrate by over 60% by Q1 2024.

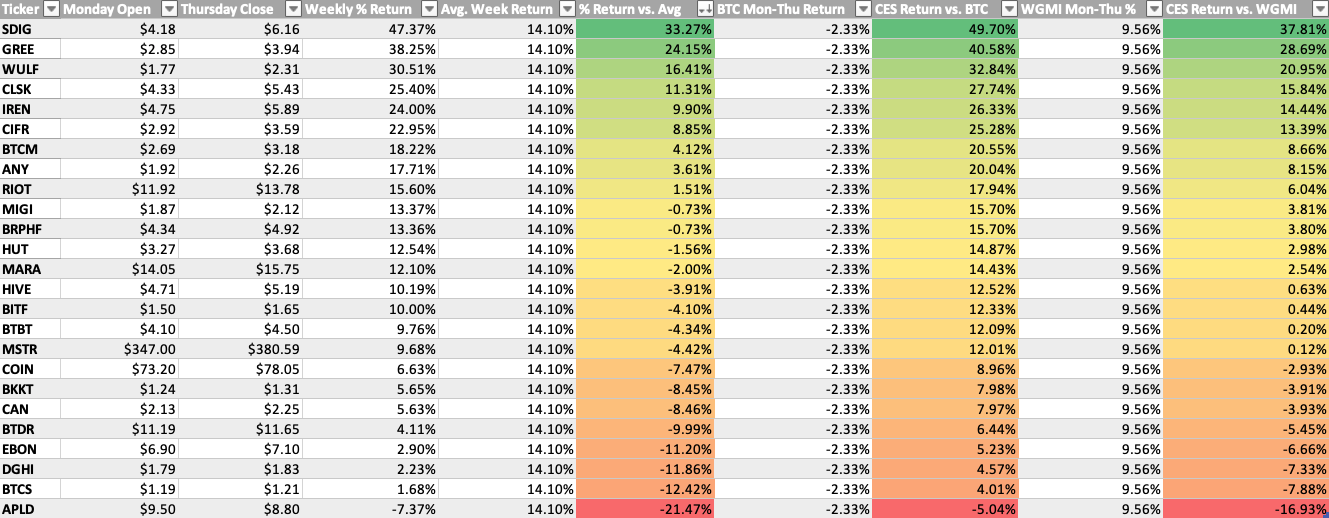

8. All Bitcoin Equities. Here's the excel sheet comparing the Monday-Thursday price performance of several Bitcoin exposed equities. It was a short trading week, but a big one for these names.

Bitcoin Technical Analysis

9. BTC Price. After running up 27% in just 9 days, BTC has begun to consolidate sideways. In our opinion, this price action is exceptional. Based on the price action of BTC’s associated equities, Q3 could be a strong one for Bitcoin price.

