Blockware Intelligence Newsletter: Week 109

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/21/23 - 10/27/23

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

SVRN Energy:

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty.

Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

1. 2024 Halving Analysis: $400,000 Bitcoin. If you’re a frequent reader of this newsletter, you’ll recall our 2024 Having Report. We have converted this report into an easily-digestible video essay, for those that prefer audio/visual content. This video provides maximum signal on everything you need to know about the halving; both as it pertains to the Bitcoin price as well as the impact on miners.

2. Blockware Intelligence Podcast. It’s been an active week on the Blockware YouTube channel. Alongside the aforementioned halving video, we double-dipped on the podcast. Tuesday we released an episode with the legendary Ben Askren. Ben is one of the greatest Wrestlers and MMA Fighters of all time; and he just so happens to be a Bitcoiner as well. The mental toughness required to pursue a living by getting punched in the head is unmatched by any other profession; this episode provides a glimpse into Ben’s mindset, how he deals with adversity, his advice for the youth, and, of course, his Bitcoin story.

3. Blockware Intelligence Podcast. The second pod of the week features an in-house guest, Blockware’s very own Chief Revenue Officer, Danny Condon! Mitch & Danny discuss the custodial concerns of the spot ETF, Bitcoin demand catalysts, Bitcoin supply catalysts, and why incumbent Bitcoin miners are positioned to thrive during the coming bull market.

General Market Update

4. Core PCE Inflation. PCE inflation numbers for September were released before the open this morning. As expected, core PCE grew by 0.3% from October and was up 3.7% YoY. Disinflation is clearly underway but with consumer spending numbers growing last month as well, the spotlight is on the Fed (who meets next week on 11/1). Will they continue to increase rates (or hold them elevated) to crush the consumer and lower inflation, or will they cut rates sooner to bail out an increasingly bankrupt US government and broken Treasury market? The market believes, with certainty, that we’ll see another pause next week.

5. Nasdaq vs. Nasdaq Breadth. While it may appear that the market has seemingly seen an overwhelming shift in sentiment since the onset of the Israel-Hamas conflict 10 days ago, this attitude has been in motion for some time. The chart below compares Nasdaq price action to breadth, or specifically the percent of Nasdaq-listed stocks above their 200-day SMA. This shows that there’s overall steadily declining positioning in mid/small caps going back to Q1. The vast majority of capital in the index is hiding in the Magnificent 7. As these mega caps have now begun to take a hit this week, it’s opened a window for serious downside for the major indices. This is a traders market, and a dangerous one at that.

6. Nvidia Corporation (NVDA). As we broadly explained above, the equity market is finally beginning to see some distribution from the Magnificent 7, and namely 2023’s poster boy NVDA. While this chart was one of the most commonly shared on Twitter this week (the sign of a crowded trade), it’s important to take into account that the price action of the Mag. 7 make up the majority weighting of the Nasdaq and S&P. Yesterday, NVDA validated a head and shoulders breakdown that, if continued, could certainly push the Nasdaq into a capitulatory leg lower. It’s also important to note that this pattern is extremely obvious, and usually when the majority thinks something is going to happen, it doesn’t.

7. iShares 3-7 Year Bond ETF. This week, following Bill Ackman’s announcement of covering his bond short, we’ve seen a small bid for Treasuries. That said, we’ve also continued to see a fairly robust bid for gold. This combination of Treasury and gold position historically occurs in a single period, most often leading up to a recession. Note that this is recessionary positioning, and doesn’t indicate that we’re currently in one (I would argue that we’re clearly NOT in a recession as of now). While falling yields are generally good for risk assets, such as stocks, the equity market hasn’t been able to shake the immense sell pressure of investors fleeing to safety in bonds, gold and Bitcoin.

Bitcoin Exposed Equities

8. Microstrategy Inc. (MSTR). With the double-digit percent week BTC has seen, it’s been a very eye-opening week for investors of Bitcoin Exposed Equities. Most interestingly, many of these names have been completely unable to buck the trend that the general market is showing. That said, a very select few names have shown immense strength in the face of gale force headwinds. MSTR is one of these names, up over 20% this week (at the time of writing) as Saylor’s BTC position is back in the green and this name serves as a proxy BTC ETF. Other names catching our team’s eye this week include CIFR and BRPHF (thin OTC stock).

9. BEE Comparison Table. As always, the table below breaks down the Monday-Thursday price action of many BEE’s, in comparison to BTC and the mining ETF, WGMI. Notice, as we just pointed out, how the average name only rose 6.0% this week, despite BTC being up nearly 14%. Although these companies' earnings may be correlated to BTC price action, it can be extremely difficult for equities to fight against the trend of the indices and institutional sentiment. Now, if BTC is going to grow in price by multitudes in the coming years, these stocks will almost certainly increase in price too, however in the short-term BTC is behaving much stronger.

