Blockware Intelligence Newsletter: Week 134

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/25/24 - 5/31/24

🚨Blockware Bitcoin Summer Special🌞🏖️

To celebrate the start of summer, Blockware is offering a limited-time special where you can mine at $0.069/kWw. Here are the terms of the deal:

Option 1:

Minimum Order Quantity: 30 Machines

Prepay 6 months of Hosting

Mine at $0.073/kWh

$24.5/T

Option 2:

Minimum Order Quantity: 30 Machines

Prepay 12 months of Hosting

Mine at $0.069/kWh

$23.5/T

At the current hashprice, an S21 mining at $0.069/kWh has a breakeven cost of $36,000 per Bitcoin

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

River

Set up your on-ramp to Bitcoin with a reputable exchange giving you US phone support and top-tier customer service.

Sign up here: partner.river.com/blockware

Bitcoin: News, ETFs, On-Chain, etc.

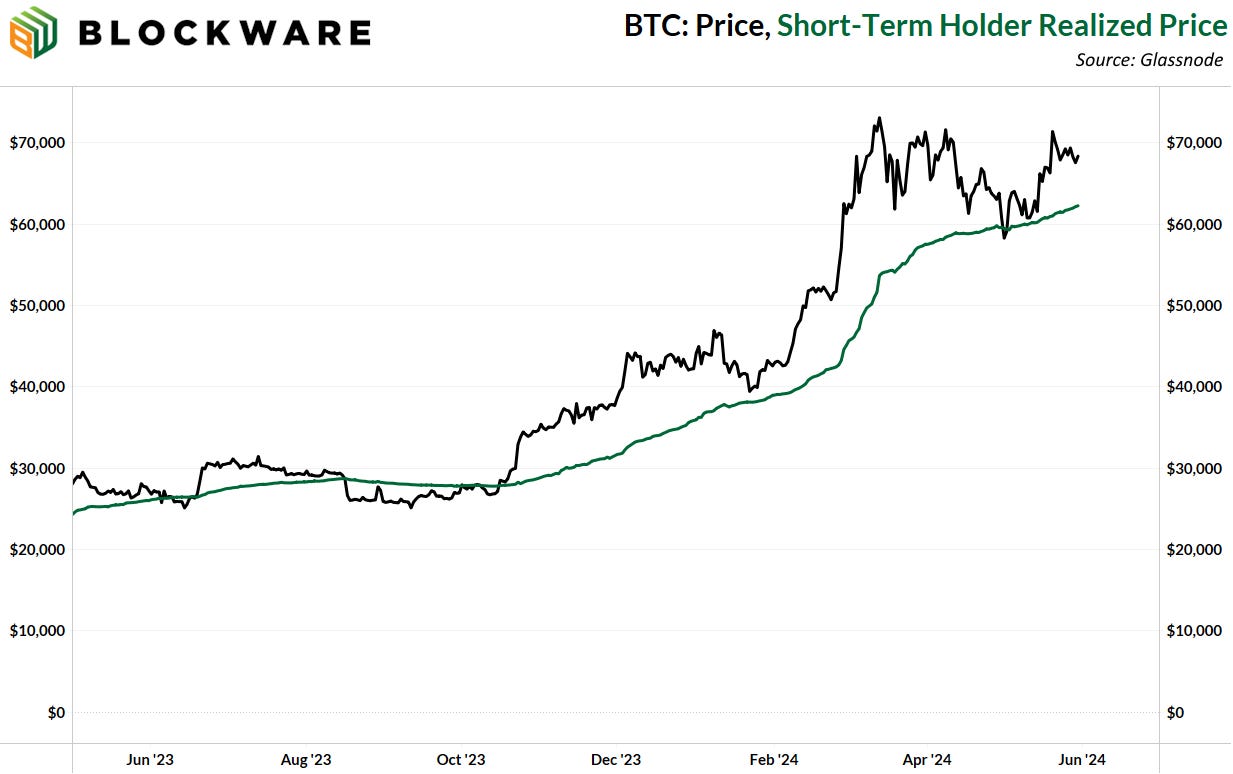

1. BTC Grinding Higher Above Short Term Holder Cost basis

The orange coin sits just under $69,000 following a week of sideways price action. Despite the past few months being relatively uneventful from a price perspective, especially given the euphoric rise at the start of the year, it’s important to zoom out, take inventory, and appreciate where Bitcoin is at right now. Just a year ago Bitcoin was grinding sideways around $25,000. Now, we’re not even two months removed from the halving, and Bitcoin is comfortably holding the $60,000’s for the first time in its history. This is bullish.

