Blockware Intelligence Newsletter: Week 156

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/30/24 - 12/5/24

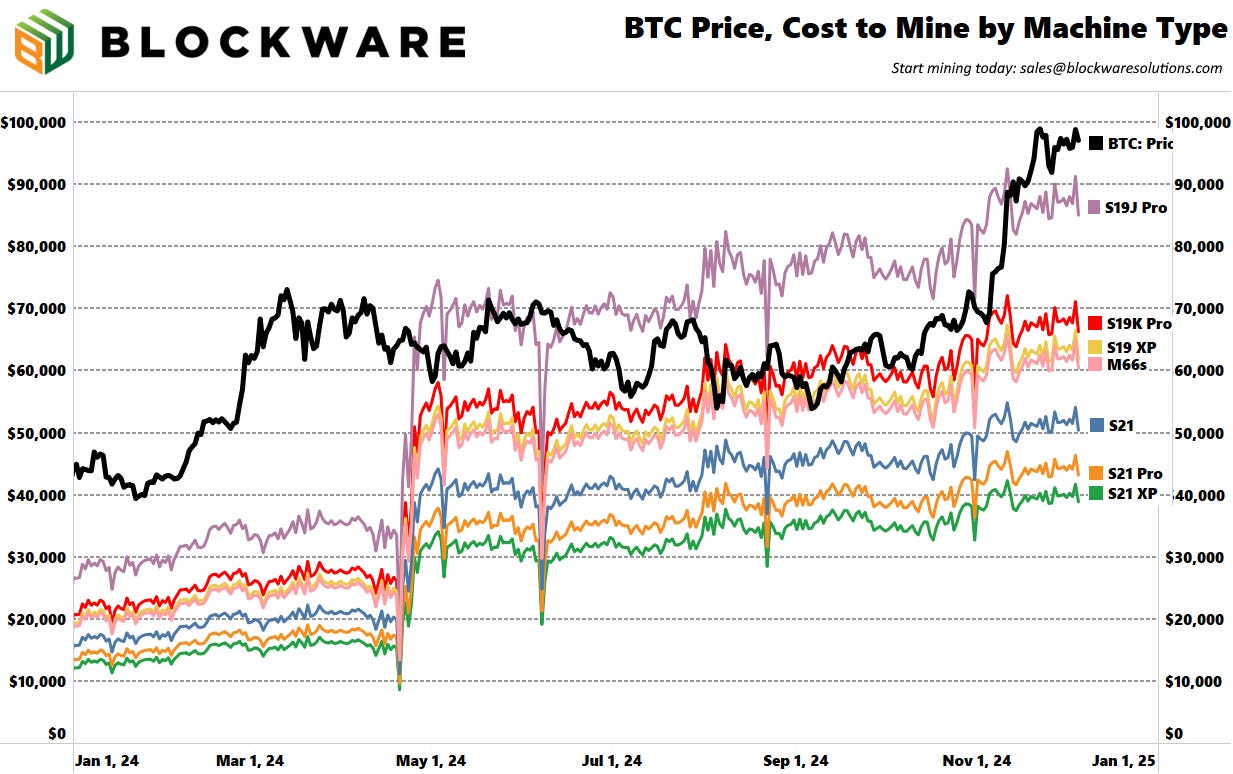

It costs $103,000 to buy 1 Bitcoin.

It costs $42,000 to mine 1 Bitcoin.

Bitcoin: News, ETFs, On-Chain, etc.

