Blockware Intelligence Newsletter: Week 124

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 3/9/24 - 3/15/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Bitcoin All-Time High

BTC made another push to new highs this week; albeit, the price has dipped in the past twenty-four hours. Pullbacks of this magnitude are nothing out of the ordinary, and the bullish thesis, ETF flows driving demand into an illiquid supply, are still very much intact. Bulls are expecting god candles, bears are expecting demon candles. Max pain is BTC grinding higher throughout 2024, in an almost uneventful fashion.

2. Bitcoin ETF Flows:

In terms of USD, Tuesday was the largest single-day inflow in spot Bitcoin ETFs since inception, with nearly $1 billion of inflows. These inflows came despite the fact that the BTC price dropped during trading hours on Tuesday. It appears that the ETF buyers understand the concept of “buying the dip.”

Wall Street, welcome to Bitcoin.

Source: https://heyapollo.com/bitcoin-etf

3. GBTC Outflows:

Outflows from Grayscale are still present, but they’re much less potent than upon the initial approval of the ETFs. We will likely continue to see steady, but diminishing, outflows as investors shuffle capital to other vehicles that possess lower annual fees.

4. ETF Holdings:

Total ETF holdings are now at ~453,000 BTC, with Blackrock alone holding 228,613 BTC. Not many analysts foresaw Blackrock eclipsing the holdings of MicroStrategy in just two months. As it turns out, the ETFs were, in fact, not priced in.

Source: https://heyapollo.com/bitcoin-etf

5. MicroStrategy:

$MSTR, up 145% year-to-date, has left every other asset in the dust. It’s pushing a market cap of $30 billion and shows no signs of slowing down. Since embarking on their Bitcoin strategy in August 2020, $MSTR is up 1089%.

Saylor wasn’t lying when he said, “I’ll be buying the top forever.” Within days of completing an $800 million convertible note offering, MicroStrategy has announced that they are issuing another $500 million in convertible notes.

The first offering bears an interest rate of 0.625% annually; Saylor is literally borrowing money at less than 1% interest to buy Bitcoin. This is a speculative attack that makes George Soro’s shorting-of-the-pound look like a Robinhood retail trader.

General Market Update

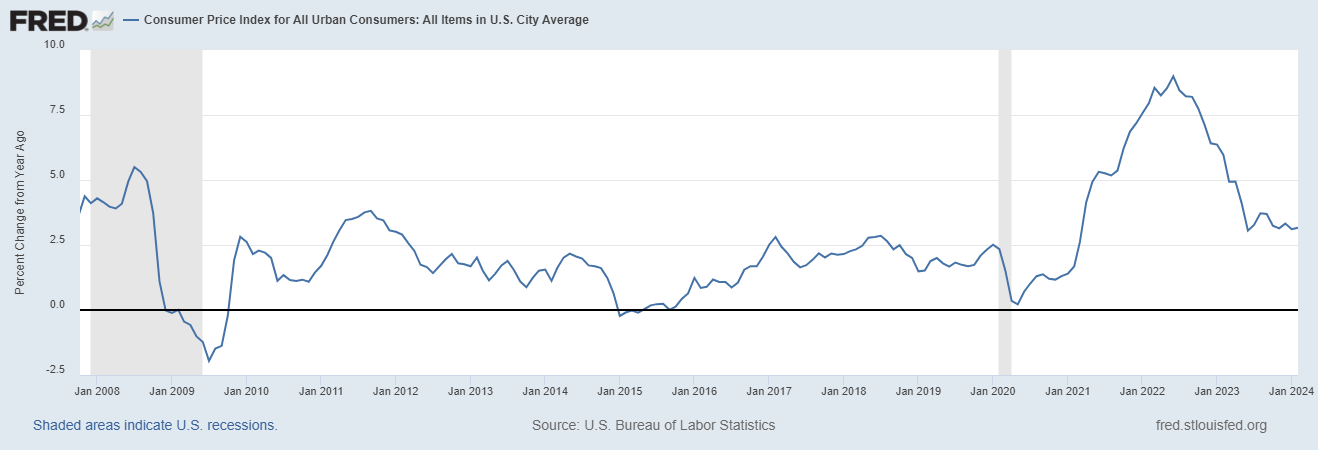

6. Consumer Price Index:

Year-over-year CPI change came in at 3.16%. With CPI stubbornly above the Fed’s 2% target, “stickiness is transitory” is the newest mantra. Sound familiar? The Fed’s attempts to tighten monetary conditions can only go so far when congressional budget deficits are in the trillions, and foreign central banks, namely China, have returned to Quantitative Easing. Global liquidity is on the rise. This is bullish for risk assets and it’s going to dampen the likelihood of the Fed getting CPI down to 2% before they themselves begin cutting interest rates.