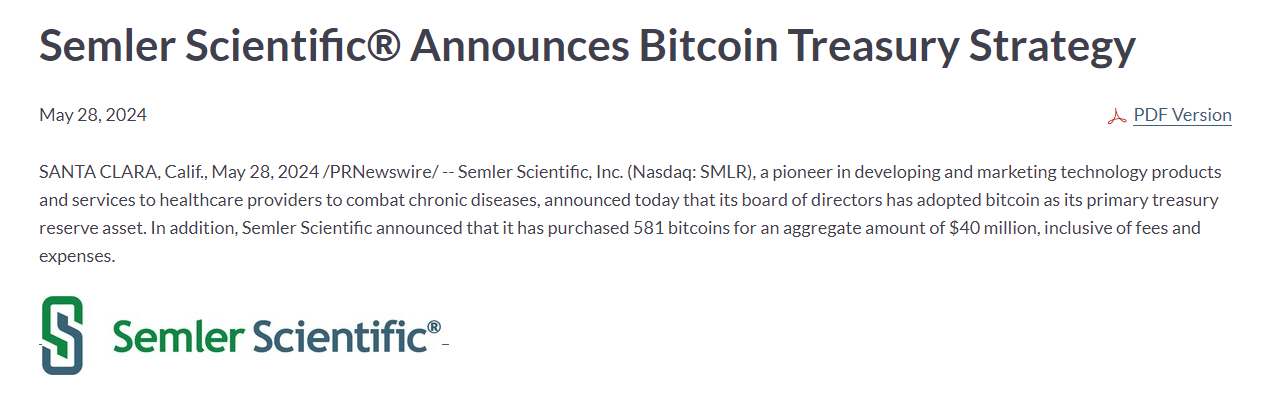

2. Another MicroStrategy Copycat Emerges - Semler Scientific

Less than a month after Metaplanet announced a corporate Bitcoin strategy, becoming the second publicly traded company to do so, we’ve got company number three: Semler Scientific. This US-based medical R&D + manufacturer announced on Tuesday that they are making Bitcoin their treasury reserve asset. Alongside the announcement, they deployed ~$40 million, acquiring ~581 bitcoins for an average price of ~$68,800 per bitcoin.

MicroStrategy, Metaplanet, Semler Scientific. Three companies, in three different industries, in two different nation-states, have all seen the orange light. Bitcoin is the ultimate escape valve from the perpetual devaluation of fiat currencies. Over a long enough time horizon, every business will adopt Bitcoin as their treasury reserve asset.

"While the whole world was having a big ole party. A few outsiders and weirdos saw what no one else could...These outsiders saw the giant lie at the heart of the economy, and they saw it by doing something the rest of the suckers never thought to do: they looked.” - The Big Short

The market immediately rewarded Semler Scientific for this move. Their stock shot up on the news; posting 34% gains on the week. Investors are eager for Bitcoin exposure; and they’ll get it anywhere and everywhere. After starting the week with a market cap of $160 million, Semler Scientific is now worth $216 million. The Bitcoin strategy works.

