Blockware Intelligence Newsletter: Week 34

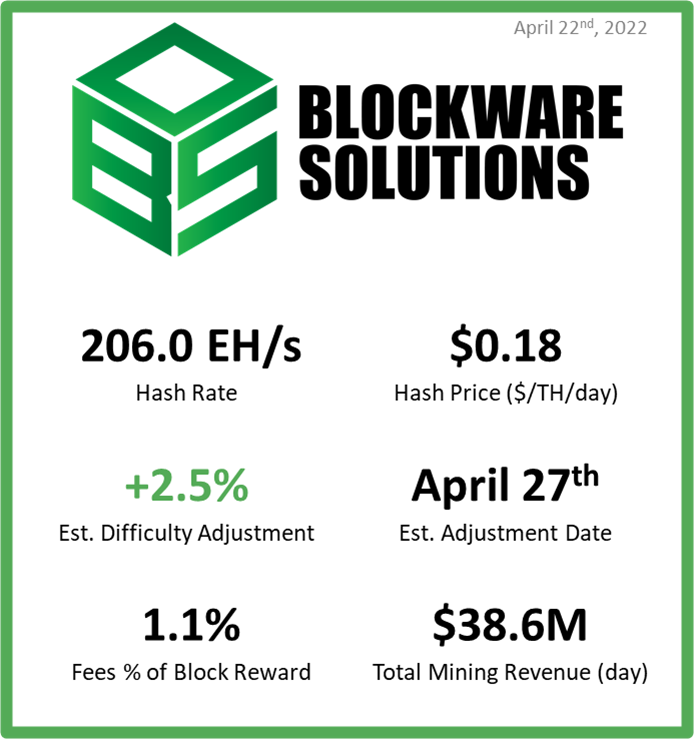

Bitcoin on-chain analysis, mining analysis, equity-analysis; overview of 4/15/22-4/22/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

FTX US - Buy Bitcoin and crypto with zero fees on FTX. Use our referral code (blockware) and get a free coin when you trade $10 worth.

Blockware Solutions (Mining) - It is difficult to buy ASICs, build large mining facilities, and source cheap scalable electricity all on your own. Work with a trusted partner like Blockware to deploy capital into Bitcoin mining.

Blockware Solutions (Staking) - Ethereum 2.0 is almost here, now is the time to stake your ETH with Blockware Solutions Staking as a Service to take advantage of 10-15% APR when the Ethereum network switches over to Proof of Stake

Summary

In the general market, not much has changed from last week. Yields are rising and compressing stock valuations, causing a sell off in equities.

Mortgage rates are on the rise and are now at 12 year highs.

Silvergate Capital (SI) has been the clear leader among crypto-equities this week after reporting strong earnings on Tuesday.

Still see closes above $47K as an area of interest for buying momentum, and low $30Ks as an area of interest for buying value

BTC correlation to Nasdaq at unprecedented levels

Beneath the surface continuing to see accumulation

Devastating new sanctions on Bitcoin miners in Russia highlight the importance of setting up mining operations in stable political jurisdictions like the United States.

Bitcoin Mining and energy markets are merging. Combined they will stabilize energy grids and turn wasted energy into sound money.

General Market Update

Over the last week we’ve seen more of what we discussed last week, risk-off selling.

To understand what’s happening in the equity markets the number one thing to watch are bond yields. As yields rise, stock valuations are compressed because the risk-free rate used to calculate discounted cash flows is higher, causing a sell-off for stocks.

US 10Y Yield (Tradingview)

As you can see above, the 10 year treasury yield is nearly at 3% and is at 4 year highs. The fixed-income market is currently working to price in inflation at 40 year highs and interest rates on the rise.

A higher fed funds rate and a flattening yield curve forces lenders to raise interest rates on consumer loans such as car loans and mortgages.