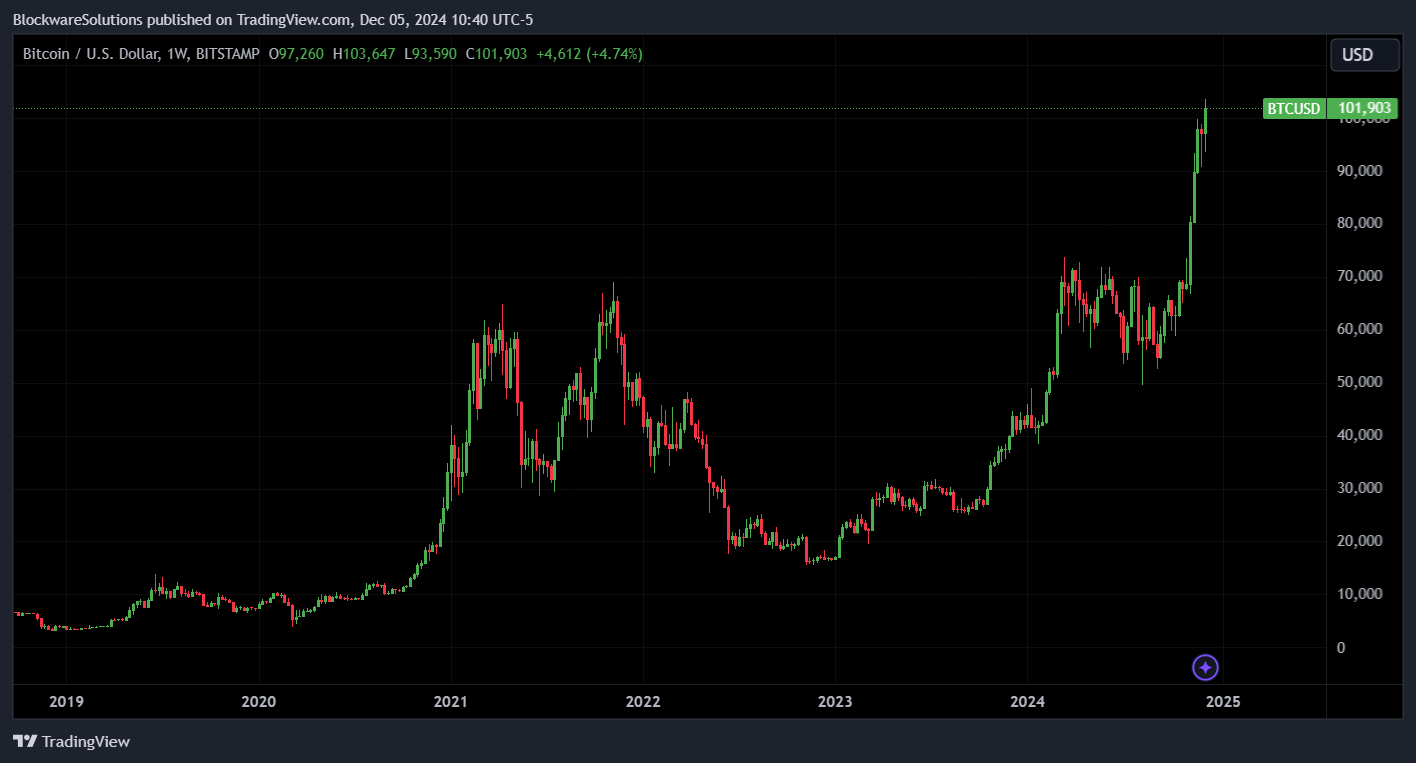

1. Bitcoin breaks $100,000

Congratulations.

Seriously.

Many of you have been rocking with us since the start of this newsletter back in 2021. BTC dropped from $69,000 all the way to $16,000 and you stuck with it. While naysayers propagated fear, uncertainty, and doubt, you stayed true to your convictions.

Take a moment to reflect. HODL’ing Bitcoin is simple – but it’s not easy. You saw an asymmetry in the market, you made your move, and now you have been rewarded.

If this doesn’t describe you. If you’re new here or if you capitulated at the bear market bottom, fret not. This run is far from over…

You may not be "early" anymore, but you're not "late." It's time to put your ego aside and study this "magic internet money." There's a reason this asset is worth as much as it is. Bubbles don't last 15 years and become adopted by Wall Street as a financial reserve asset.

Bitcoin will appreciate in value forever against perpetually debased fiat currencies.

Study this.

2. Leverage Washout

Well… the majority newsletter was written Thursday morning (the BWI team is OOO traveling to the UAE for BTC Mena as you read this), and we’re cutting in here Thursday night because there was massive leverage washout after BTC cracked $100,000 – with the daily candle wicking all the way down to $92,000. The recovery was swift, however, and BTC is back to $98,000 at the time of writing.

