Blockware Intelligence Newsletter: Week 60

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/15/22-10/21/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by producing blocks. Purchase new S19XPs today!

Have fun and learn more about our Bitcoin future at Pacific Bitcoin, the largest Bitcoin conference on the West Coast. Nov 10-11 in Los Angeles. Get 30% OFF tickets with code BLOCK.

Summary:

The US housing market index has hit its lowest value since 2012 (excluding 2020’s short dip), which is yet another signal of a deteriorating housing market.

Risk assets, such as junk bonds and equities, saw a slight bounce heading into this week but rising Treasury yields have worked to counteract this strength as of Thursday.

The 3-month/10-year Treasury yield spread flipped negative on Wednesday for the first time since 2020.

Bitcoin has seen a notable decline in volatility in recent weeks, price action points towards a large move coming.

Bitcoin below it’s 4-Year moving average as well as the Long Term Holder Realized price signals we are still in the depths of the bear market

S19XPs will likely perform as safe-haven assets if Bitcoin sees another leg down.

Bitcoin’s hash rate continues soaring even during difficult times for miners.

Bitcoin Energy Gravity, a metric used to estimate the breakeven electricity rate for a modern Bitcoin ASIC shows evidence of BTC price bottoming.

Overview of the October 2022 Macro Landscape

Economically, 2022 has been an extremely complex year, and it can be hard to keep up. I want to begin this week’s newsletter by zooming out to quickly outline some of the current macroeconomic factors that are driving the prices of securities and commodities in the US and for the world.

While these issues are intricate, I hope that by highlighting the basic forces in play, we can then look at how things are shaping up each week in order to understand if this environment is worsening in the direction explained, or if we’re seeing a move towards stability.

In my opinion, there are two main intertwined drivers in this environment, bond illiquidity and energy shortages.

Currently, the market for fixed-income securities is extremely thin, as US institutions are already full of Treasuries with little cash on the sideline to strengthen bids. Furthermore, foreign governments (mainly Japan and China) are selling their US sovereign debt reserves in order to stabilize their currencies, and quantitative tightening in the US is turning the Fed into a net seller of Treasuries.

These 3 factors are the major drivers of the current illiquidity of the US bond market.

When Treasuries are illiquid, yield tends to rise as bid-ask spreads expand. This makes the future cash flows from equities less attractive as discount rates rise, causing a sell-off in the stock market.

The current plan from central banks across the world has been to continuously raise interest rates in order to lower aggregate demand and thus, inflation. The issue lies in the fact that much of the developed world is extremely indebted, and the backbone of much of the financial system lies on the “risk-free” Treasury market.

Aggressively raising interest rates, quantitative tightening and balance sheet runoff can suck so much liquidity out of the bond market that one domino fall could break the market. This is what we’ve seen in the UK over the last couple of weeks, and the UK’s domino was their pension system.

As nominal asset prices have dropped, British pension plans, which have extreme exposure to derivatives, were unable to keep their allocation ratios intact.

As the Bank of England (BoE) warned pensions to get allocations in check, many became forced sellers of bonds in order to raise cash and post collateral on their derivatives. This is what led to the aggressive sell off in UK government bonds a couple of weeks ago.

As a result, the BoE was forced to flip back into quantitative easing (buying UK government bonds on the open market) in order to improve liquidity conditions. Yesterday, we got news of the Bank of Japan following in the BoE’s footsteps.

This could arguably be the direction the US is headed in, as QT, high rates, and foreign capital pools draw liquidity from our Treasury market. The difference with the US is much greater liquidity in the Treasury market, and less use of derivatives in the US pension system. That’s without mentioning the US’ significantly higher energy independence in comparison to the United Kingdom or Japan.

The main driver of all these issues has been high inflation, stemming from a combination of overly aggressive expansionary monetary policy in 2020/21 and large scale energy shortages.

The energy crisis has been the largest driver of inflation as of recent, and as rising energy costs create higher prices of goods, the reaction from central banks and market participants is to absorb more liquidity away from the Treasury market.

To summarize what’s occurring in the markets right now, the main question to ask is: How far can the Fed push interest rates to lower inflation without causing a severe liquidity crisis in the Treasury market?

