Blockware Intelligence Newsletter: Week 32

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 3/25/22-4/1/22

Blockware Intelligence Sponsors

FTX US - Buy Bitcoin and crypto with zero fees on FTX. Use our referral code (blockware) and get a free coin when you trade $10 worth.

Blockware Solutions (Mining) - It is difficult to buy ASICs, build large mining facilities, and source cheap scalable electricity all on your own. Work with a trusted partner like Blockware to deploy capital into Bitcoin mining.

Blockware Solutions (Staking) - Ethereum 2.0 is almost here, now is the time to stake your ETH with Blockware Solutions Staking as a Service to take advantage of 10-15% APR when the Ethereum network switches over to Proof of Stake

Webull - Trade crypto-equities. Open an account and make your first deposit by March 31st and get three free stocks, each valued between $7-$3,000.

If your company is interested in sponsoring Blockware Intelligence, please email sponsor@blockwaresolutions.com.

Summary

The major stock indexes are pulling back alongside Bitcoin, but selling is generally low volume and not showing signs of serious distribution.

The 2-10Y section of the yield curve is close to inverting, but contrary to popular belief, this isn’t an immediate cause for concern.

Crypto-exposed equities gave us an early indication of the incoming pullback in bitcoin but also in the major market indexes.

Greenpeace’s “Change the Code” campaign has virtually zero chance of changing the Bitcoin protocol to Proof of Stake.

Proof of Work is a net benefit to society by reducing wasted energy, balancing energy grids, and incentivizing the development of cheap renewable energy.

General Market Update

Overall it’s been a decently constructive week of price action across the general market. Many names look as though buyers have been exhausted from the lockout rally we’ve had the last few weeks, so the current pullback is warranted.

Pullbacks are a natural and necessary part of price action. As prices rise, especially in an aggressive move off bear market lows, you will inevitably run into profit takers and/or short sellers.

No stock goes straight up, so for a sustainable move we’d like to see shallow pullbacks as sellers try to kill the rally but are overwhelmed by bids. Sideways to shallow pullbacks allow shorter-term moving averages to catch back up to price and provide support.

On Tuesday, the Nasdaq Composite was rejected just prior to hitting the 200 day SMA (black). Moving up into a flat or declining moving average is a common place to run into some profit takers or short sellers.

Ideally, we’d see the Nasdaq find a strong bid around that gray horizontal support zone, this coincides with the 10 EMA (green). Beyond that, I’d like to see the 21EMA (blue) or 50SMA (red) be a place where buyers step in.

The selloff on Thursday was fairly aggressive from a technical standpoint as we closed at the absolute lows of the day.

But for many equities, the selling on Wednesday and Thursday was on low volume, an indication that, so far, this is normal market digestion and institutions aren’t aggressively unloading positions at this time.

Pullbacks early in a rally provide us with great opportunities to pick out the leading stocks. Names that are holding up the best are likely to have the quickest and most aggressive recovery, if they have even pulled back at all.

A few names that stand out this week are BRCC, CCJ, IRM, DLTR, OVV and SQM.

If you pay attention to financial news or twitter no doubt you have heard about the yield curve’s 2 and 10 year spread in the last couple of weeks. A lot of this talk is simply FUD, but the 2-10Y spread is significant and undoubtedly worth discussing.

For a more detailed explanation of the 2-10Y spread and its significance be on the lookout for an upcoming report from Blockware Solutions. But in short, the 2-10Y spread compares the yield (return) of the 2 year US treasury bond and 10 year US treasury bond.

The 10Y generally has a higher yield (return) than the shorter 2Y bond. This makes sense as investors expect more gains from having their money tied up for longer. Also, there’s the idea of long-term uncertainty, higher future interest rates would have more of an effect on bonds with many payments remaining.

Above is an example of a normal looking yield curve. This shows the relationship between bond yield and maturity and the shape can provide a ton of information about the current health of the economy. Maturity is our X-axis and yield is the Y-axis so you can see that normally, a shorter-term bond should have a lower yield.

But on rare occasions, the yield curve can flip (invert) when the yield of shorter-term treasury bonds surpass that of longer-term bonds. Higher yields for short-term bonds means that investors are selling and the price for those securities is falling.

Above is the current yield curve, courtesy of Bloomberg. As you can see from the table at the bottom, the curve has already begun to invert. The 3 year treasury bond is already yielding higher than the 5Y, 7Y, 10Y and 30Y.