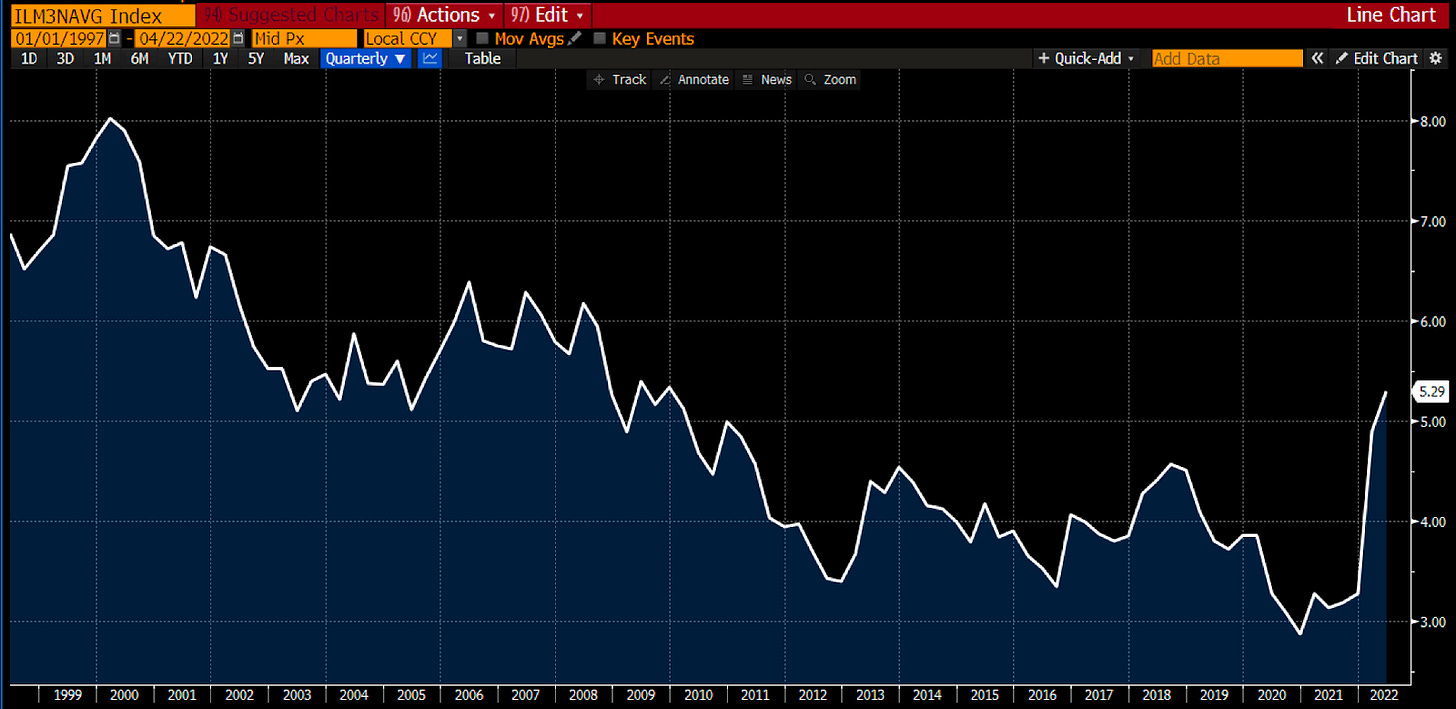

30Y Mortgage Rate (Bloomberg)

The housing market is also pricing in this current macroeconomic environment, mortgage rates are currently above 5.25% for the first time since 2010. This discourages borrowers from borrowing and encourages lenders to lend. With decreased borrowing comes decreased buying, bringing down the value of houses

NAIL 1D (Tradingview)

NAIL, a homebuilder and supplier ETF, is down ~66% year to date. That’s in comparison to the Nasdaq down ~17%, the S&P down ~8%, Bitcoin down ~13%, the Russell 2000 down ~12% and Vanguard Bond ETF down ~9% YTD.

As of Thursday’s close, the indexes are quite weak from a technical standpoint, the Nasdaq even more so than the S&P.

Nasdaq Composite 1D (Tradingview)

On Thursday, the Nasdaq was rejected at its 21 and 50DMAs and ended up closing below the lower limit of this 2 week range. This selling was on volume consistent with its 50 day average and 13% higher than Wednesday.

Thursday was a distribution day on both the Nasdaq and S&P. A distribution day is denoted by the index being down >= 0.2% on volume greater than the previous day.

Distribution days are counted on a 25 day rolling period and indicate the health of the market. Having 2-3 distribution days is generally normal but when the distribution days start to rack up it can be a sign of weakness and institutional selling.