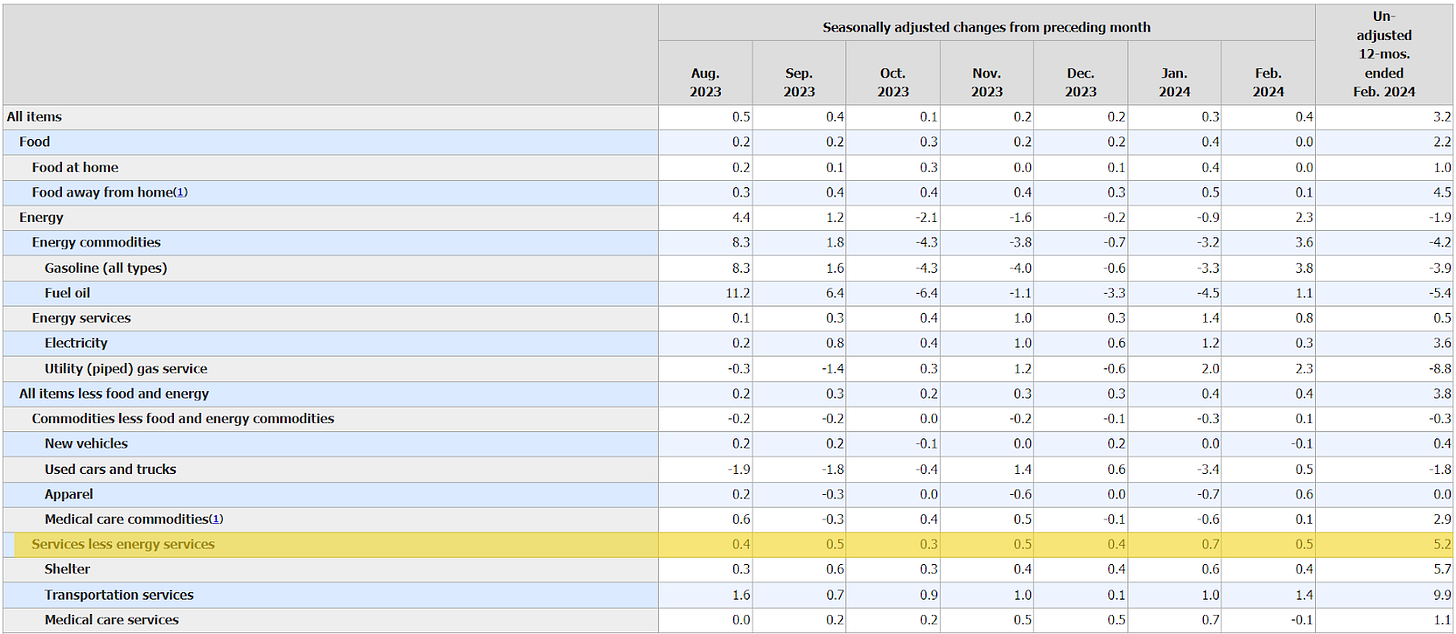

7. CPI Components:

Looking at the basket of goods comprising CPI, services less energy led the way with a 5.2% year-over-year increase in February. Energy has deflated year-over-year at -1.9%, but on a monthly basis, energy prices rose by 2.3%.

8. US 2-Year Treasury:

The 2-year reacted aggressively this week in the wake of higher-than-expected CPI data. The 2-year yield increased by more than 30 basis points in the past five days. The market is still projecting Fed rate cuts in 2024, but it appears to be waiting for more clarity on the exact timeline before they start seriously bidding treasuries.

9. Russell 2000 ETF ($IWM). This week we’ve seen a pullback from small/mid-cap growth stocks as the market digests the gains made in Q1. This type of price action is normal in bull markets, as the combination of profit-taking, short-selling, portfolio rebalancing and tired buyers create short-term opportunities to enter the best names. We still have the possibility of more downside for the Russell, with the lower range of support meeting the 50-day SMA at ~$198.50.

Bitcoin On-Chain / Derivatives

10. Short-Term Holder Realized Price:

For those familiar with AVWAP, this on-chain metric can be understood in a similar vein. It measures the aggregate cost-basis of users who have been holding BTC for less than 155 days. Price is set at the margin, and short-term holders are most responsive to immediate price action. As such, this metric has been a key support level during bull markets as short-term holders view price dropping to their cost-basis as a good time to add to their position.

