Blockware Intelligence Newsletter: Week 101

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/19/23-8/25/23

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Joe Burnett is joined by Rob & Becca from AnchorWatch to discuss self-custody, miniscript, Bitcoin scaling solutions, and more!

2. 2024 Halving Report. In case you missed it, we published our “2024 Halving Analysis” last week instead of our regularly scheduled newsletter. You can read the report by clicking here. If you prefer audio content, you can listen to this recorded Twitter space in which the team breaks down the report.

General Market

3. CBOE Equity-Only Put Call Ratio. After a period of extreme bullish sentiment across the equity market, we’ve seen a fairly robust pullback in recent weeks. Around when the market reached its short-term peak in mid-late July, the equity-only put/call ratio had reached ~0.55, its lowest reading since January 2022.

4. Nasdaq Composite Index. On Tuesday afternoon, Nvidia, 2023’s leader, reported strong earnings on the back of strong growth in the Artificial Intelligence industry. On this news, the Nasdaq gapped up ~0.83% on Thursday morning. This gap was sold heavily and was fueled by Powell’s hawkish Jackson Hole speech this morning. If the index can’t hold last Friday’s lows around ~$13,162, then ~$12,267 appears to be the next most logical support level.

5. 10-Year Treasury Yield. The equity sell-off has largely stemmed from further increases in Treasury yields in recent weeks. On Monday, the 10-year was at a new 16-year low when the Treasury’s yield topped at 4.362%. The “smart money” is clearly concerned about the Fed’s unrelenting dedication to raising interest rates to any level necessary to bring inflation back to their 2% target.

Bitcoin Exposed Equities

6. Valkyrie Bitcoin Miners ETF. The BTC miner ETF, WGMI, displays the hefty correction we’re seeing underway from publicly traded BTC-exposed companies. These stocks saw an extremely strong first ~7 months of the year, so a correction back to their longer-term moving averages isn’t overly surprising. The chart below should be a good lesson about the importance of risk management and taking profits.

7. Weekly Bitcoin Equity Price Action. The table below, as always, shows the weekly performance of many Bitcoin-exposed equities in comparison to WGMI and spot Bitcoin. 7 names are actually up on the week, EBON, GREE< BTDR, MSTR, BTCM, COIN, and SDIG. The average name was down 5.3% between Monday’s open and yesterday’s close.

Bitcoin Technical Analysis

8. Bitcoin / USD. Following the nasty price action last week, Bitcoin has largely moved sideways this week. This week’s price structure undoubtedly looks scary, with a typical bear flag pattern forming. That being said, price has thus far been able to hold a key support level around $25.3k. This level is the convergence of the February high, June low, and the Volume Weighted Average Price anchored from the year-to-date open.

Bitcoin On-Chain / Derivatives

9. Long Liquidations & Open Interest: The recent drop to ~$26k was sparked by a “leveraged long liquidation cascade.” Note the spike in long liquidations corresponding with the largest drop in open interest since the FTX implosion. This was the largest total amount of long liquidations since early 2022.

