Blockware Intelligence Newsletter: Week 142

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/3/24 - 8/9/24

General Market Update - Yen Carry Trade Implosion & Market Response

1. Strengthening Yen Triggers Market Selloff

If you follow markets, you’ve probably heard the phrase “Yen carry trade” a gazillion times this week. Let’s discuss what that is and why this caused a selloff across all asset classes.

Below are three charts:

Japan Debt to GDP

Bank of Japan Interest Rate

USD / Yen

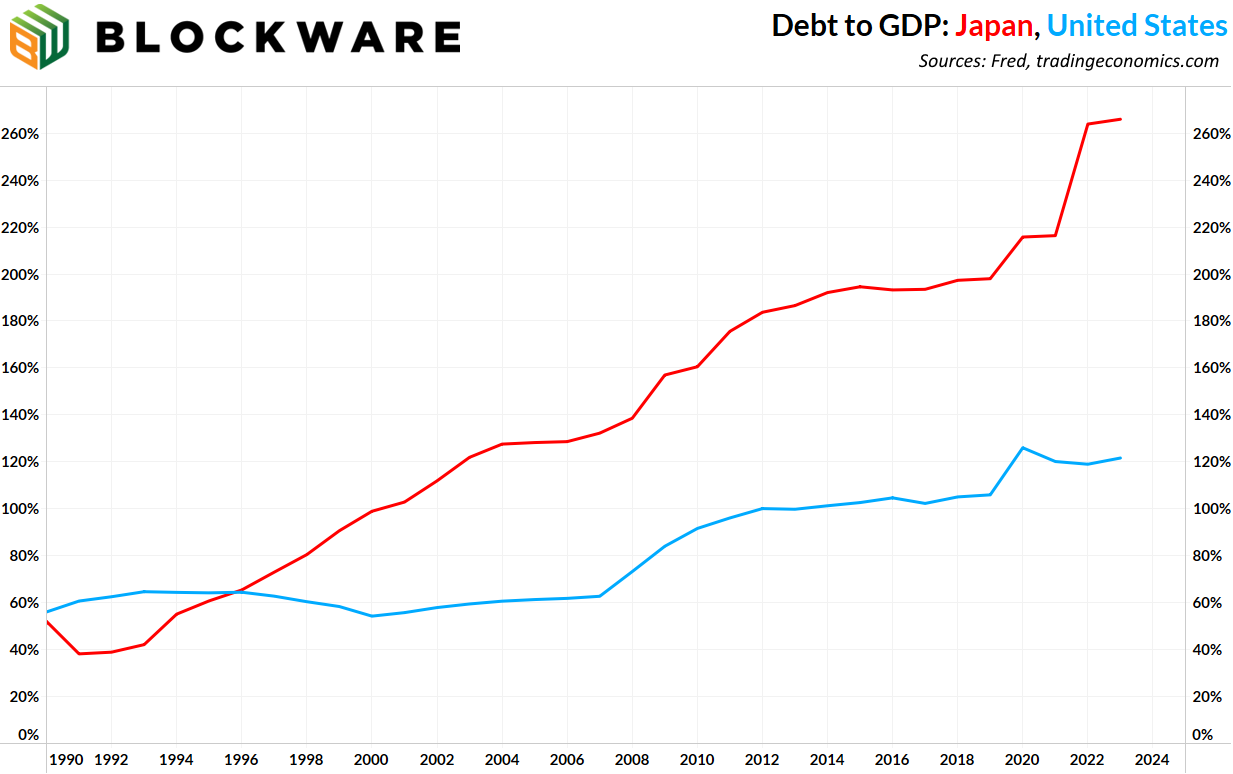

To paint a picture, Japan’s national debt situation is far graver than that of the United States. They are ~¥1.9 quadrillion in debt, with a debt-to-GDP ratio of 263%.

Japan’s version of the Federal Reserve, the Bank of Japan, has kept interest rates at or below zero for more than a decade. Low interest rates and quantitative easing allows them to service the debt in nominal terms by devaluing the Yen; a strategy known as financial repression.

