Blockware Intelligence Newsletter: Week 121

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 2/17/24 - 2/23/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

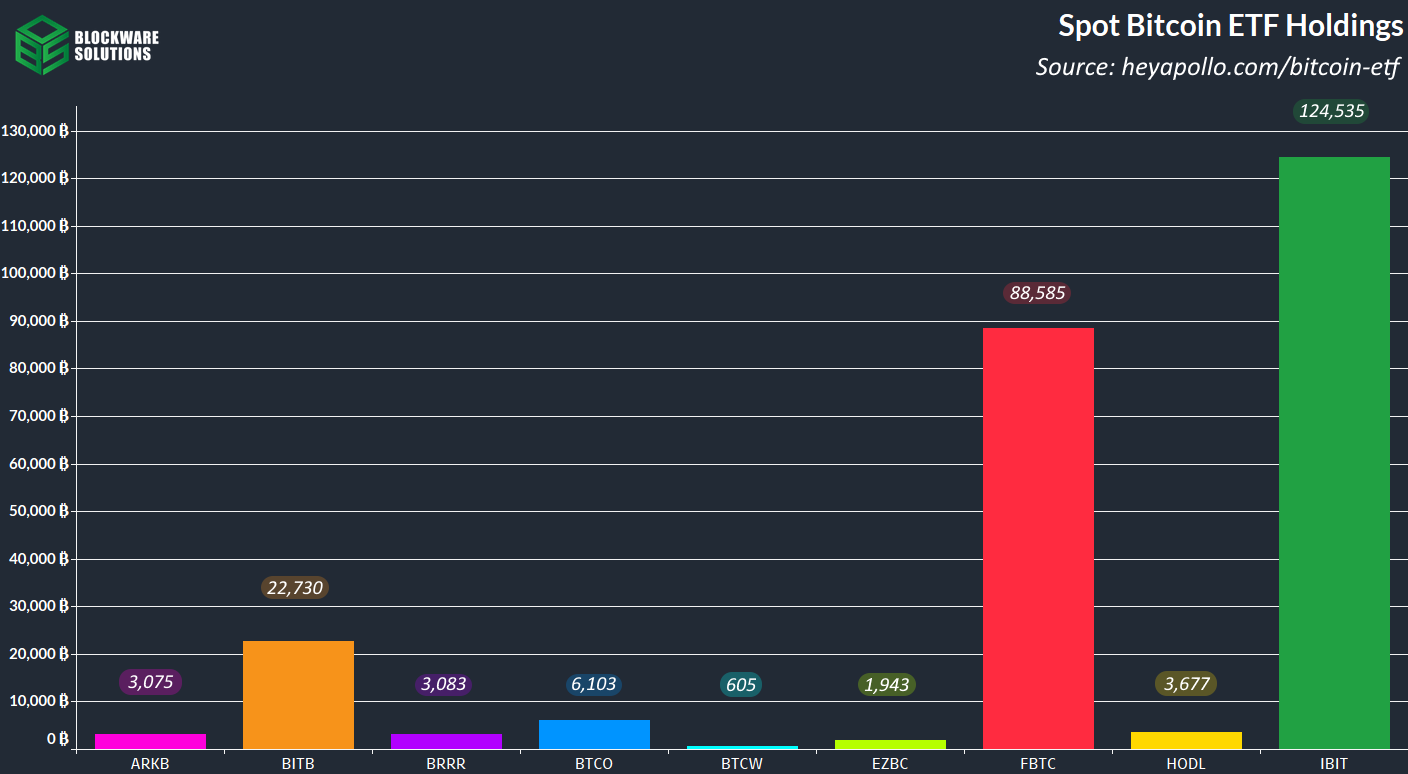

1. Bitcoin ETF Flows:

Total spot Bitcoin ETF holdings have reached ~281,000 BTC (~$14.3 billion). This is nearly 50% more BTC than the total holdings of Microstrategy. Blackrock and Fidelity are leading the charge with 124,535 & 88,585 BTC under management respectively. Daily flows have remained consistently positive; a new cohort of passive BTC allocators has been unlocked. The bullishness of these ETFs cannot be understated.

That being said, holding Bitcoin for yourself has a superior set of trade-offs. Zero annual fees, zero custodial risk, 24/7 access to funds.