Bitcoin Technical Analysis

10. Bitcoin/USD. We’re not sure if you’ve heard, but Bitcoin has had its best week of price action since (drum roll please) June. With price now tapping its highest value in nearly 6 months, and the average buyer since the market top now back in the green, it isn’t too much of a surprise to see some profit-taking around $35,000. That said, the BTC bid is remarkably strong here, with short-term dips being swallowed up by institutional capital. In the near term, ~$32k is the line in the sand for BTC to preserve this bullish price structure. To the upside, obviously a break through $35k is what bulls should be looking at. Beyond that, the next major resistance zone we see aligns with the $39.8-40k range.

Bitcoin On-Chain / Derivatives

11. Realized Price (1-2 year old Coins): Bitcoin surged to $34,000 on Monday in anticipation of future capital inflows from a spot ETF. Bitcoin has nestled right underneath the aggregate cost-basis of coins last active within 1-2 years ago. The next likely stop on the way up is at the $42,000 mark, which represents the aggregate cost-basis of coins acquired 2-3 years ago.

12. HODL Waves: Despite the recent run-up, price remains historically illiquid; with 68% of coins (still) having not moved in at least 1 year. The cohort of coins that haven’t moved in 2-3 years continues to climb at an impressive rate; having jumped from 6% of circulating supply to 16% over the past 12 months.

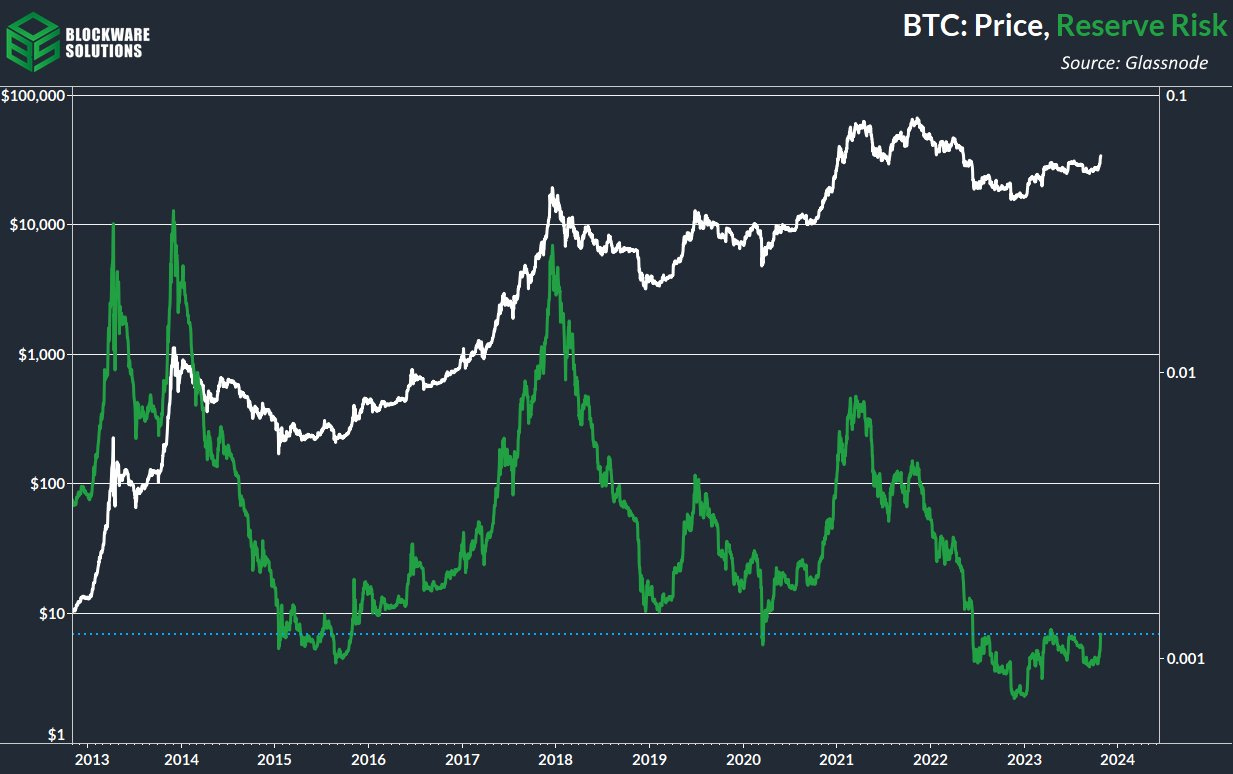

13. Reserve Risk. This measures Bitcoin price and HODL'ing behavior to assess low-risk buying opportunities. Despite the surge to $34k, the illiquidity of supply means it's still an all-time buying opportunity; on par with March 2020.