Currently the Nasdaq and S&P both have 6 distribution days in the last 25 days. In my opinion, it appears that a retest of the index lows are pretty likely, which would be a ~5% drop on the Nasdaq and ~6% on the S&P.

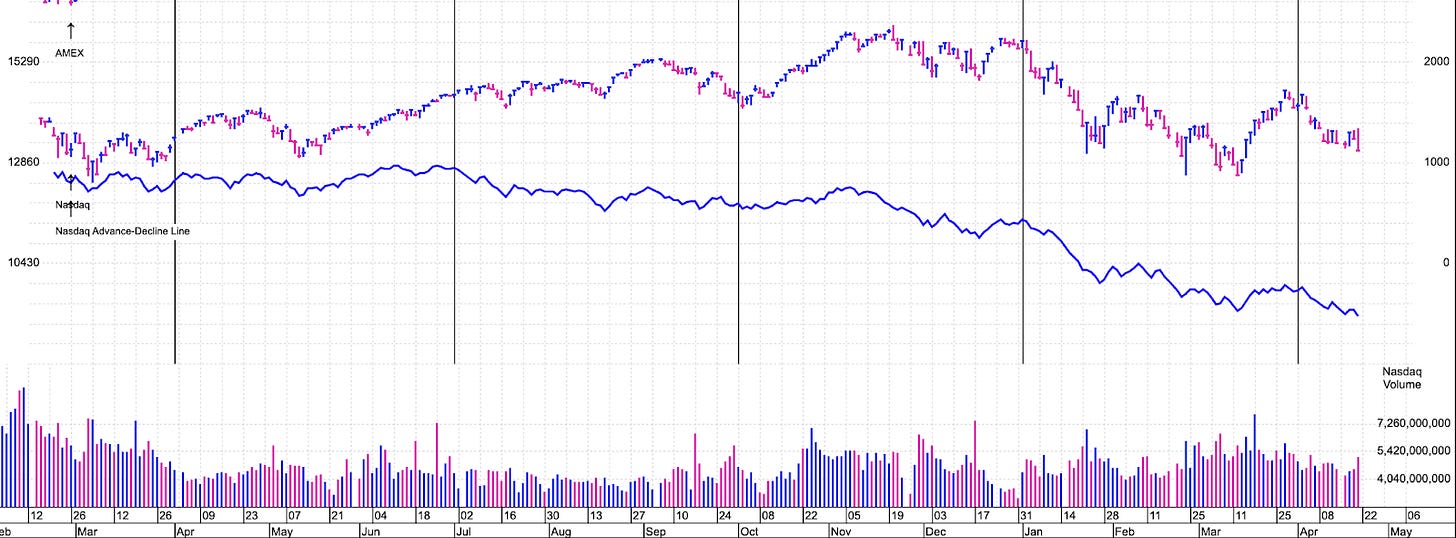

Nasdaq Comp. with A/D Line (Marketsmith)

Above you can see the Nasdaq overlaid with the Advance-Decline line. The A/D line is a breadth indicator and tells us how many Nasdaq stocks are appreciating or depreciating.

Breadth is currently very poor on the Nasdaq, as indicated by the A/D line breaking down below YTD lows. This means more Nasdaq stocks are declining than have all year.

ARKK 1D (Tradingview)

ARKK, an ETF of the Ark Innovation Fund, is a solid gauge of the market’s current risk appetite because the fund invests in tech and growth names. When institutions are willing to bet on the performance of the Ark IF it’s clear that the market is risk on.

Currently, ARKK is nearing its year-to-date lows. ARKK was a super performer in 2020 but now its price is the same as it was in April 2020.

Crypto-Exposed Equities

In general, crypto-stocks have had a rough week of price action.

Silvergate Capital (SI) has been the clear leader this week after they reported strong earnings before the open on Tuesday. Sales were up 92% and earnings were up 44% year over year.

SI 1D (Tradingview)

SI is one of the only Bitcoin related equities with price right around its 200 day moving average and above its 50DMA. SI is roughly 54% off its lows, an indication that there’s been a fair amount of demand for SI shares since it undercut the $100 century level in January.

There isn’t too much to say about crypto-equities here as their price action is primarily dependent on that of Bitcoin. After the nasty reversal on Thursday to undercut all major moving averages, it would appear that, most likely, lower prices are to come. The same can be said for crypto-exposed equities.