The medium & long-term thesis’ are unchanged by short-term volatility. To quote Michael Saylor, “volatility is vitality.”

This is why leverage trading should be avoided at all costs. Even if you are directionally accurate you can get wiped out by volatility.

If you’re looking for long exposure to Bitcoin (beyond buying spot) the best approach – one safe from liquidation risk – is Bitcoin mining. Miners have profit margins that grow exponentially during BTC bull markets while the value of their machines increases as well. Bottom line growth + capital appreciation.

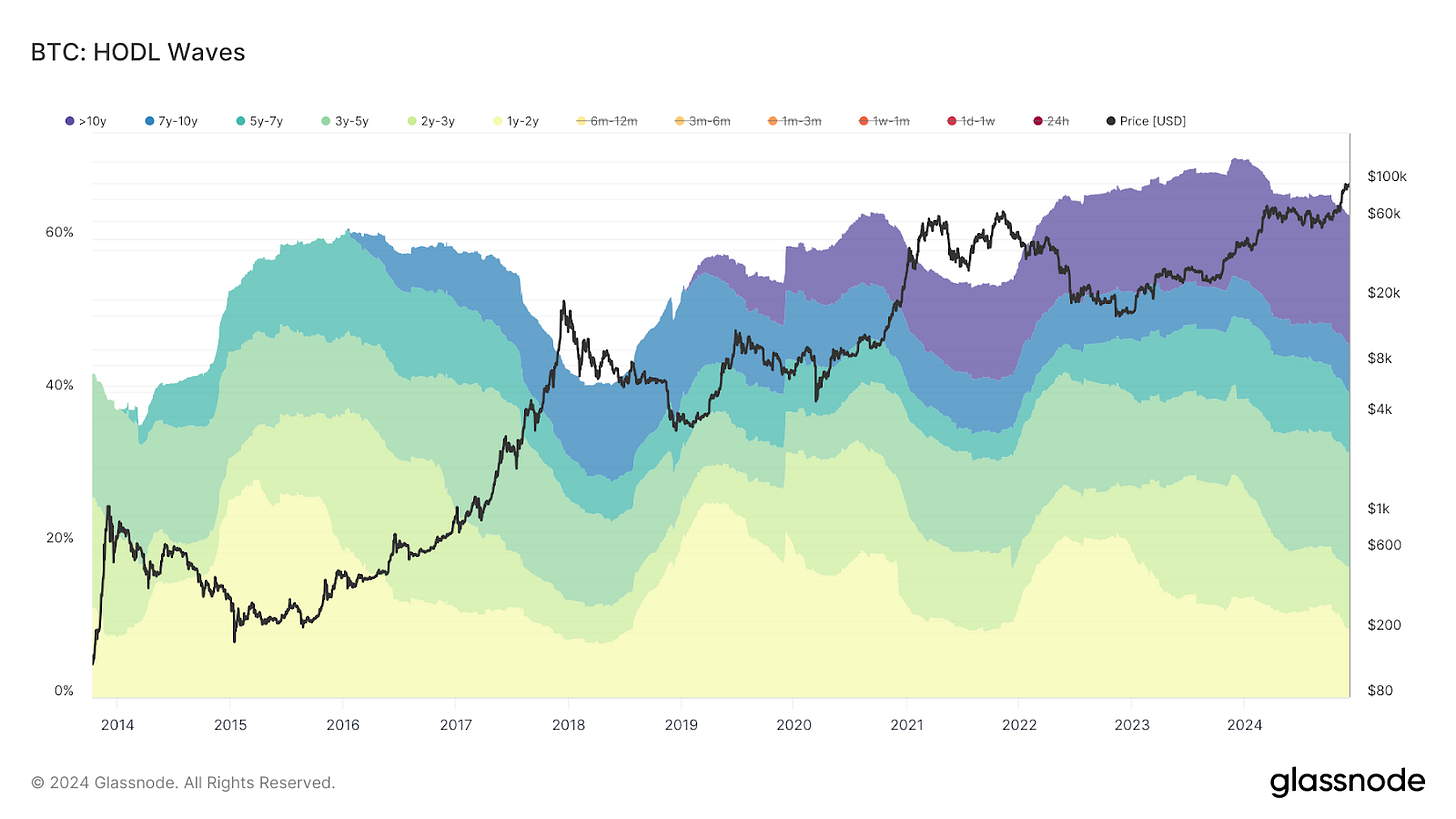

3. BTC Supply Remains Tight. Long Term Holders Unrelenting.

When new demand enters the market, there’s two ways for it to find supply:

