Blockware Intelligence Newsletter: Week 195

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/8/25 - 11/14/25

Bitcoin is below $100,000 for the first time since May and we’re 1 more down-day away for negative returns on the year. What in the world is going on? Are we entering a bear market? Should I buy now or wait for Bitcoin to dip lower?

In this week’s newsletter (available only to premium subscribers) we will be your north star – your signal in a turbulent, noisy sea. Featuring exclusive charts and analysis not found anywhere else, here’s a high-level overview of today’s market coverage:

The Reality of Bitcoin’s 2025 Underperformance

Market-Wide Liquidity Crunch

On-Chain Indicators Signaling a Local Bottom

On-Chain Indicators Signaling Cause for Concern

🚨Turning Taxes into Bitcoin — Blockware is Coming to Denver!🚨

📌”The Space (Denver, CO)

📅 Thursday, November 20th

🕠 5:30pm

Join Blockware, StrongWealth, and Arch for a night of fireside chats and networking to learn how you can turn your taxes into Bitcoin.

Free food. Free drinks. Conversations with Bitcoiners. We hope to see you there!

Sign up here: https://luma.com/32zi715n

Learn more about mining with Blockware: mining.blockwaresolutions.com/info

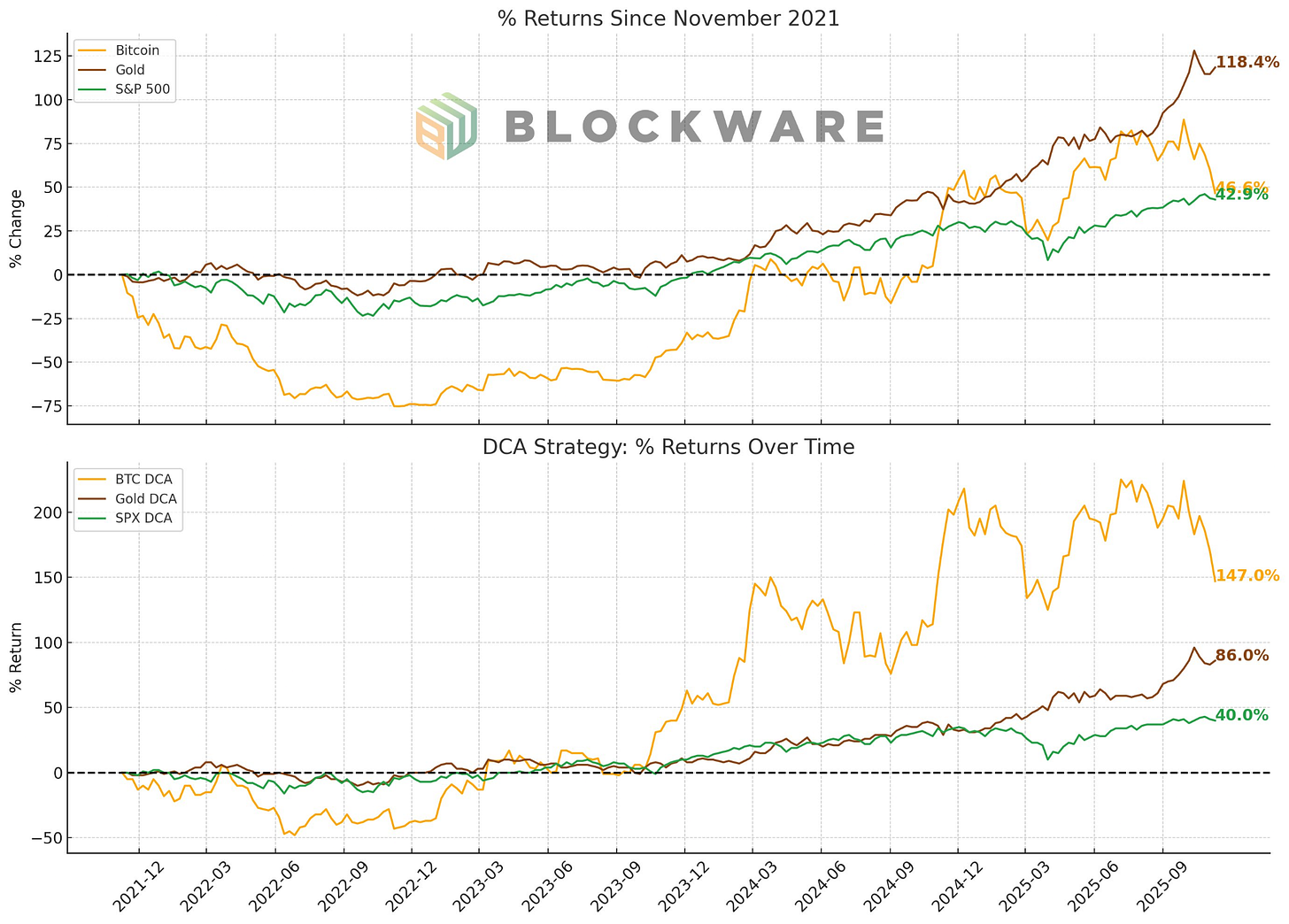

When measuring precisely from the 2021 top, Bitcoin has underperformed gold and has returned roughly on-par with the S&P 500. However, a weekly dollar-cost average into Bitcoin has greatly outperformed both:

> BTC: +147%

> Gold: +86%

> S&P: +40%

Volatility is your friend. Dips like this are for buying. Don’t let the emotions get the best of you.