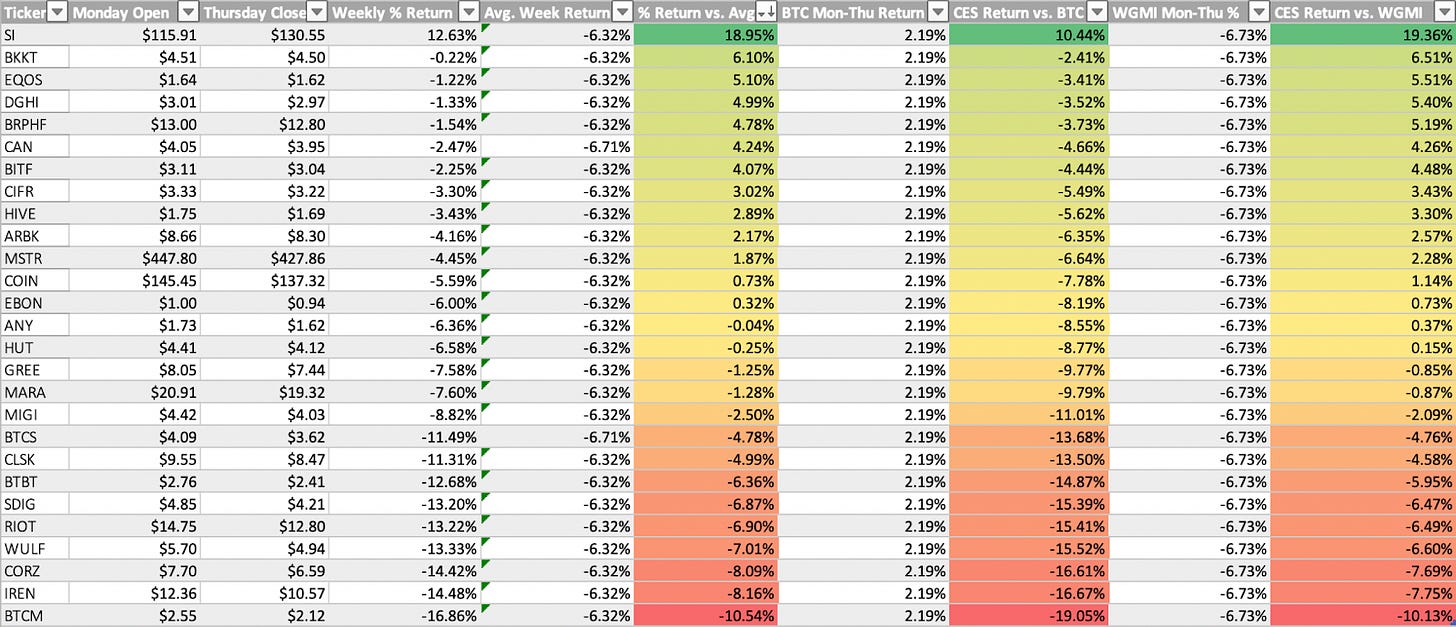

Above is our weekly excel sheet comparing the Monday-Thursday price action of several crypto-equities. To no surprise, SI tops this list with price up nearly 13% from Monday’s open.

One thing that stands out to me is that spot Bitcoin price has vastly outperformed all of these stocks except for SI. BTC is actually up from Monday’s close while most of the equities and Valkyrie's Mining ETF (WGMI) have succumbed to stock index selling pressure.

Bitcoin On-Chain and Derivatives

From purely a price structure standpoint, Bitcoin is still in “no man’s land” regarding our value/momentum framework we’ve talked about numerous times. In this time of high uncertainty in markets, I think one of the best approaches for swing traders is to simply set thresholds for yourself and let the market either show you strength or enter an area you deem fair value. DCAs gonna DCA regardless; in a moment we’ll talk about why we think this is a great time to DCA heavily into BTC for market participants with much broader time horizons. Still see several consecutive closes >$47K as momentum and the low $30Ks as value.

