Blockware Intelligence Newsletter: Week 145

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/24/24 - 8/30/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

General Market Update

1. Money Printing Forever?

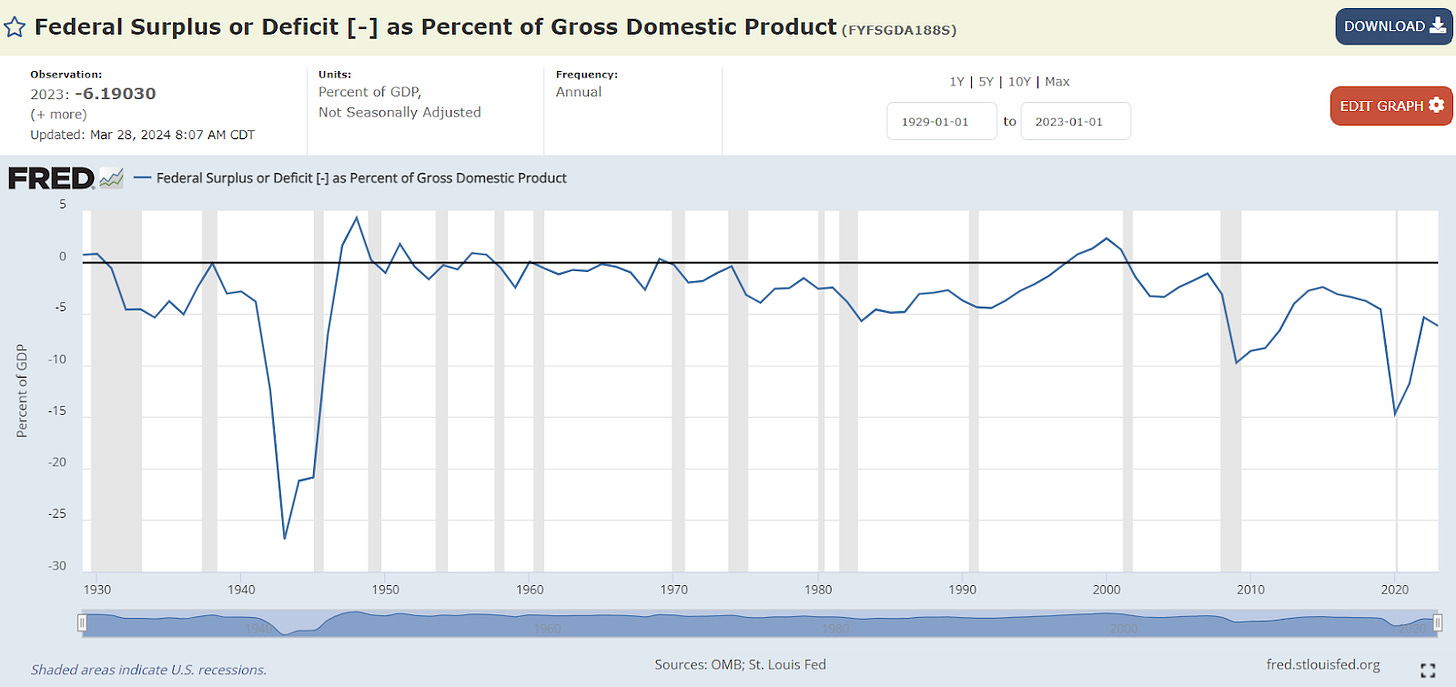

We’ve had a surplus of readers recently, so I wanted to start this newsletter by revisiting square 1 of our macroeconomic thesis - the lens through which we analyze all market activity. The annualized US budget deficit is at ~$1.6 trillion. This means that Congress is spending $1.6 trillion more than what they bring in through taxation. This $1.6 trillion difference is made up by effectively printing money. Semantically and technically it’s not that simple, the difference is technically made up by the Government borrowing money via the treasury issuing bonds, but the end effect is the same: more units of currency within the system. In the long-term, as these new units of currency trickle through the economy, this results in higher prices for consumer goods and higher prices for assets: stocks, real estate, bitcoin, etc.

