Blockware Intelligence Newsletter: Week 38

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 5/14/22-5/20/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

FTX US - Buy Bitcoin, crypto, and now US stocks with lower fees on FTX US. Use our referral code (Blockware1) and get 5% off trading fees.

Blockware Solutions (Mining) - It is difficult to buy ASICs, build large mining facilities, and source cheap scalable electricity all on your own. Work with a trusted partner like Blockware to deploy capital into Bitcoin mining.

Blockware Solutions (Staking) - Ethereum 2.0 is almost here, now is the time to stake your ETH with Blockware Solutions Staking as a Service to take advantage of 10-15% APR when the Ethereum network switches over to Proof of Stake.

Summary

Slightly contracting bond yields and short-covering led to a quick rally in the equity markets which has lacked true follow-through, as predicted here last week.

Credit spreads between Treasury and Junk Bonds continue to expand this week, indicating further deteriorating sentiment for risk assets.

Initial jobless claims have begun to increase steadily over the last two months which combined with high inflation, could lead to stagflation, as measured by the Misery Index.

Asian trading hours currently trading at a strong premium to EU/US

Still well below the momentum thresholds we’ve highlighted over the last few months

All-time high 65% of BTC hasn’t moved in at least a year

Second highest 7-day increase of retail’s BTC holdings ever

Updated Cambridge geographic data reveals a significant amount of Bitcoin mining (~ 20%) still in China.

Texas Bitcoin miners temporarily turned off to conserve power for the grid highlighting how Bitcoin miners are making energy grids more resilient.

General Market Update

It’s been a volatile week across the general market with the equity indexes attempting a rally alongside bond prices. The effect that bond prices have on the market are extremely important for both stock and crypto investors to understand, so I’ll start us off with a short explanation.

Remember that bond prices and yields have an inverse relationship. Bonds usually have a guaranteed payout (also known as face value, par value or principal) as long as they are held to maturity (2 years, 10 years, 30 years, etc.).

The only times a bond owner wouldn’t receive that face value at maturity is during a default, or when the bond issuer cannot repay the debt. With Treasury bonds, that issuer is the United States Government.

So because there’s a fixed amount expected to be received when the bond matures, when the market price to buy the bonds is rising, there is going to be a smaller annual percentage return (current yield) for buying and holding the bond to maturity, makes sense?

Now, institutional investors use bond yields as the risk-free rate when calculating what they consider a fair value for individual stocks. The yield of Treasury bonds (usually the 10-year) is used as the risk-free rate because it essentially tells investors that if this stock isn’t expected to return as much as a riskless bond, there’s no point in buying it instead of the bond.

The risk-free rate gets its name because since the government is responsible for repaying the debt, there’s basically no chance that they won’t be able to pay. Unlike with corporate bonds issued by companies.

So in summary, when bond yields are rising, stock valuations become lower which leads to stocks being sold. Rising bond yields lowers institutional appetite for risk, which we’ve also seen spill into crypto prices.

Personally, I don’t believe in using these models for valuing stocks because supply/demand and price action are by far the purest indicators of where current value is actually being placed, but you can read this Investopedia article if you’d like to learn more about discounted cash flow models.

10-Year Treasury Bond Yield 1D (Tradingview)

Above is the current yield for 10-year US Treasury bonds. As you can see, the last two weeks we’ve seen yields fall, as bonds are being bought in the midst of the first bond bear market in over 40 years.

This gave stocks some wiggle room to rally but 10Y yields aren’t even 0.50% of their highs and it is much too early to say that they’ve topped.

If we look at credit spreads, or the difference between the prices of different types of bonds, we can gauge investor sentiment for risk assets from the perspective of the fixed-income (bond) market.

IEI/HYG 1D (Tradingview)

IEI is an ETF which measures the prices of 3-7 Year Treasury bonds. HYG, on the other hand, measures the prices of high yield corporate bonds, also known as junk bonds. Junk bonds are securities that are issued by smaller, usually growth, companies with a much higher risk of defaulting on their debt.

The above chart shows the difference between Treasury (IEI) and Junk (HYG) bond prices, you can see this spread is widening and has reached the highest value since the decline it made off its 2020 high (AKA the 2020 stock market lows).

A higher IEI/HYG spread would mean the prices for Treasury bonds are higher than prices for Junk bonds. The current rising spread shows the ongoing flight from riskier corporate backed debt into safer government backed debt.