In addition to this area being a pivotal level from price interaction and being right around the 2022 yearly open, here are two charts illustrating why I view this recent rally to $47K as a failed attempt to reclaim momentum:

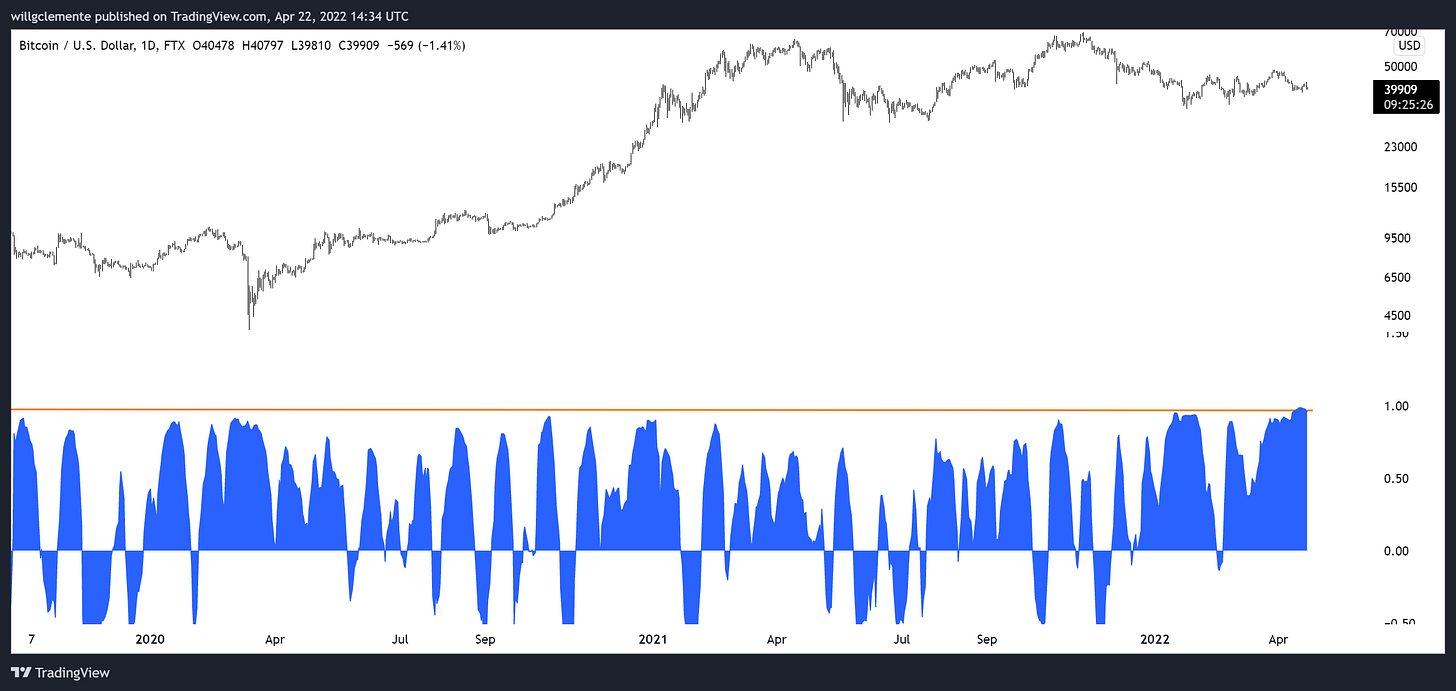

I want to focus this week’s section on the correlation as it’s been a hot topic recently and I think I have somewhat of a contrarian view. Recently Bitcoin has been trading at an extremely high correlation to the Nasdaq recently. Below you can see the 1D correlation of BTC to NQ, reaching as high as 0.98. Whether Bitcoiners view BTC this way or not, the fact is that the broader market has been viewing view as a high beta asset, basketing it in with tech.

With this in mind, you need one of two things for BTC to move up. Either:

A: Tech to rebound and drag BTC up through correlation

OR

B: Decoupling

So with that in mind, what would have to occur for that decoupling?

In the short term, some type of idiosyncratic flow; meaning some large buyer stepping in like a Luna Foundation Guard for example. In a broader sense though, I think you eventually will get a transfer of supply from correlation trading entities to convicted crypto natives, high net worth individuals, etc. One of the fund managers I look up to and spoke about this to named Su Zhu described this eloquently as a “supply gentrification”. Not sure exactly the time frame on this, but conservatively let’s say in the next 12 months. Let’s take a peek under the hood at some data backing up the point I’m trying to make here.