Investors have taken advantage of Japan’s low interest rates by borrowing Yen to purchase other assets. A simple example of this would be to borrow Yen at a 1% rate, and then purchase US Treasury bonds yielding 4%. This has been an effective trade because, not only are the interest rates lower, but the Yen has depreciated against the dollar and other hard assets, making the principal easier to pay.

This was all going well until the Bank of Japan raised interest rates to 0.25%...

Although seemingly insignificant, going from -0.1% to 0.1% to 0.25% is a big deal - and a ripple coursed through the market. This strengthened the Yen against the dollar and investors were forced to sell assets in order to pay their Yen liabilities. A cascade effect ensued as the initial selloff resulted in margin calls on Yen borrowers, leading to further sell pressure.

In the long-term, this is nothing more than a great buying opportunity for those with liquidity, and a minor hiccup in an otherwise prudent strategy: borrowing weak, devaluing currencies to purchase hard assets. Leverage in any capacity poses risk, but the Bank of Japan’s deliberate long-term devaluation of the Yen is likely to persist. The Bank of Japan has already capitulated on their rate hikes, issuing a dovish statement to quell markets.

The fragility of debt-based monetary systems is readily apparent when a 0.25% increase in interest rates causes the largest market crash in nearly four decades. Bitcoin fixes this.

2. Stock Selloff and Rebound

US Equities gapped down at market open on Monday as the Yen carry trade implosion took hold late Sunday night during Asia trading hours. The S&P 500 has slowly recovered this week, sitting roughly ~6% off its all-time high made in mid-July, and up ~12% year-to-date.

3. S&P 500 Volatility Index ($VIX)

For perspective, this was the third largest spike in the VIX of all-time; only behind the 2008 financial crisis and the 2020 “covid crash.”

Let’s take inventory of major market events during the past few years:

2019: Repo Crisis

2020: Covid Money Printing

2021: $3 Trillion Federal Deficit

2022: Highest Inflation Rate in Decades

2023: Banking Crisis

2024: Yen Carry Trade Implosion

Hypothetically, if we were in the last days of the US Dollar, this is probably what it would look like. Got Bitcoin?

