Blockware Intelligence Newsletter: Week 117

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 1/13/23 - 1/19/23

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

Blockware CEO Mason Jappa on Simply Bitcoin

Simply Bitcoin, the most watched live daily bitcoin show running Monday thru Friday on YouTube, keeping you up to date with the peaceful Bitcoin revolution. Dropping content for all audiences, from 1 min to 1 hour, they got it all.

Simply Bitcoin produced BitBlockBoom and Unconfiscatable conferences live stream as well as the famous SB news desk where they interview well known Bitcoiners in between panels.

They are the #1 source for covering the separation of money and state.

https://www.youtube.com/live/aro8K9mpdrA?si=Yf3UHZpVXS4T0Ofa , today's episode featured Blockware CEO Mason Jappa.

Bitcoin ETFs Update

The initial price action following the launch of spot Bitcoin ETFs has left much to be desired. However, underneath the hood, the launch of these ETFs has had a record-breaking amount of success.

After five days of trading the total inflows across all ETFs sit at roughly ~1.2 billion. In terms of total assets under management, the Bitcoin ETFs have already surpassed silver ETFs, despite silver having a 5,000-year head start as an asset class.

We will continue to update you on the state of these ETFs throughout the year. Don’t let the underwhelming initial price action sway your opinion; this is still an incredibly bullish development. Passive inflows will continue to trickle their way into these products over time.

Source: Eric Balnchunas

General Market Update

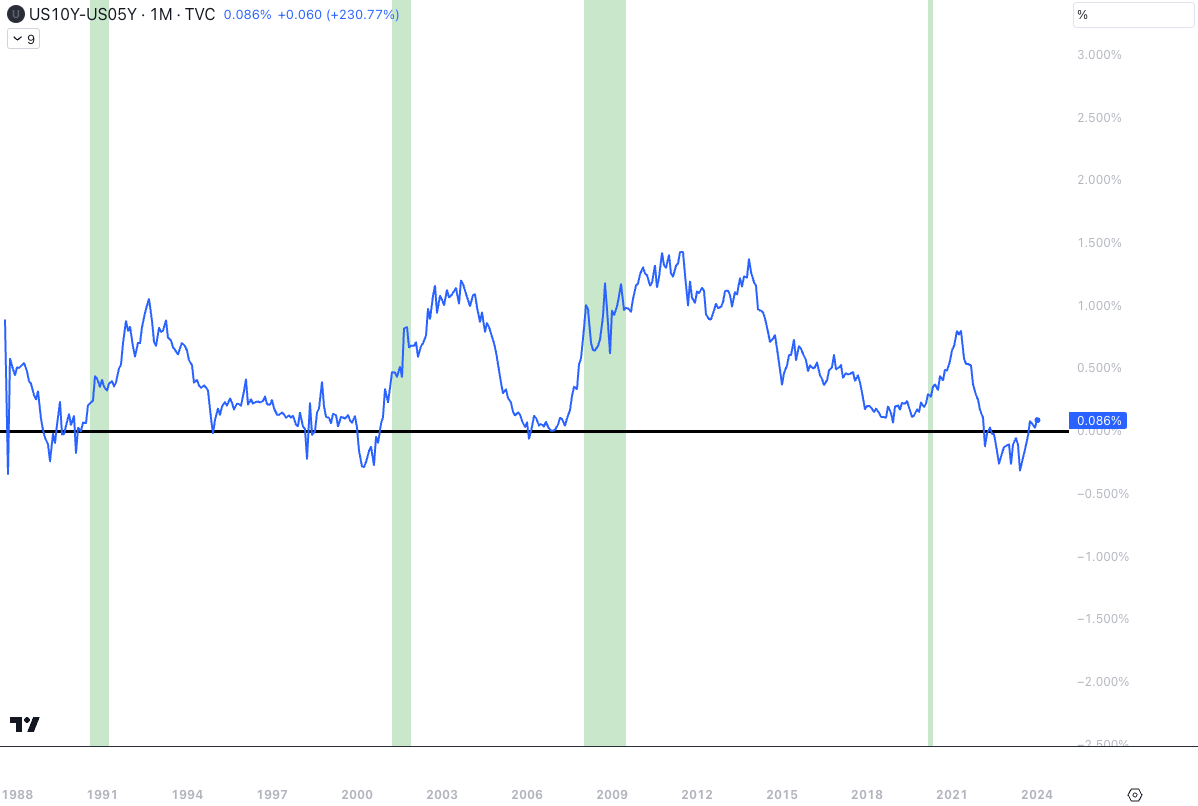

1. US 5/10 Year Treasury Spread. This week the 5/10 Year Treasury spread has continued to recover positive territory. Many investors use Treasury spreads as an early indicator for recession. Negative spreads (shorter maturity bonds having a higher yield than longer maturity) show us that the fixed income views more economic risk in the short-term. The risk premiums shift during recessionary periods, as the Fed adjusts policy to accommodate a slowdown in economic output. If history is any guide, a recession in 2024 could very well be in the cards.