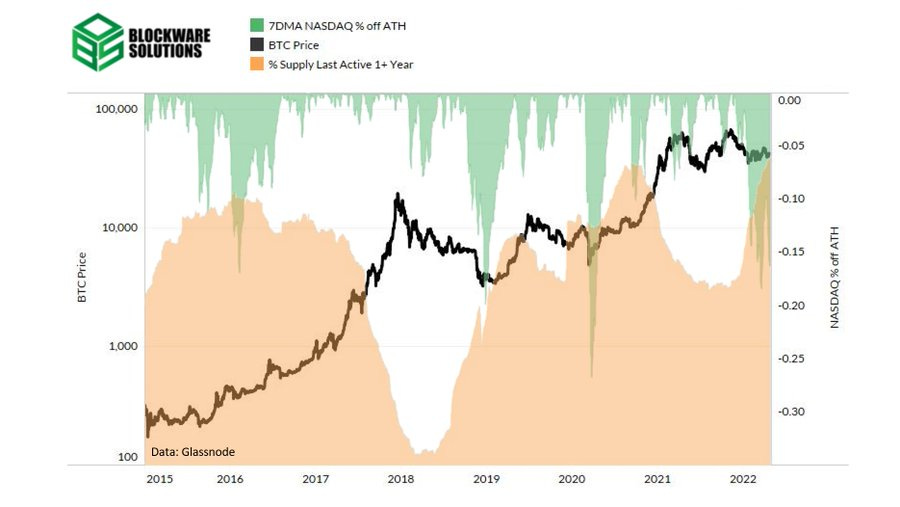

Here we are looking at the amount of supply that hasn’t moved in at least a year and comparing the 7DMA of how far the Nasdaq is off its highs. What we see is that despite the Nasdaq being down about 20%, an all-time high ~64% of Bitcoin’s circulating supply has not moved. To me, this illustrates the fact that there is a convicted base of long-term Bitcoin believers/HODLers out there utilizing BTC as a store of value despite unprecedented uncertainty in global markets.