Source: https://heyapollo.com/bitcoin-etf

2. GBTC Outflows:

Genesis Global Holdco, a subsidiary of Digital Currency Group (DCG), has been cleared to unload ~$1.3 billion worth of GBTC shares in the wake of a bankruptcy court ruling. However, this is having a negligible impact on total GBTC outflows as well as the price of bitcoin.

Source: https://heyapollo.com/bitcoin-etf

General Market Update

3. Consumer Price Index. CPI is far from perfect when it comes to measuring the changes in pricing in the economy. “Inflation is a vector” - Michael Saylor. The price of goods in an economy responds to changes in the money supply at different rates. Moreover, the goods included in this basket are not necessarily representative of an American’s spending habits.

That being said, the Fed uses CPI as one of its primary metrics for measuring inflation. The year-over-year change in January came in at ~3.1% CPI remaining stubbornly above the Fed’s 2% target, and has, yet again, shifted expectations of Fed Funds Rate cuts further into the future, with the first cut expected to occur at the June Fed meeting.

4. Treasury Bond Yields. In the wake of persistently high inflation, bond investors lost their appetite at this week’s treasury auctions. Yields have risen across the board during the second half of this week as investors are weary about locking into fixed income given inflationary expectations. Zooming out, treasury yields are up significantly from their December bottom, especially on the long end of the curve.

5. Real Fed Funds Rate. With CPI coming down, the Fed keeping rates where they are means monetary policy is still restrictionary in nature, as real rates are rising. The effects of “higher for longer” are taking longer to stranglehold the economy than many analysts forecasted. We’ll continue to monitor employment & manufacturing data to gauge for signs of recession.

6. Purchasing Managers Index: Speaking of manufacturing, the PMI rose from 50.7 in January to 51.5 in February, signaling a positive outlook on the economy from manufacturers. Declining PMI & PMI < 50 has typically been a recessionary indicator, but that has yet to play out despite the sharp drop in PMI in 2022.

7. NVDA. Strong earnings from Nividia on Wednesday single-handily pushed the US stock market up; with both NASDAQ and the S&P boasting strong performances at the market close on Wednesday as well as off-hours from Wednesday to Thursday. The hype surrounding AI has not subsided, and it’s clear that Nvidia is profiting off of these advancements in technology

Bitcoin On-Chain / Derivatives

8. Short-Term Holder Cost Basis (Realized Price): The cost-basis of coins last moved on-chain within the past six months has served as a nearly flawless support level during previous Bitcoin bull cycles. Following a successful rebound in January, short-term holder realized price continues to climb up. During bull markets, short-term holders tend to defend their cost-basis by “buying the dip.” During bull markets, so long as BTC stays above this metric, you can reasonably expect positive short-term price action.

9. % of Supply Last Active 1+ Year(s) Ago: Revisiting one of our favorite metrics, again, the HODL waves. Despite the bullish price action of the past 12, 6, and 1 month(s), the BTC supply remains incredibly inelastic. Until HODL waves begin to roll over as we saw during the 2017 & 2021 bull markets, there’s minimal reason to flip bearish on BTC in the medium term. The wave of demand from the ETFs is facing an immovable wall of illiquid supply; price will respond accordingly.

10. ETH/BTC: After finding support at ~-.05, ETH priced in BTC has rebounded and is attempting to fight its post-merge downtrend. Retail market participants are anticipating approval of an ETH ETF, however, that’s a far more complicated proposition than a Bitcoin ETF, given the drastically different decentralization profile of the two assets. Given the incessant inflows into BTC from institutional investors, it’s unlikely that ETH/BTC can gain any significant steam off of ETH-retail flows alone.

Bitcoin Mining

11. Ethiopian Bitcoin Mining: Ethiopia has joined the ranks of Nation-States mining Bitcoin. At this point, it’s illogical and financially irrational to not mine Bitcoin if you have access to abundant sources of energy. The global competition to monetize otherwise-stranded energy, and secure a slice of the remaining 21,000,000 BTC continues.