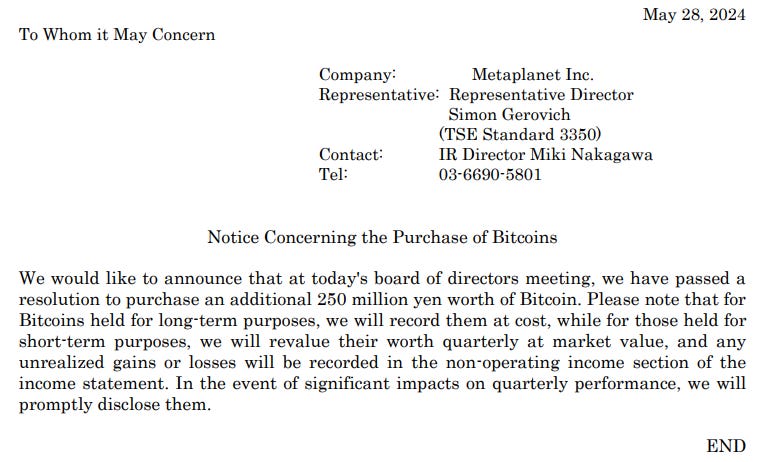

3. Metaplanet Purchases Additional Bitcoin

On that note, Metaplanet announced another Bitcoin purchase this week. 250 million yen worth (~$1.4 million USD). While in comparison to MicroStrategy this sounds like a child’s piggy bank, it’s a testament to Bitcoin’s mass appeal and the mantra of “stay humble, stack sats.” It doesn’t matter how much capital you have: Bitcoin is the superior savings vehicle.

4. Trump Continues to Posture as Pro-Bitcoin

Bitcoin’s infiltration into political discourse continued over Memorial Day Weekend. Presidential Candidate Donald Trump reinforced his positive views of Bitcoin and “Crypto.”

“I will support the right to self custody to the nation’s 50 million crypto holders… I will keep Elizabeth Warren and her goons away from your Bitcoin.”

You can listen to the full clip here.