General Market Update

This week has been interesting as more negative economic data has resulted in sideways price action for equities, and negative price action for fixed-income securities.

In the UK, headline CPI inflation came in at 10.1% YoY for the month of September. This puts UK CPI at July’s level, but before that, the highest since 1981.

Back in the US, we’re continuing to see a weakening housing market.

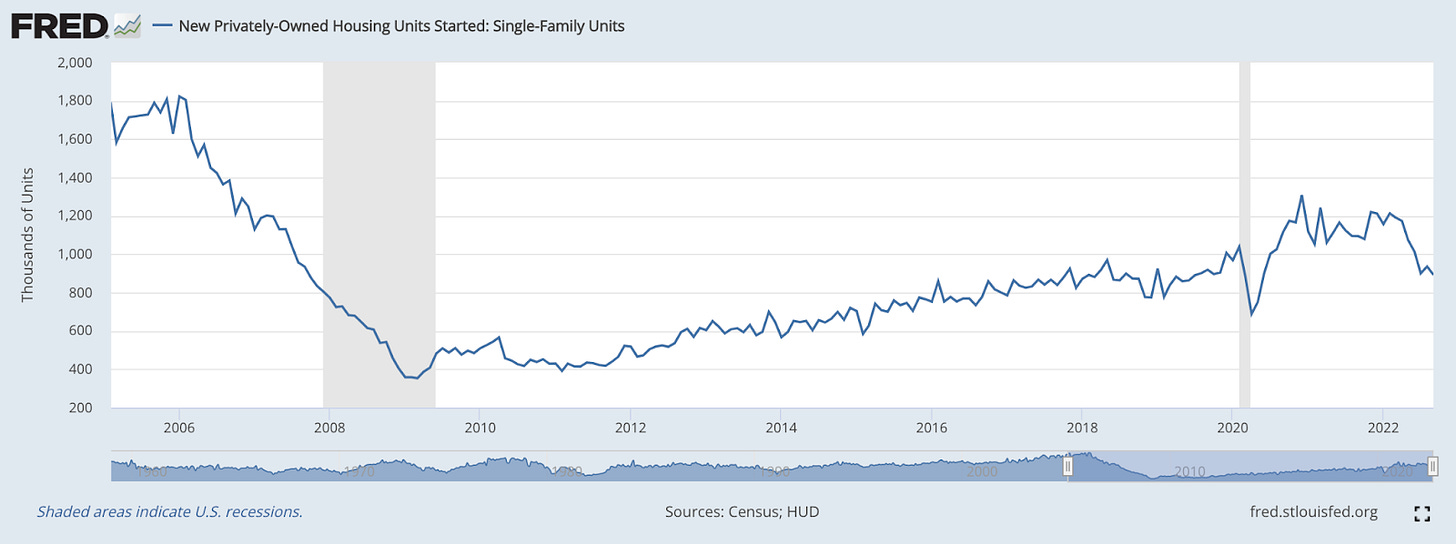

New data released this week from the US Department of Housing and Development indicates that in the month of September, US single-family housing starts hit its lowest level since May 2020.

New Privately-Owned Single-Family Housing Starts (FRED)

Housing starts refers to the number of new homes that began construction in a given month. For September 2022, that number was 892, that’s in comparison to 750 in May ‘20, and the peak of 1308 in December ‘20.

Unsurprisingly, this has resulted in steeply declining optimism from homebuilders.

NAHB/Wells Fargo Housing Market Index (TradingEconomics)

The chart above plots the housing market index (HMI) that is compiled by the National Association of Home Builders. This data indicates that, ignoring the very brief V-shaped recovery of 2020, sentiment among homebuilders is at its lowest level since 2012.

October marked the 10th straight month of decline for the HMI.

The two previously discussed data points come at the result of a swiftly rising cost of capital in the US. High interest rates and inflation dissuade individuals from making large, relatively discretionary expenditures, such as building a new home.

As of yesterday, the US average 30-year fixed mortgage rate sits at 6.94%, according to Freddie Mac.

In the energy market, it’s worth noting that the White House announced this week their plan to sell the remainder (14M) of the 180 million barrels of oil from the strategic reserve that were approved for release in May.

