Blockware Intelligence Newsletter: Week 79

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 3/11/23-3/17/23

Blockware Intelligence Sponsors

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin.

No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

Get yours today at:

https://foundationdevices.com/?mtm_campaign=Blockware

Use code: BLOCKWARE for $10 off!

Blockware Solutions - Buy and host Bitcoin mining rigs.

If you are interested in purchasing 300+ machines, there’s a last-chance bear market special before prices increase. First come first served.

Summary:

Following the collapse of Silicon Valley Bank, Silvergate and Signature, we’ve seen liquidity contagion affecting a couple of other lenders this week.

As a result of bank liquidity concerns, the market is now pricing in a 25bps hike from the FOMC next week.

With heightened systematic risk and an increased likelihood of a Fed pause, Treasuries have had their strongest week since 2021.

BTC bounces off support levels (RP, STH RP, 200DMA) and rips through resistance at 200-week moving average.

On-chain data shows investors are fleeing to Bitcoin during times of uncertainty.

BTC’s year-to-date correlation coefficient with risk assets approaches zero.

92% of all 21,000,000 BTC already exists yet, ~ $45B worth of BTC is still to be mined.

The breakeven electricity rate for a modern Bitcoin ASIC is $0.12/kWh.

At an average hosting rate today, new-gen Bitcoin ASICs require ~$14,600 worth of energy to produce 1 BTC.

General Market Update

It’s been a very quiet week in the markets, so not much to catch you up on… Just kidding.

Clearly, the biggest news this week surrounds the banking sector as a whole. With Silvergate, and Signature closing down operations, and Silicon Valley taken over by the FDIC, it highlights that despite markets appearing to have bottomed (for the time being), systemic macro risk is extremely prevalent.

It wasn’t just SVB, SI and SBNY, later in the week we saw illiquidity concerns bleeding into European lenders such as Credit Suisse and other smaller American banks like First Republic.

Fortunately, First Republic was saved by other banks providing deposits, and Credit Suisse received liquidity from the Swiss National Bank, but these almost certainly won’t be the last lenders we’ll see run into trouble.

As we mentioned last week, bank failures can have a domino effect that can change the market environment extremely quickly. At the moment, the markets appear confident in the ability of the Fed, FDIC, and larger banks to handle any liquidity issues that may arise.

Nasdaq Composite Index, 1D (Tradingview)

The Nasdaq has staged quite the reversal this week, after looking quite bearish at the end of last week. On Thursday, the index was able to close above the upper trendline shown above.

As mentioned, the market appears fairly confident in the banking industry, but more pressing on the markets is the idea that Fed will likely be more dovish next week, as a result of the banking troubles.

FedWatch Tool (CME Group)

As you can see above, the market is now pricing in a roughly 80% probability of FOMC hiking rates by 25bps on Wednesday (March 22nd). On Thursday, that likelihood jumped by about 25% as the Credit Suisse and First Republic news hit the markets.

The table at the bottom of the chart above shows you how these probabilities have shifted in the last day, week and month.

Heading into FOMC next week, it’s important to keep in mind the dichotomy the Fed faces between inflation and bank liquidity. They now have to weigh even more factors:

Raise interest rates to a large degree (50bps) in order to help lower inflation, which has remained stubbornly high in 2023

Leave interest rates at 4.75% in order to not place more stress on a clearly troubled banking industry

Or meet in the middle and hike 25bps

The European Central Bank elected to raise their market interest rate by 50bps this week.

Speaking of inflation, we also received February’s CPI numbers on Tuesday, which were largely in-line with the consensus estimates.

Headline CPI grew by 6.0% YoY and 0.4% MoM in February, as the market had predicted. Core CPI grew by 5.5% from last year, which was the expectation, however MoM Core CPI was 0.5%, slightly higher than estimates of 0.4%.

The 6.0% headline number was down from January’s 6.4%, and was the 8th straight month of a declining YoY value. Keep in mind that declining YoY CPI doesn’t mean that prices are falling, but instead shows us that the rate of price growth is slowing.

Producer Price Index (PPI) numbers were also released this week, which unexpectedly fell in the month of February. YoY headline PPI came in at 4.6%, and -0.1% MoM.

Clearly, we’re seeing disinflation underway in the US. The question will be if it will go far enough to be considered deflation, which is generally a textbook recessionary indicator.

US YoY M2 Growth Rate (YCharts)

Prices are a function of liquidity, and with monetary liquidity declining at a nearly unprecedented rate, there’s potential for a true collapse in asset prices. But time will tell.

Interestingly, as a result of the Fed and FDIC working together to “bail out” depositors, we’ve seen an uptick in the Fed’s balance sheet size. While this is not exactly the same as quantitative easing, it could have a similar effect on the markets.