General Market Update

5. Treasury Borrowing Short

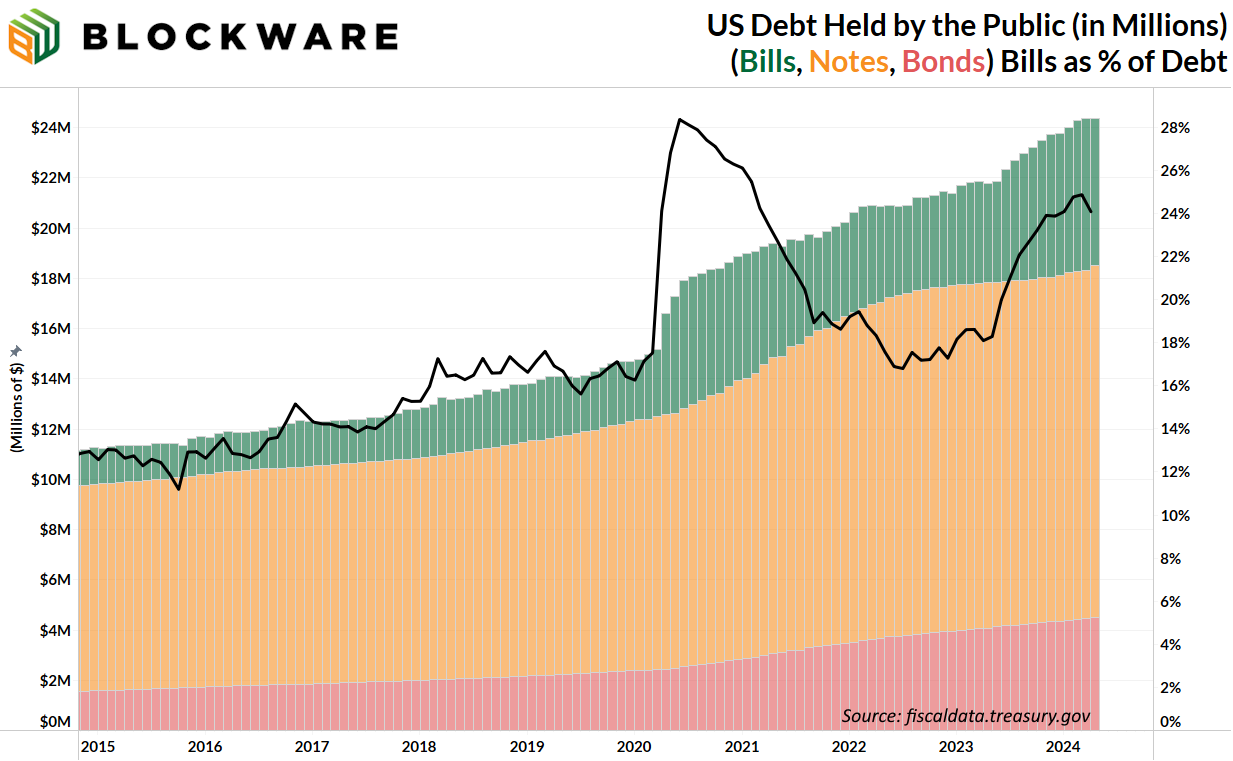

We all know (or at least we should) that the US is ~$34 trillion in debt. That’s a big number. The treasury has become increasingly reliant on short-duration debt; 1 month - 1-year maturity (bills). The $ of US Debt Held by the Public that is in the form of T-bills is at ~24%. This is up from ~17% in 2022 and ~12% in 2016.

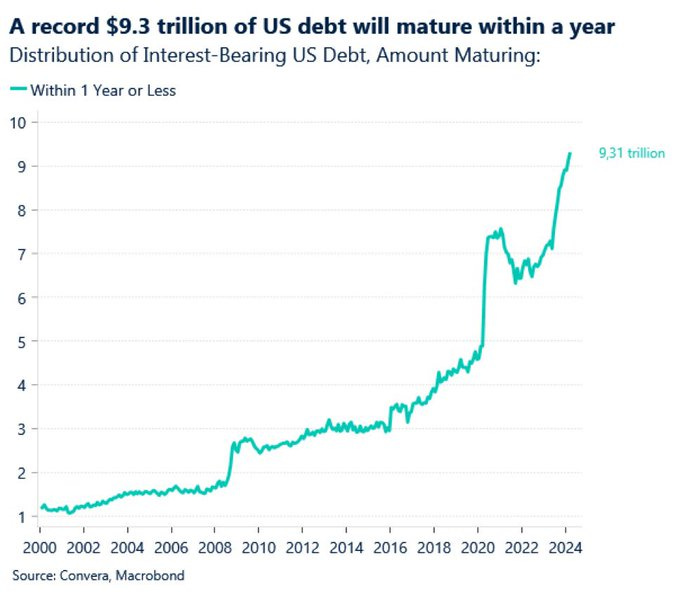

6. Debt Maturity Timeline

Here you can see the compounding effect that the continuous issuance of short-term treasuries (T-bills) is having on the US fiscal situation. The debt will need to be refinanced sooner and sooner, at higher rates.

It’s understandable why the treasury has taken this approach.

They don’t want to lock in long-term debt at the higher rates

Any marginal sell pressure on long-duration treasuries could cause the market to tank further