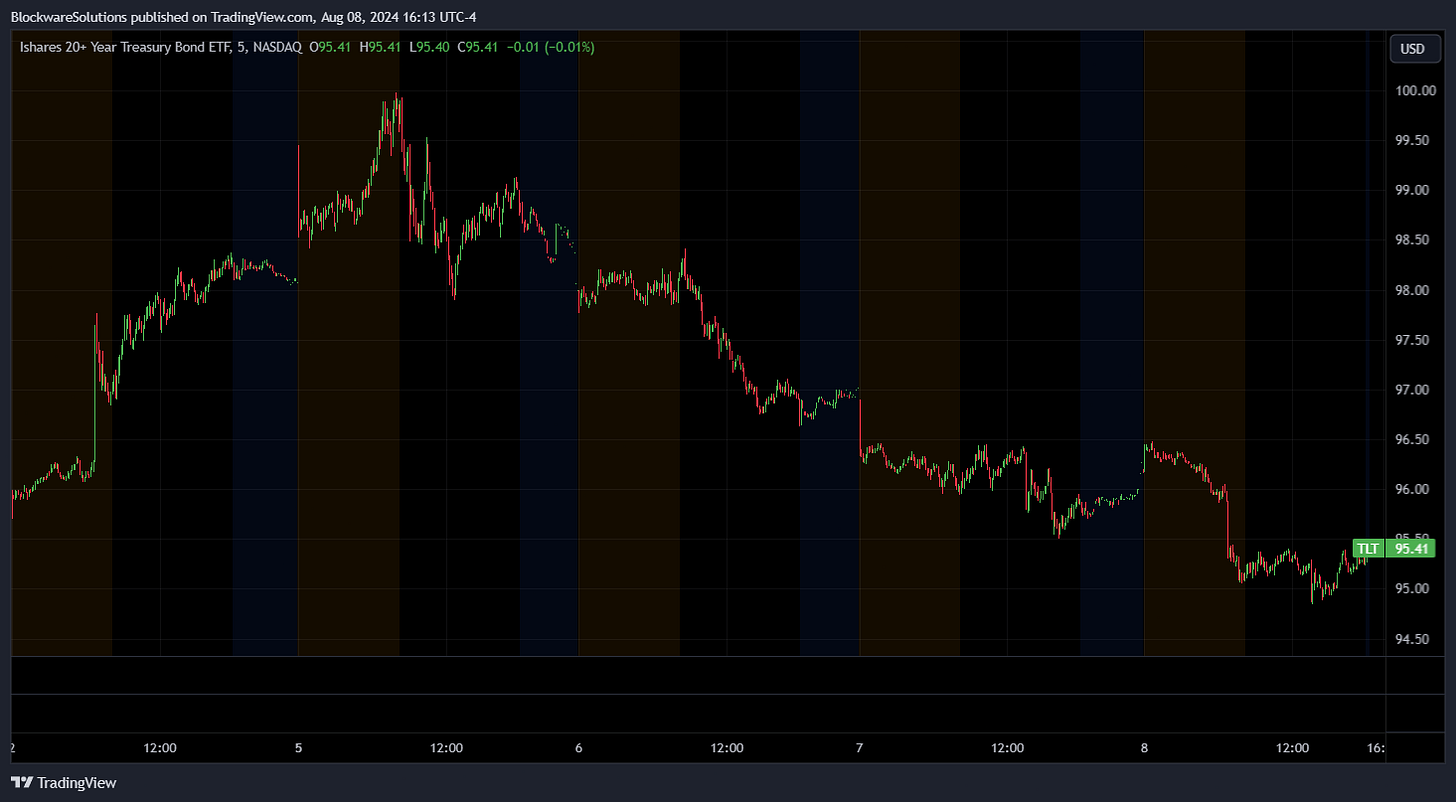

4. US Treasury Bond Selloff

Given the fears of impending recession and fragility in the foreign exchange market, you’d normally expect the world’s “safe haven” asset, US Treasury Bonds, to perform well. However, the seismic struggle for long-duration treasury bonds in the post-covid era continues. The long-duration treasury bond ETF ($TLT) has been down only all week long. After putting in a low of ~3.7%, the US 10 10-year yield is now back up to nearly 4% in just a week.

5. Yield Curve Inversion

For a split second the 10-2 treasury yield curve uninverted back into positive territory. The yield curve has been inverted since Q2 2022; uninversion is one of the most accurate recession indicators in all of financial markets.

For secure and easy-to-use self-custody, we recommend Theya:

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

Bitcoin: News, ETFs, On-Chain, etc.