The spread of two yields is found by simply subtracting the 2Y’s yield from the 10Y’s yield.

The difference between the 2 and 10 year yields is the most common spread studied by analysts, but others may prefer the 1-10Y, 3M-10Y, 1-30Y etc.

Above you can see the 2-10Y spread overlaid with shaded regions showing American recessions. As you can see, when the curve goes negative it has historically been a strong predictor of an incoming recession.

This is because it’s a signal of investors losing confidence in the near-term health of the economy. A loss of confidence usually results in capitulation which can be enough to pop debt bubbles.

Many analysts on twitter would like you to believe that we’ll wake up tomorrow in a recession simply because 2 year treasury bonds are close to yielding more than the 10 year.

Looking at the last 5 times the 2-10Y spread flipped negative, we can see that on average, a recession didn’t start for almost 11 months. In that time, the Nasdaq returned an average of about 50.5%. In the 2 months following the inversion, the Nasdaq was green every time.

Throughout the entire course of modern US history, the average time it takes for a recession to begin after the 2-10Y spread flips is around 20 months.

Inversion also hurts banks who borrow at lower, short-term rates and lend at higher, long-term rates. Therefore, one consequence of yield curve inversion is that it forces banks to raise interest rates on consumer loans such as mortgages and auto loans.

Source: Bloomberg

As you can see above, mortgage rates have skyrocketed in 2022 as the Fed was gearing up for their first rate hike and as lenders seemingly prepared for yield curve inversion.

Crypto-Exposed Equities

Similar to the general market indexes, the selling in crypto-equities this week has, for the most part, been on low volume and lacking signs of true distribution.

What stood out to me this week was that mining equities front ran the pullback in Bitcoin. These stocks generally began to pullback on Monday when BTC ran into its 200SMA.

BTC made another attempt at its 200SMA on Tuesday while many leading crypto-equities were already on the decline. It will now be interesting to see if these equities will begin their recovery before BTC.

So, crypto-equities front ran the pullback in bitcoin, but also, bitcoin front ran the pullback in the major indexes. BTC began to pullback on Tuesday and the S&P and Nasdaq began on Wednesday. So if you think about it, the sell off in crypto stocks was an early indication that the selling may hit the rest of the tech/growth market.

The crypto-equity that’s stood out the most this week has been Iris Energy (IREN). IREN is up almost 9% from last week’s close compared to a negative BTC and WGMI.

This stems from news that Iris has closed on $71M in financing from NDIG for ASIC purchases. IREN is a relatively smaller operation with an operating hash rate of roughly 844 PH/s, they plan on increasing this number over 10x in the next year to 10 EH/s by early 2023.

Above is our excel sheet comparing the weekly performance of several crypto-exposed equities to that of bitcoin and WGMI (Valkyrie's Mining ETF).

It is no surprise that IREN tops the list, with its stock price up ~7% from Monday’s open. ANY is the only other name who is up from Monday’s open as of Thursday’s close.

That being said, many names are outperforming the average crypto-equity this week, this is mainly due the fact that SDIG is down over 40% from Monday’s open on missed earnings and EBON is also down big, to the degree of over 20%.

Even excluding those two names, the average crypto-equity is still down 5.71% this week.

Bitcoin On Chain Analysis and Derivatives

From a price structure standpoint, Bitcoin reacted quite cleanly off prior range highs during this pullback thus far; and is now back above the yearly open and short-term holder cost basis at the time of writing.

A good portion of the driver of this move has simply been a rebound in traditional risk-on assets, with the blue indicator on the bottom of this chart showing the growing 1D correlation to the Nasdaq on this rebound.

As stated above, for the time being, Bitcoin is back above short-term holder realized price, a psychological level we have spoken about time and time again. Would like to see more than 1 daily close above this to feel confident in momentum continuation.

Aside from the correlation to risk on equities, another driver of capital inflows has been the Luna Foundation Guard accumulating a Bitcoin reserve; both directly, as well as through front-running and general narrative momentum. LFG now holds 30,727 BTC, roughly $1.5B at current market prices.

With this, we have seen coins being taken off exchanges fairly aggressively throughout this rally.