7. Long-Duration Treasuries

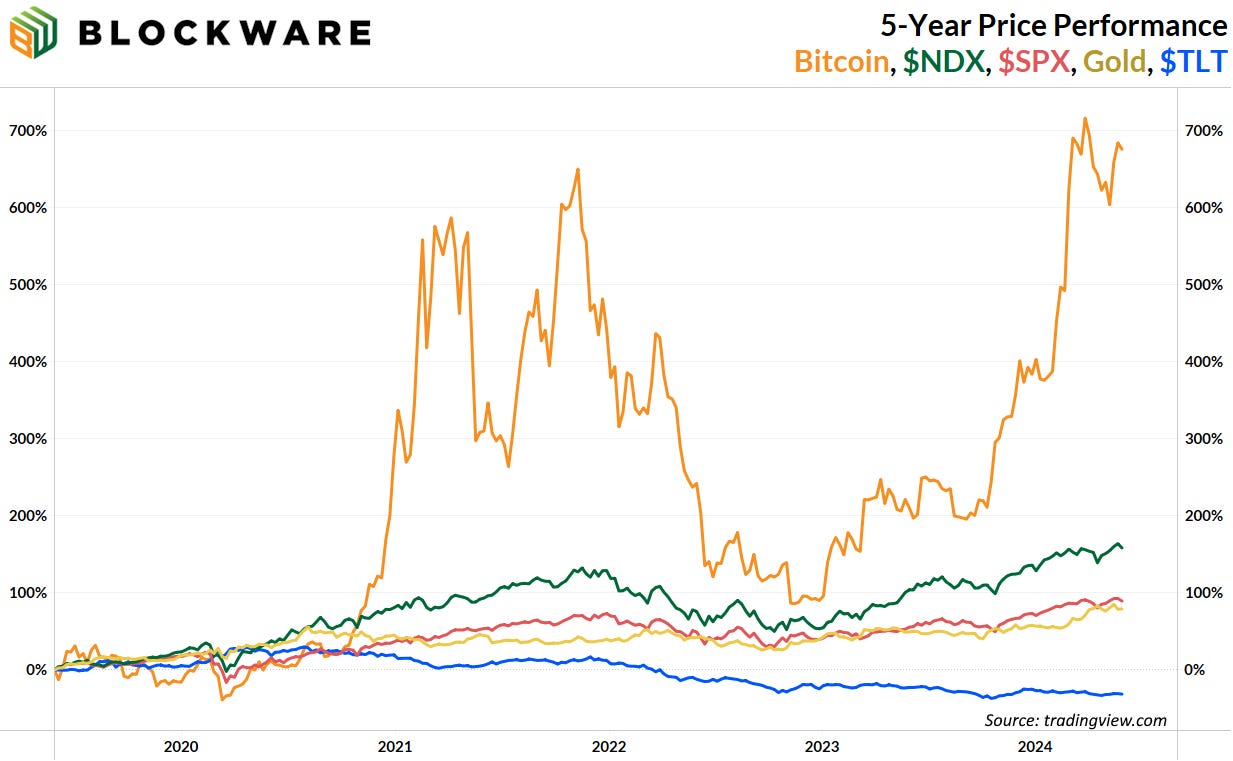

Long-duration treasuries are down 31% over the past five years. And that’s only in terms of depreciating fiat currency. When juxtaposed with other assets; the abysmal performance of treasuries is put into perspective. Over the past five years:

Bitcoin: +676%

Nasdaq: +158%

S&P: +89%

Gold: +79%

Treasuries have been the cornerstone of investment portfolios for decades, but conventional wisdom is shifting. Locking in fixed returns of 5% for decades on end is far from desirable when inflation (as measured by CPI, which is a low-bar measure) has been as high as 9%; and is likely to return to those levels during the coming decades.

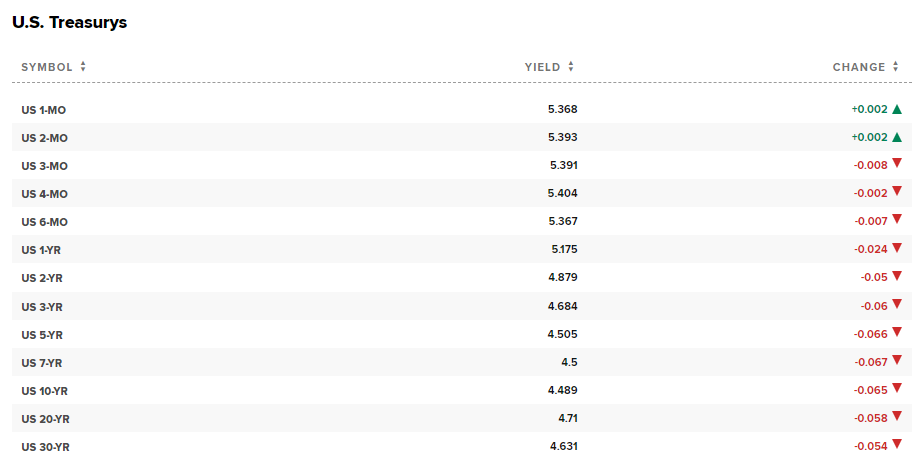

8. Treasury Yields

On a short-term time frame, treasury yields are down this morning across the board. Although there has yet to be any material change in market sentiment on future fed policy. If you’ve been reading the newsletters from recent weeks, you’ll know that the Fed is likely prolonging rate cuts until Q4 of this year, or possibly late Q3.