New supply entering circulation via mining (capped at 450 BTC per day)

Bid the price higher to incentivize holders to sell some coins

Bitcoin is only as complicated as you make it for yourself. In the simplest terms, this is an asset with a finite supply – unlike every other asset in the world. For other assets – gold, oil, stocks, real estate – when demand increases, investors can deploy more time, energy, and capital into producing more of those assets, and supply will increase. When demand for Bitcoin increases – even if investors deploy more time, energy, and capital into Bitcoin mining – the rate at which new supply is mined DOES NOT increase. Therefore the ONLY way for new demand to find supply is to bid the price higher. There is no alternative.

With that in mind, looking at the movement of Bitcoin supply on-chain gives us good insight into how much supply is realistically available, how high buyers have to bid price to find that supply, and how much “steam” is left in a given Bitcoin bull run.

Right now 63% of the Bitcoin supply has not moved in the past year despite a 130% price increase during the same time period. The percentage of “stagnant supply” is down from a peak of 70% this time last year, but it’s still at a historically high level. What this means is that some holders were incentivized to sell between $60,000 to $100,000, but the majority were not. The price will continue to increase until a larger portion of the HODL’ed supply is distributed into the market.

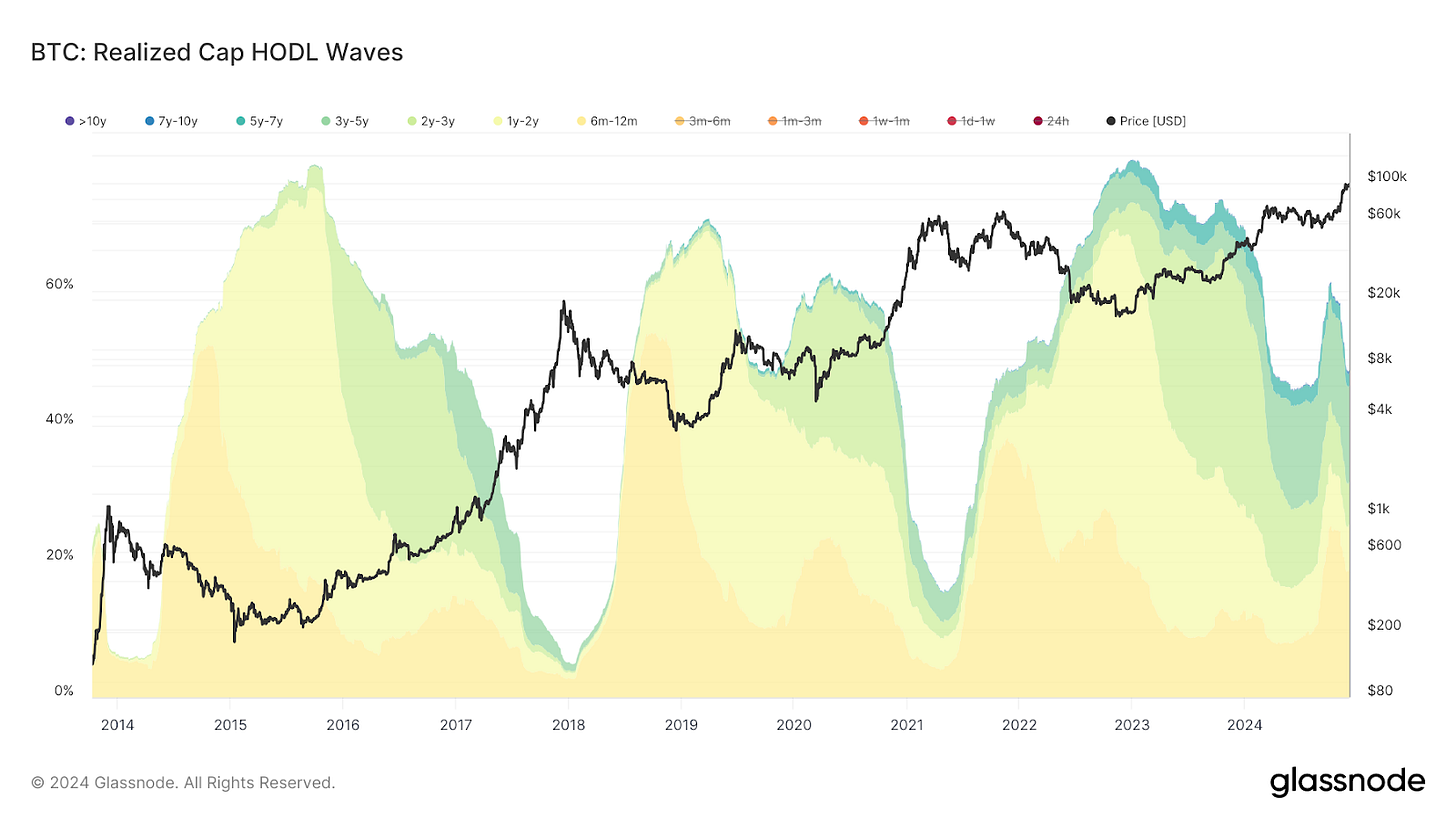

4. Realized Cap HODL Waves

It’s one thing to know how many coins belong to long-term (convicted) holders. But it’s another to know how much of the total value in the network belongs to these holders – this is what the “realized cap HODL waves” tells us. It is the HODL Waves adjusted by the cost-basis of the coins acquired.