If this trend is to continue, we could see a strong period for the markets followed by another spike in inflation.

In the bond market, Treasuries have seen a crazy week of price action as investors flock to safety.

2-Year Treasury Yield, 1D (Tradingview)

This chart, when put into context with the banking news, a spike in gold prices, and the likely shift in Fed posturing to occur next week, is in-line with typical recessionary price action.

It’s likely that Q1 GDP will have grown enough to avoid a true contraction in economic activity, but the amount of Treasury demand this week shows us that investors clearly want the safety of holding government bonds.

This also can create tailwinds for higher risk asset prices, as we’ve seen this week.

Crypto-Exposed Equities

With the closing of 2 major crypto-friendly banks, it creates a bit of added pressure in the market for crypto-equities. That being said, many of these stocks have held up surprisingly well.

From a technical perspective, MARA, DGHI, RIOT, COIN and CIFR look strongest in comparison to the rest of the group, in our opinion. These are names that are near their YTD highs, and/or have had relatively tighter price action.

While there’s no guarantee that any particular name will continue to outperform, looking for relative strength can point us in the direction of institutional favorites.

Above, as always, is the table comparing the Monday-Thursday price performance of several crypto-equities.

Bitcoin Technical Analysis

It’s been quite the week for Bitcoin price action as we cracked above $27,000 for the first time since June 2022.

Bitcoin / US Dollar, 1D (Tradingview)

At the moment, we’re seeing a major AVWAP pinch underway for BTC. As you can see above, price is bound between its 2022 low AVWAP (from Nov. 21st) and its cycle high AVWAP (Nov. 10th 2021).

Our base case for price action in the near term is that we’ll likely remain between these two AVWAP’s, traveling sideways for the time being. While anything is possible, it would be very healthy to see BTC consolidate its recent gains.

In the very short-term, we’d like to see BTC hold its recent breakout above ~$25,200.

Bitcoin On-chain and Derivatives

It has been a wild seven days since last week’s newsletter.

If you recall we were eager to see if Bitcoin would close above the support of realized price, short-term holder realized price, & the 200-day moving average. It did just that and has ripped upwards in the face of a global banking crisis; blowing past the 200-week moving average in the process.

As it becomes increasingly clear that QE infinity is the reality for the dollar and other fiat currencies, investors are fleeing into the only decentralized, digital asset with an immutable supply limit.

The primary theme we will be examining in this section of the newsletter is that Bitcoin is not A risk-off asset, it is THE risk-off asset. While this is clear to those that have spent many hours learning about Bitcoin, the market as a whole has not yet put those pieces together. However, that is changing and we will look at various metrics to prove it.

In the past seven days we have seen the largest decrease in the supply of stablecoins since the collapse of the UST (terra/luna) stablecoin.

USDC was the biggest mover here as its issuer, Circle, held a portion of its reserves in Silicon Valley Bank.

Contrary to their name, “stablecoins” are far from stable as they contain multiple layers of counterparty risk and are interwoven with the exceedingly unstable traditional financial system. Seeing investors flee out of stablecoins and into Bitcoin during a period of uncertainty is a bullish indicator and has definitely played a role in the recent price pump.

Bitcoin’s year-to-date correlation with the S&P 500 (used as a proxy for risk assets as a whole) is near zero.

In current market conditions, with contagion spreading, equities have an uncertainty about them as you cannot be sure if a company is exposed to failing entities or not. This uncertainty does not exist when holding Bitcoin in self-custody. The decreasing correlation between Bitcoin and risk assets can in-part be attributed to a growing understanding of this reality. However, the primary reason for the decreasing correlation is due to the fact that, in the words of our friends at the Bitcoin Layer, “Bitcoin is the most porous sponge for global liquidity.” As the market is front-running a potential pause in rate hikes from the Fed, Bitcoin’s USD price pumps more than other assets as it is the most sensitive to changes in monetary policy.

With the latter fact in mind, if you believe that monetary expansion is an inevitable outcome, which, by the way, the probability of this being the case increased greatly this past week as the Fed wasted zero time ensuring a backstop in liquidity, then it’s probably a good idea to hold the asset which will appreciate the most when liquidity expands.

Another on-chain chart that highlights Bitcoin as a safe-haven during times of uncertainty is the supply last active 1+ year ago.

Typically the signal we derive from this is the unrelenting conviction of HODLer’s to HODL through turbulent times and the supply shocks that ensue accordingly. However, that’s not what I want to highlight today.