Source: Forbes

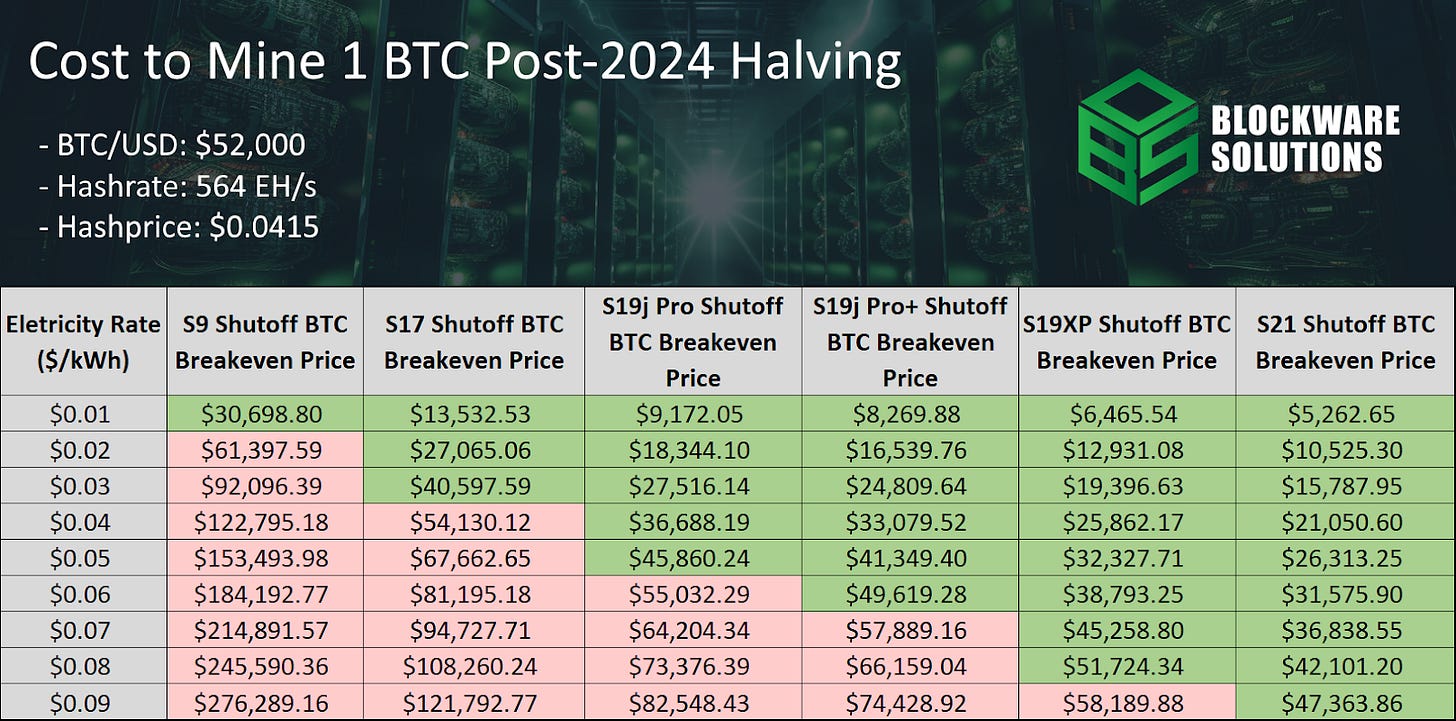

12. Cost to Mine 1 BTC Post-Halving: The chart below shows the breakeven cost of Bitcoin mining rigs post-halving.

Assumptions:

3.125 BTC block subsidy

$52,000 per BTC

564 EH/s

$0.0415/Th/Day

Miners using the following machines must be at or below the following electricity rates to remain profitable post-halving:

S19j Pro (104 Th/s, 30.5 W/Th): $0.05

S19j Pro+ (120 Th/s, 27.5 W/Th): $0.06

S19 XP (141 Th/s, 21.5 W/Th): $0.08

S21 (200 Th/s, 17.5 W/Th): $0.10

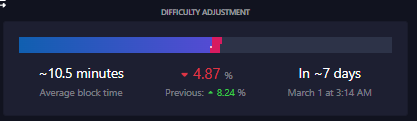

13. Mining Difficulty: After a hefty 8.24% increase, the next difficulty adjustment is forecasted to be a decrease. We’re now less than two months away from the 2024 Bitcoin halving; and only four more difficulty adjustments will occur between now and then.

14. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$26,463 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Top tier newsletter 🔥💯🚀

Big thank you to the team.

Have been following up for more than 3 years now.

Always great quality content.