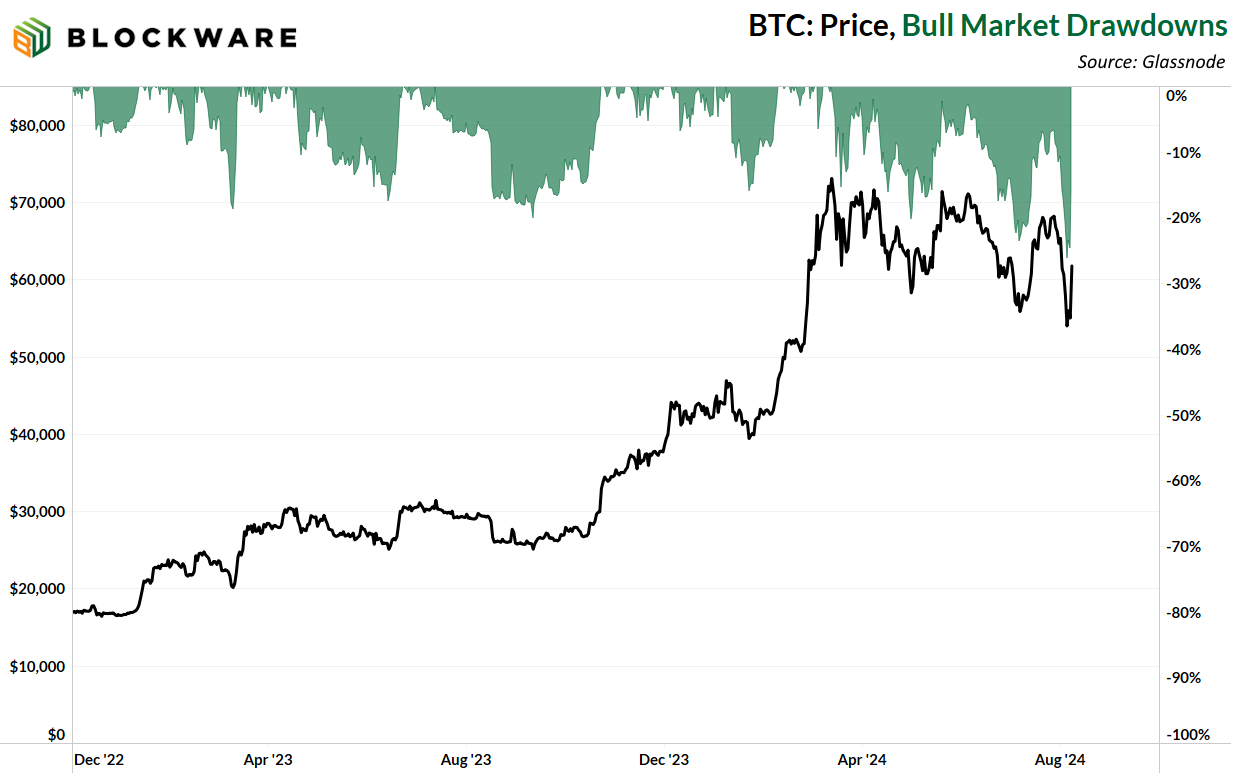

6. Bitcoin Bounces Back

Bitcoin dipped as low as $49,000 early Monday morning but is now back at $60,000; talk about a quick recovery. This was the largest correction in Bitcoin since the bear market bottom in late 2022 - with BTC dropping ~30% from its high of $74,000. As is typical with these drawdowns: weak hands were shaken out, and seasoned veterans bought the dip.

