Blockware Intelligence Newsletter: Week 139

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 7/6/24 - 7/12/24

🚨Limited Time Offer: Discounted Bitcoin Mining🚨

Today is the last day of our discounted hosting rate!

All Whatsminer M66s’s purchased on the Blockware Marketplace before EOD will lock in an electricity rate of $0.074/kWh!

The best time to start mining is at the beginning of a new Bitcoin halving/hardware cycle.

A miner using an S19 since the 2020 halving (the most efficient ASIC at the time) has accumulated 40% more bitcoin than someone engaging in a dollar-cost average strategy. And this is accounting for the initial cost of the machine!

Don’t wait to start mining. Click here to head to the marketplace and purchase an M66s. These machines are sold turnkey, so you’ll begin earning mining rewards the very same day!

Bitcoin: News, ETFs, On-Chain, etc.

1. Donald Trump to Speak at Bitcoin Nashville 2024

After months of rumors, BTC Inc. finally confirmed that the 45th President of the United States will be the headline speaker for The Bitcoin Conference 2024. Regardless of political preferences, it is undeniably bullish that the front-runner for the next POTUS is speaking at the world’s largest Bitcoin conference. Bitcoin is no longer an obscure hobby for computer scientists and financial speculators. It is at the forefront of American political discourse and is being adopted by the most capitalized asset managers in the world. We’ve come a long way so far, but there’s still a long way to go.

This year’s Bitcoin Conference will likely go down in history as one of the most important Bitcoin events of all time. You DO NOT want to miss this! Click here to purchase your ticket and use the code ‘BLOCKWARE’ for 10% off. Prices increase tonight, so don’t wait!

2. BTC Holding Steady at $58,000

This week was uneventful in terms of Bitcoin price action, which is honestly refreshing after the 15% drop over the past month. Stagnation in the first few months post-halving is very typical; inefficient miners are exhausting their reserves in an attempt to stay afloat. BTC will likely turn a new leaf, and begin exploring uncharted territory, in Q4 of this year, once this sell pressure is relieved.

3. Germany’s Bitcoin Blunder

The German authorities that have sold upwards of $3 billion worth of BTC onto the market over the past month are nearly out of coins to sell, with ~$220 million remaining in their wallet. The BTC price has held up extraordinarily well given the speed and volume of this sell pressure. With this downward force on price almost entirely relinquished, we could see BTC re-bound into the $60,000’s in the near future.

Source: Arkham Intelligence

4. Puell Multiple Indicates Local Bottom May Be Forming

The Puell Multiple is calculated by dividing the daily BTC issuance in dollar terms by its 365-day moving average. This effectively shows the amount of potential miner-induced sell-pressure on the market relative to the past year. Puell Multiple made lows after each of the past two halvings prior to price making an exponential move upwards. PM is at its lowest level since January 2023 and appears to be forming a bottom, providing a bullish indicator for price action going forward.

5. Realized Profit / Loss - Market Cap Adjusted

After months of on-chain profit-taking (coins being moved at a higher price than that at which they were acquired), we are on the cusp of enticing a regime of net-realized losses.

The significance here is investors are weary of realizing losses during bull markets (bear markets are a different story due to fear-based capitulation). During the 2016/17 and 2020/21 bull markets, there were multiple drawdowns throughout. During these drawdowns there were brief periods of net-realized losses, which consistently marked local bottoms. Nobody likes to sell at a loss, especially during bull markets, prompting investors to come in and “buy the dip.”

General Market Update

6. Consumer Price Index (CPI)

June CPI released on Thursday showing a year-over-year change of 2.97%, the lowest CPI print since March of 2021. On a month-over-month basis, CPI actually showed deflation of 0.1%; a sign that the year-over-year values will likely disinflate in the coming months.

The Fed must avoid deflation at all costs as it is incompatible with the debt-based monetary system: decreased prices → decreased income → inability to repay debts. Declining YoY CPI values gives them the ammunition they need to justify rate cuts, and the market has now set its sights on the September Fed meeting as to when those cuts will begin.

7. Producer Price Index (PPI)

While CPI is disinflation, PPI rose yet again, as it has every month this year. PPI is showing a 2.6% increase in prices year-over-year, lending credence to what we’ve discussed ad nauseam in the newsletter this year: inflation is sticky. However, the psychological element of CPI starting with a 2, even if it is 2.9, gives the Fed enough cover to claim victory against inflation, and begin the next cycle of interest rate cuts.

CME FedWatch Tool has placed an 88% probability of a 25bip rate cut by the September 18th Fed meeting.

8. Treasury Market Rate Cut Expectations

The biggest signal this week comes out of the treasury market, with the 6-month yield dropping from 5.3% to 5.2%; below the threshold of where Fed Funds currently resides. Bond investors stepped into the market, locking in a 6-month return at these rates as they expect the overnight rate to decline during the next 3 months.

Bond yields across the board took a dive this week. Pictured below are the 1, 2, 5, 10, and 30-year bond yields. Twice this cycle there have been fake outs of lower bond yields. However, given the tameness of CPI, a weakening labor market, rising debt burdens, and the fact that this is an election year, this time is likely to be the real deal: rate cuts are finally inbound.

