Blockware Intelligence Newsletter: Week 21

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 1/07/22-1/14/22

To preface: we are launching a sweet of educational videos next week covering all the metrics discussed in the newsletter on our YouTube channel! Stay tuned.

Summary:

There’s been a strong rotation into areas of the equity market that can potentially benefit from higher interest rates.

This week we saw the announcement of the largest YoY increase in CPI in nearly 40 years. Encouragingly, we saw Bitcoin uptick on this news.

BTC has been increasingly correlated to the equities market. Certain names, like BTCS, have fought the downtrend and caught strong bids.

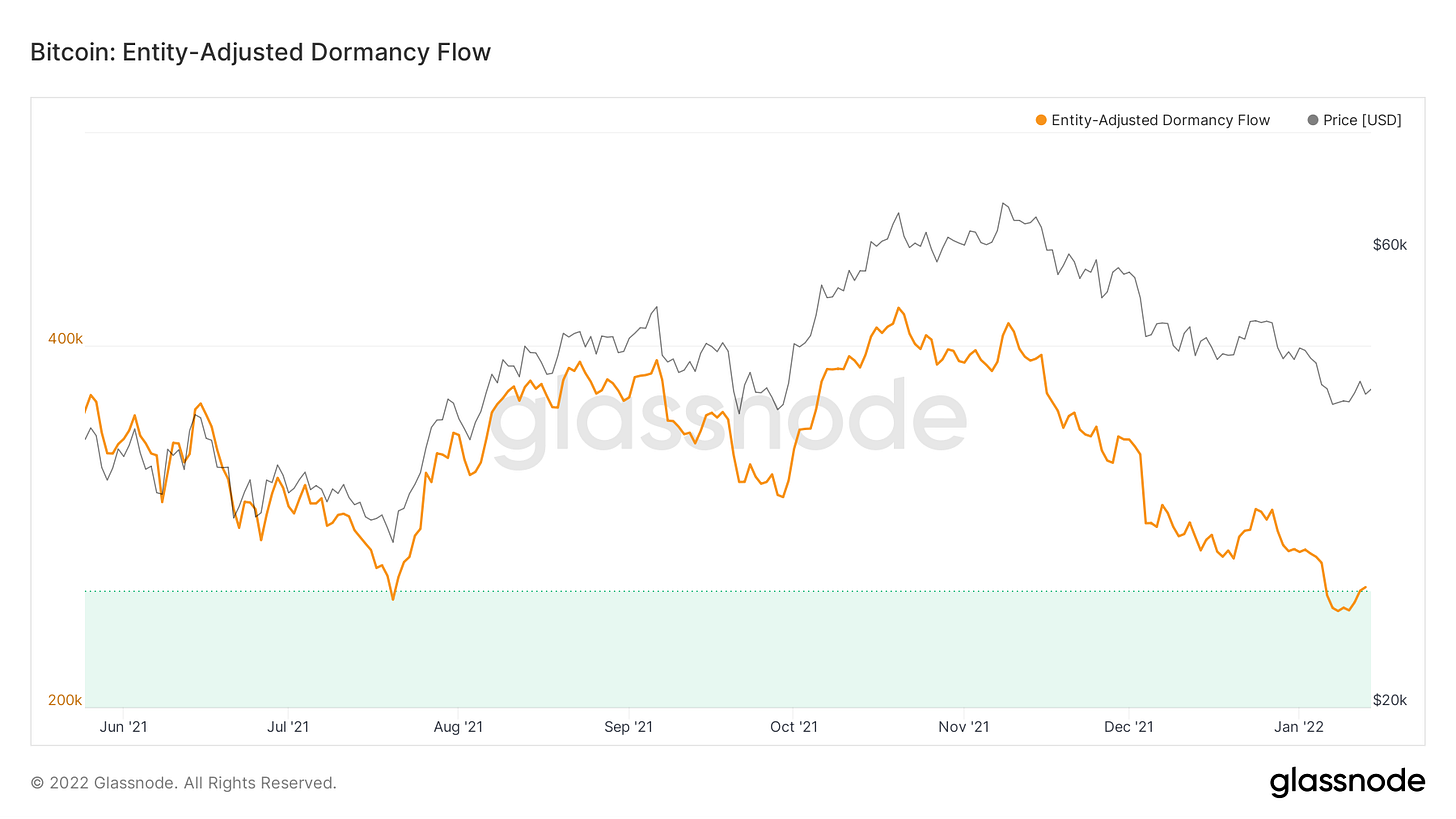

Dormancy flow has entered the buy zone for just the sixth time in Bitcoin’s history

Open interest relative to market cap is still very high

Hash rate at ATHs, our analysis shows that Bitcoin’s hash rate should end 2022 at around 300 EH/s (+65%).

Derivatives/On-Chain Analytics Update

From a price structure standpoint, Bitcoin bounced off the macro support level we talked about in last week’s letter of $40K. Now currently watching to see if BTC puts in a local higher low in this current area (42,500 at time of writing).

Open interest is still high and in the area of which we have seen major squeezes/flushes take place. This is the longest the ratio has sustained these elevated levels. A lot of leverage is still built up and Bitcoin is still far from out of the woods volatility-wise.

As a way to gauge some of the aggression of this open interest, we look at funding. Last week we talked in-depth about what open interest and funding both mean, so not going to repeat again. Also will be covering these topics in our upcoming educational video series.

We have finally seen some negative funding, showing that either spot is leading perps or perps are fading spot. Upon some further digging, it appears Coinbase has been bidding aggressively (shown by cumulative volume delta). Coinbase has a large weight to the weighed spot index that’s used for funding payments on all major perpetual exchanges. In this case, it appears to be more so that spot is leading perps than perps fading spot. Still a good sign and glad to see a little regime of negative funding get carved out here.