This isn’t too surprising as institutions have been derisking for months due to interest rates and CPI rising, but it further illustrates the poor institutional sentiment for owning risk assets. As I mention constantly, institutional accumulation is a requirement for a sustained bull market.

This week, slightly falling yields, combined with the largely oversold prices of the equity indexes, alleviated some of the selling pressure we’ve seen in stocks and led to a short rally attempt, as predicted here last week.

QQQ Short Interest (Nasdaq Data Link)

Continuing from last Friday, the Nasdaq attempted to rally higher, mostly stemming from shorts covering. Above you can see the number of shares sold short for the Nasdaq ETF, QQQ, which decreased this week.

When shorting a stock, you are borrowing shares from your brokerage to sell, then to close your position, known as covering your short, you buy those shares back. If price fell and that initial sell price was higher than the buy, you profit. Bear markets normally see numerous rallies fueled by shorts buying shares to cover.

It can be difficult to tell when a bear market rally is legitimate versus being fueled by short covering. This is why we wait for confirmation in the form of prices making higher highs, recovering over key moving averages and strong buying volume before getting too aggressive.

Nasdaq Composite Index 1D (Tradingview)

On Tuesday, the Nasdaq managed to close above its 10-day EMA (green) but this buying was on light volume (-4% from its 50-day average), an indication that institutions weren’t yet accumulating.

This was followed by a continued sell off on Wednesday where the Nasdaq put in its 2nd worst single day performance of this bear market (behind May 5th). This was also on relatively light volume (-3% from its 50-day average), which is a testament to how low liquidity is.

After Thursday’s reversal, it looks like an undercut of the May 12th lows is likely. This could lead to another break in the market, but also be on the lookout for an undercut & rally pattern as I discussed in the crypto-exposed equities section last week.

An undercut of ~$11,100 for the Nasdaq would likely draw in high short interest and execute stop losses for traders which could add dry powder for higher prices if there’s a strong enough reversal. I’m just speculating here, only time will tell.

DXY 1W (Tradingview)

As discussed last week, the value of the US Dollar has been on the rise and attempted a breakout over 5 year highs. This week, we’ve seen that breakout appear to fail with an undercut of previous resistance levels.

If you don’t recall, a rising USD in comparison to foreign currencies is generally a good thing for US equities, as the value of US goods increases overseas. The reason as to why USD has been appreciating is not because things are going great monetarily in the US, it’s more so because of the deteriorating Euro, British Pound, Chinese Yuan and Japanese Yen.

In the macro world, there’s been increasing fear about a stagflationary recession in the US, which we haven’t seen since the 1970’s. Stagflation is a period where economic growth is declining with high unemployment, but inflation is still elevated.

US Misery Index (Bloomberg)

The Misery Index is a metric that measures both inflation and unemployment. It saw extremely high values during the stagflation of the 70’s and early 80’s. At the moment, the misery index isn’t extremely elevated because we currently have high inflation but historically low unemployment, but if you are concerned about stagflation this is the metric for you to watch.

The spread between unemployment and CPI is at 40 year lows. When inflation is rising it can be a good thing for employment, to an extent. Businesses have stronger profit margins and are able to increase production and take on more employees.

But when inflation is extremely high and there are issues in the supply chain, it can lead to both prices and unemployment increasing.

Initial Jobless Claims (Bloomberg)

Initial jobless claims have begun to curl higher over the last couple of months. This metric records the number of people filing for unemployment benefits for the first time after losing their jobs.

It isn’t clear whether this increase is significant quite yet, but keep an eye out for higher values. Historically high inflation combined with higher unemployment is a dangerous combination, hence the name Misery Index.

Crypto-Exposed Equities

Despite all the market pressure, a few crypto-equities have held up very well this week, relative to Bitcoin and the market indexes. That being said, these stocks are all still in stage 4 downtrends, under all or most major moving averages.

As mentioned nearly every week, crypto-stocks are mostly higher volatility avenues for traditional investors to gain exposure to Bitcoin. Without a bottom in BTC, it is extremely unlikely to see a bottom for these equities.

And because Bitcoin has generally been trading side by side with the Nasdaq, understanding what is going on in the equity markets and macro landscape can be very helpful.

While these stocks build out the left sides of these bases, we can work hard at identifying those names showing the highest relative strength. This could give us some clues as to which names may perform the best whenever the market turns.

This week, some of the names that stand out to me are BTCM, CAN, IREN, SDIG, and BTCS.

A few things I’m looking for are prices above key moving averages, higher distance from the lows compared to BTC/the rest of the industry group and strong green volume bars.