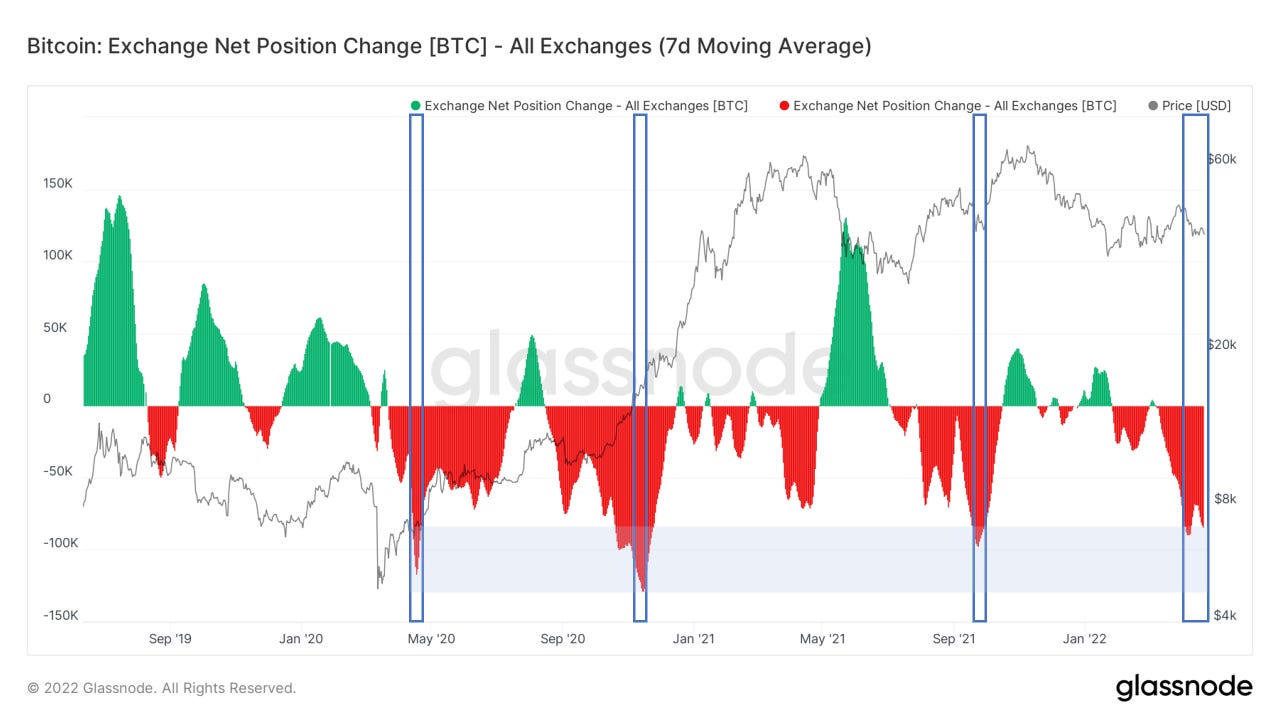

Bitcoin outflows from exchanges are rolling over again this week; entering back into the zone highlighting a rate of outflows from exchanges only seen 3 times previously in Bitcoin’s history.

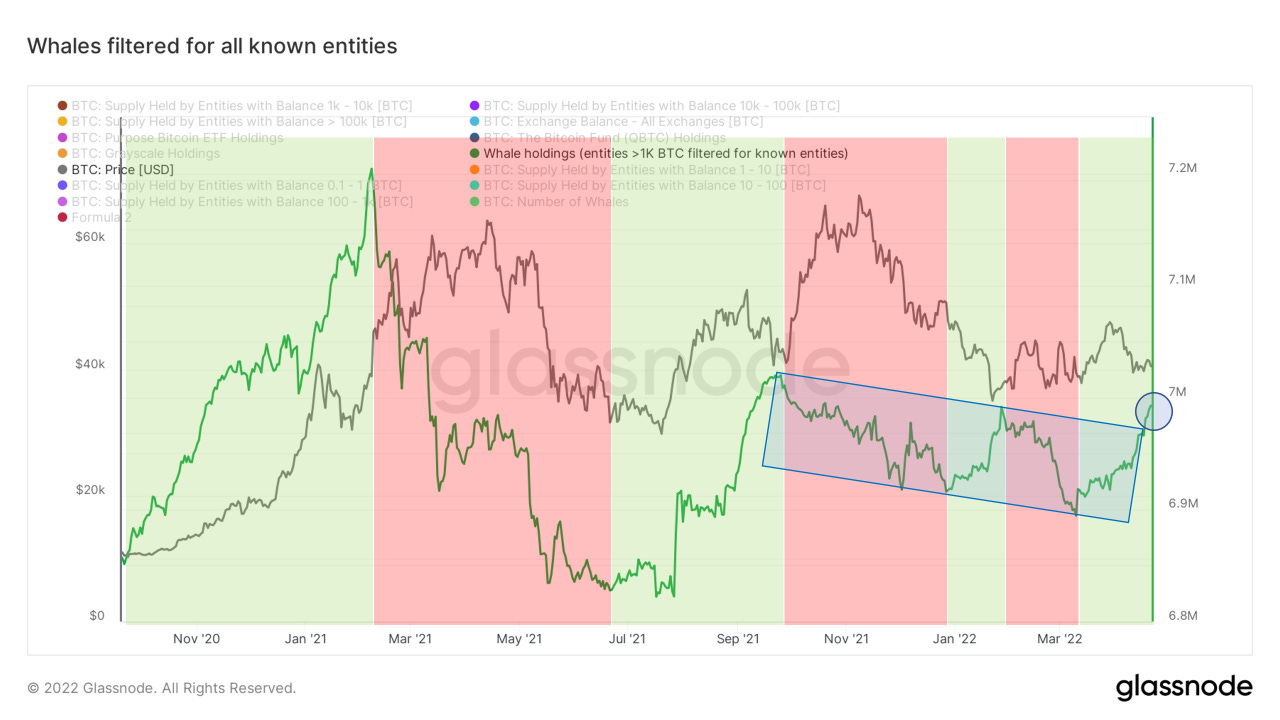

We’ve also seen some whale BTC accumulation continuation this week, a surprising trend that has gone on for a month now.

I think the story of this bear market is the transfer of supply from correlation trading traditional finance entities to long-term convicted crypto natives, HNW individuals, and forward-looking institutions. Once this supply transfer is complete, I suspect we can see a prolonged multi-week decorrelation at a minimum. This would be quite powerful and have a lot of ideological reflexivity, especially with the shaky backdrop of the current state of the economy.

