Blockware Intelligence Newsletter: Week 112

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/25/23 - 12/01/23

1. Blockware Intelligence Podcast. Mitch Askew interviews John Haar of Swan Bitcoin. Before working at Swan, John spent 13 years at Goldman Sachs; working across various departments. John describes his experience transitioning from TradFi to Bitcoin, and what he thinks TradFi people fail to understand about Bitcoin. Mitch and John dive deep into macro, the problems with Keynesian economics, the many bullish Bitcoin catalysts that are looming, and more!

General Market Update

2. PCE Inflation (YoY). The Fed’s favorite inflation metric rose by 0.2% last month and 3.5% on a yearly basis. To the surprise of very few, disinflation continues to be a defining factor for the market in Q4. For bulls, this piece of data combined with several other deteriorating macro metrics point towards an impending pivot for Fed policy.

3. Median New Home Sale Prices. One of the more interesting charts being discussed recently has been the pricing on new home sales. While it’s obviously too soon to say with confidence, it appears we’re on the front-end of a relatively significant decline in residential real estate prices. The hard impacts of historically high debt servicing costs are likely to be a defining factor for 2024.

4. 10-Year Treasury Yield. With the futures market currently expecting the first rate cut to come in the first half of 2024, we’ve seen a broad-based decline in Treasury yields across the curve in recent weeks. As you may know, declining yields tend to bode well for risk assets as the discount rate falls.

5. S&P 500 Index. It’s hard to believe, but the S&P now sits ~5% below ATHs. With breadth still narrow, AKA names like Apple and Microsoft leading the rally, all eyes go to the small-caps to signal a true start to a bull market. If you’ve missed this rally, this may not be the time to jump in. The indexes are extended, and pullbacks will provide opportunities to position into the high fliers.

Bitcoin Exposed Equities

6. Cleanspark (CLSK). Following JPMC’s report naming CLSK their favorite of the public miners for growth, we’ve seen continuous outperformance in their price action. This has culminated this morning, as CLSK is now up over 20% on the day at the time of writing. Institutional investors are clearly bullish on the future of hashprice in 2024, and CLSK is a clear leader after being up nearly 83% in the last 2 months.

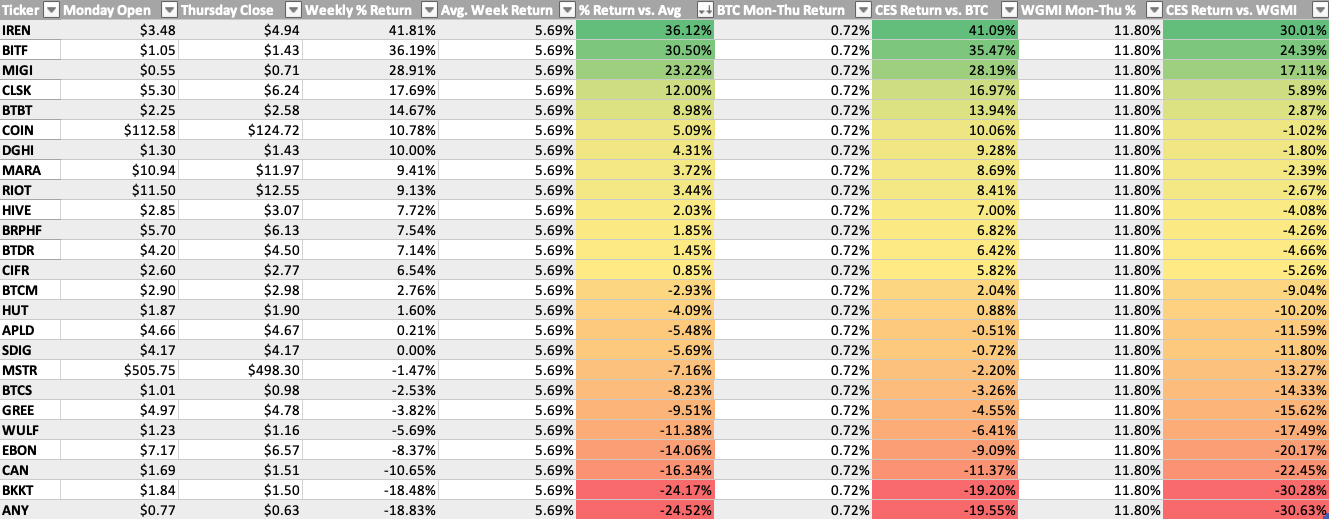

7. BEE Comparison Table. Per usual, the table below breaks down the Monday-Thursday price performance of several Bitcoin Exposed Equities. This sheet doesn’t include Friday’s price action, and we’re still seeing strong outperformance from several names. IREN, BITF, and CLSK all stand out.