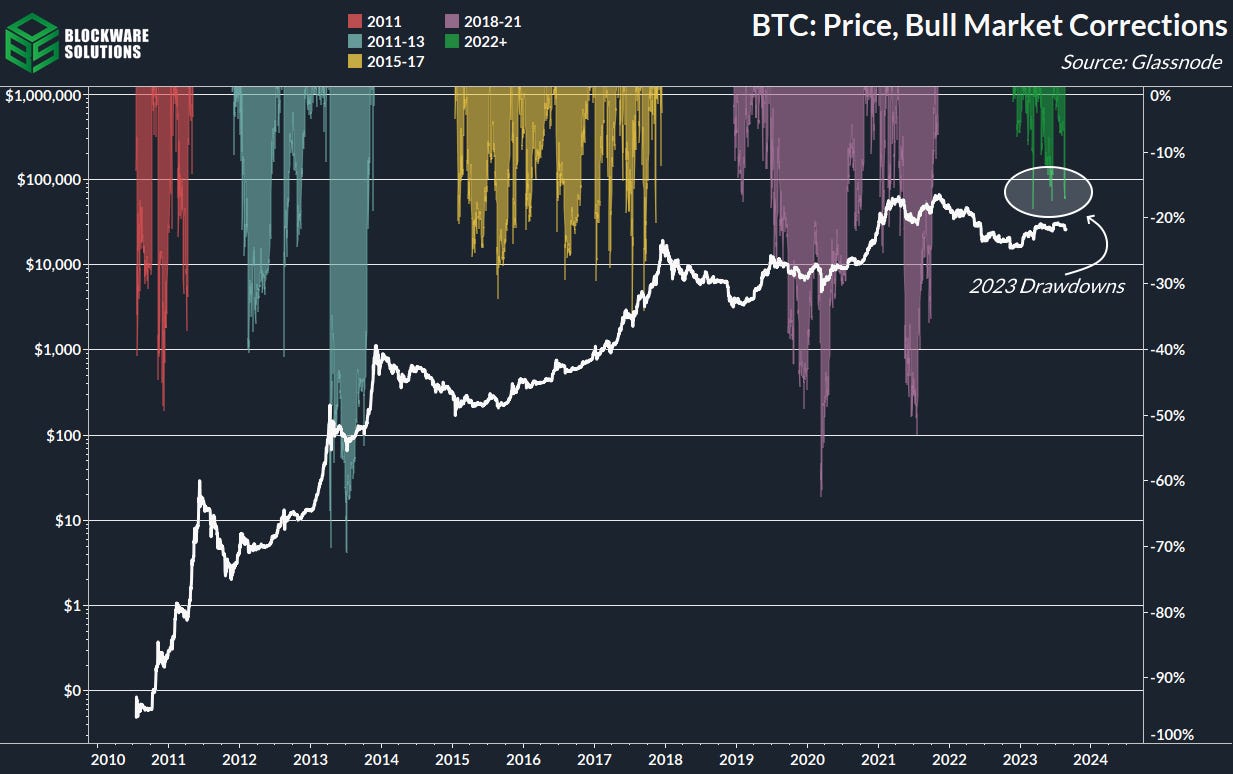

10. Bull Market Corrections

Shakedowns and price corrections such as this one are par for the course for Bitcoin; twice before in 2023, we’ve seen corrections of this magnitude. Both times prior resulted in local bottoms.

11. Realized Profit/Loss: This metric further illustrates this recent price move’s lack of severity. Hardly any on-chain losses were realized by this move; the worst of the capitulation is behind us.

12. “Pleb Accumulation”: One of our favorite metrics in this bear market has been tracking the accumulation behavior of holders with between .01 and 1 BTC. This is a good representation of convicted Bitcoin “plebs” that stack on dips, and immediately withdraw off exchanges. Spikes in accumulation from this cohort have coincided with local bottoms in an eerily accurate manner.

13. HODL Waves: The amount of Bitcoin supply that is old and inactive continues to climb; specifically we’ve got our eyes on the “2-3” year HODL wave. These coins were bought during or just prior to the 2021 bull market. Having held all the way from $69k down to $16k, a drop from $29k to $26k is not going to phase these holders. Sideways, volatile price action will result in BTC continuing to transfer from weak hands to strong hands.

14. Realized Price by Time Held: The cost basis of coins 1-2 years old is now less than that of 2-3 years old coins. This is typical for late-stage bear markets as coins acquired during the previous bull market age into the older (2-3y) cohort. The cost-basis of 1-2 year old coins will continue to plummet as coins acquired post-FTX collapse will soon be aging into this cohort.

Bitcoin Mining

15. New Bitmain S21 (210T). Bitmain has announced the release of the latest generation in the Antminer series: the S21. This machine is rumored to have an energy efficiency of 15 J/Th; finally cracking the 20 J/Th barrier. This is a ~30% increase in efficiency over the S19 XP. At 210 TH/s, this machine has the potential to shake the mining landscape up tremendously. It is scheduled to hit the market in March/April 2024, just in time for the halving.

16. Difficulty Adjustment. Bitcoin mining difficulty has reached a new all-time high following a 6.17% increase earlier this week. This comes in the wake of a summer in which hashrate/difficulty remained relatively flat, most likely due to curtailment. This increase in difficulty reinforces the importance of mining with the most energy efficient ASICs possible.

17. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,039 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.