2. CBOE Equity-Only Put/Call Ratio. Across the last couple of weeks we’ve seen market sentiment reach extreme bearish readings, as measured by the Put/Call Ratio. January 10th’s 1.55 print was the highest level of put buying since December 2022. In classic market fashion, equities moved higher from this print, and the S&P is now nearly at a new all time high.

3. NASDAQ 100 (weekly). While the full Nasdaq Composite is still yet to make new highs, the Nasdaq 100 sits firmly in all-time highs. After ~$6T was parked in Money Market Funds across the last 2 years, it’s only logical for that capital to seek risk again with the prospect of a Fed pivot. The combination of strong forward earnings guidance, lower rates on the horizon and tons of sidelined capital has created the perfect storm for equities across the last year.

Bitcoin Exposed Equities

4. Grayscale Bitcoin Trust (GBTC). As you likely know if you’ve been closely following the BTC market in the last week, the ETF launches have been characterized as a flood of capital out of GBTC. With their 1.5% expense ratio towering over the competition, funds are fleeing the ETF to purchase ones that are more capital efficient. In the last 5 trading days, over $2.2B has exited GBTC and been reallocated into other funds. This is likely a main driving factor behind BTC’s poor price performance of recent.

5. Bee Comparison Sheet.

Bitcoin Technical Analysis

6. Bitcoin / USD. While the start to 2024 certainly wasn’t what many had in mind for BTC price action, there is a silver lining. We know that spot ETFs will likely have a net-positive effect on BTC price action in coming years, but we didn’t get the long awaited “god candle”. Why is that good? Because it gives us an opportunity to stack cheaper sats and ASICs before the likely run to ATHs. At the moment, BTC price is near a key support level of ~$40.2k. If buyers can’t regain control here, we see the $38-38.5k range as the next likely support level.

Bitcoin On-Chain / Derivatives

7. Short-Term Holder Realized Price: There’s certainly been a wave of “sell the news” putting downward pressure on the Bitcoin price. In the near future, we may see a re-test with the short-term holder cost-basis; something we haven’t seen since October of 2023.

8. Depositing Addresses: One of the many advantages of Bitcoin over the traditional financial system is the ability to derive data from the transparent ledger and observe the behavior of market participants in real-time. Since the bull market peak, the number of unique on-chain addresses sending BTC to exchanges has been in a downward trend. We see a noticeable spike upon the launch of the ETFs as coins, from both retail selling the news as well as GBTC conversions, were sent to exchanges. The downward trend has resumed since then, likely indicating the “sell the news” event is over.

9. Realized Profit/Loss (Market Cap Adjusted): For perspective on how early we are within the scope of the current bull cycle, take a look at on-chain realized P/L adjusted for the market cap. There’s still plenty of room for BTC to run in the medium term; we’re far from being “overheated.”

Bitcoin Mining

10. Hashrate: There’s been a slight downtick in hashrate over the past two weeks, with a negative difficulty adjustment of ~4.21% in the cards for this weekend. Hashrate trending relatively sideways alongside price paints a good picture of the current state of the mining market: miners with high energy costs and/or low-efficiency machines are teetering on the edge of profitability, plugging in when BTC pumps and unplugging when it dumps. However, with the S21s and M60s set to reach the shores of the US over the coming months, expect hashrate to trend slightly up regardless of BTC price action.

11. Transaction Fees: The only constant in the on-chain transaction fee market has been volatility. The price to get into the next block has fluctuated between ~40 sat/vByte and ~70 sat/vByte over the past week. Meanwhile, the total stockpile of TX’s in the mempool continues to grow.

Considering blocks are limited to 4 MB worth of transaction data, on-chain fees in the future will likely be even higher than they are today. Consolidating UTXOs now will allow you to save on future transaction fees. Check out this video to learn more about UTXOs.

12. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$21,000 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

The second half of 2024 will be purely bullish, and 2025 will be insane!