In the meantime, we continue to trade at an extremely high correlation to NQ, but I suspect that the pendulum will swing in the opposite direction in the coming months. It will be obvious if/when this occurs.

Bitcoin Mining

Devastating Sanctions on Bitcoin Miners in Russia

“WASHINGTON, April 20 (Reuters) - The United States on Wednesday imposed sanctions on dozens of people and entities, including a Russian commercial bank and a virtual currency mining company, hoping to target Moscow's evasion of existing sanctions over Russia's invasion of Ukraine.”

US-based companies with mining rigs in Russia are required to immediately cease all dealings with hosting facilities located there. Machines are being turned off, and they will NOT be turned back on. Rigs hosted in these Russian facilities cannot be exported out of the country due to the new sanctions. Millions of dollars worth of Bitcoin mining rigs were deployed in Russia, and that capital has practically vanished overnight.

This is a key reason why Blockware Solutions and Blockware Intelligence have always advised deploying mining rigs in the most stable political jurisdictions. Blockware Solutions has never placed client mining rigs in high-risk countries like Russia and Kazakhstan, and we remain committed to growing hash power in the United States of America.

Last, geopolitical issues in Russia and Kazakhstan, where each region contained over 10% of the total network hash rate as of August 2021 (Cambridge), likely explain the unexpectedly slow growth of the hash rate throughout 2022. Miners in the US not only have less political risk, but they are actively benefiting from machines being turned off elsewhere by mining more BTC.

Bitcoin Mining and Energy Markets in Texas

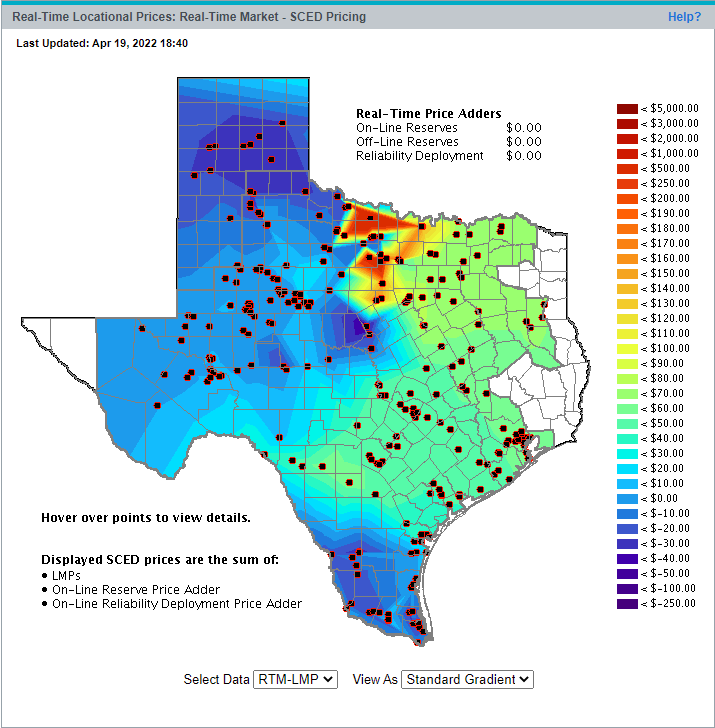

ERCOT, the Texas energy grid, broadcasts real-time commercial electricity rates. On a Tuesday night in Amarillo, TX, a Bitcoin miner could plug in 1MW worth of rigs, get paid by the grid to take the extra load, and mine BTC. While these prices are variable every 5 minutes, and other potential costs come into play such as ancillaries, line loss, and other minor expenses, it is fascinating to see that it is possible to be paid to mine BTC when the grid has excess capacity.

These business strategies to capture excess energy from power producers and energy grids are only beginning. Since ASICs are commoditizing as outlined in our report, Why the 2020s will be a Golden Age for Bitcoin Mining, new generation machines today will ultimately be demanded by grid stabilizing mining companies 4+ years from now to be plugged in when and where there is excess energy.

A Bitcoin mining rig is a machine that converts energy into sound money. As Bitcoin continues to monetize, mining rigs will become recognized as financial assets. They will become more liquid and retain value over longer periods of time. Our outlook on the future of Bitcoin Mining in the US remains highly optimistic.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Excellent analysis. Very impressive.

Great newsletter