9. Equity Response

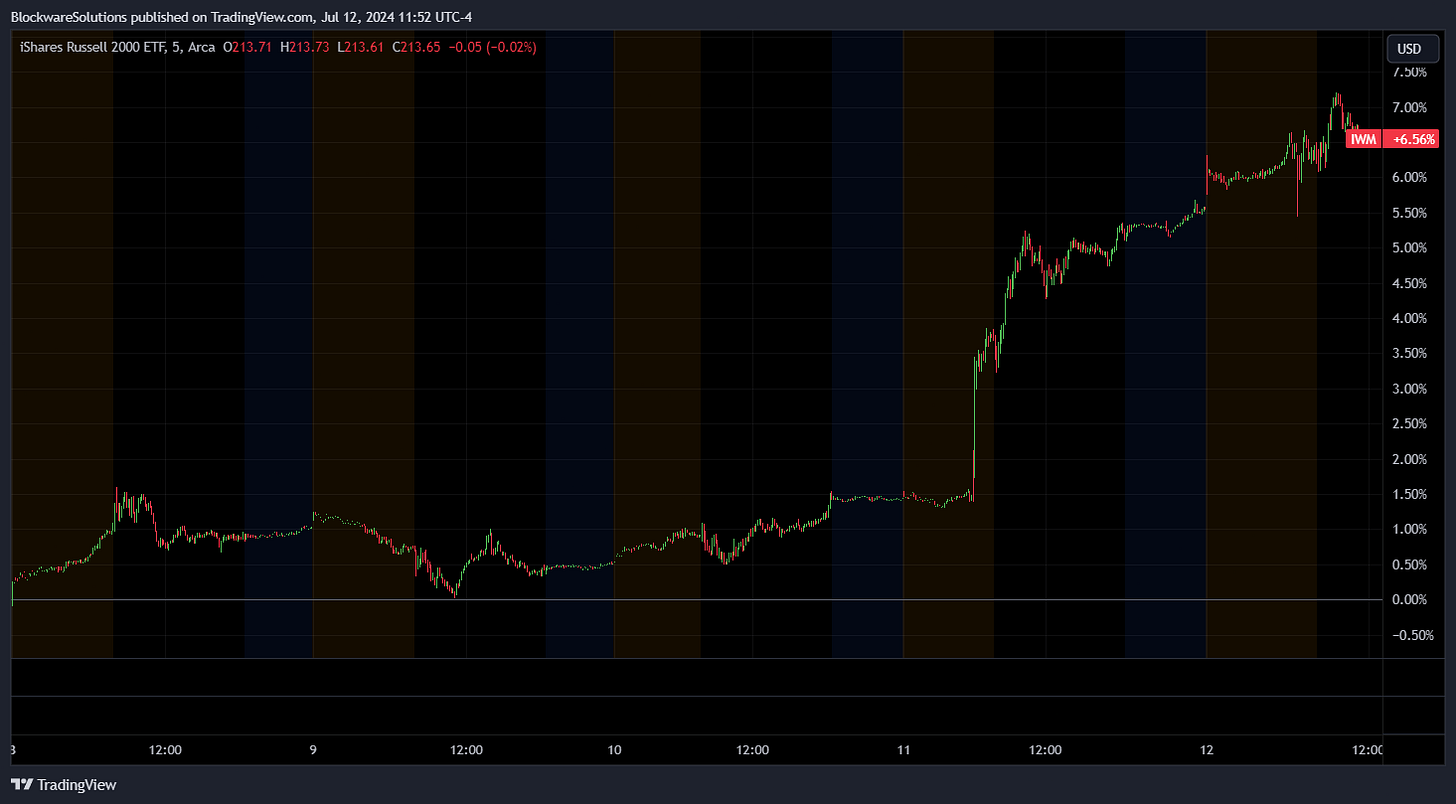

Risk assets took a tumble after this release of the inflation data. $NDQ dropped to ~20,170 points but has since rebounded sharply to ~20,444. The S&P has rebounded even harder, returning to it’s all-time high.

The drop in the Nasdaq and S&P came with a rotation into smaller cap equities. The Russell 2000, an ETF of lower-cap stocks, is up 6% this week.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

10. Core Scientific Conversion of Outstanding Notes

Core Scientific ($CORZQ) is converting a substantial portion of its outstanding convertible notes into equity, effectively eliminating $260 million of debt from its balance sheet. CEO Adam Sullivan had this to say about the move:

“The conversion of the secured convertible notes represents another important milestone that highlights the significant progress we have made since our emergence from bankruptcy earlier this year and the value creation potential ahead for our business as we continue to work to deliver on our growth strategy,”

After filing for bankruptcy in 2022 in the depths of the bear market, Core Scientific released shares on the NASDAQ in January of this year. Since doing so their stock is up ~161%. We interviewed CEO Adam Sullivan on the Blockware Pod during Q4 2023. In this interview, Sullivan outlined his plans to lead the company and his expectations for this Bitcoin cycle.

11. Core Scientific + Blocks Partnership

Among other breaking news, Core announced a partnership with the Jack Dorsey-owned Block ($SQ). Block will supply Core Scientific with 15 Exahash worth of their new 3-nanometer chip ASICs; with the option for even more. This agreement marks one of the industry's largest Bitcoin mining ASIC deals in terms of hashrate.

This is an important step in decentralizing all verticals of the Bitcoin mining ecosystem. The vast majority of ASIC manufacturing takes place in Asia, so it's a huge win to see a US-based company enter the fray; especially one spearheaded by a Bitcoiner as dedicated to the mission as Jack Dorsey.

12. Bitfarms Appoints New CEO

Bitfarms has appointed Ben Gagnon as its new CEO, marking the company's fifth leadership change in five years. Gagnon, having previously served as Chief Mining Officer at Bitfarms, is looking to turn things around for Bitfarms shareholders. Bitfarms ($BITF) has struggled this year, being down ~25% year-to-date, in stark contrast to the significant gains seen by other Bitcoin mining companies and Bitcoin itself.

In their press release, Bitfarms set forward expectations that they will expand and diversify revenue streams. Citing energy generation, heat recycling, energy trading, high performance compute, and AI, as new prospective lines of business.

13. Energy Gravity:

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$50,500 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.