Blockware Intelligence Newsletter: Week 148

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/21/24 - 9/27/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

General Market Update

1. BTC - We are so back

It’s been a great week for the bulls - at the time of writing Bitcoin is at ~$66,200, up 22% in the past three weeks.

The two key short-term indicators we’ve been eyeing:

200-day moving average

Short-term holder cost-basis

…have both been surpassed. So not only does the broader macro regime – rising liquidity and declining interest rates – paint a bullish picture, but so do the technical indicators.

2. Global M2

We spent much of last week’s newsletter discussing the Federal Reserve interest rate cut and its impact on US dollar liquidity. But the US dollar is not the only fiat currency - and BTC is closely tied to global liquidity, not just dollar liquidity.

As you can see from the chart below, linear changes in global M2 almost ubiquitously result in exponential moves in the price of BTC. This makes sense as BTC is traded globally, 24/7, and has a finite supply. When global liquidity increases, investors look for something to exchange those currency units for - something scarce.

3. People’s Bank of China (PBOC) Pulls out the Liquidity Bazooka

With that said, the PBOC took action recently that makes the Fed’s 50bps cut seem hawkish by comparison. The PBOC provided more liquidity to Chinese markets through a few various mechanisms:

Lowering the Bank Reserve Requirement (freeing up more capital to lend/invest)

Lower Rate for “Medium Term Lending Facility”

Lower Minimum Down Payment Ratio for Mortgages

Direct Liquidity Injection via state-owned banks

The CSI 300 (Chinese version of the S&P 500) immediately responded positively. The policy enacted by the PBOC was effective in providing a much needed boost to a market that has been struggling for the past few years.

4. China Debt-to-GDP

The debt burdens of powerful Governments across the world continue to grow year after year. For each of these nations, currency devaluation is the only viable option to repay their debts. While not in as precarious of a position as Japan (255%) or the USA (123%), China’s debt to GDP for 2023 was ~83% and climbing.

As Governments continue to devalue their currencies over the coming years and decades, Bitcoin will soak up that liquidity like a sponge. Absolute scarcity and immutable property rights are a clear, favorable alternative to the perpetual inflation and capital restrictiveness of fiat currencies.

5. Gold and S&P 500 make all-time highs

Gold and the S&P 500 have continued their 2024 trend of making all-time highs; with Gold currently at ~$2,667/oz and the S&P at 5,745. The position of capital tells us two important things:

Investors are worried about inflation and rising government debts (Gold bid)

Investors are in risk-on mode (Equity bid)

…the performance of both of these assets is a canary in the coal mine for Bitcoin. The narrative that has investors flocking to gold is even more applicable to BTC. Moreover, the increasing appetite for risk will lead to a BTC bid, especially as rates continue to decline.

While BTC is not (yet) at an all-time high, it has still outperformed gold and the S&P on a year-to-date basis:

BTC: +47%

Gold: +28%

$SPX: +21%

6. US Treasury Yields

The anticipation of continued rate cuts was present this week in the treasury market as investors scooped up short-duration treasuries such as the 3-month and 6-month (yields for both fell this week). However, demand was not so abundant for the longer-duration treasuries. In fact, since the Fed’s rate cut last Wednesday, yields on the 10-year, 20-year, and 30-year treasury bonds are all up! Alongside gold making new all-time highs this is further evidence that inflation is a concern for investors on a forward-looking basis.

This is a canary in the coal mine if I’ve ever seen one. Investors worried about inflation will ultimately find the solution: Bitcoin.

For secure and easy-to-use self-custody, we recommend Theya:

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

Bitcoin: News, ETFs, On-Chain, etc.