Bitcoin Mining

9. Riot Acquisition of Bitfarms

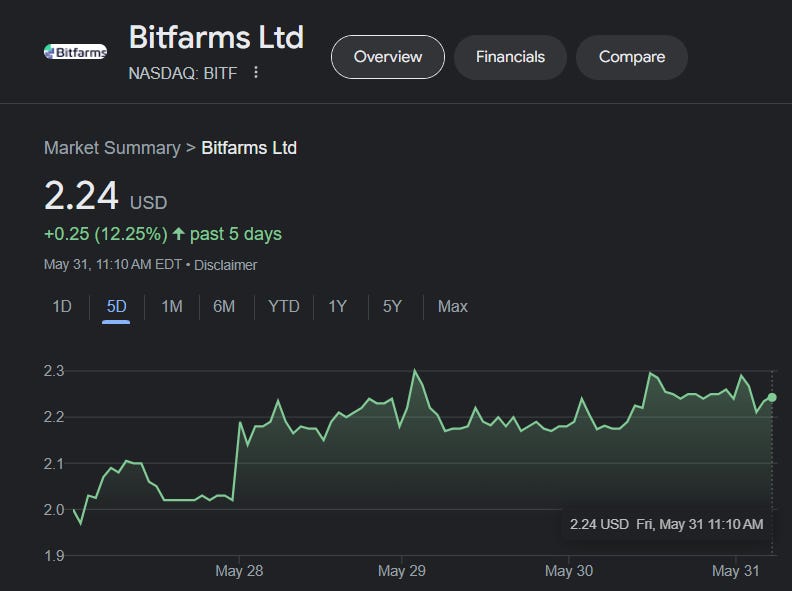

If you read the Monday edition of this newsletter, which focuses exclusively on developments in the Bitcoin mining industry, then you’ve already heard about Riot’s proposed acquisition of Bitfarms. Riot offered to purchase all outstanding shares of Bitfarms at $2.30 a piece. When we discussed this on Monday, $BITF was trading at $2.17. It is now up to $2.24, showing that the market is pricing in an increasing likelihood of the deal going through. $BITF is up ~12% on the week compared to $WGMI, the Bitcoin miner ETF, being up just 1%