For instance, in the depths of a bear market most of the “short-term holders” are absent. So nearly all of the value being stored in the network at these moments comes from long-term holders, and most of these long-term holders are around breakeven. As the long-term holder realized hodl waves begin to drawdown, that’s a sign that new market participants are constituting a larger portion of the value within the Bitcoin network.

The arrival of these new market participants, by definition, means that the long-term holders are beginning to part with some coins. Moreover, the new market participants are less convicted in Bitcoin’s long-term value propositions, and thus are more likely to sell after a quick gain.

That was alot – so here’s a summary and the signal: Right now most of the value stored in Bitcoin is coming from long-term holders, but it is trending down given the recent price action. There’s still plenty of fuel left in the tank for further BTC price appreciation in the short & medium terms, but we’ll keep an eye on this metric to see if/when this rally may show signs of exhaustion.

Theya - Simplified Bitcoin Self-Custody

For secure, intuitive self-custody that fits seamlessly into your life, we recommend Theya.

Theya is the simplest way to safeguard your bitcoin, whether you're using their mobile app or their new web app. With flexible multi-sig and cold storage options, you choose how to hold your keys securely. Experience the ease of a true multisig solution, on your terms.

Ready to secure your bitcoin? Click here to get started and enjoy 10% off an annual subscription!

Click here to download the app and get 10% off an annual subscription!