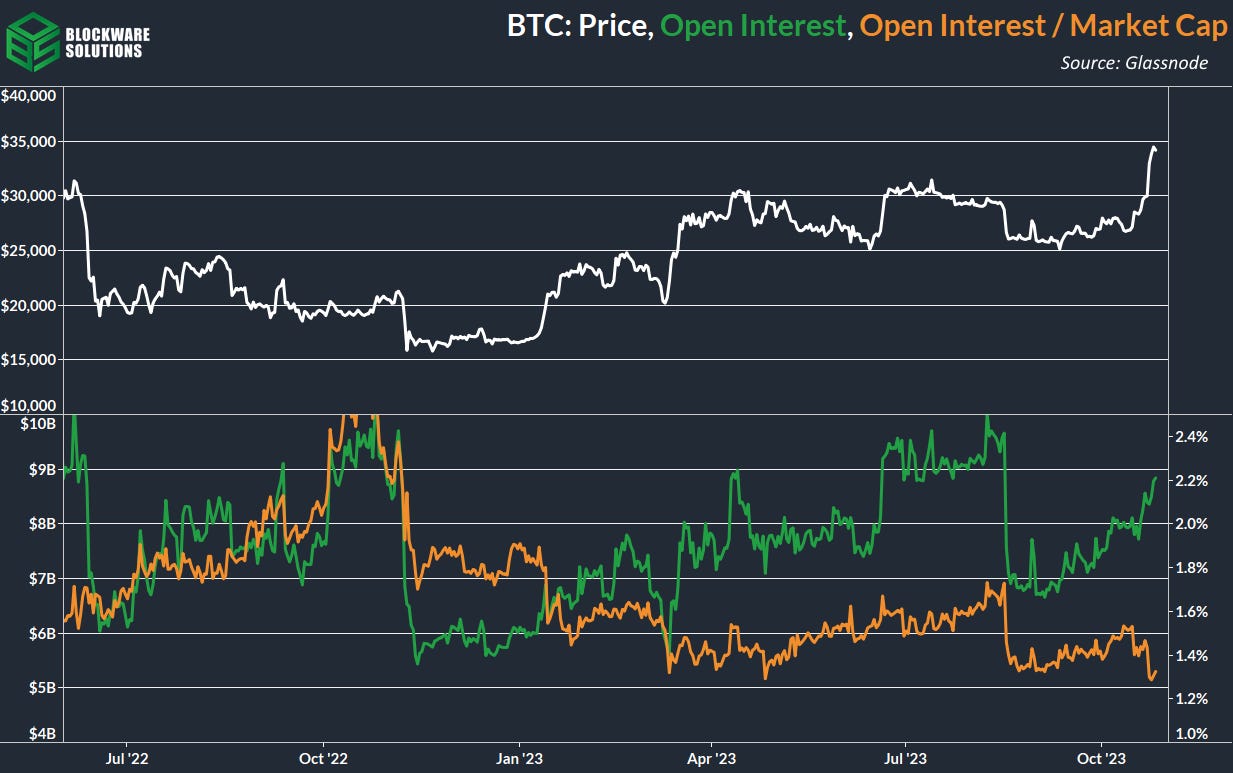

14. Perpetual Futures Open Interest: Open interest has climbed in the wake of the price surge, but on a market cap adjusted basis it is down. This divergence between open interest and market cap-adjusted open interest is a good sign that spot is in control and that this pump has staying power; which it has already demonstrated as it has held throughout the week.

15. ETH/BTC: This rally has been driven directly by inflows into Bitcoin. Alts have bled against BTC over the past week, month, and year; with ETH/BTC being the best proxy to represent this trend. ETH/BTC has found some support at the .052 level, the same place it found support prior to the “merge.” The bleeding out of alts relative to BTC will likely continue during the bull market as wall-street capital allocators have shown little to no intention of accumulating anything other than BTC. This could lead to a positive feedback loop; as BTC’s market cap grows, it becomes a much safer place for HNW capital allocators to place their wealth, further increasing the market cap. Those with billions of dollars to allocate cannot enter the illiquid altcoin markets.

Bitcoin Mining

16. Whatsminer M60: MicroBT revealed the specs for their next-generation ASIC. Coming in at 186 Th/s and 18.5 W/Th, the M60 is an absolute beast of a machine. The importance of upgrading your Bitcoin mining hardware cannot be understated; those who don’t upgrade prior to the halving must bank on serious price appreciation in the meantime. Once M60’s and S21’s are plugged in, hashrate will rip. Granted, the increase may not be as drastic as some would expect, many mid-generation rigs (S19s, M30s, etc.) will likely get unplugged in order to make room for the new-generation rigs; infrastructure/rack space remains the largest bottleneck for Bitcoin miners.

17. Antminer T21: In classic Bitmain fashion they have announced an alternate version of their 21 series of ASICs, the T21. In “normal energy mode” this machine operates at 190 Th/s and 19 W/Th. In “high energy mode” it reaches 233 Th/s with an energy efficiency of 22 W/Th.

18. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$20,381 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.