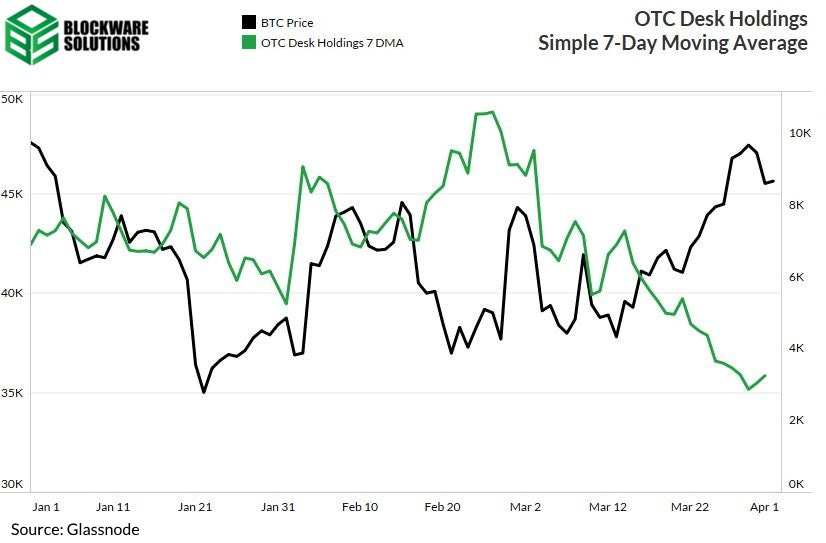

In addition, OTC desk’s Bitcoin holdings have declined as well.

And lastly, illiquid supply has taken another massive leg up, showing coins moving to on-chain entities who have a history of selling less than 25% of their BTC.

The open interest build-up we talked about last week has declined a fair amount, squeezing out some shorts on the push above $46K as well as longs on this pullback over the last 48 hours. Suprised to have not seen more reaction above $46K if this build-up was aggressive shorts as we had hypothesized.