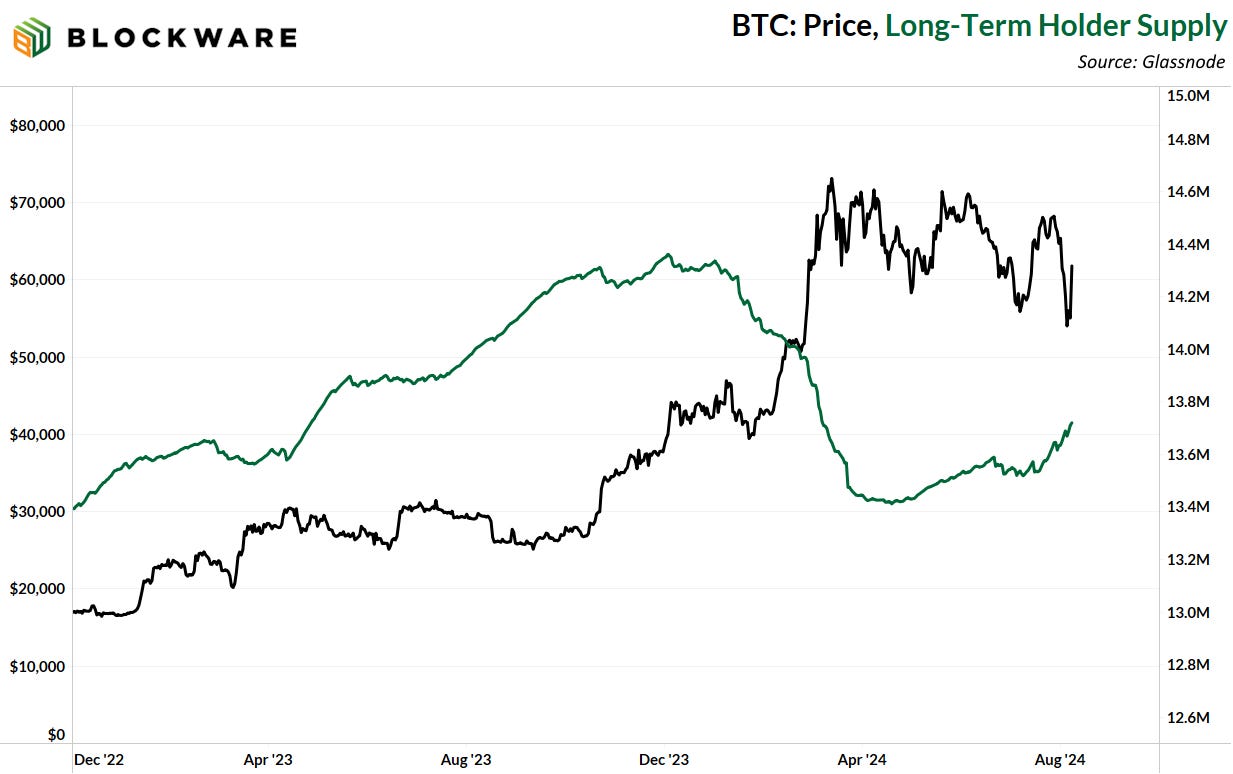

7. Long Term Holders are Accumulating

The supply of Bitcoin held by long-term holders has been steadily increasing for the past four months. Long-term holder supply trending up is bullish because it tells us that the investors who have been in Bitcoin for the longest feel that the price is undervalued where it is now, and they are accumulating accordingly. There was a slight drop in LTH supply when BTC reached all-time highs, which is typical. But that trend has clearly reversed.