This is an attempt to flood the market with supply in order to bring down oil and gas prices in the short term. Once these barrels are sold, the US will begin to refill reserves beginning in 2023.

One potential issue lies in the fact that when commodity prices are declining, it becomes less attractive for producers to produce. In the US, we’re seeing oil production essentially flat since prices peaked in June, but OPEC has announced production cuts in recent weeks.

As Europe is still importing Russian oil, OPEC production cuts may work to raise European energy prices even higher heading into winter.

Speaking of production cuts, on Tuesday, Apple announced cutting production on iPhone 14. For those who actively watch the markets, this potentially recessionary signal had a large effect on the equity indexes on Tuesday.

Apple cited smaller than expected demand as the reason for the production cut.

As explained in our discussion of housing starts, in periods of rising food, energy and interest costs, people generally have less sidelined capital and are unwilling, or unable, to make unnecessary purchases, such as buying a new iPhone.

In the fixed-income market, it's been an interesting week of price (yield) action.

Alongside the equity indexes, we’ve seen a slight bounce in demand for high yield corporate debt, also known as junk bonds.

Rating agencies, such as Standard & Poors and Moody’s, rate the debt quality (safety) of bonds. Securities such as US Treasury’s are rated AAA, as their likelihood of default is near 0.

Bonds that are rated BB or lower are considered to be “speculative grade”, meaning that this debt has a high chance of default. For this reason, junk bond prices are much more volatile and they are considered risk assets.

Following junk bond price action can provide us with key insights into current institutional risk preferences. When their prices are rising, it tends to be a leading indicator of what’s to come for equities and crypto-assets.

HYG 1D (Tradingview)

As previously mentioned, junk bonds caught a fairly strong bounce last week heading into early this week. Thursday’s price action looks to be an apparent reversal in prices and could usher in a return to price declines for other risk assets.

Furthermore, we’ve seen weakness this week in the “risk-free” Treasury securities.

On Wednesday, the yield of the 3-month Treasury surpassed 4.0% intraday for the first time since October 2007. This week we also saw the 2-year cross above 4.6%, the 10-year above 4.2%, and the 30-year also above 4.2%.

This is a signal of extreme fear and lack of confidence from “smart money” investors.

US Yield Curve (Highcharts)

The blue line above is the plot of the US’ Treasury yield curve. The yield curve illustrates the relationship between bond maturity and yield to maturity.

In healthy economic periods, longer maturity bonds have higher yields, as investors expect to be paid more for having their money tied up longer,

As you can see from the dotted lines in the chart above, the US yield curve is being pulled up and to the left, as lower maturity bonds are selling off more aggressively than longer maturity ones.

In other words, investors are pulling money out of short-term bonds in exchange for longer dated bonds, or cash. This is a signal of doubt in the near term economic health of the US.

We’ve discussed yield spreads in this newsletter many times. Yield spreads show us the relationship between 2 specific points on the yield curve to check for inversion.

The 2-10Y spread is perhaps the most widely discussed, but the 3-month/10-year spread is also significant.

3M-10Y Spread (FRED)

This week, the 3M-10Y spread flipped negative for the first time since 2020. In other words, demand for the 10-year is now higher than demand for the 3-month.

The 3M-10Y spread doesn’t flip negative AS often as the 2-10Y, making it an even more accurate indication of an incoming recession.

But as explained in our previous yield spread discussions, a negative spread DOES NOT indicate that we are currently in a recession and it could take up to 2 years for recession to follow inversion.

These yield dynamics are resulting in an influx of sellers working to stuff the rally we’re seeing in the stock market.

Nasdaq Composite 1D (Tradingview)

Following last Thursday’s upside reversal on CPI numbers, we saw an overall continued bounce earlier this week.

On Tuesday, we saw the Nasdaq gap up nearly 2.7% but ultimately, prices reversed lower in the session and put in a bearish candle despite the index being up 0.90% at the close. Tuesday’s open appears to be a local top for the time being, as prices headed lower on Wednesday/Thursday.

The selling on Tuesday came after the index opened above its 21-day EMA, the same moving average that became resistance to the short bounce in the first week of October.