General Market Update

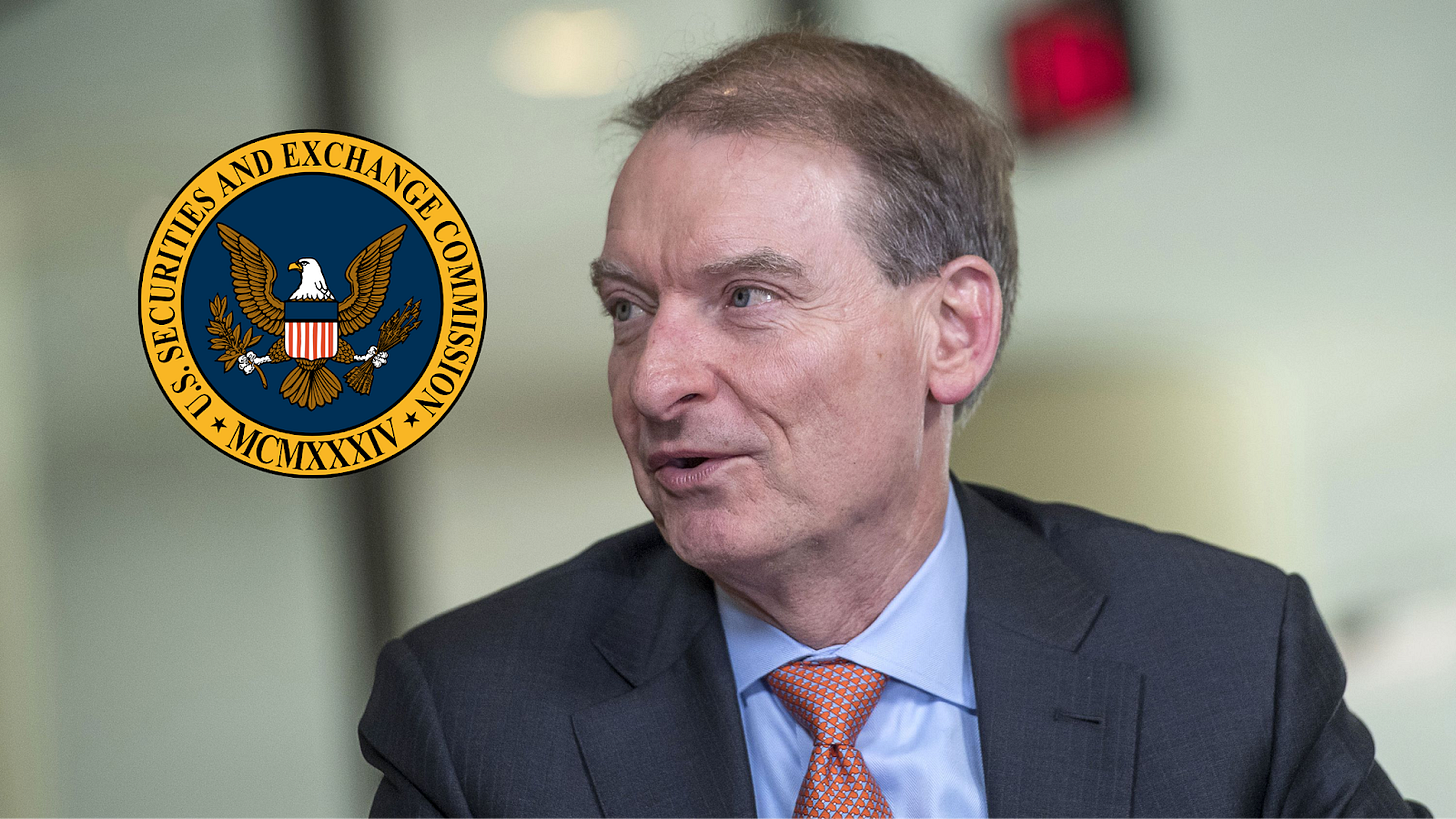

5. Trump Picks New SEC Chairman

President-Elect Trump has announced that Paul Atkins – CEO of Patomak Global Partners and former SEC Commissioner – will be appointed as the next chairman of the Securities and Exchange Commission.

This is a solid pick for Bitcoin & the broader digital asset industry. Crypto will thrive in an environment with transparency & consistency -- Atkins is known for both of these. Atkins, as a libertarian, will at the very least take a neutral regulatory approach, which will be a step up from the Gensler administration.

Transparency & consistency in regulation will give a brighter green light to institutional investors while also protecting retail investors from fraudulent tokens, projects, and platforms.

6. USD Strength

It’s worth noting that the US Dollar is showing relative strength over the past few months – which makes this Bitcoin rally all the more impressive. The $DXY (US Dollar Currency Index) is above 105 after bottoming for the year at ~100 back in October.

Typically a strong dollar is bad for BTC/USD price action. However, this data point must be viewed in the context of the fact that the $DXY is measuring the US Dollar against other inflationary fiat currencies. This relative dollar strength comes in the wake of the Fed’s forward guidance on interest rate policy: that their future rate cuts may not be as aggressive as the initial 50bp cut in September.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

7. Hut8 Announces $500 Million ATM

Hut8 ($HUT) announced a program in which they are going to raise $500 million through the issuance of controlling equity, while repurchasing $250 million of common stock.