Bitcoin Mining

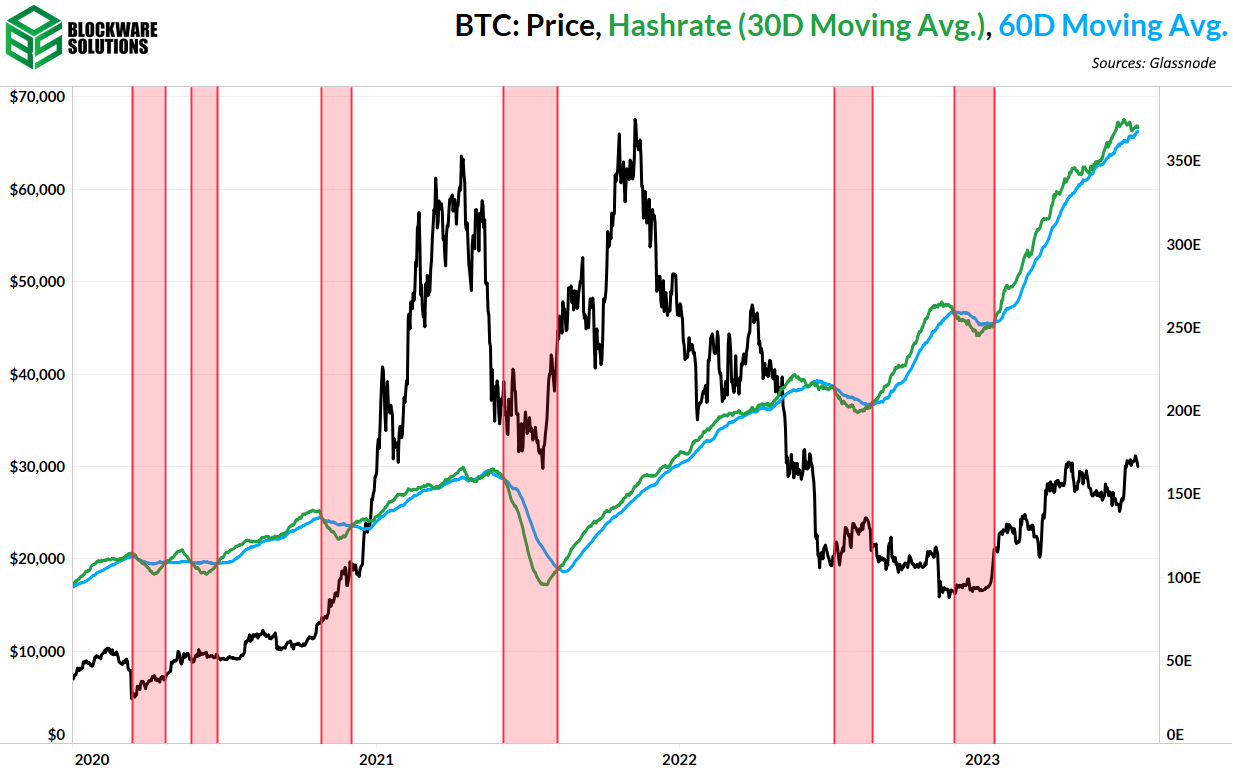

10. Hashrate. The summer heat has successfully hindered hashrate growth over the last 30 days, but still no official “miner capitulation” is in progress.