While the indexes are seeing a bit of weakness, we are seeing select industry groups flashing relative strength. Specifically, oil/gas, energy, iron/steel, and select medical companies have seen strong price action, in comparison to the general market.

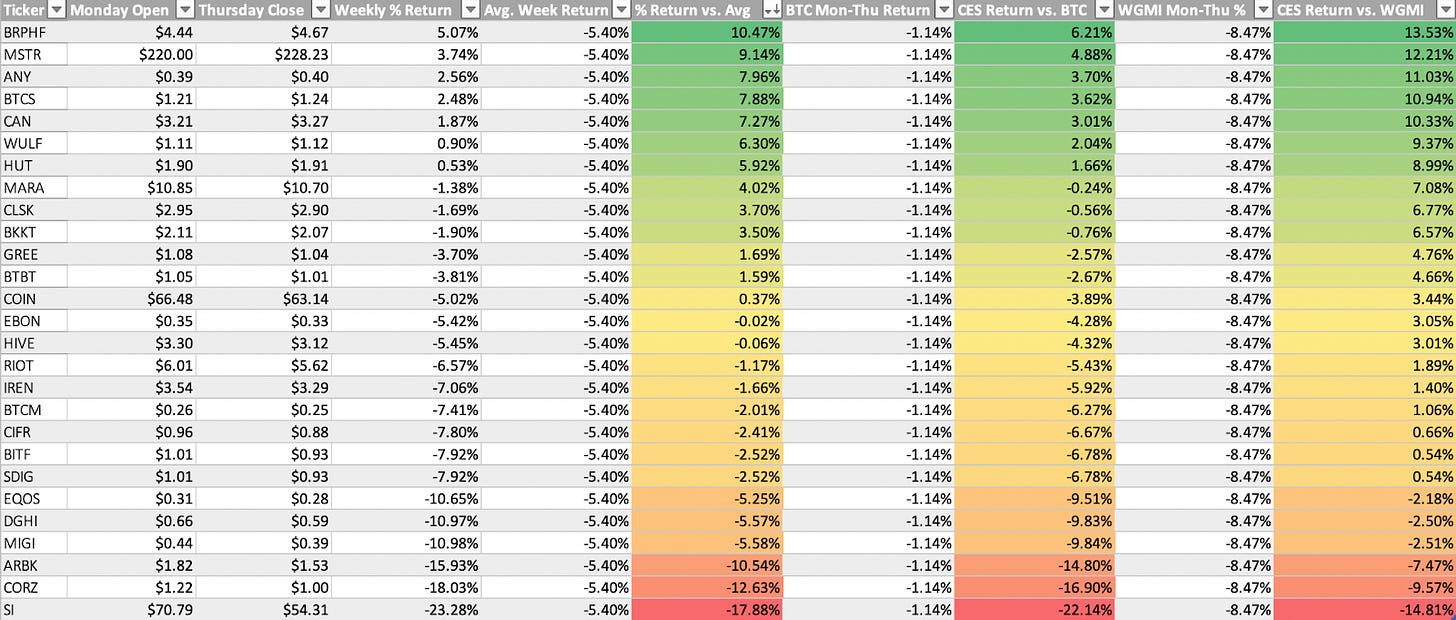

Crypto-Exposed Equities

From the crypto-exposed industry group, we’ve seen a mixed bag of price action this week.

The strongest names have been those who tracked the Nasdaq closest this week, meaning that they had a small bounce reverse towards lower prices. The weaker names never even caught a bounce.

As we roll into earnings season, we’ll tend to see reactions to one company’s number have a ripple effect on the rest of the group. This week it was Silvergate Capital (SI) reporting.

SI reported earnings after the close on Monday and clearly the market wasn’t impressed, as shares of SI traded nearly 23% lower by Tuesday’s close.

This may come as a surprise at first glance because:

EPS was up 13% from last quarter, and 45% from last year

Revenue was up 12% from last quarter, and 73% from last year

Net income was up 13% from last quarter, and 73% from last year.

But EPS came in at $1.28, below analyst estimates of $1.45. Furthermore, SI saw a notable decline in digital asset deposits and transactions on the Silvergate Exchange Network (SEN).

