Blockware Intelligence Newsletter: Week 3

The market digests some profit-taking from older coins, Hash rate starting to recover, and more

Dear readers,

Hope all is well. In last Friday’s newsletter we touched on a few things to keep an eye on throughout the week. The update sent out Tuesday was a follow up on some of those things that did occur. As the subtitle suggested, after a failed break above $50K on-chain suggested caution in the short term and following that we got a pullback to $46,315. What are these trends looking like now? And what else should we watch now to provide some context as to current market structure? Let’s dive in.

In addition to on-chain, this week’s letter will include some analysis on Bitcoin related equities, written by Blake Davis. This is in effort to provide you with more breadth of insights into the market.

Key takeaways from this week:

- New all-time highs in supply held by Long Term Investors

- Transaction activity and demand for blockspace both still a ghost town

- After Tuesday, exchange flows have neutralized (no longer bearish)

- Stablecoin margined futures continue to grow in popularity, funding slightly positive, OI/Mkt Cap still low

- Hash continues to come back online, difficulty adjusts, BTC revenue per hash declines as result

- 86% of addresses are now in profit, market bounced off a state of profit, profits taken by 3-5 year holders seems to have been a one off thing so far

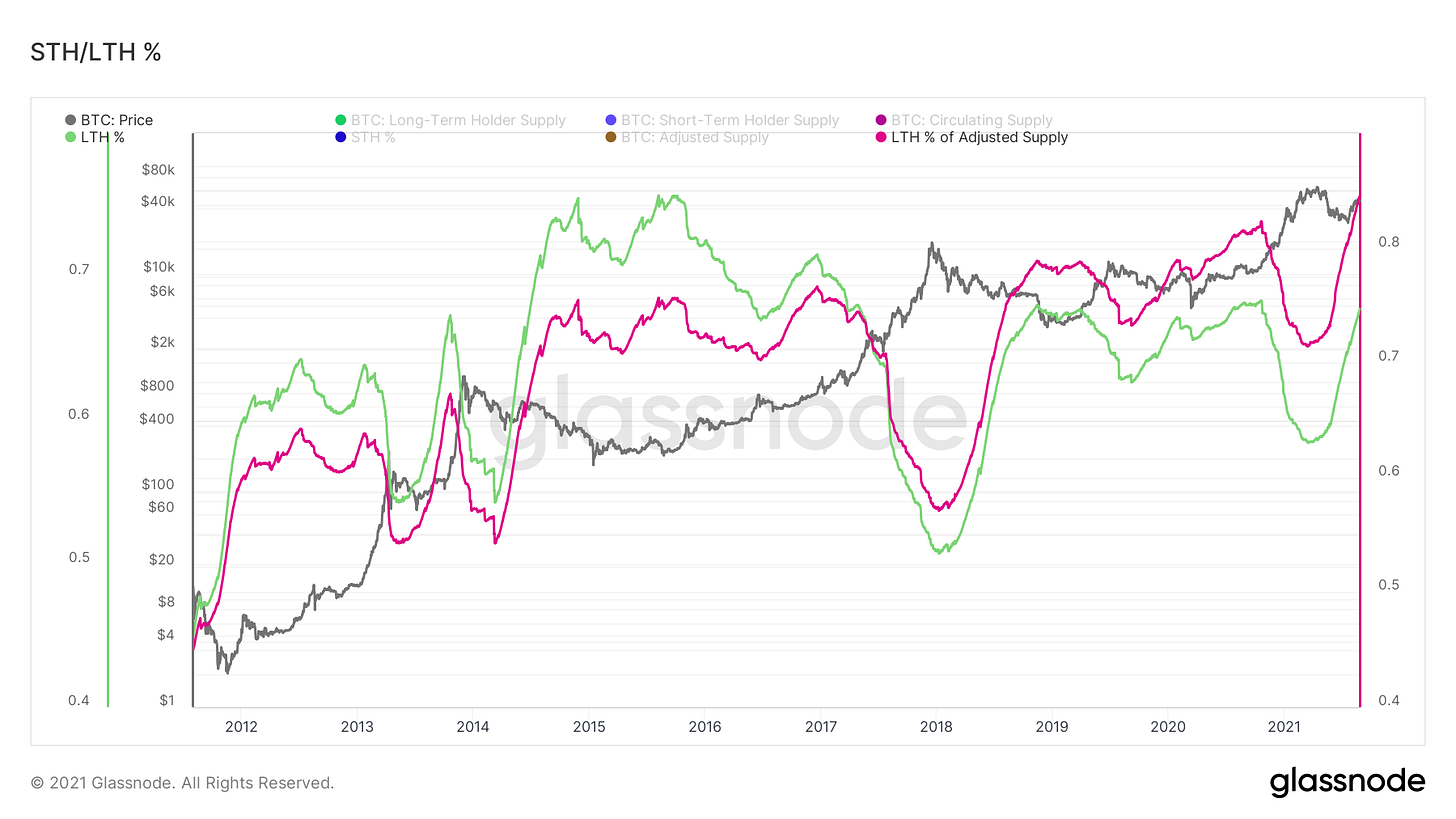

Firstly, we’ve got a new all-time high in Bitcoin supply held by long term investors. These entities now hold 12,731,020 Bitcoins.

As a percentage of circulating supply, these long term investors now possess 67.7% of supply. When factoring out lost coins (using adjusted supply instead of circulating) this number is as high as 84.5% of supply.

Part of this is convicted long term investors that have been buying relentlessly, but also maturation of UTXOs past the 155-day threshold that is used as a cut off to determine short/long term. Shown by realized cap HODL waves, we’re seeing really strong maturation of coins bought within the last few months.

