Blockware Intelligence Newsletter: Week 104

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/9/23 - 9/15/23

S19 XP and 12 Months of Free Hosting Giveaway

In order to enter the giveaway (~ $7,000 value today), you must complete the following three steps. With just around 50 sign up entries received so far, your odds of winning are looking exceptionally favorable.

1. Sign up for the Blockware Marketplace

2. Complete the 2 onboarding steps

3. Like & RT this tweet

Additionally, purchasing an ASIC on the marketplace gives you 10 additional entries. Deadline for entries is EOD Friday, September 22nd, 2023.

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Mitch Askew interviews Sam Callahan, Lead Analyst at Swan Bitcoin. In this episode, Mitch & Sam dive deep into the problems of central banking, both presently and historically. Sam discusses his recent article in which he lays out the striking similarities between the Federal Reserve and the Bank of Amsterdam, a central bank which failed in the 1700s. This is a must-see episode!

General Market Update

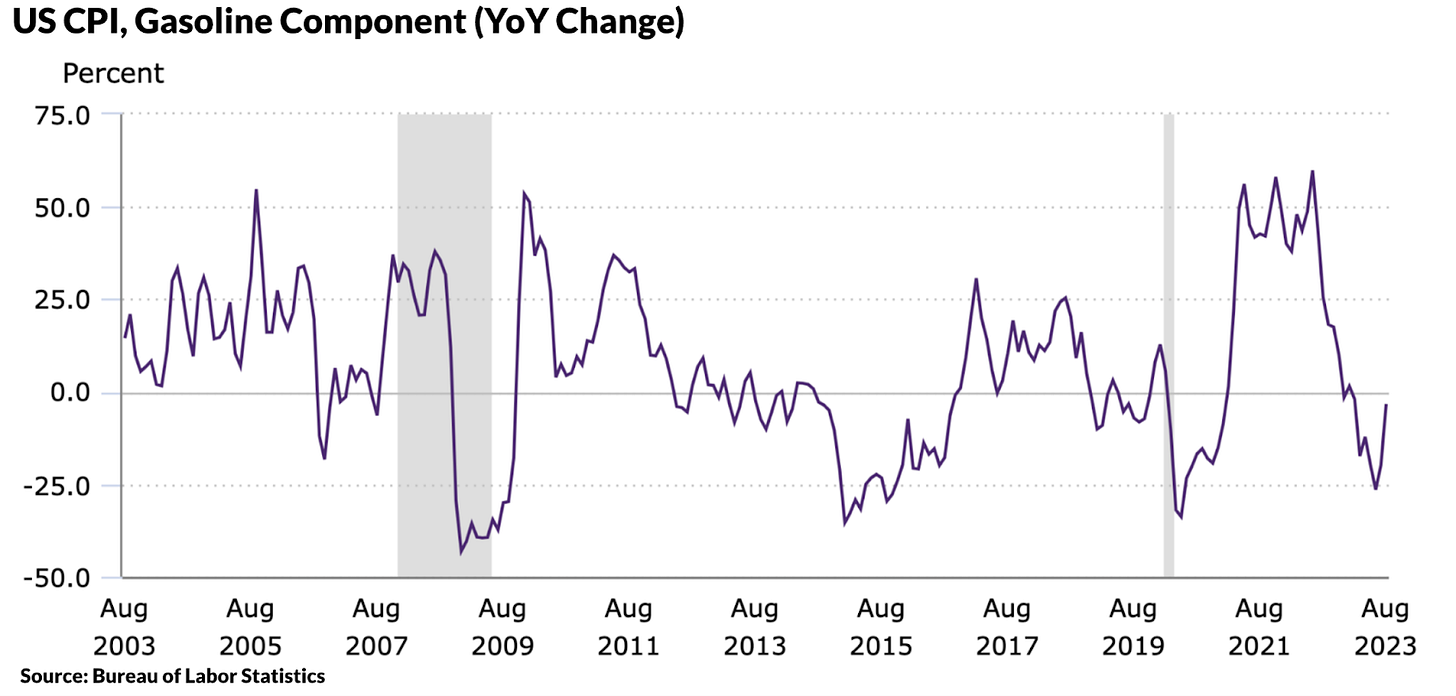

2. August CPI. The Consumer Price Index for August came in above expectations at 3.7% YoY for the headline number. Core CPI saw 4.3% growth YoY. The most important piece of data was that headline CPI grew by 0.6% from July, this was the largest month-over-month increase of the year. This monthly increase was largely fueled by rising energy costs, including a massive 10.6% increase in gas prices.