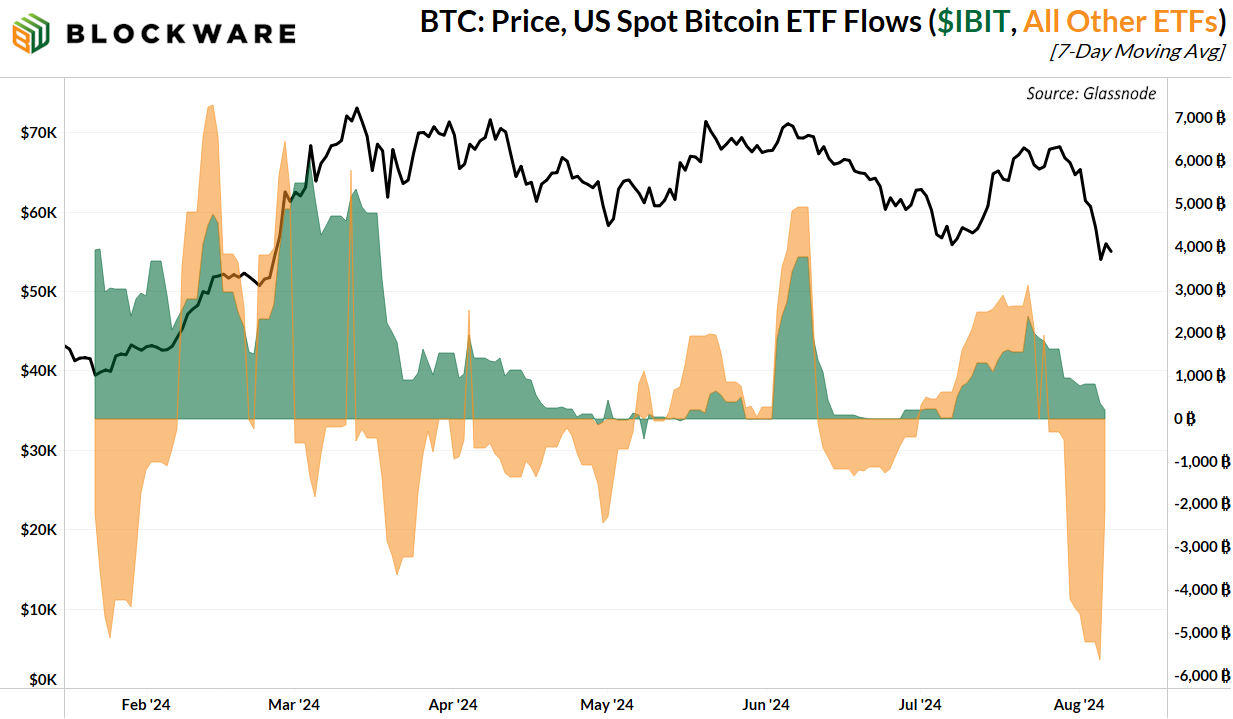

8. ETF Flows

Speaking of accumulation, here’s an interesting observation: the Blackrock Bitcoin ETF has had net inflows this week while all other spot Bitcoin ETFs have had net outflows. This is a sign that smarter money is purchasing the Blackrock ETF. While others were panic selling the dip, $IBIT holders added to their positions. In fact, there have hardly been any days of net outflows for the entire existence of $IBIT.