Bitcoin Technical Analysis

8. Bitcoin/USD. Bitcoin has continued to show extreme strength as price has broken through to new YTD highs this morning. If price can hold above ~$38.5k, we could very well see prices at or above $40k this weekend. Notice the green volume candles at the bottom of this chart, this spot bidding is clearly institutionally driven.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

Bitcoin On-Chain / Derivatives

9. BTC Correlation Coefficient with $SPX: A prevailing narrative, particularly within traditional finance circles, throughout this cycle, suggests that Bitcoin correlates with risk assets, a notion supported by historical trends. However, those well-versed in Bitcoin's fundamentals recognize it as far from a "risk asset." With endorsements from BlackRock and Fidelity, the broader market is gradually acknowledging this truth. The 5-year correlation coefficient between BTC and the S&P 500 index, commonly employed as a gauge for risk assets, is notably weak, standing at just 0.17.

10. Short-Term Holder Realized Price: Long-time newsletter readers will know that the cost-basis of short-term holders is one of our favorite metrics for analyzing the current trend/momentum of the BTC price; this metric has historically been a support or resistance level when BTC is above or below it respectively. Since breaking the resistance in October, BTC has held well above STH-RP(~$32,000 and rising) over the past few weeks.

11. Price Performance Since Cycle Bottom: BTC is up ~2.3x from the cycle low of ~$16,000. Juxtaposing with the price performance during previous cycles you can see that BTC still has plenty of room to run. All of that has allowed BTC to rise off the bottom, most notably illiquidity on the supply side, to remain intact.

12. % Supply Available: This metric shows the percentage of the circulating BTC supply that is held on exchanges or in other active on-chain addresses. This metric continues the downtrend that has defined this epoch, reaching ~21%, a level not seen since 2016. Now, it’s not possible to know the exact true amount of supply available, available in the sense that the users holding these coins are willing to sell at a certain price. However, the trend of this metric is what matters. And the trend is that coins are increasingly moving to addresses that have zero historical precedent of relinquishing their holdings; a trend that historically leads to significant price appreciation. The question is: how much price appreciation will have to happen to incentivize these HODL’ers to let go of some of their stash?

13. HODL Waves: Here’s a further illustration of the supply-side illiquidity. In spite of the fact that BTC is up 116% from where it was this time last year, ~71% of the Bitcoin supply has not moved in a year or longer (an all-time high).

14. Perpetual Futures Open Interest (Market Cap Adjusted): The growth in price over the past few weeks has not been met with a proportionate increase in futures open interest; open interest as a % of BTC’s market cap is at its lowest level since April 2022. High degrees of open interest can increase BTC’s volatility, both up and down, as it can trigger short-squeezes and long-liquidations respectively. However, the supply illiquidity means that BTC can still experience extreme volatility to the upside if/when there are demand catalysts, a decrease in the amount of open interest within the market lowers the possibility of extreme downward volatility while the potential for massive, face-melting moves to the upside remain highly possible.

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

Bitcoin Mining

15. Oceans Mining Pool: On Tuesday Jack Dorsey and Luke Dashjr launched a new mining pool called Oceans; with a stated mission to “radically decentralize Bitcoin mining.”

For those that are unfamiliar, mining “pools” are when Bitcoin miners combine their hash power in order to increase their chance of mining blocks. Due to the highly competitive nature of Bitcoin mining and the difficulty adjustment mechanism, an individual miner has an extremely low likelihood of being the one that finds the correct hash first, adding a block to the ledger and earning the 6.25 BTC block subsidy + transaction fees. The combined hash power of mining pools allows miners to earn consistent rewards proportional to the amount of hash power each miner contributes, with the pool provider incurring the risk of finding blocks in exchange for a small fee.

The status quo of Bitcoin mining pools has a few flaws as it pertains to trust and decentralization, which Oceans mining pool is purporting to solve:

Custodial Payouts

Block Templates

Transaction Fees

15. Custodial Payouts. Ocean’s is unique in that miners contributing hash power to this pool receive their rewards directly from the coinbase transaction of the Bitcoin network. The coinbase transaction (not to be confused with the company Coinbase, from whose name is derived from this feature) is the transaction in which the mining rewards (BTC block subsidy + transaction fees) are sent to the miner that added that block to the ledger. The current structure of mining pools is custodial in this manner. The pool operator receives the coinbase transaction before distributing mining rewards to its contributors once they reach a certain threshold.