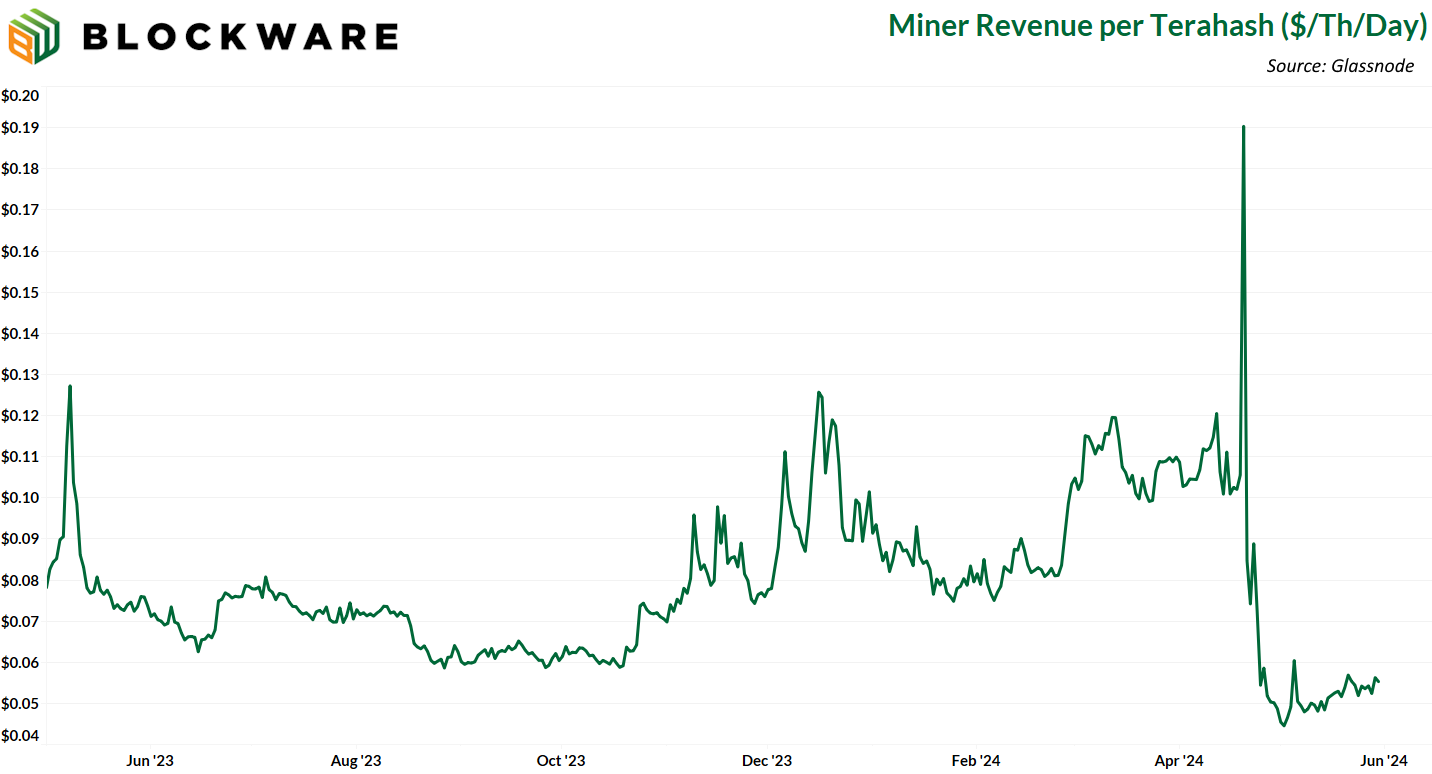

10. Hashprice - $0.057

Hashprice is inching its way back up, and the likelihood that halving was, indeed, a hashprice bottom is increasing. Projections for the next difficulty adjustment have dropped throughout the epoch, and now a modest increase of ~1.1% is expected to occur. The worst moment for miners may be in the rearview mirror; and the miners with efficient hardware and low electricity costs feast on the increased margins that will come when price makes its next leg up.