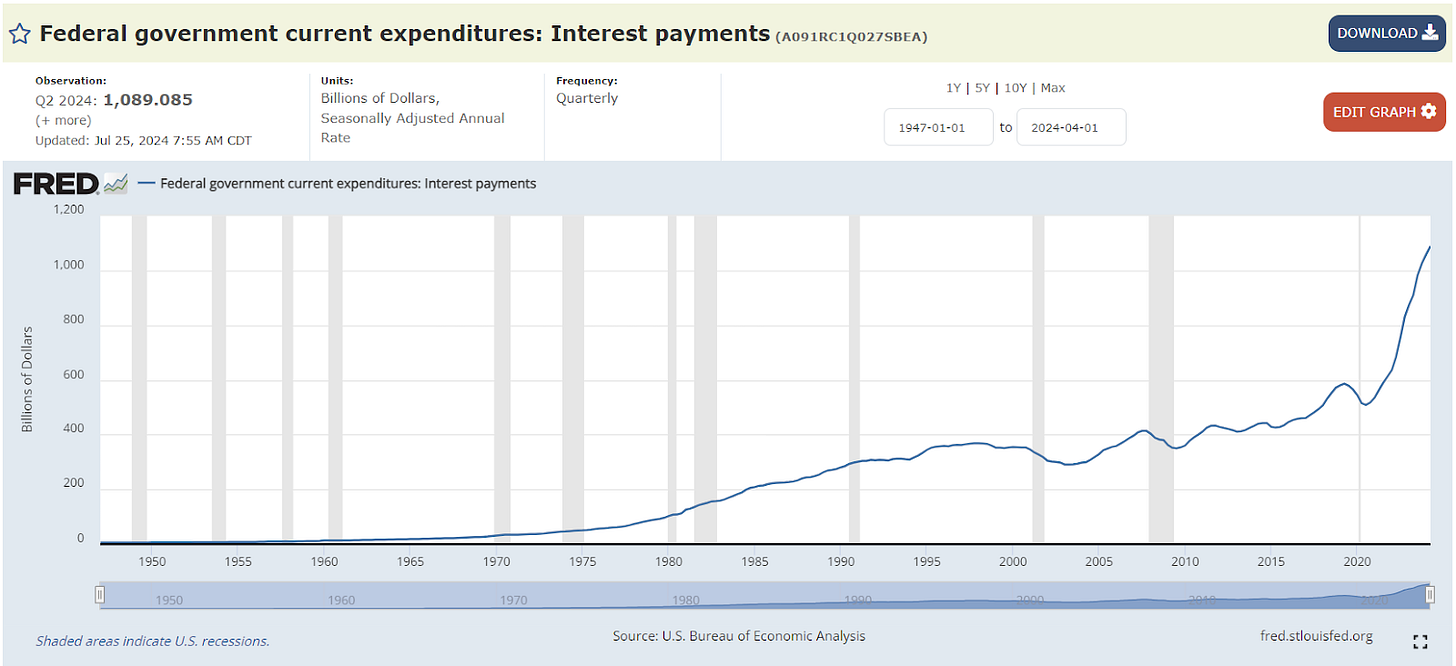

So long as a budget deficit exists the dollar will continuously lose purchasing power over the long-term. We are at a point where, because the interest payments alone are expanding the annual deficits, perpetual growth of the national debt has arguably become irreversible.

As a total % of GDP, the annual deficit is at negative 6%. In 2020, the deficit as a percentage of GDP reached a level not seen since World War II.

Moreover, on top of the interest payments, due to the demographics of the country (more ageing people reliant upon social security and medicare compared to fewer young people working to pay into these programs), entitlement spending is going to increase in the future. Unfunded liabilities are pictured below.

This is why the phrase “QE Infinity” has become popular within the Bitcoin world. Because regardless of short-term action by the Federal Reserve, they will be forced to print more dollars in the long-run. With that in mind, getting exposure to Bitcoin, even if it is only a small % of your total net-worth, is paramount.

2. Core PCE

Now that you’re caught up to speed, let’s get to recent developments.

Inflation as measured by the ‘Personal Consumption Expenditure’ (less food & energy prices) came in at 2.62% annualized - just below expectations of 2.7%. It may sound silly to measure inflation without looking at food energy, I agree. The reason this metric is used is because food and energy prices are volatile, and they can be impacted by non-monetary policy factors. By excluding them you can get a directionally accurate measure of how ~monetary policy~ is impacting purchasing power. As such, the Fed takes this metric into consideration when determining ~monetary policy.~

This is telling a similar story as CPI - disinflation is slowing down. So prices are still going up, the rate at which they were increasing was slowing, but the rate has mostly leveled off. This is at a low enough level to give the Fed cover as they look to lower interest rates, but it is still much higher on an actual % basis than the 2% target, a sign of the times. Extreme deficit spending from Congress is resulting in structural higher inflation despite higher than average interest rates from the Fed - this is bullish for risk assets, including Bitcoin.

3. Q2 GDP Revision

The annualized GDP (Gross Domestic Product) growth rate for Q2 was revised up from 2.8% to 3%. Positive data revisions don’t tend to get as much press as negative revisions, so we wanted to make sure we highlighted this. However, the Fed is still

4. CME Fed Funds Futures

Likely on the back of the revised GDP data, the market is narrowing in on a 25 bip rate cut from the Fed at the September meeting rather than a 50 bip cut. The odds of a 25 bip cut rose from 64% last week to 69.5% this week. Barring a particularly egregious unemployment data release on September 6th, it’s unlikely that we get a cut larger than 25 bips. With a looming election, the implications of a 50 bip cut would be unfavorable for the incumbent administration, and Jerome Powell likely wants to remain neutral in this environment.

5. S&P 500 pushes for new all-time highs

A side effect of large fiscal deficits and currency debasement has been a sort of over-financialization. In a time period where the economy is in an objectively mediocre state, higher than average inflation and uneasy expectations for labor and growth, the stock market is at near all-time highs. This is because as the deficit-spawned currency units make their way through the system, these units are ultimately used by investors to purchase assets in order to preserve their purchasing power (can’t hold dollars).

For secure and easy-to-use self-custody, we recommend Theya:

Theya is the world's simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before!

Click here to download the app and get 10% off an annual subscription!

Bitcoin: News, ETFs, On-Chain, etc.

6. Bitcoin in ‘Sideways Purgatory’

With macroeconomics covered, let’s dive into Bitcoin. It has been yet another week of boring, sideways price action. Technically, BTC is down ~7% this week, but that is what we call ‘a dip for ants.’

As it stands, we are ~9% of the way through the currency halving epoch. This is Bicoin’s worst performance price-wise at this point in the cycle - but we have yet to reach the point where significant, exponential growth is typically seen. It is our belief that BTC will likely continue to trade sideways for another two months, and then begin moving up after the election.

7. Short-Term Holder Realized Price

The cost basis of short-term holders (last moved BTC six months ago or less) is at ~$63,000. We should expect some resistance at this level - which is what we’ve seen over the past couple weeks. Breaking through this level will likely result in a large move upward for price coming shortly after.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

8. Energy Gravity

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$58,421 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig.The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.