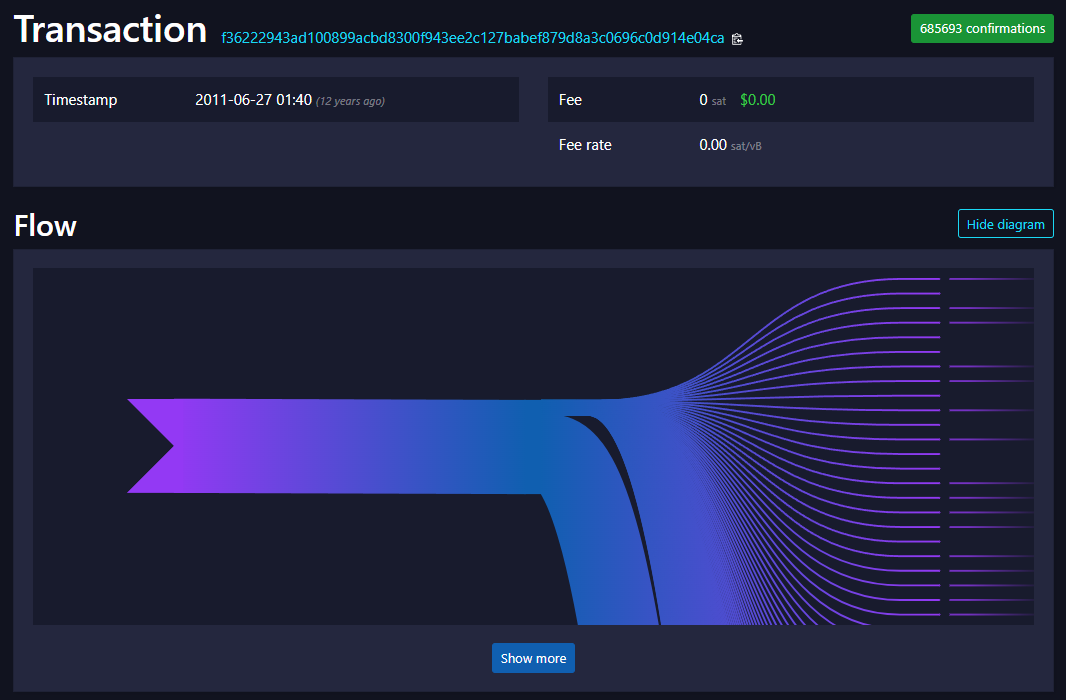

Below is an example of the coinbase transaction from Oceans mining pool; you can see the many outputs going to over 700 different hashrate contributors. As of right now, the minimum threshold for receiving payouts through Oceans is .01048576 BTC (~1,048,576 sats). Such a threshold is designed to avoid small UTXOs which can cause issues for users as well as it is a less efficient use of block space; learn more about UTXOs by watching this video we published on Monday.

16. Block Templates. When miners are working on adding a block to the blockchain, they can choose which transactions they want to include in that block. With the current pool structure, pool operators are able to obfuscate what transactions are in the block while miners are hashing to solve the block; hashrate contributors won’t see what the block looks like until it gets mined. This leaves the door open for pool operators to censor certain transactions from being included in blocks. With Oceans each miner will get to build their own block templates, including the transactions they want to include.

17. Transaction Fees. Lastly, as mining economics makes the transition to a 100% fee-based revenue model, ensuring that miners are properly compensated for transaction fees is critical. Fees are not 100% predictable and the current structure of mining pools, even FPPS pools which compensate payout miners for transaction fees as well as the block subsidy, relies heavily on trust. Miners are paid out according to the hash they contribute and fees are paid out according to the expected fee rate over a certain period and not based on the actual amount of fees that are included in the blocks that the pool mines. The non-custodial payout of mining rewards ensures that miners contributing hash to the oceans pool receive 100% of their share of transaction fees, without having to trust the pool operator to compensate them if fees end up being higher than what was expected.

18. Update: Oceans Block Mined

The aforementioned paragraphs were written Thursday afternoon, as we sit down to edit on Friday morning we have to update that Ocean’s has mined a block.

It appears that the rewards from the coinbase transaction were not immediately sent, but will be after 100 blocks.

Oceans is a fascinating development in the Bitcoin mining industry, and we’ll continue to update our readers as their story unfolds.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.