Blockware Intelligence Newsletter: Week 176

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/10/25 - 5/17/25

Your money can buy more Bitcoin than you think.

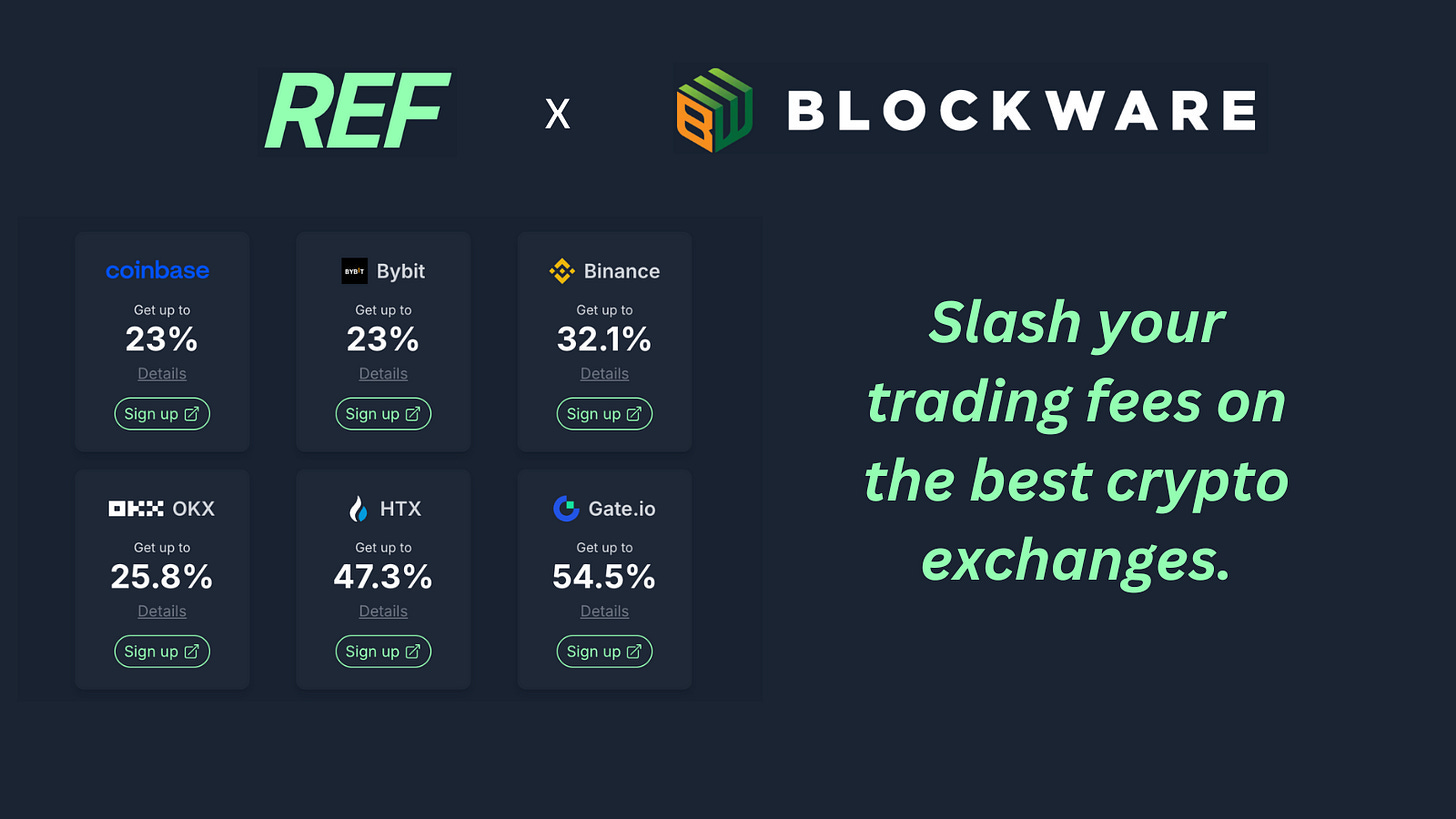

Slash your trading fees on the biggest exchanges like Coinbase, Binance, Bybit + more. Blockware has partnered with REF to offer you incredible trading fee discounts.

Get up to 54% off when you join REF here: theREF.io/a/blockware

CBI and Blockware Enter Strategic Bitcoin Mining Partnership with $10M Deployment Plan

Blockware, on behalf of CBI, will deploy and manage next-generation Bitmain ASIC miners on the Bitcoin network.

CBI will finance the first US$10 million tranche of the mining rig investment in stages, as the necessary funding is secured.

Bitcoins mined by CBI enables the acquisition of Bitcoin at a cost below market price.

Blockware to receive partial compensation in CBI shares and intends to reinvest a portion of its profits into additional CBI equity. The final ownership stake will be determined by the business’s performance over the coming years.

CBI (ALCBI:PA) is up more than 170% in the days following this announcement. Investor excitement about the ‘Corporate Bitcoin Treasury Strategy’ is not exclusive to merely direct purchases – CBI’s mining partnership with Blockware has been received similarly by the market.

For public (or private) companies looking to use Bitcoin mining as a way to accumulate a Strategic Bitcoin Treasury (acquire BTC at a discount over time), it makes far more sense to mine with a hosting partner such as Blockware rather than to invest in your own infrastructure and operations. It takes far less time and capital to execute the strategy.

Moreover, one of the main benefits of a Bitcoin Treasury Strategy is that it can turn a company's stock into a levered-Bitcoin play. This hasn’t been the case for many “mining” companies because far more of their capital is tied up in data center infrastructure than it is in Bitcoin Mining hardware or BTC. By purchasing hosted ASICs directly – rather than the infrastructure itself – CBI’s balance sheet becomes far more exposed to BTC price action than it otherwise would.