Most likely is that the extent of SI’s price decline was the result of the current market environment. Furthermore, SI earnings miss could be illustrative of what’s to come from the rest of the group.

A few names that have held up relatively well this week are: SOS, COIN, MARA, MSTR, and HUT, in my opinion.

Above, as always, is the excel sheet comparing the Monday-Thursday price action of several crypto-exposed equities.

Bitcoin Technical Analysis

Unlike the equity indexes, Bitcoin has seen a notable contraction in volatility as of recent.

BTCUSD 1D (Tradingview)

Declines in volatility come before large price moves, to the upside or down, as the battle between buyers and sellers intensifies into a near stalemate. Then, as one side manages to gain a strength advantage, we tend to see cascading moves in a particular direction.

In my personal opinion, Bitcoin is likely nearing an inflection point that will result in a large move. The direction of that move is truly anybody’s guess, but there are a couple reasons why it’s more likely down than up.

We’re already beginning to see crypto-equities break down, throughout 2022 we’ve seen numerous instances of Bitcoin-equity price action leading that of spot BTC.

Furthermore, the primary price trend has been downwards throughout the last few quarters. When we zoom out, the current price structure looks more like a bear flag than it does a bottoming pattern, but of course anything is possible.

BTCUSD 2018 vs. 2022 1W (Tradingview)

What we’ve seen since June has created a very similar pattern to what we saw in June-November of 2018.

This DOESN’T mean that we’re absolutely going lower, and it’s possible that this is too obvious of a conclusion. People seem to be extremely bearish, and after all, the market almost never does what the masses are expecting.

Furthermore, this is also a similar pattern to what we saw at the bottom of the 2018 bear. Obviously the economic environment of 2022 and 2018/19 are very different, but the price action similarities are worth noting.

Bitcoin On-chain and Derivatives

BTC has spent another week hanging around $19k.

BTC has now spent an unprecedented amount of time below its 4-year moving average; which in previous bear markets served as support. We’ll be looking to see if this crosses the 200-day moving average which has been making a beeline down. The 200 DMA being less than the 4 YMA would also be unprecedented. Unprecedented negative price action in the bear market makes me optimistic that the next bull market will be equally unordinary.

We are likely a couple months off from price flipping the 200-day moving average, but when that happens it will be a good sign that the worst of the bear market is in the past.

BTC is still below both the Short Term Holder and Long Term Holder Realized Prices. As we have discussed, this situation has historically been an incredible opportunity to enter the Bitcoin market.

The gap between price and STH RP is getting smaller and if the former can flip the ladder and turn it into support that will be a good sign that the bear market bottom has occurred. After that happens, if price can then flip LTH RP, that will essentially confirm the end of the bear market.

The 30D moving average and 4Y moving average of active addresses are close to an intersection. Bear markets weed out Bitcoin tourists and there are fewer active addresses as a result. These metrics touched briefly just after the 2018 bottom and that was followed by a sharp and somewhat sustained increase in the 14D. We will keep an eye out for similar behavior to possible signal that the bear market is ending.

The ceaseless increase in the 4Y moving average of active addresses shows the underlying adoption of the Bitcoin network that will be a driving factor behind future bullish price action.

Let’s discuss a recently added metric on glassnode: realized volatility. Unlike the Bitcoin Volatility Index, which is a measure of implied volatility, Realized Volatility is a measure of actual volatility based on the mean and standard deviation of returns. Here we are looking at the annualized daily realized volatility over a 1 month rolling window.

As discussed in the past two newsletters, low volatility tends to precede a large price movement. Previous times in which Realized Volatility was at the current level or lower include: prior to the 2013 bull run, and prior to the beginning of the 2015 bear market, prior to big moves up multiple times throughout the 2016/7 bull run, prior to the 50% drop in the 2018 bear market, and prior to the start of the 2020 bull run.

If realized volatility is anything to go off then we should expect one final, bloody capitulation. Or the beginning of the end for this bear market.

The purpose of on-chain analysis is not to predict which direction the price heads in the short term. The purpose of on-chain analysis is to observe where we are in the broader Bitcoin cycle as well as to observe various trends and behavior patterns. Currently, our interpretation of the on-chain metrics is that we are likely very near to the bottom of the bear market; or the bottom has already occurred and we are to begin climbing back up very soon.