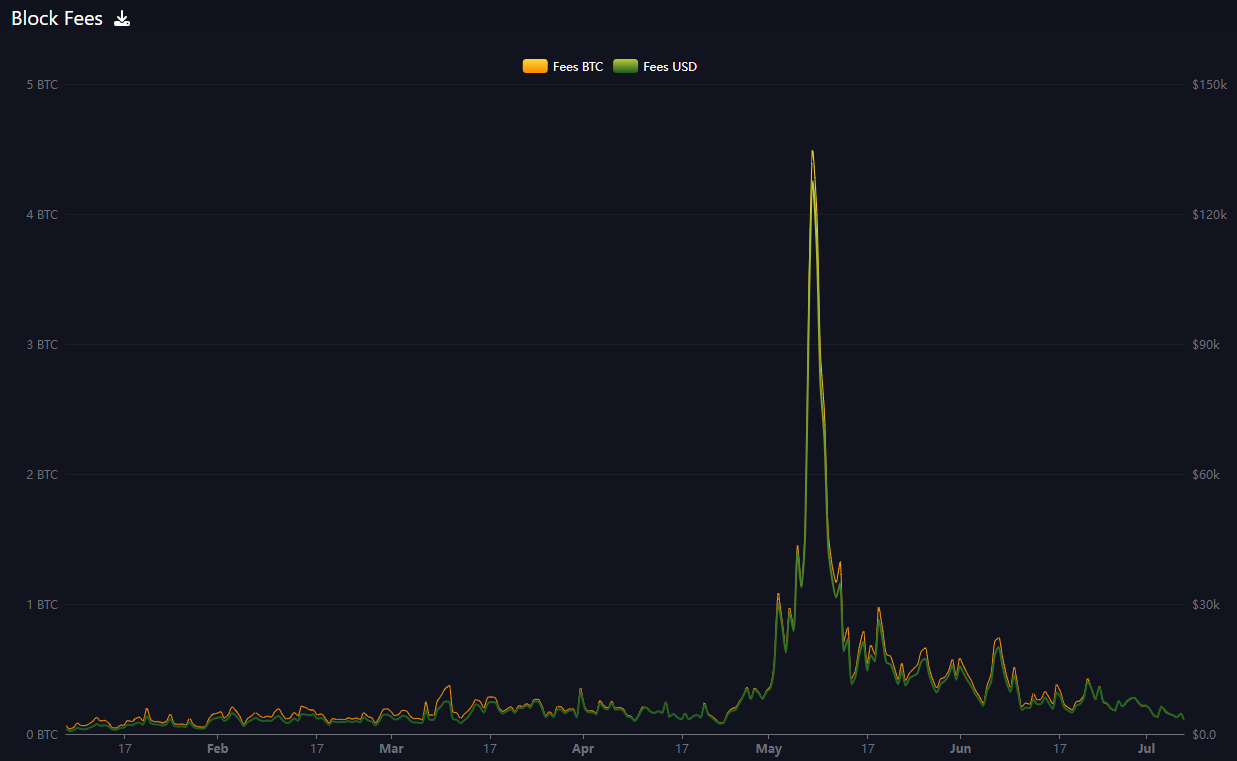

11. Block Fees. The ordinal fad of May 2023 has receded and the average fees per block has been hovering around $4,000.

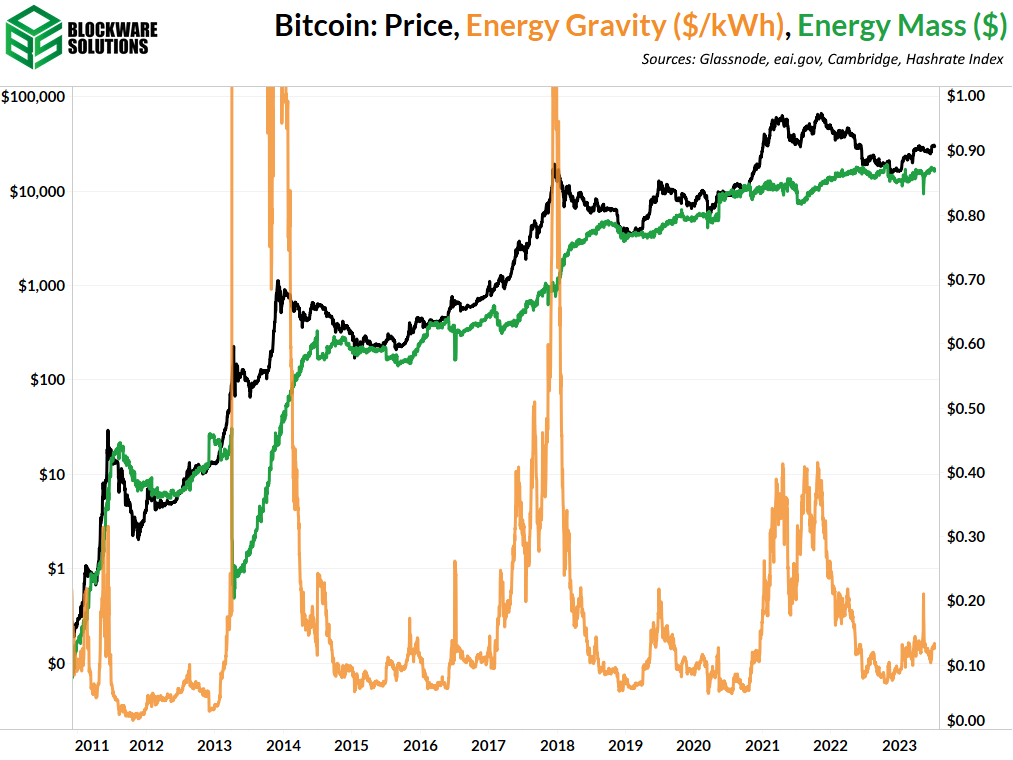

12. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$17,196 worth of energy to produce 1 BTC.