Hut8’s strategy is somewhat of a mix between the MicroStrategy play (dilute shares to acquire more BTC for HODL’ing) and the historical public miner play (dilute shares to fund hashrate / infrastructure growth). In the announcement, Hut uses the popular new colloquial "strategic reserve” – stating that they’ll use the proceeds to grow their Bitcoin holdings while also using them to expand their data center infrastructure.

With Marathon Digital ($MARA) also announcing a $700 million ATM earlier this week, it’s clear that the industry leaders are leaving no stone unturned in preparation for 2025.

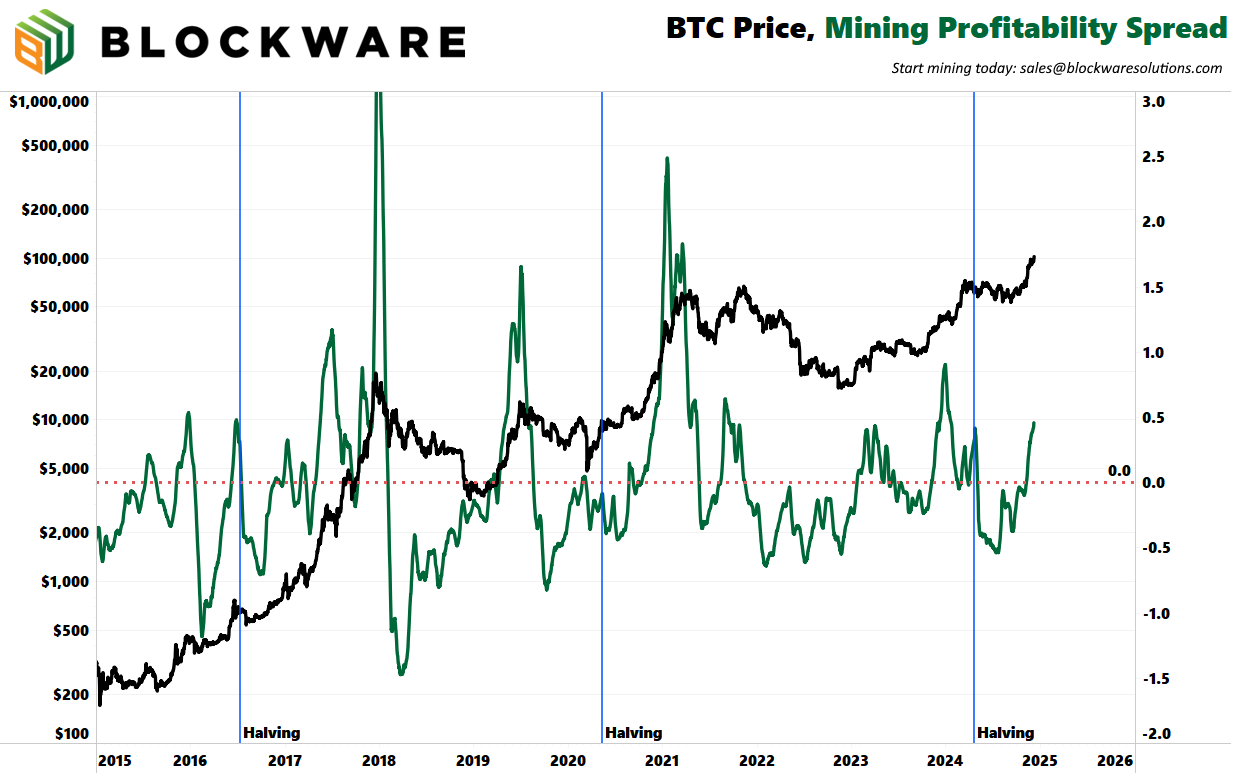

8. Mining Profitability Spread on the Rise

The delta between BTC price growth and hashrate growth continues to widen with BTC’s recent move past $100,000. In the past month the Bitcoin price is up roughly 50% while the mining difficulty adjustments during the same time period have amounted to a ~2.2% combined increase. The “mining profitability spread” which measures the delta between these growth rates to show whether the net profitability of Bitcoin miners is increasing or decreasing.