The outperformance of several crypto-equities has led to a very strong average performance for this basket of stocks this week. The average name on the list above is up 1.75% this week compared to -3.25% for BTC and -1.40% for Valkyrie's Bitcoin Mining ETF, WGMI.

Also, be sure to note the strong performance of Bitcoin relative to the general stock market indexes this week. The Nasdaq is about 1.60% from its lows as of Thursday’s close, Bitcoin was 16.30% off its lows at that daily close. This is a fairly strong decoupling, a trend we’d like to see continue.

Bitcoin On-chain, Derivatives, Price action

Last week we highlighted the highest 3D volume bar for BTC in a year paired with BTC being at macro range lows likely meant that the market had put in a local bottom. However, Bitcoin remains well below the momentum thresholds we’ve used in this newsletter throughout the last few months, a confluence of which sits at $47K.

With that in mind, for the macro cyclical bottom, which could potentially take months to form (not sure), we still view the low 20,000s as an area of confluence from both price action and on-chain. The approach I’m taking personally is the following:

Momentum buyer above $47K (confluence of 180WEHMA, STH realized price, 200DMA, 2022 yearly open) with invalidation on a break back below

Value buyer in the low-mid 20Ks. Laddering bids down from realized price ($24K) to the 200-week moving average ($22K)

For the multi-year time horizon investor, we still view this as a great time to dollar cost average heavier than usual, with all cyclical on-chain oscillators in the lower 10th percentile

No clear regime from funding rates, which is in our view a reflection of both increased market efficiency and market indecisiveness. A regime of strong negative funding rates (shorts paying longs to open/hold positions) would be a bullish sign; particularly in the face of upwards grinding price action. A regime of strong positive funding rates (longs paying shorts to open/hold positions) would be a bearish sign; particularly in the face of downwards grinding price action.

One interesting trend that has shaped up this last week especially has been the premium of Asian trading hours in comparison to US/EU trading hours. Asia has dominated this market for the last 2 years; selling the early 2021 top, buying the summer bottom, sold the first pump off the summer lows; buying the dip to $40k, and then selling heavily in November. The current state of the premium is the largest increase since last summer, something that has definetely caught our eye.

As talked about in last week’s newsletter with the sale of LFG’s ~80k Bitcoin reserves last week there was a sharp decline in whale balances. When filtering out LFG we can see both the increase and subsequent decline in whale holdings (turquoise) are much more muted.

On the other hand, there has been a huge uptick in retail’s Bitcoin holdings this week. This is shown below by the percentage of supply held by entities with less than 10 BTC, as well as the 7-day change of their holdings in blue.

It should be noted this is solely tracking entities who have taken self custody of their Bitcoin and we suspect the majority of retail holds their coins on exchanges and other custodians.