STH-RP is ripping alongside price, just as it has during past bull markets. Notice how impeccable this metric was as support during the 2017 & 2021 bull markets; there’s no reason to expect anything different this time around.

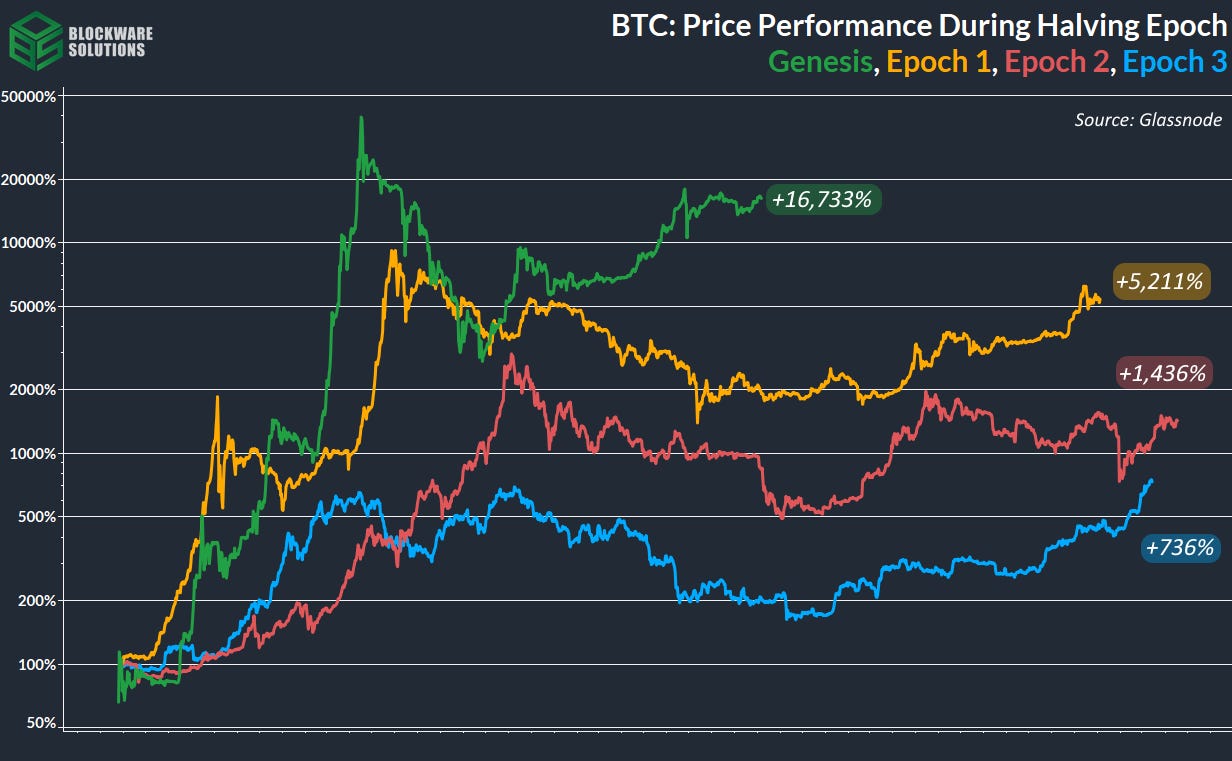

11. Price Performance Since Halving:

We’re now ~1 month away from the next Bitcoin halving. Here’s how price has performed during each epoch.

Genesis: +16,733%

Epoch 1: +5,211%

Epoch 2: +1,436%

Epoch 3: +735%

With the 2024 halving right around the corner: prepare accordingly...

12. Total Futures Liquidations:

It’s still nothing but crickets in the futures market compared to the last time BTC was in this price range. The cycle top isn’t in until degen retail traders step in with 100x leverage.

Bitcoin Mining

13. Hashrate / Mining Difficulty

The hashrate of the Bitcoin network has hit 600 EH/s on the 14-day moving average. This week, mining difficulty adjusted up by ~5.79%. Year-to-date, hashrate has grown by ~16%. The most robust computing network in the world is growing more powerful by the day. Continual hashrate growth at this rate is likely as newer generation ASICs, S21s & M60s, start plugging in.

14. Valkyrie Sells ETF Platform to Coin Shares

Valkyrie, known for the creation of $WGMI, a Bitcoin Mining stock ETF, and more recently their spot Bitcoin ETF, $BRRR, has sold their ETF platform to Coin Shares, a European digital asset investment firm. So far there’s been no changes to WGMI’s holdings, but we’ll continue to monitor to see if new ownership changes the strategy.