Non-expiring futures contracts relative to market cap continues to be up and to the right. This shows the market is still extremely leveraged in preparation for the upcoming rip or dip.

Open interest no doubt experience a sharp drop off once the volatility ramps back up. I am curious to see how it behaves after that. Will this relatively high level of leverage continue? Will it go even higher during the bull run? Only time will tell. If relatively high leverage becomes the new status-quo then it's likely that the next bull run could be even more volatile than the last.

Considering the increasing adoption in both retail and institutional investors, as well as a more mature market with many different platforms offering Bitcoin derivatives, it is not unreasonable to assume that high relative leverage will persist.

HODL waves are showing that the supply of Bitcoin that has not moved in 1+ year(s) is continuing to ascend to all-time highs.

This supports the short-term thesis that the bear market is near completion. These coins have been held all the way down from the $69k top last November and are effectively non-existent from a supply side at this point. If they haven’t been sold yet they definitely won’t be sold at $19k unless it’s absolutely necessary for these holders to do so in order to survive. However, that concept really only applies to entities in the 1-2, and 2-3 year holding cohorts as the holders of the coins in the older cohorts are likely extremely well off financially considering, at a minimum, they have been in Bitcoin since 2019. The dip in HODL waves during the bull markets shows that these entities took chips off the table at higher prices. Considering those entities were wise enough to get into Bitcoin years ago, it’s safe to assume that they are wise enough to not sell during the bottom of a bear market.

Lastly, I wanted to point out something that is not very important but rather a funny coincidence.

Since early September, Bitcoin has been trading at a discount during European trading hours; in other words, there is marginally more sell pressure coming from Europe. However, we saw the EU trading discount top out, and almost reach a premium, during the week of the Bitcoin Amsterdam conference. Since then it has begun descending again.

Do you think the Amsterdam conference actually had an impact on the EU premium or do you think this is a nothing-burger?

Bitcoin Mining

S19XPs as Bitcoin Safe Havens

Ethan Vera from Luxor posted an insightful tweet that the Blockware Intelligence team has broadly discussed many times before. He noted that if hashprice, a metric used to determine the USD revenue a miner earns per unit of hash rate, drops below many miners' profitability levels then the most efficient mining rigs will ironically find an underlying bid. This means that even if Bitcoin falls further, it is possible that the market price of an S19XP won’t drop significantly. The rig may even increase in BTC terms.

How is this the case?

If the price of Bitcoin drops significantly lower, machines less efficient than the S19XP (every other model) may become unprofitable or have seriously tight margins. At that point, it would be logical for these machines to be replaced by the most efficient machines on the market, S19XPs. This effectively creates a market-based bid for a relatively small amount of rigs, insulating the short-term market value of an S19XP.

If you don’t own any S19XPs, consider purchasing a batch from Blockware Solutions.

Rig Model Bitcoin Breakeven Price

Using the table above, you can see how many rigs will turn off before S19XPs start turning off, even if the S19XPs are operating at some of the highest electricity rates. It is important to note that if the price of Bitcoin does drift down toward $13k, mining difficulty will likely drop and Bitcoin will experience another miner capitulation. This however would consequently lower the breakeven BTC price of S19XPs, revealing the “safe haven” potential of S19XPs.

With that said, it is unlikely that Bitcoin makes new lows without a major macro selloff, but S19XPs are good assets to protect against downside pressure and still capture the upside of the next parabolic bull run.