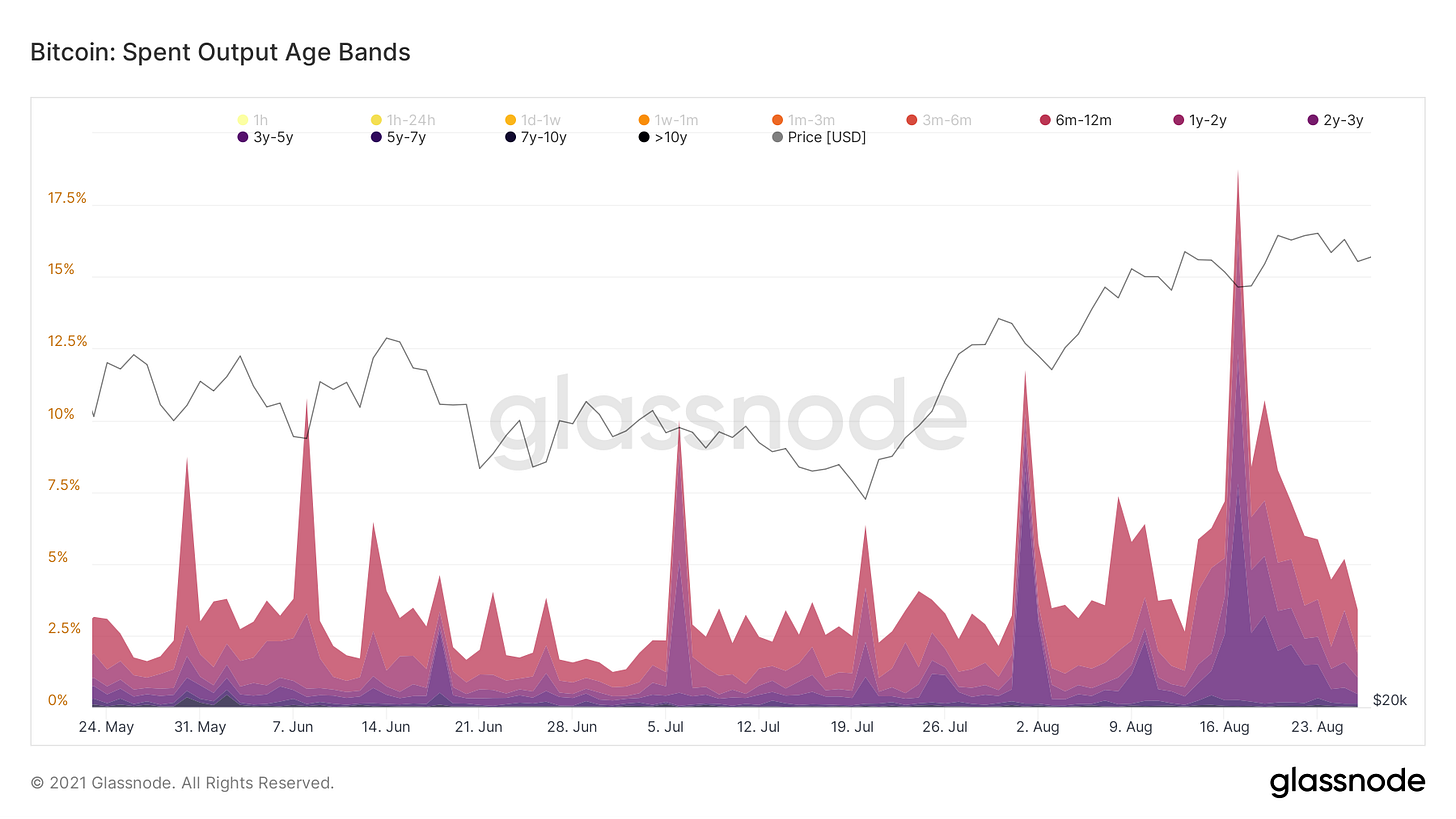

However, we have started to see a bit of spending coming from older coins, although nothing too alarming. We can look at this a few ways: Spent Output Age Bands, Average Spent Output Lifespan (preferably entity adjusted version), CDD, and Dormancy. The recent spike to 18.74% seems to have been a one-off thing, with spent outputs over 6 months having cooled off to just 3.4% since.

By looking at different age groups here, we can see that aside from the 2-5 year cohorts that were responsible for the recent spike, there hasn’t been anything abnormal in terms of specific age groups.

As mentioned, another way to look at this is with Average Spent Output Lifespan, this is the entity adjusted version. We can see the general uptrend over the last few weeks which is to be expected. As we’ve looked at in prior newsletters, long term holders naturally distribute into strength throughout Bitcoin history. So, in that sense seeing an uptrend isn’t fully concerning, but just don’t want to see everyone abandon ship like the 2017 dead cat.

One of the more useful terms to look at perpetual futures is funding rates. These funding rates are the mechanism that pegs the perp contract to the index price by incentivizing traders to take the other side of the trade. As a general premise prolonged negative funding is bullish while prolonged positive funding is bearish. Funding is also very useful in the short term when price goes one way, but funding goes the opposite. Right now, we have had a series of positive days, but I am not entirely concerned for a few reasons.

Have seen several folks expecting a large cascade of long liquidations because of this positive funding paired with the fact that long liqs have been relatively muted lately. This is a logical thought process, but is not taking into account the fact that futures open interest in comparison to Bitcoin’s market cap is small right now, shown by the OI Dominance Ratio. Also leverage is muted, shown by the Futures Estimated Leverage Ratio. Lastly, when comparing funding to where it was at these same prices back at the beginning of the year it’s very mild as well. Not saying it’s impossible to get a long squeeze here, but I think the chances are lower than many are saying.

On a similar note regarding futures, the percentage of open interest that is margined by crypto (coin) continues to decline. The market has been favoring stablecoin margined futures, but why? Bitcoin as collateral is great for traders that are long when Bitcoin is in a raging bull market because their collateral rises with the price of the asset they’re betting on. This adds to the massive reflexivity to the upside in the market. However, on the downside having majority of traders margined with coin collateral can create convexity, accelerating moves down as the collateral in traders account’s is decreasing alongside their position. After traders got wiped out on May 19th, it seems that they are being more cautious in their positioning. In theory this also means that on a move up shorts can get squeezed more easily as now their collateral isn’t rising in value along with the price that is going against them.