Bitcoin On-Chain/Derivatives

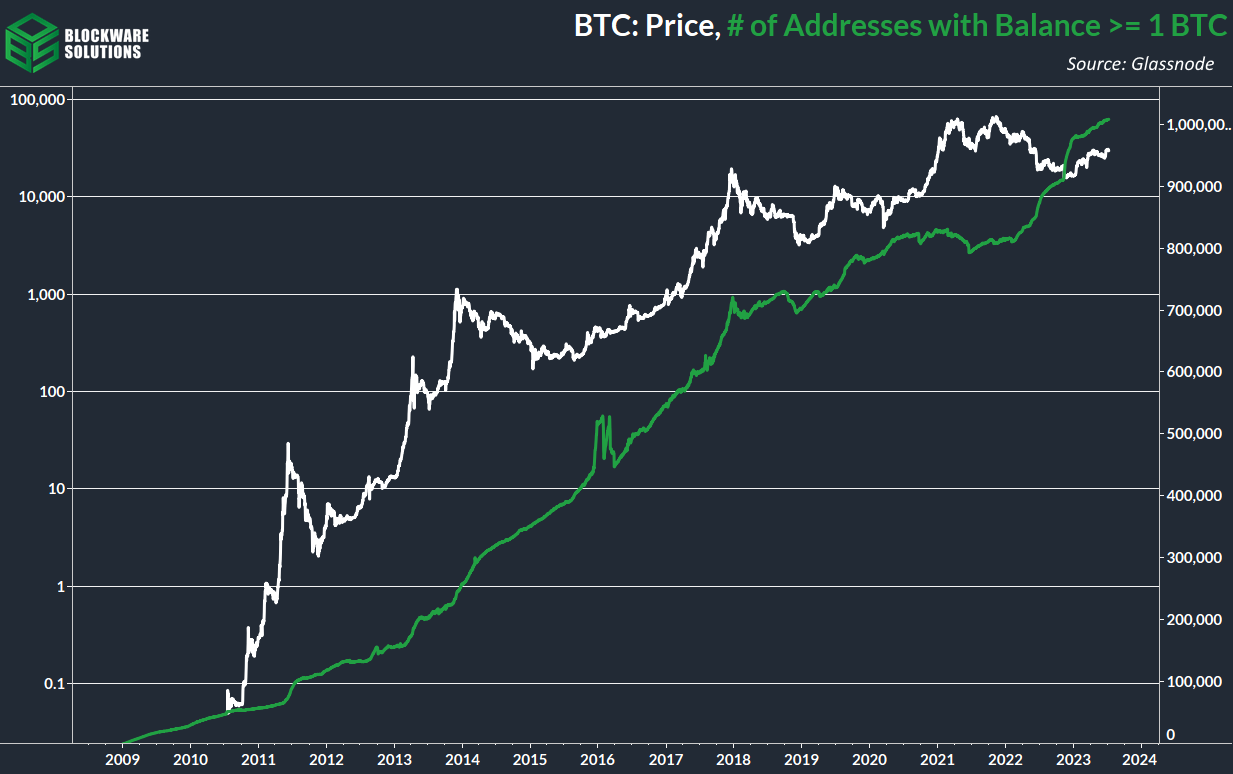

There's 1,007,530 unique addresses that hold 1+ BTC.

People have been sharing this statistic and claiming "1 million people own a whole Bitcoin."

That is incorrect and misleading.

Unique addresses with 1 BTC does not equal unique people with 1 BTC.

Let’s do some math to get a better estimate of the real number of wholecoiners.

Firstly, let’s explain a slightly “beneath surface level” technical element of Bitcoin; something that the average person wouldn’t necessarily need to know in order to use or understand Bitcoin, but it’s necessary for this discussion.

A “Bitcoin wallet” is effectively composed of two elements. A private key, which most people are familiar with, and an extended public key (xPub for short). Most people are familiar with public addresses, the long string of letters and numbers that you share with people that are going to send you BTC. Public addresses are derived from an xPub. It is possible for a single xPub (extended public key) to generate 4,294,967,296 unique public addresses. To maximize user privacy, the default setting for 99% of wallets is to generate a new public address each time you receive funds.

There is no way to know that any two addresses derive from the same xPub (wallet), unless someone shares their xPub. This is part of what allows Bitcoin to be simultaneously 100% transparent, but also pseudonymous/private.