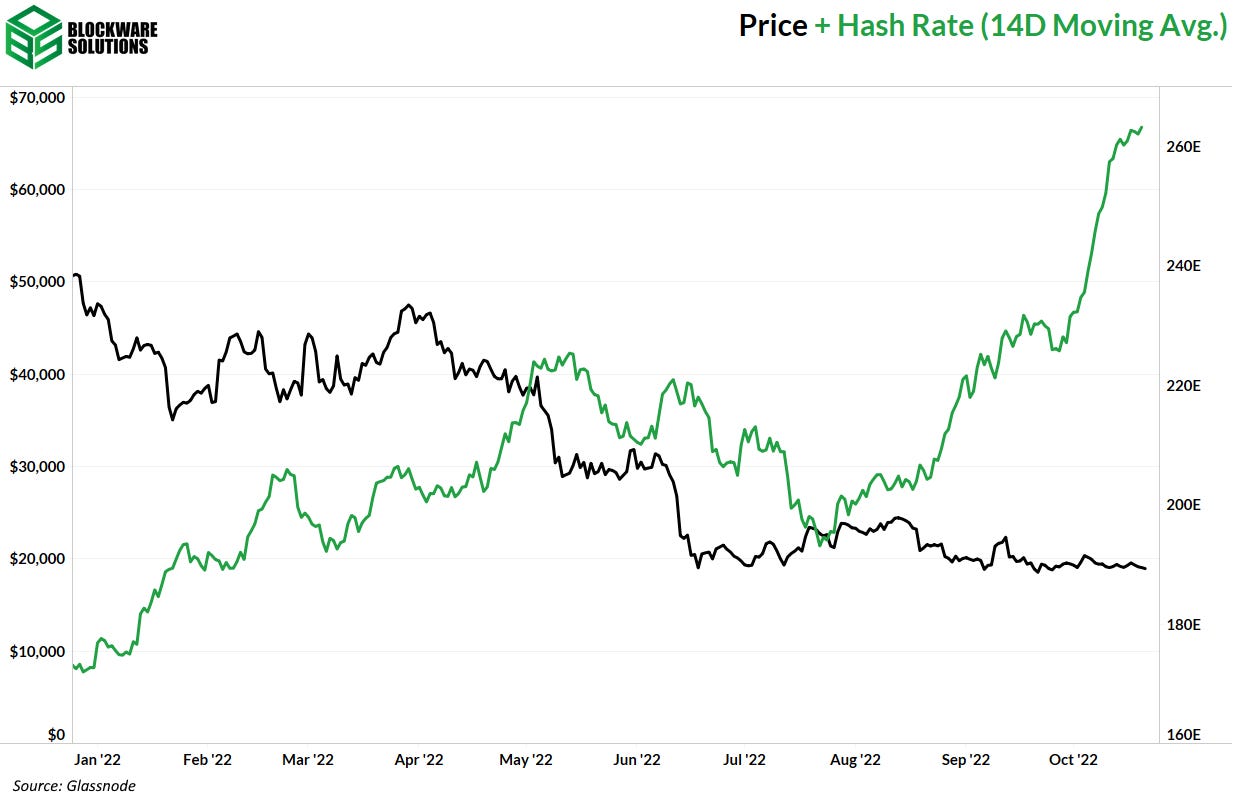

Why is Hash Rate Soaring?

There was a discussion on Twitter about how Bitcoin’s extreme hash rate growth was potentially due to a nation-state deploying rigs to attack the network. This is a very low probability of this, but many market participants are shocked by how the total hash rate can grow so rapidly while the price of Bitcoin is significantly off all-time highs, mining difficulty is at a record high, and energy prices are soaring. Miners around the world are getting hammered by all three of these market forces, but hash rate is still relentlessly growing. There are four key reasons why.

Large S19XP orders that were previously placed during higher BTC prices are actively being shipped and plugged in.

Extra rack space from the ETH merge is being filled with BTC ASICs.

It is still profitable to mine BTC with new-gen rigs (capital allocators are buying cheaper rigs).

As old rigs become unprofitable, their rack space gets replaced by XPs and M50s. Replacing an S17 with an S19XP is still a net growth in hash rate.

This explains how hash rate is still growing rapidly, but it doesn’t say much about the future growth of hash rate. Many of these key reasons will likely play out by the end of Q4 2022, and bearing no massive surge in the price of BTC, it is reasonable to expect much slower hash rate growth throughout 2023.

Bitcoin Energy Gravity

Bitcoin Energy Gravity, a metric used to estimate the breakeven electricity rate for a modern Bitcoin ASIC now sits at $0.07 / kWh. This indicates that miner margins are low.

This results in new capital flowing to spot BTC pushing the price up 📈 (instead of buying ASICs, infrastructure, and energy).

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.