Dormancy flow has entered the buy zone for the sixth time in Bitcoin’s history. Zooming out we look at dormancy flow as a macro/high time frame chart. Let’s break down what this means. At a high-level dormancy flow compares the amount of coin destruction to Bitcoin’s market cap. What is destruction? Think of it this way: A coin is moved to a wallet and sits there for 10 days. It has now accumulated 10 coin days. Once it is moved out of that wallet, there are now 10 coin days destroyed. Dormancy takes coin destruction and adjusts it for volume because by definition coin days destroyed will be higher in times of high volume. With that in mind, from first principles this is essentially telling us that smarter money (assuming more experienced market participants are smarter money) has slowed the spending of their coins.

Note this offers a great zone to average in buys, but not necessarily a “pico bottom”. For momentum-oriented market participants, it’s not a bad idea to wait for the metric to exit the buy zone.

Interestingly enough, it seems to be exiting the buy zone as of yesterday. (NFA)

Bitcoin’s hash rate has reached new all-time highs. This is remarkable given how fast it has recovered since the China mining ban. This speaks to the resiliency of the Bitcoin network, as all of this computing power was relocated around the world and back online within months; in a completely uncoordinated decentralized way. This also has eliminated one of the biggest criticisms of Bitcoin, the claim that the majority of Bitcoin’s mining power was coming from China. This also means the Bitcoin network is more secure than ever before.

Next, we look at the portion of supply held by retail. One of the biggest criticisms of Bitcoin is that supply is held by a small portion of market participants. Here I have taken all entities with less than 10 BTC (roughly $425,000) and compared them to the overall Bitcoin circulating supply. Over time where does this trend: Up and to the right. Of course the rate of this increases in a bull market, but even in a bear market we see this trend upwards steadily. This shows that the supply distribution of Bitcoin is heading in the right direction over time. Also, keep in mind, this doesn’t even take into account the fact that most “whales” are actually exchanges/custodians that are holding BTC for hundreds of thousands if not millions of individuals. Making this argument against Bitcoin is analogous to saying that USD supply distribution is unfair because the banks hold a large portion of the circulating supply of dollars. Anyone who just looks at the amount of BTC held by the largest Bitcoin addresses is making an intellectually lazy or dishonest argument against Bitcoin. Again, not saying the supply distribution is perfect (Bitcoin is still just 12 years old), but is heading in the right direction. Over time we expect to see supply distribution continue to trend this way.