Perhaps these guys know a thing or two about Bitcoin…

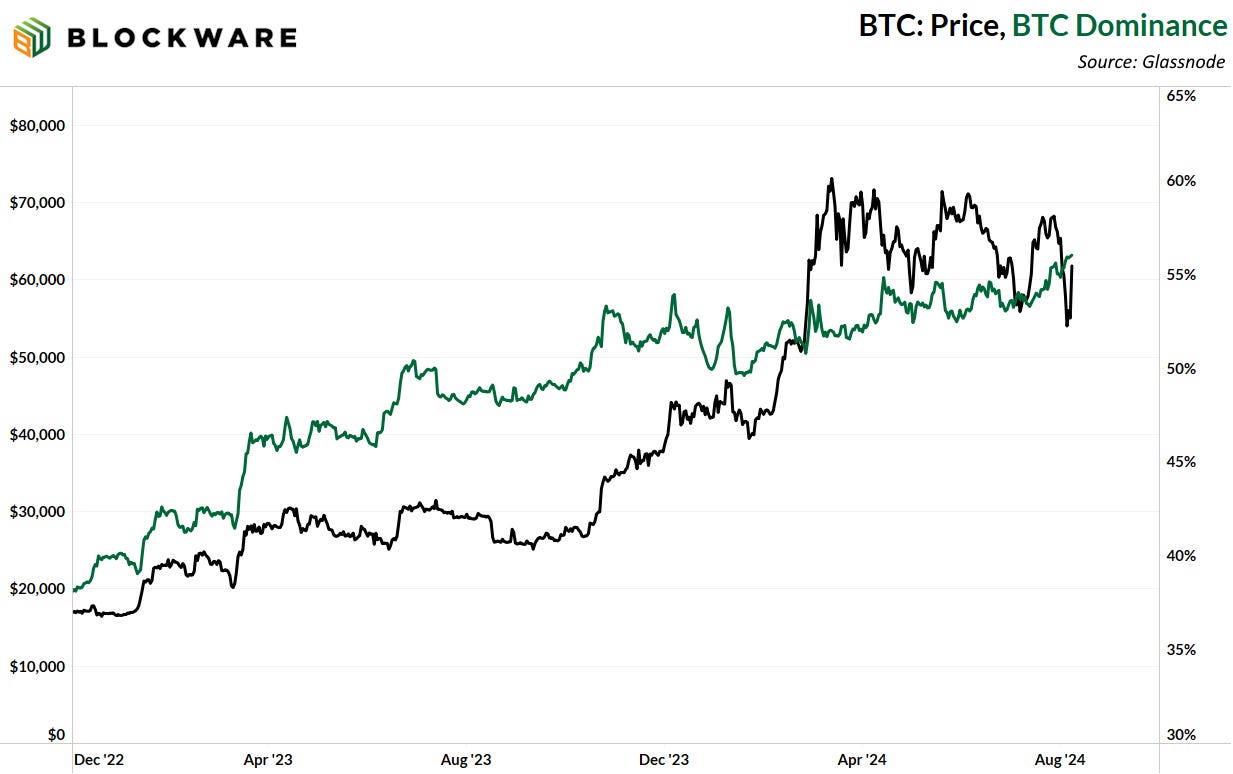

9. BTC Dominance

Bitcoin’s outperformance of alts over the past 18 months has been astounding. At the start of 2023, BTC was ~40% of the total ‘cryptocurrency’ market cap, now BTC dominance sits at 55%. This metric can be a bit deceiving, to the downside, as much of the “crypto” side of the equation can be diluted with coins whose market cap is most or entirely illiquid. However, this consistent upward trend shows that throughout all the macroeconomic uncertainty over the past year and a half, digital asset investors are choosing BTC above all else.

10. ETH / BTC

Looking at ETH performance relative to BTC is another way to gauge the performance of alts and Bitcoin; being that ETH is a gateway network for many altcoins. Despite getting a spot ETF of its own, ETH is down ~20% year-to-date when priced in BTC, and ~45% since “the merge” in September of 2022.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

11. Russia Legalizes Bitcoin Mining

Vladimir Putin signed a law this week which legalizes Bitcoin mining in Russia. This should come as no surprise given the United States’ embracement of Bitcoin in 2024 - and Trump’s commitment to “mining all Bitcoin in the United States.” Game theory is playing out, nation states are competing for stake in the Bitcoin network.

Given Russia’s abundance of energy and ostracization from the traditional financial rails (SWIFT), the Russian Government has undoubtedly already been involved with Bitcoin - mining and holding - for quite some time.

Traditional media outlets will try to spin this into a negative narrative about Bitcoin, “ruSsiAn cRiMiNals uSe iT.” Bad take - the morals and public perception of those using a technology are not indicative of whether or not that technology is objectively good. Everyone uses fire, math, language, energy, cars, etc. The United States’ Geopolitical relationship with Russia has nothing to do with whether or not Bitcoin is good for humanity. In fact, the embracement of Bitcoin by Russia means the US should start adopting Bitcoin with even more haste. This is the modern-day space race.