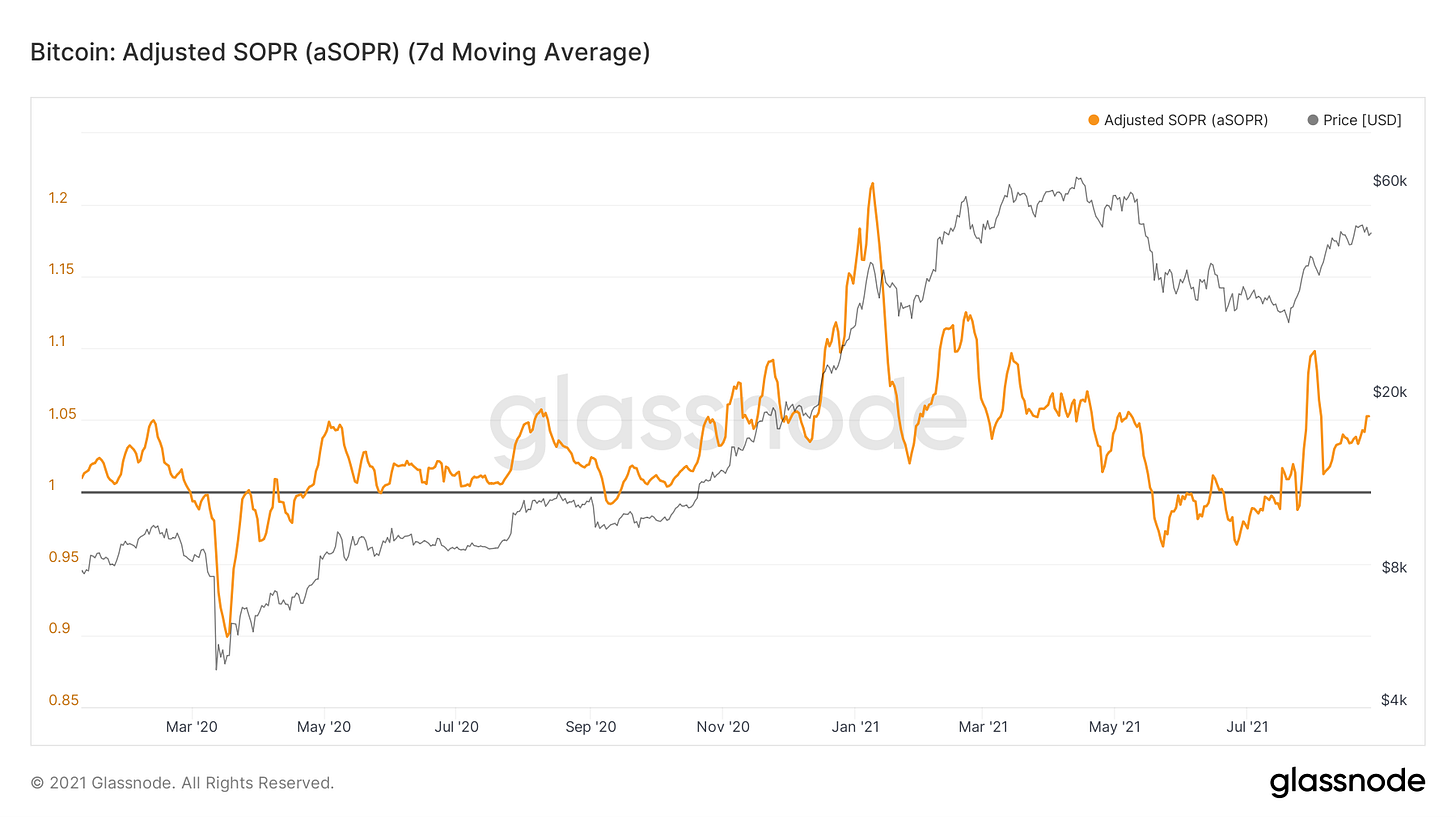

We’ve talked about older coins being spent, but on a similar note let’s look at the profitability of market participants which can have affect on market dynamics. After the recent rally, 86% of addresses are now in profit, up 17% from the lows of 69%. Comparing realized loss to realized profit, it looks like most of the selling is coming from below, not overhead. This is also evident by looking at spent outputs earlier in the letter.