Last we take a look at another macro trend in the Bitcoin market: the decreased percentage of futures open interest collateralized with coin/crypto versus stable coins. Since the May long liquidation event, we’ve seen traders more akin to using stable coins as margin for their futures contracts. This impacts the overall risk structure of the market. More use of crypto margin means a higher potential convexity (or risk) to the downside. This is because when using crypto as collateral if you’re long and the trade starts to go against you not only is your PnL on the trade decreasing but so is the value of the collateral you have posted for that contract. This makes you more susceptible to getting liquidated or stopped out of the trade. Would like to see this trend continue, currently down to roughly 40% of contracts margined with crypto from 70% in early 2020.

General Market/Macroeconomic Environment

This week we’ve seen a short rally attempt in the major market indexes turn into an apparent continuation of the sell off. At the moment, we’re seeing the tech market sell off quite aggressively while other areas of the market are vastly outperforming.

Financials, oil & gas, automotive manufacturers and metal miners are a few groups that have been on the receiving end of this capital rotation. This is likely to be a trend that continues as more uncertainty builds around the Fed’s decisions.

Oil and gas producers are the Investors Business Daily’s #1 ranked industry group.

Oil&Gas Group 1D (Marketsmith)

This week there was a release of consumer price index (CPI) numbers, marking the largest year-over-year increase we’ve seen in nearly 40 years. Bitcoin caught a roughly 3% spike on this news.

CPI gives us the percent increase in the prices of a particular basket of goods. It provides a solid baseline for us to gauge the level of inflation in the US.

The issue with CPI is that the basket of goods is chosen by a centralized government body and therefore, the weighting of items can be manipulated to provide a number much lower than the monetary inflation rate.

YoY CPI % Change (Source: Bureau of Labor Statistics)

The inflation rate is different for everyone, based on what type of goods/services you purchase. For example, the inflation rate in 2021 was much higher for those who choose to buy goods that required overseas shipments. Inflatuion will remain low for those who buy goods that rarely ever increase in price, like a McDonald’s cheeseburger for example.

Generally, we’ve seen a negative correlation between inflation data and cryptoassets. In theory, this doesn’t make much sense. Bitcoin was built to combat issues that arise with owning assets with ever-increasing supplies. But today, bitcoin is treated as a high beta (risk) investment and therefore, has sold off when inflation is rising.

As most hodlers could tell you, BTC is the best inflation hedge out there. So seeing bitcoin catch a bid on news of rising inflation in the US is very encouraging to see. This correlation is certainly something to keep an eye on in 2022.

This week we’ve seen an even greater increase in the correlation of BTC to the general equity market. Below is a plot of the correlation coefficient of BTC compared to the S&P 500, which is now at 0.79 (79% correlated).

Correlation Coefficient of BTCUSD vs. SPX (Tradingview)

Price action of BTC tailing that of the stock market, in general, is not a great trend to see increasing. Ideally, we’d like to see BTC stealing capital from the equity markets as it becomes the asset of choice for those who wish to grow their cash flows and fight inflation.

Crypto-Equity Update

This, of course, is not an ideal environment for bitcoin-exposed equities, yet a few of them have been able to fight the trend.

BTCS, as mentioned last week, is a company focused primarily on crypto data analytics. Essentially, their main product is a platform to view your crypto portfolio. The other side of their business is involved in mining proof-of-stake coins.

BTCS has continued to outperform the rest of the group on news of a dividend paid in bitcoin. But this name has been in a downtrend for the last year and is a low market cap and illiquid name, so it’s not too surprising that a single positive news event could spike prices ~47% like they did this week.

