Blockware Intelligence Newsletter: Week 8

Is the worst behind us?

Dear readers,

Hope all is well. With September soon behind us, which has historically been bearish for BTC, we now head into Q4. Q4 is skewed bullish as 6 out of 10 (60%) of Bitcoin’s quarterly candles have been positive. Let’s dive into some interesting trends from this week. PS: Blake did a longer than usual section on Bitcoin-related equities in the latter half of the letter, be sure to check it out.

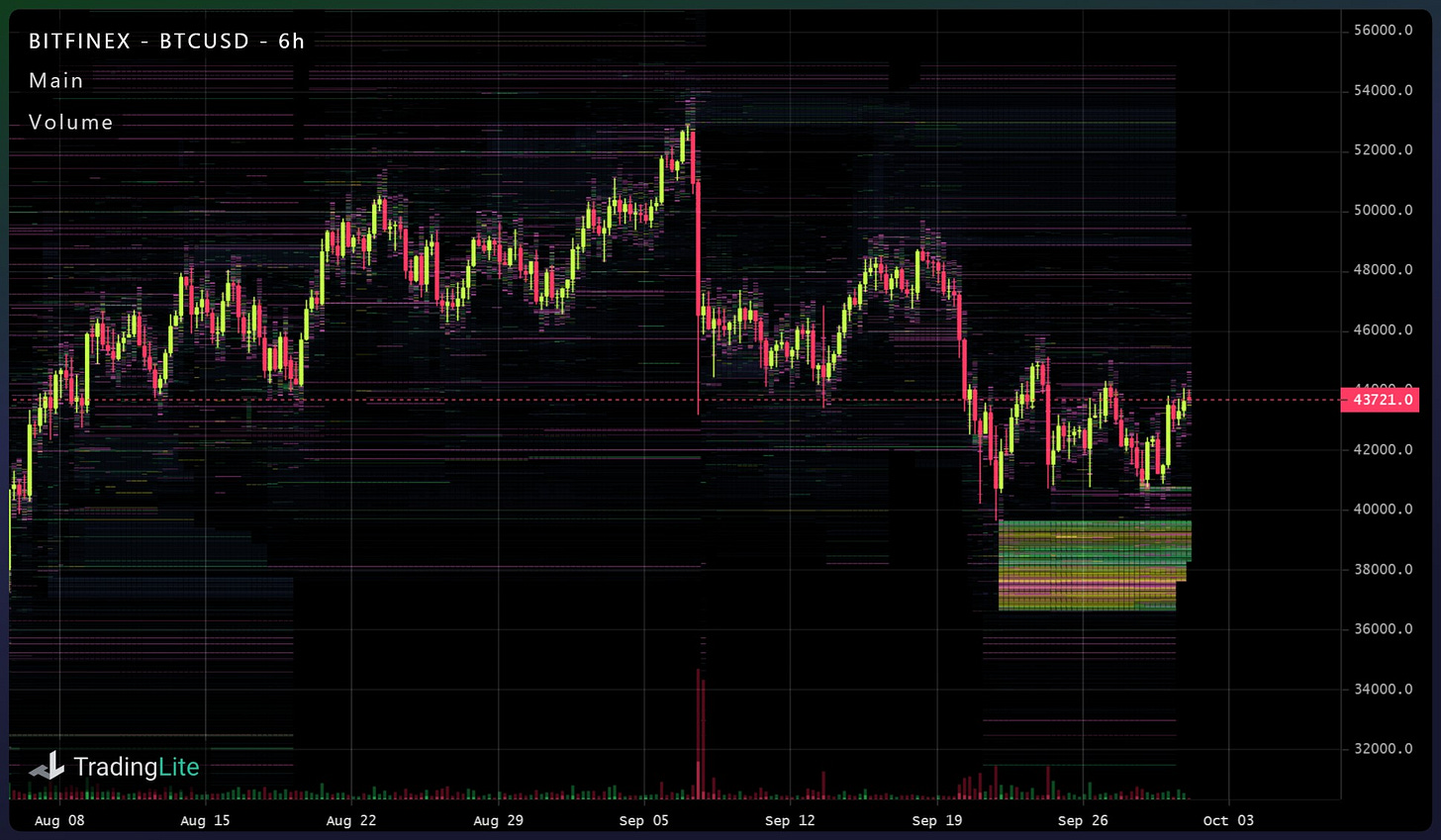

Let’s start with this chart, which is a heatmap of the order book on Bitfinex. There are a large number of bids set between $40K and $36K, one of the largest buy walls seen since going back to mid-2020. (Just FYI this is also confluence with my on-chain floor model that is around $39K)This is important to keep in mind for a few reasons. The bull case of this of course would be that some bull whales have set a concrete floor. The bear case however is a bit more nuanced. Large walls of bids or asks can be used to trick other market participants into providing the market participant(s) that have placed the wall liquidity. For example: Whale(s) set a buy wall, other market participants buy right above (front-run) the wall, because who would sell into a giant wall of bids?… Right? Meanwhile, the whale(s) are using that liquidity generated above the bids to unload their positions. The same could be said conversely with sell walls, which could actually be psyops to generate liquidity for entering longs.

Not saying the bids are psyops, as some of the bids actually began to fill a few days ago. Just something to keep in mind.

SOPR is a ratio of the profit that coins hold on each given trading period, using aSOPR adjusts for outputs under an hour. For this week I also added a 7 day moving average, in other words making this weekly aSOPR. Have gotten that bounce off 1, now want to see follow through.

Next we look at our entity flows, comparing the behavior of different market participants separated into cohorts based on the size of their holdings. Whales have been buying since late July. Shrimp, crabs, fish, & octopus have been stacking harder than ever. The only cohort that has been on a decline is the 100-1K cohort, which has just recently started increasing their holdings as well.

So where are those coins coming from? And who has been doing the selling over the last few weeks? The first answer is that coins have been coming off exchanges. Exchanges are down 2,869 ($134M) this week, down 62,251 BTC ($3.2B) this month. At the same time we’ve seen BTC continually locked up by entities with low spending behavioral, meaning they are statistically unlikely to sell the BTC they take in.