A positive sign has been the behavior of aSOPR, which measures the profit that coins carry traded on each given day. We are back above the 1 threshold in “bull” territory on the weekly version. On the daily version we bounced off 1 during this recent price drawdown which is a good sign. This indicates that market participants aren’t currently willing to sell at a loss and in theory are respecting the current uptrend.

The strongest bear case continues to be the lack of both transactional activity and demand for blockspace. The number of transactions and active addresses remain muted, although they’ve slightly increased over the last few weeks. As a proxy for blockspace demand, transaction fees continue to decline. This can also be seen by looking at how empty the mempool has been, which is essentially a ghost-town. Big swing, no “ding” in on-chain activity yet. Some have explained this by saying small transactions are just migrating to the lightning network, which is difficult to quantify. Also, I’ve heard some argue that the increased HODLing behavior that we’ve been tracking is responsible and people just don’t want to transact with their BTC.

Next up we have our exchange flows, which in tandem with supply becoming liquid were the mains reasons for the letter that was sent out on Tuesday suggesting caution in the short term. Since that letter, it appears flows have reversed bullish again and the market is reabsorbing the profits that were taken earlier this week. As you can see, on Wednesday there was a drop in Coinbase’s balance, while Binance’s is rising. This could suggest selling from the east and buying in the west, or just reflects the demand to use Binance’s speculative products. Always good to give the heuristics a few days to confirm and also watch the multiday trend, but so far looks good and alleviates the concerns I had in that aspect.

Lastly, we’re seeing a continued steady grind up in hash rate. As a result, after Wednesday’s difficulty adjustment, miner revenue in BTC per hash has declined. As hash continues to come online, the opportunity for miners still on the network to capture this window of profitability is fading. This likely explains why they’ve been hoarding Bitcoin like no tomorrow.

This section is written by Blake Davis:

As of writing this after the close on Thursday, this week has been a relatively strong one for crypto-related equities. Despite the on-chain metrics of Bitcoin showing signs of profit taking and price action moving in a sideways chop, a lot of crypto stocks have shown some nice relative strength. Crypto-equities rely on both the health of the crypto market (mostly just BTC) and the general market to keep them afloat. Weakness in either one of them generally doesn’t bode well for these stocks but their combined strength can be huge. With some underlying weakness in both crypto and the stock market at the moment, I am keeping a pretty short leash on my crypto-exposed stock holdings. Stop-losses are key, there’s no point in arguing with price. While there are definitely certain names being sold, we’re focused on the strongest stocks that aren’t being distributed. Institutions appear to be confident in the crypto rally for the time being, thus so far not heavily selling those strong names. Sideways and downward movements are the best time to hunt for relative strength, it makes it easier to separate the leaders from the laggards. There’s a few clear tiers of these kinds of stocks. The best of which are the names that have held their short-term moving averages on lighter volume and are now back to riding those MAs. In my opinion, the three strongest of these names are Marathon Digital, Riot Blockchain, and MicroStrategy. Some other notable mentions, we’ll call them Tier 2, would be COIN, SI, BITF and HUT. These Tier 2 names have nice looking price action but they were sold a little too aggressively to be the sector leading names. Also, BITF and HUT are thinner stocks without the liquidity that the rest of those names have. They both have average daily dollar volume greater than $20M, technically making them liquid enough, but it’s pretty close so it should be noted. Let’s breakdown the technicals of those Tier 1 leaders. MARA - Held its 21EMA (blue) area last week with a nice jump back over the 10EMA (yellow) the next day. It retested that 10EMA on Tuesday, forming an upside reversal with a 98% closing range. Wednesday it made new relative highs and MARA’s relative strength line indicates that to a decent degree, it is outperforming the general market. I would like to see some follow through above that $39.68 level.

RIOT - Last week RIOT came into the 200SMA (white) area and held it. Next day it cleared through all other moving averages. Watching this one closely Friday to see if it can hold that 10EMA again as it did Thursday. RIOT is near a resistance area around $40. Watching for a clear break through this area and it could really get going, assuming general and crypto market action doesn’t hinder it.

*Disclaimer: Nothing in Blockware Intelligence’s Newsletter is financial advice content is solely opinions from writers

awesome stuff, very clinical

Thanks sir