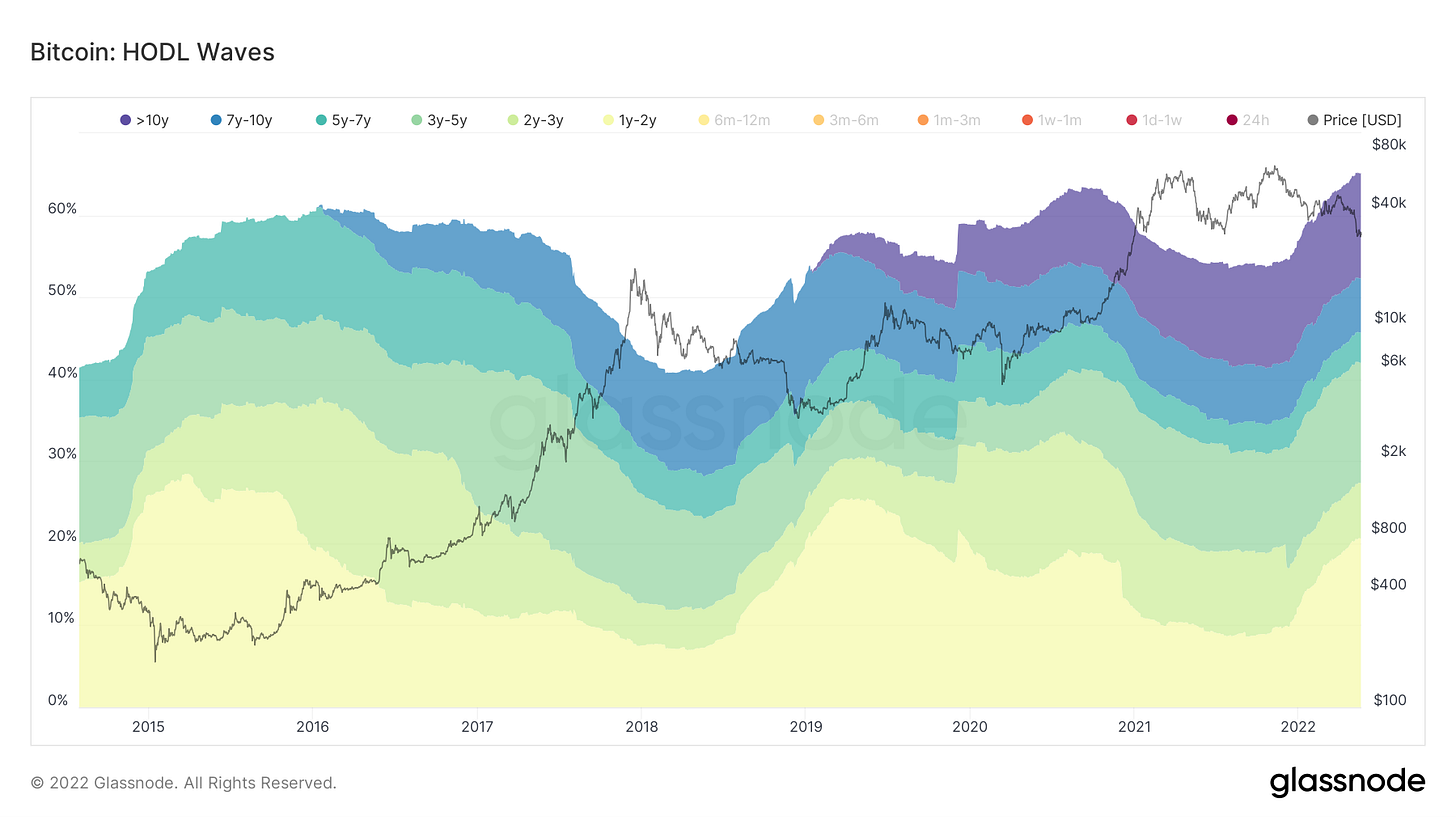

Lastly, the amount of supply that hasn’t moved in at least a year continues to climb to new all-time highs, reaching over 65%.

Bitcoin Mining

Cambridge Updates Mining Geographic Data

The University of Cambridge just released updated geographic data on Bitcoin mining operations. You can read more about their exact methodology for estimating this data, but this newsletter will mainly focus on their results and the implications of their unperfect but accurate update.

Looking at the map, you can see that the United States and China are the top two leading countries, but generally, Bitcoin mining is thoroughly distributed across the entire planet. Bitcoin miners are economically incentivized to find and capture cheap or would-be wasted energy.

All over the world, this ultra-cheap energy is being consumed by Bitcoin ASICs. From Bolivia to Sweeden to Iran, Bitcoin ASICs are hashing for BTC every day.

Above you can clearly see the China “mining ban” during the summer of 2021 and how that severely disrupted Bitcoin’s geographic distribution of hash rate. Cambridge states “This strongly suggests that significant underground mining activity has formed in the country, which appears to empirically confirm similar assertions by leading industry insiders and miners. Access to off-grid electricity and geographically scattered, small-scale operations are among the major means used by underground miners to hide their operations from authorities and circumvent the ban.”

Concluding, this data reveals what many deep in the mining industry have known all along: There are still Bitcoin ASICs hashing in China.

Texas Bitcoin Miners Turn Off to Conserve Power for the Grid

As announced in a press release from the Texas Blockchain Council, Texas Bitcoin miners recently temporarily shut off to help conserve power for the ERCOT electricity grid. Due to abnormally high temperatures and an unexpected short-term drop in energy production, Bitcoin miners were instructed to turn off their machines as part of ERCOT’s demand response program.

Bitcoin miners that enroll in ERCOT’s ancillary services are constantly on standby to be powered down under ERCOT’s discretion. Enrolling in these services enables miners to receive abnormally cheap electricity, but they agree to power down on occasion when directed.

This is a real-life example of how Bitcoin mining is making energy grids more resilient. Bitcoin miners are energy buyers of last resort, buying energy regardless of location or time. This will continue to incentivize more long-term energy production, and it will drastically increase the reliability and likely even lower the cost of electricity for consumers and businesses.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.