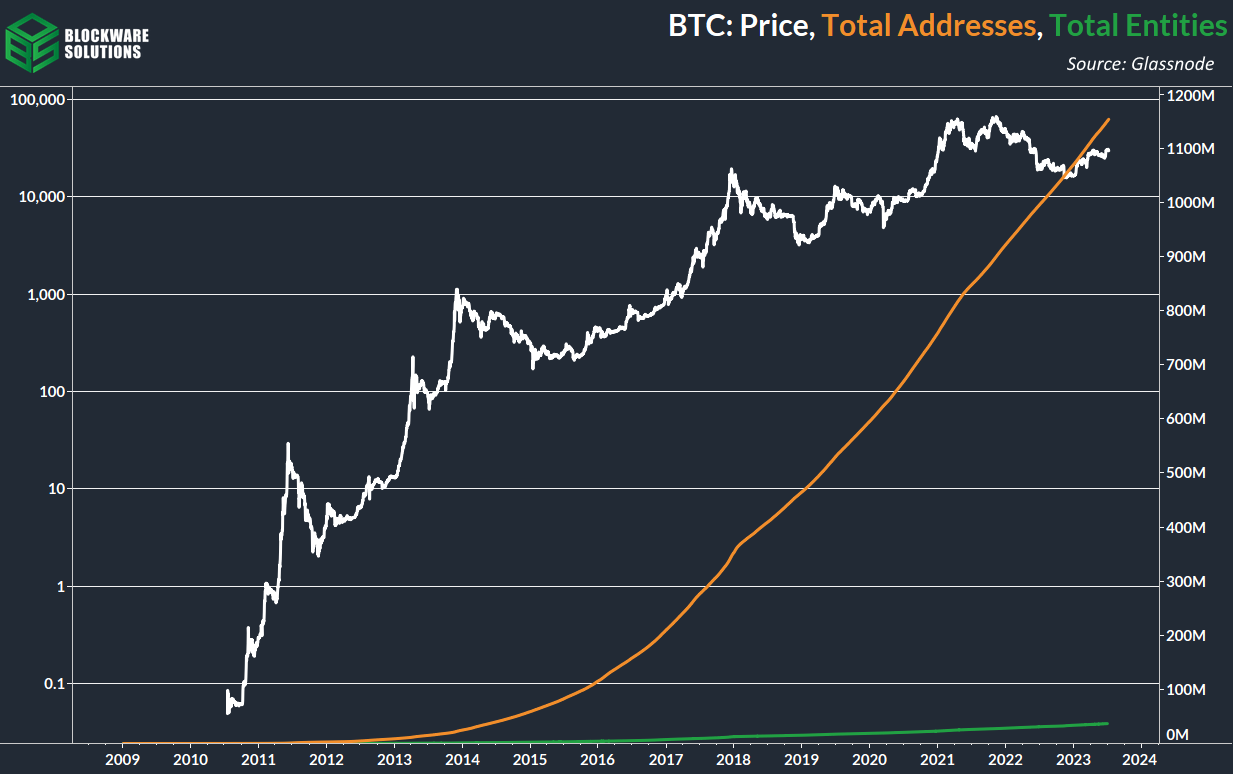

However, by factoring for known addresses, such as those belonging to exchanges, as well as observing when a cluster of addresses consolidate funds into a single address, on-chain data provider Glassnode provides an estimate of Bitcoin “entities”; which we can use as a proxy for the number of users.

While it's impossible to have 100% accurate information on the total number of Bitcoin users, and thus, the total number of wholesalers that we are trying to determine, Glassnode “entities” is the best estimate of the former.

Read more about Glassnode entity adjusted metrics here.

Okay, now that that technical explanation is out of the way, you can understand why 1,007,530 addresses with 1+ BTC does not equate directly to 1,007,530 “wholecoiners” (people that own 1+ BTC).

Most users, especially those with 10s, 100s, or 1000s of BTC, aren't going to hold all of their BTC in a single address. They are going to have multiple addresses with 1+ BTC belonging to them. So the total amount of wholecoiners is going to be much less than the 1 million number that's being thrown around.

Based on Glassnode entities, the rough estimate for total Bitcoin users is 36.8 million. Now, we can divide the ~1.15 billion unique public addresses on the network by 36.8 million users to get a rough estimate for the average number of addresses per user.

1.15 billion / 36.8 million =~31.5 addresses per user.

To get the most accurate estimate for the total number of wholecoiners, we need to account for two factors:

1) A single user controlling multiple addresses containing 1+ BTC

2) A single user controlling multiple addresses with less than 1 BTC, whose sum is >= 1 BTC.

Dividing the number of addresses with 1+ BTC by the estimated number of addresses per user accounts for the first variable.