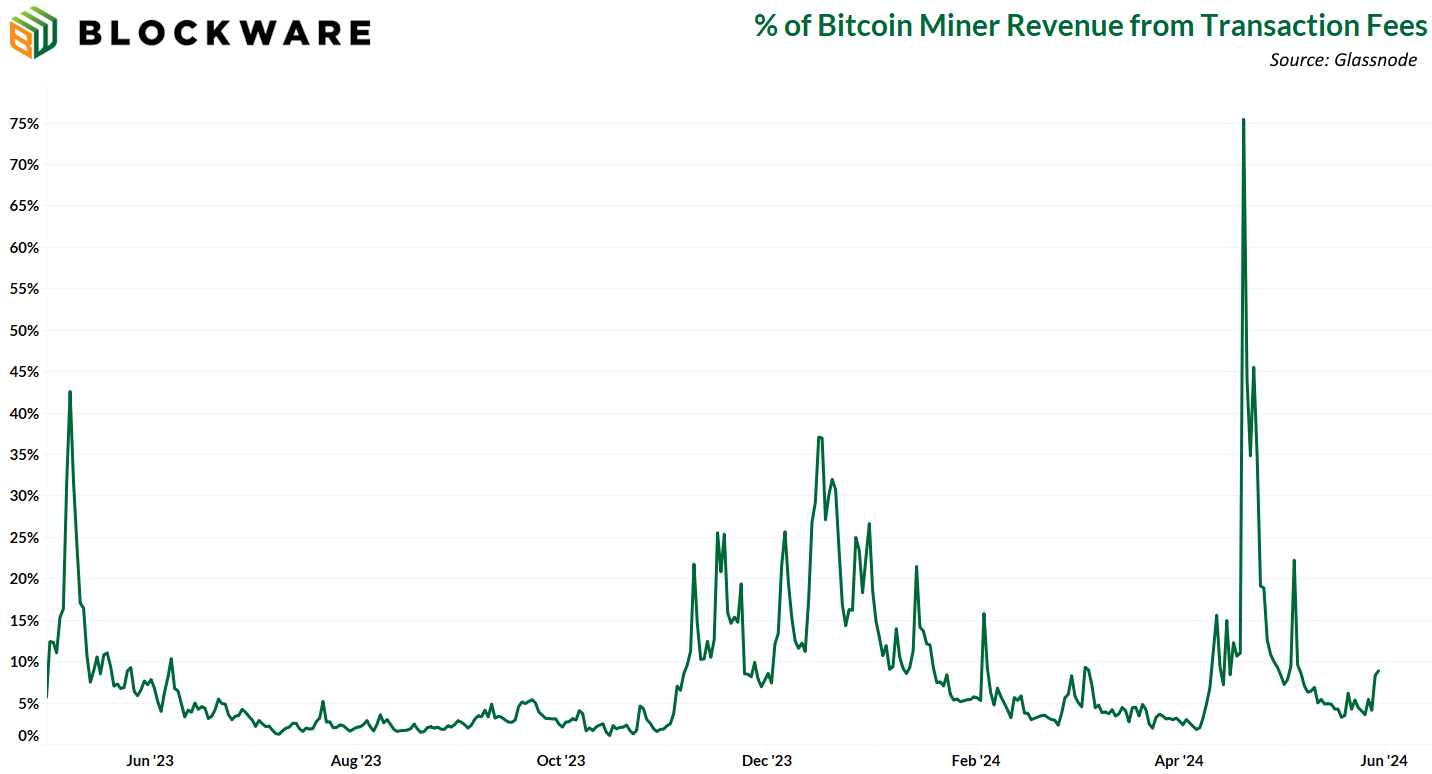

11. Transaction Fees as % of Block Reward

The price of Bitcoin rising over the past month has, of course, been a factor in the rising hashprice. But now we’re also seeing the first bump in transaction fees since the post-halving inscription mania calmed down. Fees as a % of the total block reward are up to ~8% the past day, and the rate to get into the next block (at the time of writing) is roughly 69 sat/vByte.

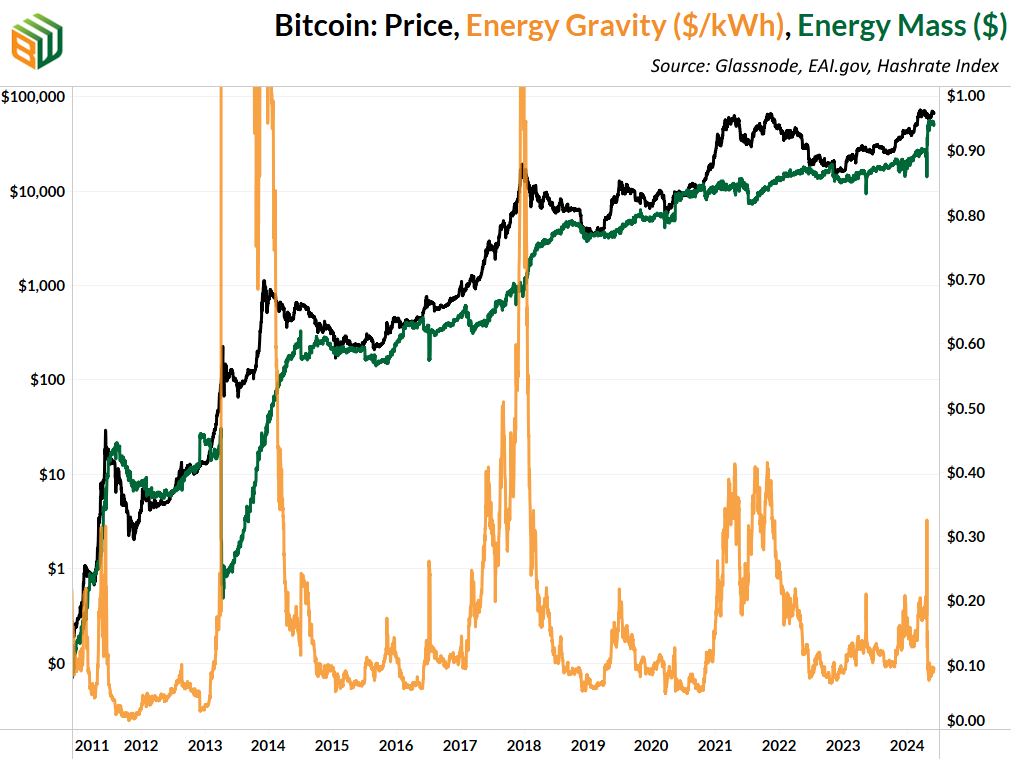

12. Energy Gravity:

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$52,012 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.