Note: This chart was created last night, so price isn’t perfectly updated here.

I try to add in my own personal creations to these letters to give you guys some unique information. You’ve seen my illiquid supply shock ratio which is now used by other analysts like Willy Woo, my illiquid supply floor model, now here’s another new one. This is titled Delta Valuation model. Delta cap (conceptualized by David Puell) takes the difference between average cap (all-time moving average of BTC) and realized cap (average price investors paid for their coins, essentially an on-chain VWAP). This has caught macro bottoms quite nicely, but when taking a multiple of this, the tops are caught just as nicely. Taking the mean between the top and bottom cap’s you get the middle blue line. This has been an important level for Bitcoin’s price to interact, serving as resistance to the 2019 mini bull market.

The main potential bearish case from an on-chain perspective revolves around the transactional activity around the network. Things like transaction count, the mempool, overall volume, and active entities are all low. This could be seen as bearish because there is low demand to use the network. However, the counter to that argument would be that speculative market participants are gone (also reflected by google search trends), batching done by exchanges, or also TXs are starting to migrate to the lightning network.

On that same note about the lightning network, check out this growth. Lightning network capacity and average channel size are both going parabolic, as number of channels and number of nodes continue to climb. Here at Blockware we are very bullish on the lightning network, as it is crucial for Bitcoin to inevitably shift to a medium of exchange.

Lastly, let’s take a peek at what’s going on with miners. Orange is hash rate, blue is difficulty. The difficulty adjustment was one of Satoshi’s greatest accomplishments, as it keeps issuance in check with the amount of energy securing the network. When hash comes back on the network, we see positive difficulty adjustments, when hash comes off the network, we see negative difficulty adjustments. Recently BTC has had 5 straight positive difficulty adjustments, the first time since February 2020. This shows just how quickly hash rate continues to come back online following the Chinese miner migration.

Bitcoin-related Equities: written by Blake Davis

The price action we’ve seen in tech stocks as of recently went from bad to worse this week. Below I’ll give two ways of analyzing the current market depending on how you personally invest (spoiler alert they give us the same answer).