3. FedWatch Tool. Despite major strength from the US consumer and increasingly rising energy prices, the market still expects, with near certainty, that the Fed will not raise rates next week. As of today, the market expects rates to stay where they are until the first cut in July 2024.

4. US 10 Year Treasury Yield. Yields are back on the rise this week following the CPI news on Wednesday. Despite the futures dynamics explained in Chart #3, the Treasury market seems to be pricing in higher rates in the short-term. This “yield action” can often place downward pressure on risk assets, such as stocks or Bitcoin.

5. Nasdaq Composite Index. With rising yields potentially creating sell pressure on equities, keep an eye on this rising trendline for the Nasdaq going into the weekend. This appears to be a fairly significant make-or-break spot for equity price action.

Bitcoin Exposed Equities

6. Valkyrie Bitcoin Miners ETF. Despite last week’s FASB news, it's been a relatively poor week for price action from publicly traded Bitcoin miners. Many names have now given back all of the gains they made in July. The miners ETF, WGMI, has been flirting with its 200-day SMA, and so far, has held it.

7. Bitcoin Equity Comparison. Per usual, the table below displays the Monday-Thursday price performance of most Bitcoin-exposed equities. The average name was pretty much flat on the week, at 0.26%. Spot Bitcoin has outperformed this week, up over 2.7%.

Bitcoin Technical Analysis

8. Bitcoin / USD. After briefly dropping below its YTD AVWAP (blue), Bitcoin recovered nicely and sits above its 21-day EMA, as of the time of writing. Holding this AVWAP was important, as it shows the conviction from algorithmic traders and funds to continue to accumulate sats when they view themselves getting a deal. As we head into next week, keep an eye on the 50-day SMA hanging overhead.

Bitcoin On-Chain / Derivatives

9. Coin Day Destroyed: This metric shows the number of coins moved each day multiplied by the number of days since they each last moved; effectively measuring transfer volume with increased weight given to coins that have not moved in a long time. Spikes indicate either profit taking or capitulation, flat periods/downtrends indicate minimal on-chain activity. The recent drop to $26k saw a spike in Coin Day Destroyed, showing that some capitulation took place. But this spike pales in comparison to the capitulatory events in 2022.

10. Net Profit/Loss: Despite the minor capitulation in terms of coin days destroyed, hardly any losses were realized on-chain. This signals that coins being moved here were more or less accumulated at just slightly higher prices than where we are today. 2023 has been a mixed regime, switching between net profits and net losses multiple times, which is certainly indicative of the crabishness and uncertainty of the current environment.

11. Available Supply: This metric combines BTC belonging to exchange addresses as well as “liquid” BTC; coins that are moved frequently. This gives a good gauge of how much Bitcoin is actually available for purchase. Coins that are inactive are unlikely to get moved (for purposes of being sold for fiat), unless the price increases by many multiples. Available supply has declined significantly since the start of this halving epoch in 2020, and has made another leg down this summer as hardened, diamond-handed Bitcoiners continue to stack sats into their cold-storage.

12. ETH/BTC: It has been just over 1 year since “the merge”, the event in which Ethereum switched from proof-of-work to proof-of-stake. Since then ETH is down 28% when priced in Bitcoin; with each attempted rally falling flat. The divergence between Bitcoin and every other “crypto” asset (stablecoins not included) is only going to grow wider when institutional capital enters the market as the major asset managers of the world have yet to express interest in anything other than Bitcoin.

Bitcoin Mining

13. Hash Ribbons: Many people suggest miners don’t have a large effect on the price of BTC due to a large percentage of BTC already mined, but hash ribbons historically tell a different story. Almost all local bottoms are marked by hash ribbons. When miners have been struggling, buy Bitcoin. Miners are the only consistent sellers of spot BTC.

14. Upcoming Difficulty Adjustment: Unfortunately for miners, difficulty is expected to increase by another 3% - 4%. The adjustment is expected to occur on Tuesday morning.

15. S21: Bitmain has recently announced its new generation Bitcoin ASIC. Blockware is now accepting pre-orders for the S21. Upon release this will be the most efficient machine, breaking 20 J/TH. Reach out for more information on MOQ, specs, etc. (sales@blockwaresolutions.com)

16. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,404 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.