1,007,530 / 31.5 = 31,985

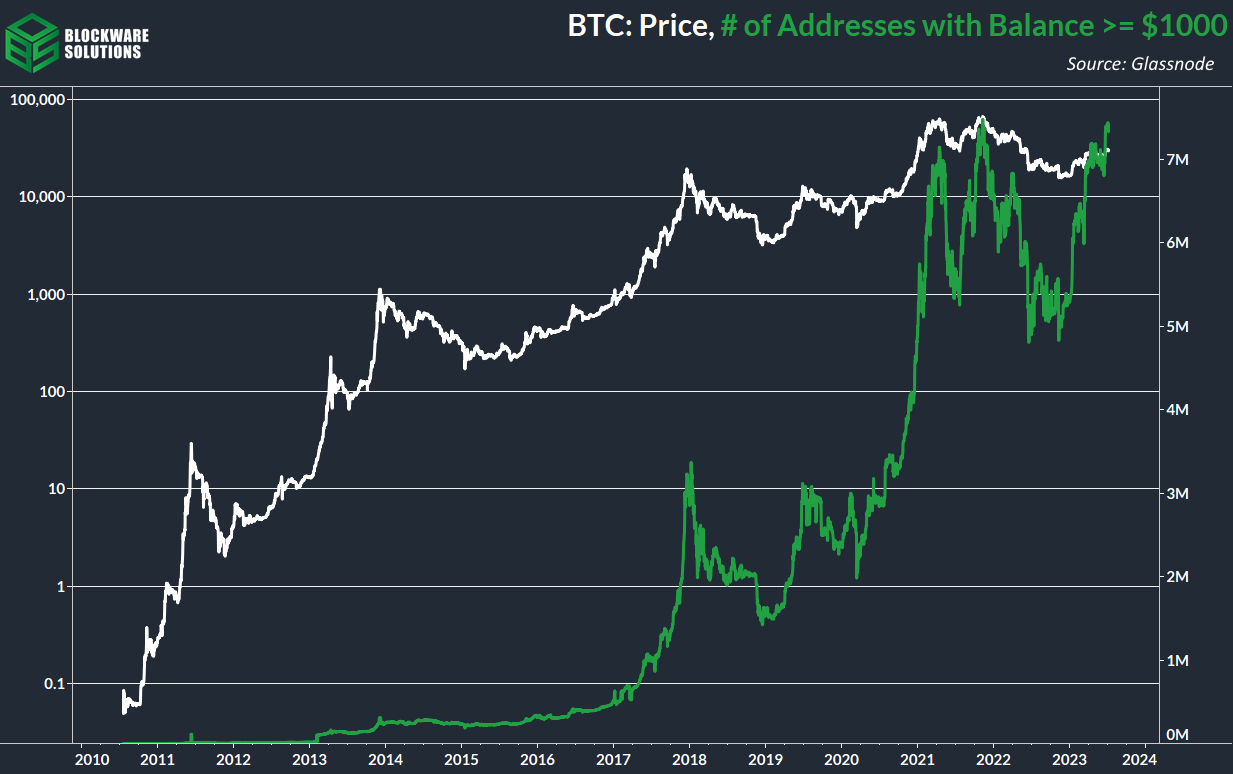

Based on ~31.5 estimated addresses per user, we can assume addresses holding between .0317 BTC and 1 BTC, as belonging to whole coiners.

1 / 31.5 = ~.0317

So we need to use the number of addresses with .0317+ BTC .I don’t have access to data that specific. Fortunately, .0317 BTC is just under $1000. So we can use the number of addresses with >$1000 as a close approximation. We’ll take the # of Addresses with $1000+ of BTC and then subtract out the # of addresses with 1+ BTC that we’ve already accounted for.

7,408,819 - 1,007,530 = 6,401,289

Next, we’ll divide that by the 31.5 addresses per user.

6,401,289 / 31.5 = ~203,215

Finally, we can add together our two numbers.

31,985 + 203,215 = 235,200 wholecoiners.

This seems to be a reasonable estimate for the total number of people that own at least 1 BTC. I have purposefully neglected to consider BTC left one exchanges because:

Nobody truly owns BTC if left on an exchange.

Data about who/how many people have claim to BTC in exchange addresses is not public information.

Again, this is just an estimate and we can never know for sure. The transparency to investigate such questions, yet the privacy to not know for sure, is just one of many characteristics that makes Bitcoin so special

235,200 represents 0.002% of the global population. This cohort of people will likely gain an extraordinary amount of wealth and influence over the coming decades.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.