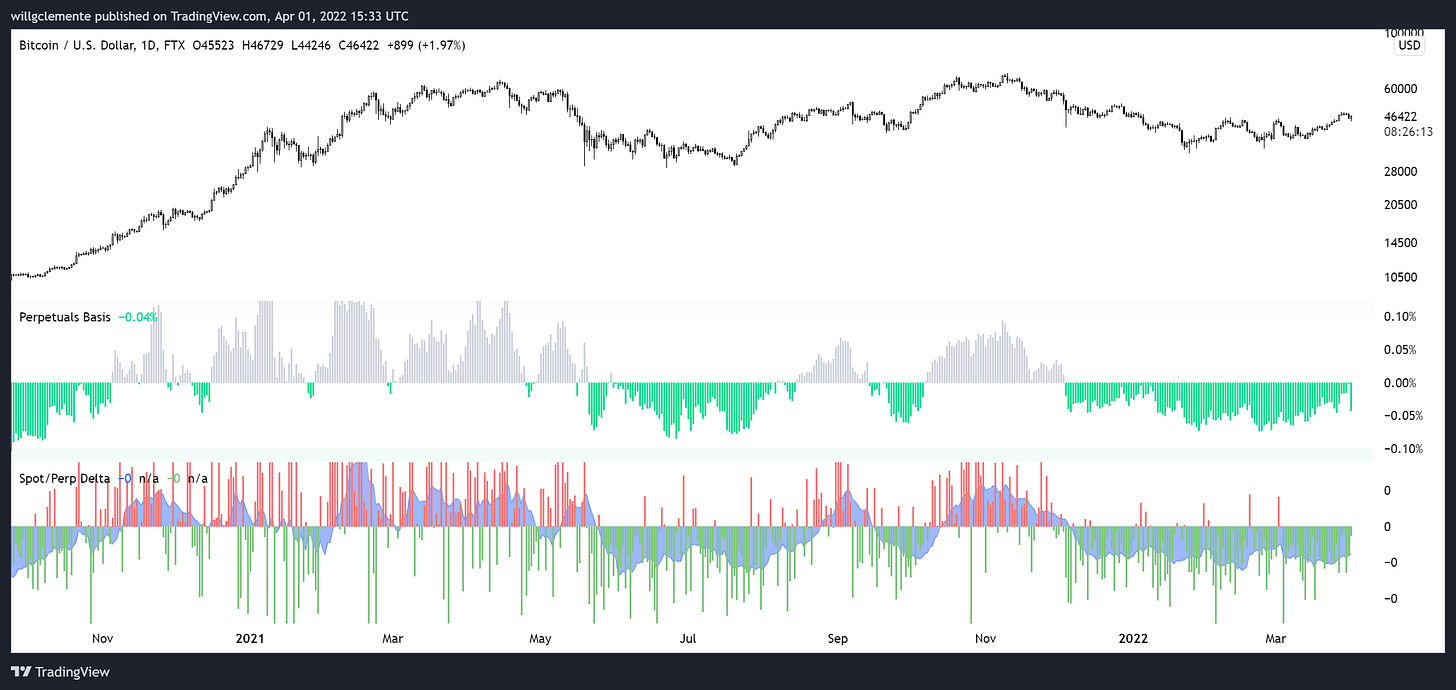

Spot premium over perps persists, both from an aggregated standpoint (top indicator), as well as looking at Coinbase spot versus Bybit perps specifically (bottom indicator). Prolonged regimes of spot premium are good times to allocate to BTC, especially when taken into context of positive price action.

One macro shift that is notable in the Bitcoin derivatives market is the percentages of futures open interest collateralized with crypto versus stablecoins. This creates a healthier backdrop for the market. Why? When longs are collateralized with BTC, they have a negative convexity; meaning as price goes against them, not only does their PnL decrease but the value of their collateral as well. With stablecoins as collateral, this effect is no longer there. Conversely, shorts that are margined with stablecoins versus crypto are more likely to be squeezed, because they no longer have an inadvertent hedge against price appreciation via their collateral.

