Blockware Intelligence Newsletter: Week 125

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 3/16/24 - 3/22/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Bitcoin Rebounding

After breaching new all-time highs and since pulling back, BTC now sits comfortably at ~$64,000. In the grand scheme of things, this “pullback” is nothing. The market landscape is as bullish as ever, and pullbacks like this are healthy as they stop excessive leverage build-up.

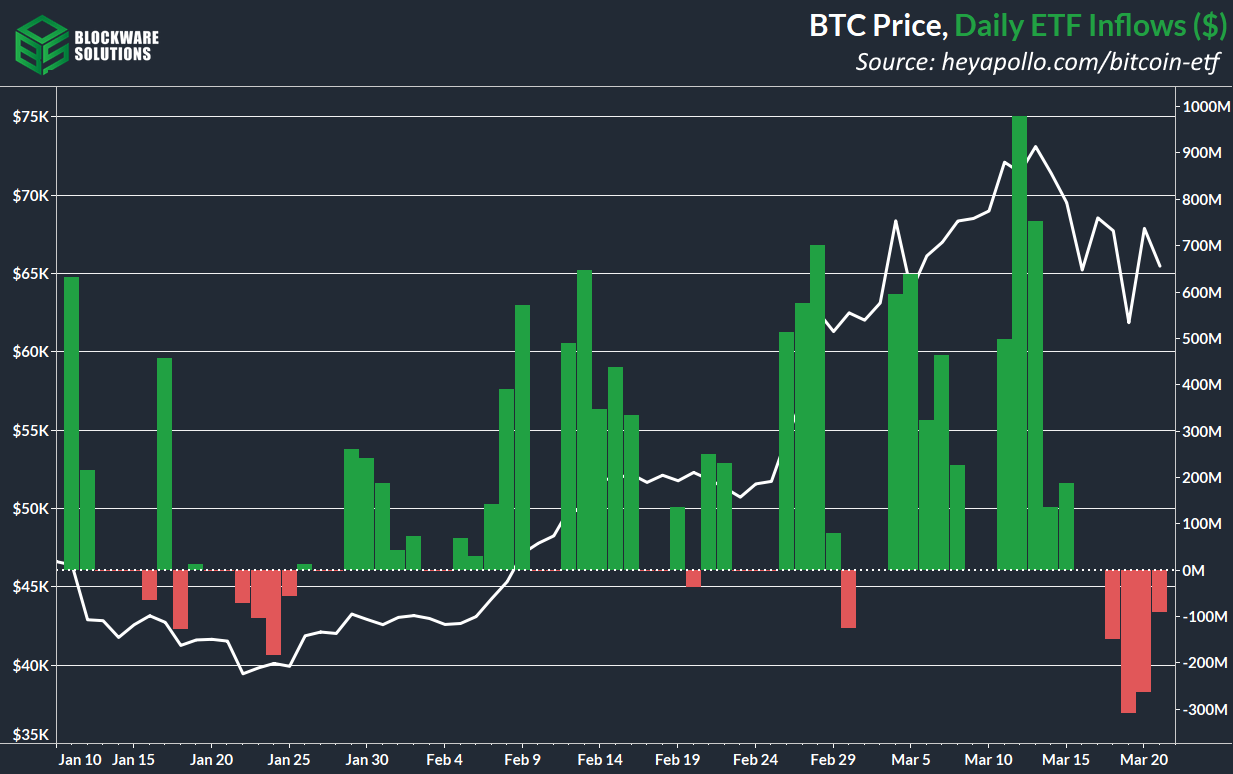

2. Bitcoin ETF Flows:

This was the first week of net outflows from the ETFs since late January. Unsurprisingly, the BTC price is down week-over-week. You can see quite a strong correlation between ETF flows and the Bitcoin price; Wall Street is in the driver's seat.

Many analysts predicted that the ETFs would dampen volatility due to portfolio rebalancing, and this appears to be true. Following the rapid run from $50k to $70k, we’ve seen some ETF outflows. However, these outflows pale in comparison to historical inflows, the latter of which will likely resume shortly. Total net inflows are still north of 200,000 BTC.

Source: https://heyapollo.com/bitcoin-etf

3. Grayscale Bitcoin Outflows:

It was a big week for outflows from GBTC; with this likely being the primary catalyst for the recent price action. Over 27,000 BTC (~$1,840,000,000) exited GBTC from Monday to Thursday.

GBTC anticipated net outflows from their product, however, it appears they underestimated the degree to which this would take place. Grayscale CEO, Michael Sonnenshein, said in a CNBC interview this week that “fees will go down over time.”

They are trying to find a balance that optimizes their fee revenue. They supposed that long-time holders of GBTC would be wary of exiting their position due to having to pay capital gains tax. And that the 1.5% fee would generate more revenue for them despite some assets funneling into other products, rather than lowering their fee to a more competitive rate and retaining a higher AUM. However, this change in posturing signals that the outflows were far more extreme than anticipated.

4. MicroStrategy

MicroStrategy executed the Bitcoin buy that we’ve anticipated since last week when they announced the issuance of even more convertible notes. On March 18th, $MSTR acquired 9,245 additional BTC, pushing them past the coveted threshold of 210,000. With ~214,246 BTC, MicroStrategy officially holds more than 1% of the total Bitcoin supply that will ever exist. They have won the game before the rest of the publicly traded companies even realized it started.