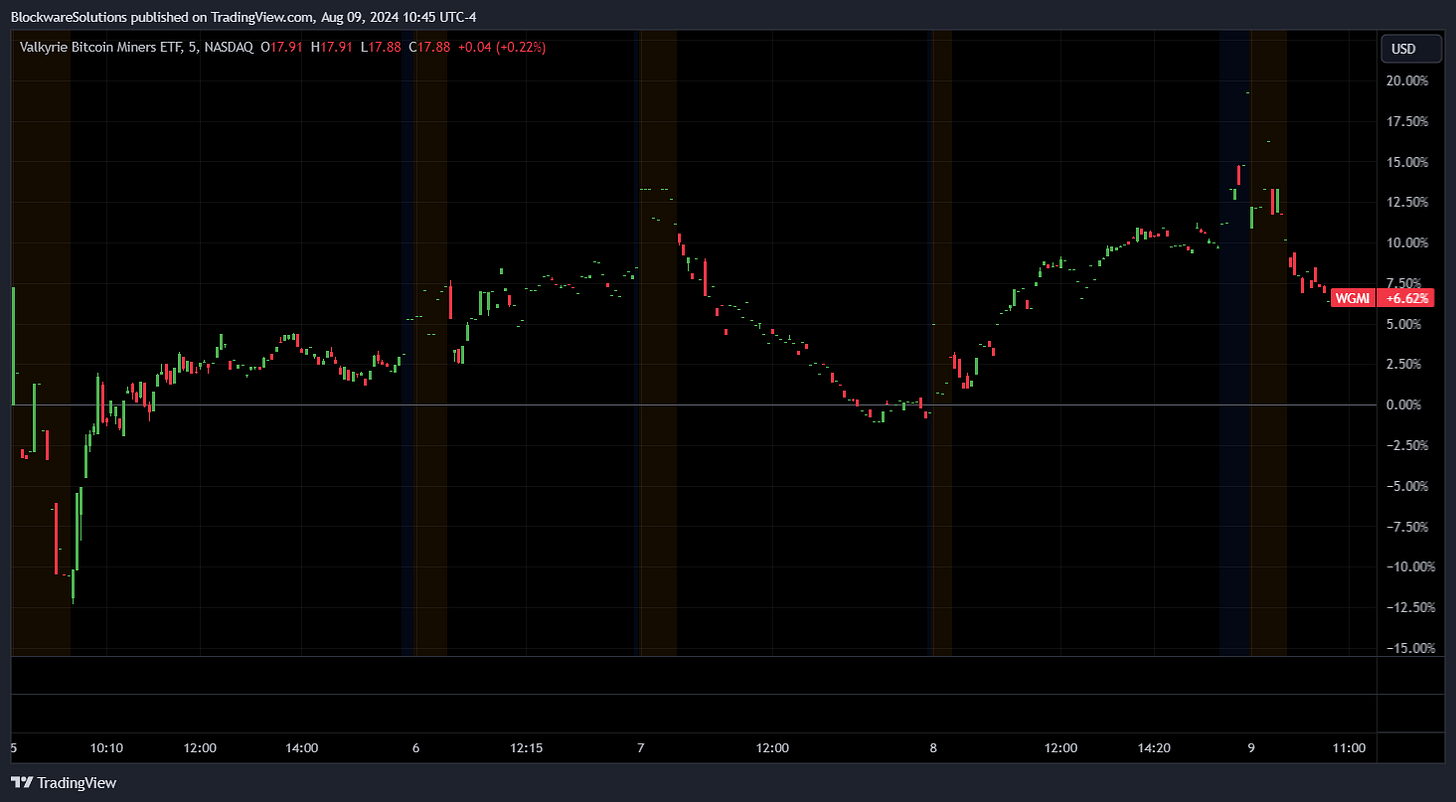

12. Bitcoin Miner ETF ($WGMI)

You wouldn’t notice hashprice is at an all-time low if you were just looking at mining stocks - $WGMI is up ~6.6% on the week. However, year-to-date mining stocks in the aggregate have struggled, $WGMI is down ~12%.

The most effective way to gain exposure to Bitcoin mining is by self-mining - either at home or with a host. This allows you full control over the efficiency of your ASICs, your balance sheet, and you’re not beholden to stock dilution and executive compensation packages that are baked into the cake with public mining stocks. Check out the Blockware Marketplace to start mining Bitcoin today.

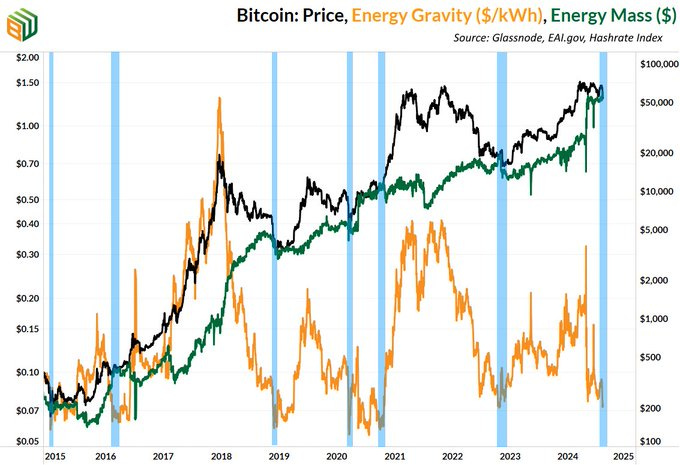

13. Energy Gravity

Energy Gravity flashed an incredibly bullish signal this week. For the first time since November 2022 (pico bottom), it actually cost more to mine 1 BTC, using an average ASIC with average electricity rate, than it does to buy 1 BTC spot. (Latest-generation ASICs like the S21, S21 Pro, and M66s are still mining below the BTC price).

Every time this has happened before, it has preceded a major move up in price.

- Nov 2022

- Sept 2020

- March 2020

- Dec 2018

- Jan 2016

- Jan 2015

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$58,000 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.