15. WGMI:

Speaking of WGMI, BTC mining stocks have been getting pounded recently; down 27% year-to-date despite the exceptional performance of spot BTC during the same period. The reason for this disappointing performance is likely three-fold:

Competition from spot ETFs & $MSTR for BTC exposure through traditional investment vehicles

Fearful expectations in regards to the 2024 halving.

General selling in the broader equity market this week.

As mentioned in previous newsletters, fears about the halving are unsubstantiated. The vast majority of publicly traded mining companies operate with high-efficiency ASICs and low electricity costs; they will remain profitable in a 3.125 BTC block subsidy environment. Should BTC continue to rip, the ability to produce the asset for less than the market price will make these entities highly profitable.

16. WGMI / BTC:

There’s clear cyclicality in the performance of mining stocks when denominated in BTC. However, a previous support level has been broken in the past few weeks. This underperformance of mining stocks relative to BTC, during a time in which BTC is pumping, is unprecedented. We’ll keep an eye out for a rebound after the halving. Once that negative catalyst for mining profitability is in the rearview, the path forward will be essentially void of bearish catalysts for miners.

17. Hashprice Year-over-Year % Change:

Hashprice tends to trend down in the long-term as the Bitcoin mining industry grows: more miners coming online increases mining difficulty. However, during BTC monetization periods, bull markets, hashprice goes on parabolic bull markets. Growth in mining difficulty requires the development of physical infrastructure, energy sources, and ASIC deployment. This is a time-consuming process, and it cannot happen nearly as fast as BTC price appreciation.

Hashprice year-over-year growth switching from positive to negative has been a powerful leading indicator for Bitcoin bull markets. What we are seeing now is a positive omen for Bitcoin mining profitability, despite the halving that has many investors concerned.

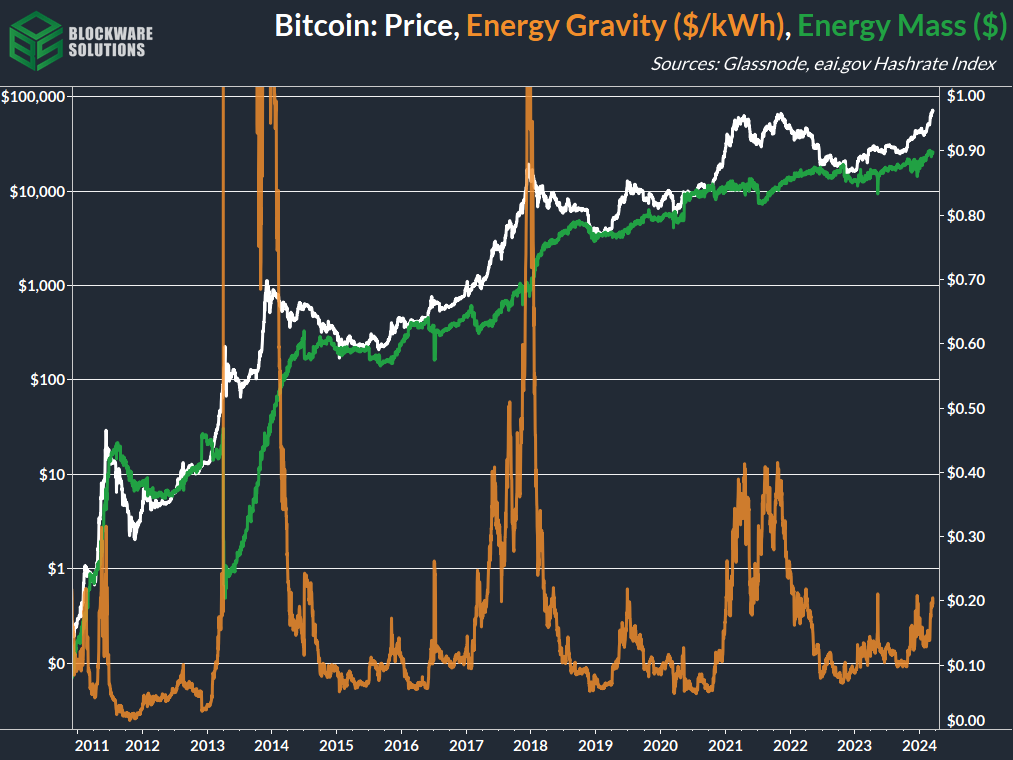

18. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$26,279 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Are you able to add the STH-RP chart to the Intelligence Dashboard? Or would Glassnode not allow a live chart feed like that?

Is there any chance of Big money not having an effect on price of Bitcoin just after the halving when hopefully the retail investors will be fully invested in the market?