General Market Update

5. FOMC Meeting:

At Wednesday’s meeting The Federal Reserve, as expected, elected to keep the target Federal Funds Rate unchanged. In 2021 & 2022 Jerome Powell was criticized for leaving rates near 0 for too long. He is keen on not making a similar mistake this time around and is alluding to the fact that he will start cutting rates prior to seeing a deterioration in the employment market. Powell states that rates are likely at their cycle highs and balance sheet runoff is set to end “soon”. The market rallied on the meeting, with risk assets & short-duration treasuries both catching bids.

The dot plot below shows the Fed Official’s expectations about rates for the foreseeable future. The FOMC retained its outlook of 75bps of cuts in 2024.

6. 3 & 6 Month Treasury Yield:

As mentioned, short-dated treasuries caught a bid in the wake of the Fed meeting. The 3 and 6-month treasury yields are signaling rate cuts sometime in that window. So we’re looking at either the July or September meeting for the first cut.

7. Long Bonds

We didn’t see any crazy price action on the long-maturity treasuries this week. $TLT, the 20+ Year Treasury Bond ETF, moved down just 0.25% this week. However, $TLT is down ~5.3% year-to-date and ~11.5% year-over-year. Multi-trillion $ deficits from Congress adding to a mounting $34 trillion outstanding debt will likely continue to cause fragility among bonds, despite the treasury skewing recent auctions to shorter maturities.

Bitcoin On-Chain / Derivatives

8. Short-Term Holder Realized Price:

The cost basis of short-term holders continues to rise as newer market participants accumulate at higher prices. The short-term holder realized price currently sits around ~$57,000. The closer this metric gets to touching price, the more likely it is that we get another wick-up. Should BTC continue to trade range-bound, a test of this level will occur in the next few weeks.

9. HODL Waves:

This chart breaks down the supply of BTC based on the time since each coin last moved. We’ve got:

1 year+

2 years+

3 years+

5 years+

As you can see, the 1 & 2 year cohorts have begun to trickle down. This is occurring as those who bought the top in the previous cycle (2-3 years ago) are taking their ball and going home now that BTC has hit breakeven levels from their entry point.

The eldest coins on the network are not moving. In fact, we’re seeing a continued rise in the 3+ year cohort. The 3 & 5 year old coins are the primary metrics to watch they indicate coins that have essentially been held through an entire cycle (or most of a cycle). In the previous Bitcoin bull markets, we haven’t seen the 3+ year cohort of coins diminish in size until near the market top. Until we see that happen, we’ll know that supply illiquidity is still intact.

Think for a minute about everything that has been endured by someone who has held their coins for 3 or more years (March 2021 or sooner):

Elon FUD

China Mining Ban

$69k top in 2021

Terra/Celsius/Voyager/BlockFi contagion

FTX Collapse → $16k bottom

Coinbase & Binance Law Suit

ETF Approval and surge to new all-time highs

…despite all of these, these coins have not moved.

It’s going to take much higher prices to incentivize those who endured this rollercoaster to part with some of their coins.

10. HODL Waves:

Here's some perspective on where we are in the current Bitcoin cycle.

Average on-chain transfer volume (USD Denominated) is well below the 2021 bull market peak. Hardly any value is being moved on-chain. Granted, much of the spot volume is taking place through the ETFs, which will inherently result in less on-chain activity than retail buying from exchanges (and subsequently withdrawing).

However, once we see the price really start to move, that's when on-chain volume will surge. Older coins will move to exchanges to be sold. Until then, low on-chain volume is a sign of supply-side illiquidity.

Nobody wants to sell their BTC.

Bitcoin Mining

11. Bitcoin Mining Stocks

After starting the year off on the wrong foot, BTC mining stocks had a fantastic week. $WGMI, the miner ETF, posted 21% returns over the past five days. Mining stocks are facing serious competition from $MSTR when it comes to a higher-beta play on spot BTC. Moreover, the drop in revenue induced by the halving is no doubt pricing itself into mining stocks, as evidenced by negative YTD performance. The halving could be a “buy the news” event for mining stocks. Yes, revenues for these businesses will drop. However, most are at no risk of becoming unprofitable. They have low energy costs, efficient ASICs, and BTC is ripping.

12. WGMI / BTC:

Last week we observed the cyclicality of $WGMI / BTC (mining stocks priced in terms of BTC) and forecasted that a rebound was likely; it did just that. The dominant theme of this chart is volatility with lower highs. This is indicative of the cyclical nature of Bitcoin mining, and the importance of timing the market accurately.

Long-term growth in hashrate/mining difficulty is a downward force on mining profitability. However, bull markets remain highly profitable for miners as the rapid monetization of BTC far outpaces increasing mining difficulty. It is critical to properly time your entry into the mining market, whether you are entering via public equities or buying ASICs yourself. Getting in before the bull market is where the most success is found. In other words, now is a great time to stack ASICs.

13. Price Growth vs Difficulty Growth: Over the past 90 days, price has grown at a faster pace than mining difficulty; which is net-positive for Bitcoin mining profitability. These regimes do not come often as mining difficulty is in a state of near-perpetual growth. However, these regimes, as sparingly as they may be, are potent for mining profitability when they occur. BTC price appreciation during bull markets significantly outpaces growth in mining difficulty; which blows miner profit margins through the roof.

14. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$26,281 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.