Right now the spread has reached approximately 0.5. It’s on track to reclaim its 2023 high of 1.0 – which took place during last year's run from $25,000 to $40,000, but prior to the most recent halving.

During previous halving epochs, the spread has gone parabolic during the 12 to 18 month window after the halving – and it appears as if we’re headed that direction again. Bitcoin miners who upgraded machines – enduring the drop in revenue from the halving – are being rewarded with rapid growth in their profit margins.

The reason this happens is because it’s much easier to get a 50% price candle than it is to increase the entire computational power of the network by 50%

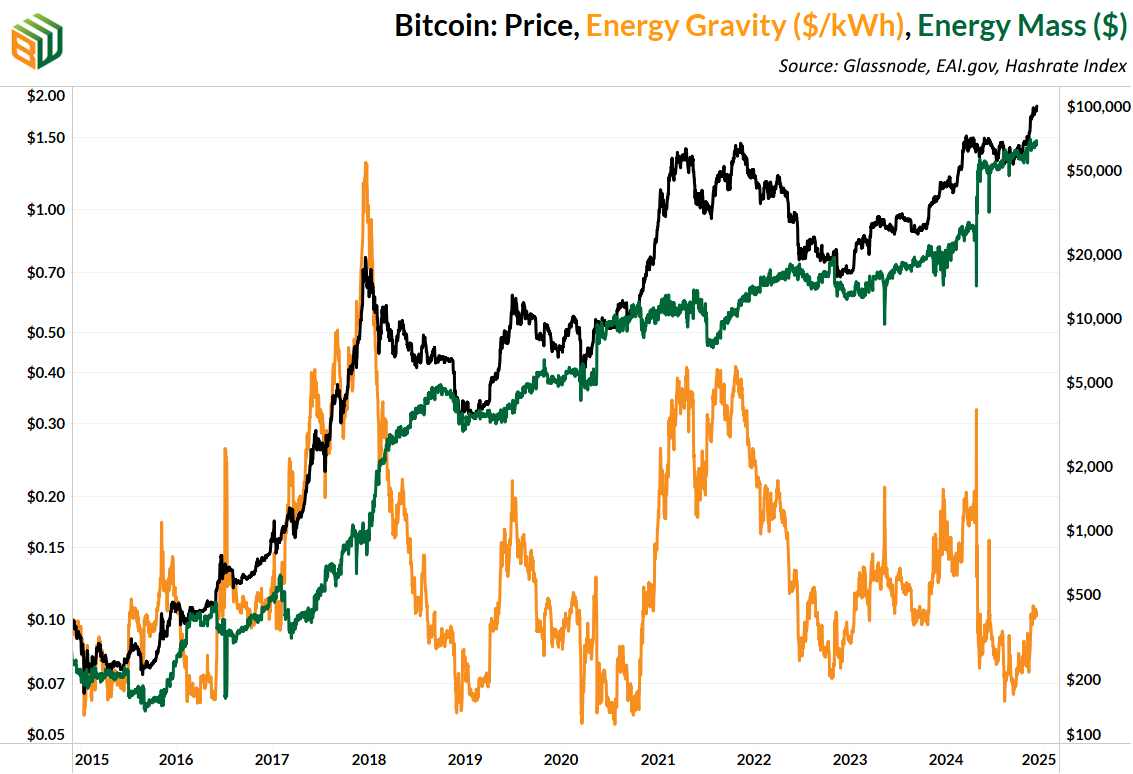

9. Energy Gravity

At a typical hosting rate today, the average miner requires ~$69,000 worth of energy to produce 1 BTC (green line). The orange line shows how many $ (output) miners are able to earn for each kWh of power (input).

This metric is different from the chart at the top of the newsletter. This one looks at the aggregate cost of production (combination of all miners) while the former chart breaks it down by machine type

To learn more about Energy Mass & Energy Gravity, read our report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.