Notice this large spike from February 28th, 2023. Considering this is a measure of the supply held for 1+ year(s), we should look back exactly 1 year to see what event may have triggered this flight to Bitcoin. As it happens February 28th, 2022 was when tensions escalated significantly in the Russian/Ukraine war. ~142,800 BTC were accumulated that day and have been HODLed since.

In a world of uncertainties, the world wants to store wealth in the least uncertain asset: Bitcoin.

On the derivatives side of things, we saw the lowest regime of negative funding since the FTX implosion. This massive desire for shorts quickly subsided as the price ripped up over the weekend. The trend we have seen thus far in 2023 held up once again: negative funding = local bottom.

Perpetual futures open interest relative to market cap continues declining. Further highlighting the flight from uncertainty (derivatives) to certainty (cold storage, spot BTC).

Bitcoin Mining

Hashrate

Total network hashrate continues soaring.

Despite a tough 2022 for miners, more and more ASICs continue getting plugged in as it’s still profitable to convert energy into BTC. Blockware Intelligence expects hashrate to continue steadily increasing, especially if the price of BTC is beginning another bull run.

Value of Future BTC Supply

Roughly 92% of all 21,000,000 BTC already exists yet, ~$45B worth of BTC is yet to be mined. An interesting trend is despite the remaining amount of BTC approaching zero, the total USD value of the remaining supply continues soaring like the price of BTC.

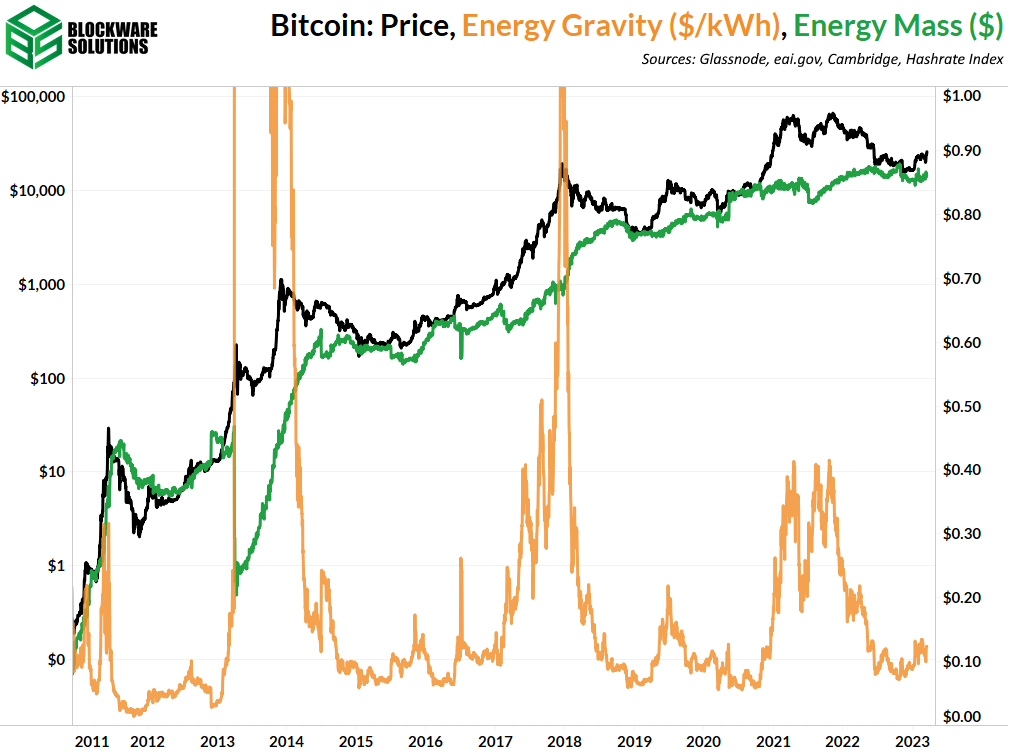

Energy Gravity

The following chart is based on a previous Blockware Intelligence Report that models the relationship between Bitcoin's price and its production cost. The model makes it easy to visualize when the price of Bitcoin is overheated or bottoming.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Love bitcoin, got my own keys, learned how to program it, and see the usefulness for humanity.

But I have a problem with the apparent lack of intrinsic value of bitcoin. This is the only advantage gold seems to have over bitcoin.I heard some people saying that the network has a value by the service it provides, so that it somehow gives a value to bitcoin.The service provided by the network is the transfer and conservation of a store of value, but for the network to have a value, bitcoin needs to have a value.Otherwise the network value would be a collective illusion.

Michael Saylor is speaking about the big bang of digital energy. But what can you build with that energy?With steel, you can build skyscrapers, but what can you build with bitcoin?

Hopefully someone has already answered those questions and you would be able to point me in the right direction.