Personally, I am avoiding this name due to the low liquidity. BTCS trades an average daily volume of roughly $14M, making it hard for institutional investors to enter or exit with ease, this is exactly why many of them will avoid a name like this.

When institutions decide to enter low liquidity names it can cause massive price spikes, like we’ve seen this week. It is certainly something to keep an eye on but Thursday we saw signs of a potential blow off top.

BTCS 1D (Tradingview)

Tops generally come with massive volume, as seen yesterday on BTCS. Furthermore, the downside reversal candle tells us that sellers overwhelmingly stepped in once price was up substantially on the day.

It is certainly possible that buyers continue to step in here, but from a technical analysis standpoint, my best guess is that BTCS has topped out for now.

Another strong name to keep an eye on is ZIM. ZIM is a shipping company based out of Israel who uses blockchain technology to efficiently transfer documents and bills.

ZIM broke out of a ~4 month base this week, with weekly volume trending 28% higher than its 10 week average. At the moment, ZIM is one of the strongest true market leaders.

I should mention that I do have a personal position in ZIM. Also, it is now 7.4% above its 10 day EMA, a historically high level for this name.

If there is indeed a pullback here, the ability of ZIM to hold its previous all-time high at $62.20, or previous resistance at $61.50 and around $60 will be a strong indication of the strength of this name going into the future.

Mining

2022 Bitcoin Hash Rate Projection

Two days ago, Galaxy Digital released their Bitcoin hash rate projections for 2022. It was a fantastic report, and I encourage you to read it. Galaxy projected that the total network hash rate would reach 335 EH/s by the end of this year (+84% from the current 14 day moving average).

After completing our own analysis, we expect hash rate to end the year at roughly 300 EH/s. For reference, the current 14 day moving average of total hash rate is 182 EH/s. This would be a 65% increase.

A large amount of this hash rate is expected to come from public miners leveraging debt and equity markets to finance $100M+ ASIC orders and capital-intensive mining infrastructure. The data in the table below was compiled from public and private company filings and projections.

In November 2021, we published our original version of the public miner ASIC orders table. Since then, companies like $MARA have significantly increased their 2022 projections, and more companies have gone public or publicly released their hash rate projections. These updates are now incorporated into the table above.

If public mining companies are able to execute on their hash rate deployments in a timely manner, and the global hash rate grows to 300 EH/s, then public mining companies will have 38.6% of the total hash rate (115.9 EH/s).

The remaining non-public hash rate growth is expected to be around 34.4 EH/s (40% of the amount of hash rate that public miners are bringing on in 2022). Private miners won’t be able to bring on as much hash rate due to public miners having access to large amounts of cheap capital (billions of dollars).

In aggregate, we project hash rate to grow from 182 EH/s to 300EH/s by the end of the year. This means roughly 2.27 EH/s should be added to the network every week from here on out. This is roughly the equivalent of 25,000 Antminer S19j’s (95 MW) getting added to the network every week.

A significant amount of ASICs need to be shipped and plugged in, large physical infrastructure needs to be built, and a massive amount of electricity needs to be sourced for the Bitcoin network to grow at this rate by the end of 2022. This combined with global supply chain issues and older generation machines (S9s) potentially dropping off the network is why we don’t expect the network hash rate to double in only one year.

What this means for miners

Hash rate growing by 65% likely won’t be a huge issue for most miners moving forward. If Bitcoin goes back to $69,300, that itself will be a 65% return. As long as Bitcoin goes up to $69,300 or more this year, then mining will be equal or more profitable on a dollar basis than it is today.

Even if price remains the same, and this incoming hash rate still arrives, new generation machines should still be spitting off positive cash flows for their owners.

If you aren’t already mining Bitcoin with us, consider mining with Blockware Solutions.

mining is going to be a very big opportunity... get yours now.

Does a high OI with decreasing percentage crypto-collateralized futures mean that most of the OI are longs? And would this not increase the risk of a liquidation event for longs? Any thoughts appreciated.