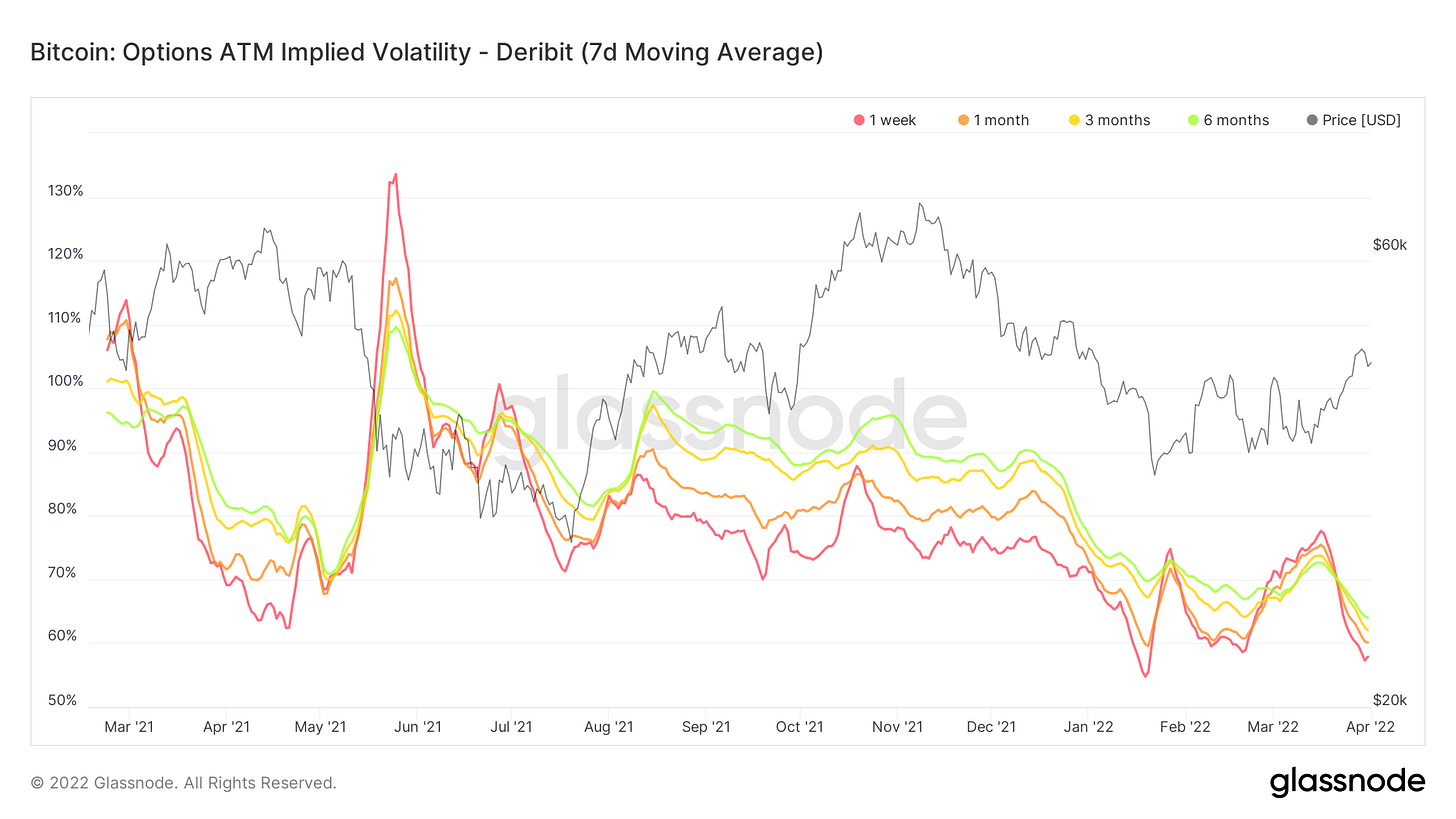

Implied volatility from the options market is on the decline, despite Bitcoin being at a pivotal HTF price level. I posted this yesterday, and since then have started to see IV tick up slightly, but still generally think this is a decent time to consider going long vol.

The last trend to note, which we talked about last week; the US trading hour price premium has been in an uptrend for roughly a year now, although declining slightly this week. Something to keep an eye on, potentially indicating a shift in market dominance from Asia to the United States.

Bitcoin Mining

Ripple Co-Founder and Greenpeace want to change Bitcoin

In case you missed it, the organization Greenpeace is launching a “Change the Code Campaign” to attempt to change Bitcoin and reduce its energy consumption. After the announcement this week, the campaign has already received extreme backlash from the Bitcoin community. No miners will support this, and no users that run their own Bitcoin full nodes will support this.

This “Change the Code Campaign” has virtually zero chance of going anywhere, as far as being able to change the actual Bitcoin protocol. In fact, since Bitcoin is anti-fragile technology, this campaign will likely only strengthen Bitcoin’s immune system. It will show people how immutable Bitcoin’s core protocol rules really are.

Just like the Blocksize War from 2015 to 2017, this will continue to set the precedent that Bitcoin is highly resistant to any changes that could alter its value proposition of being immutably perfectly scarce, portable, durable, and divisible. Bitcoin is a Schelling point on a set of rules with no rulers.

It is the most certain asset in the world as it has 2 important characteristics.

No counterparty risk

No dilution risk

In addition to the “Change the Code Campaign” having practically no chance of changing Bitcoin, it’s important to understand why Bitcoin’s Proof of Working Mining algorithm is actually a net benefit to society.

Proof of Work Mining is a Net Benefit for Society

First, Bitcoin miners are incentivized to find and power their machines with the cheapest energy available. From the Bitcoin Mining Council’s 2021 Q3 slide deck, they cited that ⅓ of all energy production is wasted. Global Bitcoin mining consumes 0.38% of the world’s wasted energy.

This wasted energy is cheap and Bitcoin miners are incentivized to use wasted energy that is easy to access. A great example of this is natural gas flaring, which Exxon Mobile and Conoco Phillips are already doing. Bitcoin miners are able to reduce energy waste by setting up containers of mining rigs next to natural gas fields. They utilize this excess natural gas instead of wasting it and flaring it into the atmosphere.

Second, Bitcoin miners can help balance energy grids and incentivize the build-out of extra energy capacity for more resilient cheap electricity for consumers. Bitcoin mining farms are able to negotiate special contracts with regional utilities and power grids like ERCOT (Electric Reliability Council of Texas). These contracts enable the miners to lock in a low electricity rate with the stipulation of agreeing to occasionally turn off machines during unpredictable times when the grid is strained. This could occur due to extreme weather or natural disasters harming energy production plants (solar, wind, nuclear, etc.). Instead of consumers going without electricity when these events occur, Bitcoin miners sacrifice their power first, as they can turn their operations on and off at a moment's notice.

Last, Bitcoin mining is effectively a massive bounty on who can generate the cheapest renewable energy at scale. Entrepreneurs and utilities now have a huge incentive to deploy more capital into R&D projects that focus on the development of cheap renewable energy. If there is any new breakthrough technology, energy producers can partner with Bitcoin miners to immediately begin monetizing their newfound energy source.

Importantly, producing and using energy is not a bad thing. It’s literally how society scales and our lives become better. Every technology we value today uses energy. AC, Heating, Cars, Planes, Christmas lights. They all use energy and more energy production means more abundant affordable goods and services for everyone.

In a unique way, Bitcoin mining is connecting the physical world (energy) with the digital world. In the long run, I think we will see the energy industry merge with the Bitcoin mining industry, and that will be good for Bitcoin and the world.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.