Fundamental investors like to study relationships to ask themselves why this price action is happening. By examining the correlation between interest rates and bond yields we can try to explain why we’re seeing technology stocks sell-off in favor of commodity stocks. On Monday, we had news from a few federal reserve officials who are in support of scaling back the COVID era policies the fed has implemented for the last year and a half. The fed hiking interest rates is a sign of confidence in a strong economy, one with plenty of profitable avenues to invest. Because of this, bond investors would like to see a greater current yield on their notes (more profit as a % of their price). With this, liquidity moves from higher-risk growth names into the booming bond market and areas of the equity market that profit from rising yields. Bonds becoming more profitable benefits a few areas of the market that this week we’ve seen outperform growth. Commodities like gold and oil move indirect relationship with bond yields and financial firms increase their interest revenue with rising rates. It appears that for now, tech stocks need a break from leading the market.

The best part about using technical analysis is that understanding the bond market and macroeconomics, while it can be helpful, isn’t totally necessary. For investors who use technicals, the reasons why prices may be trending one way doesn’t matter. Trying to define why the market is behaving the way it is can make people emotional when it doesn’t do what they’re convinced it should. Technical analysts care only about price, volume and how we react to the changes in them we see in front of us. The impact of bond yields on the stock market can be seen through clues left on a chart of price and volume. By going through a variety of charts, we can see money leaving growth stocks in the form of big breaks of support levels and longer-term moving averages on large volume. On the contrary, we can see explosions of volume in commodity and financial names as they breakout to the upside. Growth stocks have had a big run the last few months and many names were quite extended from their last bases. The stock market works cyclically with September historically being a tough month, so this current sell-off shouldn’t come as too much of a shock. Stocks are like people, we squat down before we jump up. It looks to me like things are lining up for a big end of the year.

A general market correction is a great time of the year to sit back and observe price action. Once you know some of the things to look for we can determine the names being accumulated at these levels and avoid the names being sold too aggressively. Let’s take a deeper dive into the crypto stock that is outperforming the rest of the industry group this week.

Silvergate Capital (SI)

Silvergate Capital is the crypto-exposed stock that is standing out the most to me this week. By comparing this chart to other crypto stocks the difference is clear because price is king. I’ve said this before here but it cannot be overstated. There’s a ton of different metrics we can look at to judge relative strength but most of the time we are judging the price action compared to different indicators. SI began to move to lower prices around Sept. 7th alongside the general market and bounced with it last week. Instead of reversing to form another leg down, like the indexes and most of the other crypto names, it has been grinding higher. One of the first things I look at to judge relative strength is the price compared to the 10EMA, 21EMA, 50SMA, 65EMA and 200SMA. SI is above all these moving averages, while most of its industry group is below most or all of theirs. The relative strength line for SI, which compares a stock’s price movements to that of the S&P 500, is at relative highs and pointed up towards 2:00. This tells us that SI is outperforming the S&P and price is looking to enter new highs as long as demand outweighs supply at this previous resistance level. Another thing that stands out is the volume bars for Silvergate. Although price has sold off recently, on the volume bars we can see that this week there has been strong demand for SI. Jim Roppel calls these skyscrapers of blue volume. We like to see big positive volume bars and smaller negative volume, this is exactly what SI is showing us this week. There are institutions running prices up by buying lots of shares, but on red days we don’t see people dumping their Silvergate. Furthermore, the two red days this week, Tuesday and Thursday, were both upside reversals. This means that although price was down from the previous day’s close, SI closed in the top 60% of the daily range (intraday high vs. low). This is constructive price action, a sign that Silvergate was accumulated even though the price was down.

Possible dumb question for Will (or anyone else)... if a hardware wallet creates a new wallet address for every transaction, how does on-chain track wallet contents beyond a single transaction? Isn't BTC by design meant to hide this type of info - unless of course people are using the same wallet address over and over.

always a good time to buy more ₿!

... a good run in september... accumulation month. now, we grow. and profit. hold on folks!