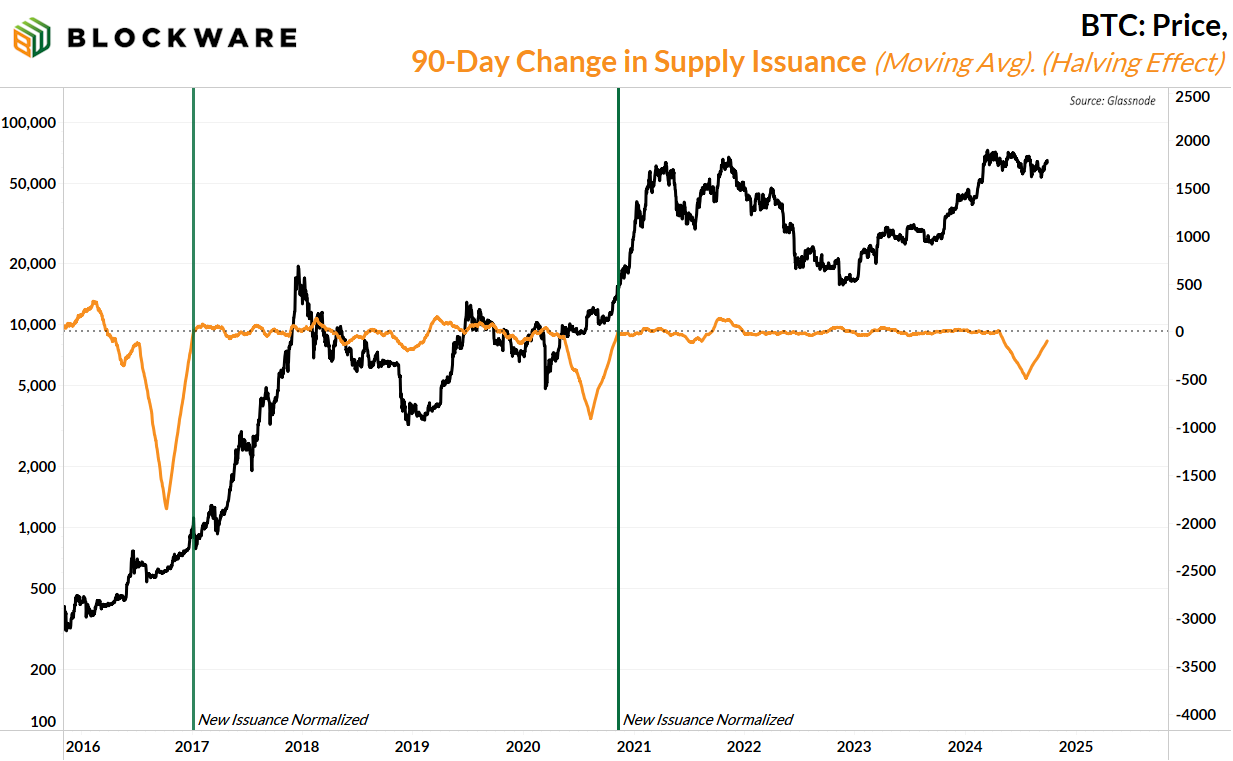

7. Bitcoin Halving Effect

The impact of the 2024 halving is close to being fully normalized by the market. Changes in monetary policy have a lagged impact

Just like Fed rate cuts don't immediately create a noticeable change in USD liquidity, changes in BTC supply issuance take ~6 months to create a real impact on supply dynamics. Soon the market will adjust to an inflation rate that is half of what it was for the past four years. The last two times this happened, the Bitcoin price moved up a few orders of magnitude very quickly

8. Total Short Liquidations

More evidence for the “this time is different” bucket is that the recent rally is not being accompanied by an excess of short liquidations in the futures market. BTC hitting $60,000 in early 2021 brought with it hundreds of millions in short liquidations every single day - very indicative of a “blow off top.” Until we see similar behavior it is unlikely that the bull market is anywhere near over.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

9. Swan Bitcoin Sues Former Employees & Mining Partners

Swan Bitcoin, which gained notoriety within the Bitcoin mining industry for stealthily deploying more than 10 EH/s worth of mining hardware in late 2023, continues to be shrouded in drama. After troubles with the mining side of the business resulted in mass layoffs back in July, Swan Bitcoin is now filing suit against former employees for alleged theft of important business intelligence related to Swan Mining. Furthermore, the suit alleges that a former Swan executive conspired with other ex-employees to quit Swan en masse and spin up a competitor known as “Proton Management”, and use the stolen intel as well as Tether, the financing partner of Swan Mining, to run a competing operation.

Check out the lawsuit here: https://pacermonitor.com/public/case/55223284/Electric_Solidus,_Inc_v_Proton_Management_Ltd_et_al

10. Energy Gravity

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$64,700 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.