Blockware Intelligence Newsletter: Week 132

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/10/24 - 5/17/24

🚨Buy The Latest-Generation of Bitcoin Mining Hardware🚨

Blockware has partnered with a world-class immersion mining facility to bring you the opportunity to mine using the Whatsminer M66s.

288 TH/s (up to 330 EH/s when in “high-performance mode”)

19.5 W/Th

Immersion has a few notable advantages over air-cooled mining:

Heat Resistance

Greater Up-Time

Longer Machine Lifespan

Superior Hashrate & Efficiency

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Make sure to check out our YouTube channel! The team has been publishing a ton of great content: weekly market updates, long-form interviews, etc.! The latest video is a one-on-one discussion with Blockware’s Head of Mining Operations, James!

James is a native of Kentucky and a third-generation coal miner. He lead’s Blockware’s mining operations at our eastern Kenutcky Bitcoin mines.

With coal industry challenges due to hostile legislation, economic opportunities have dwindled in Kentucky. James and others like him have embraced Bitcoin mining as a way forward. James discusses all this and more in his interview.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

Bitcoin: News, ETFs, On-Chain, etc.

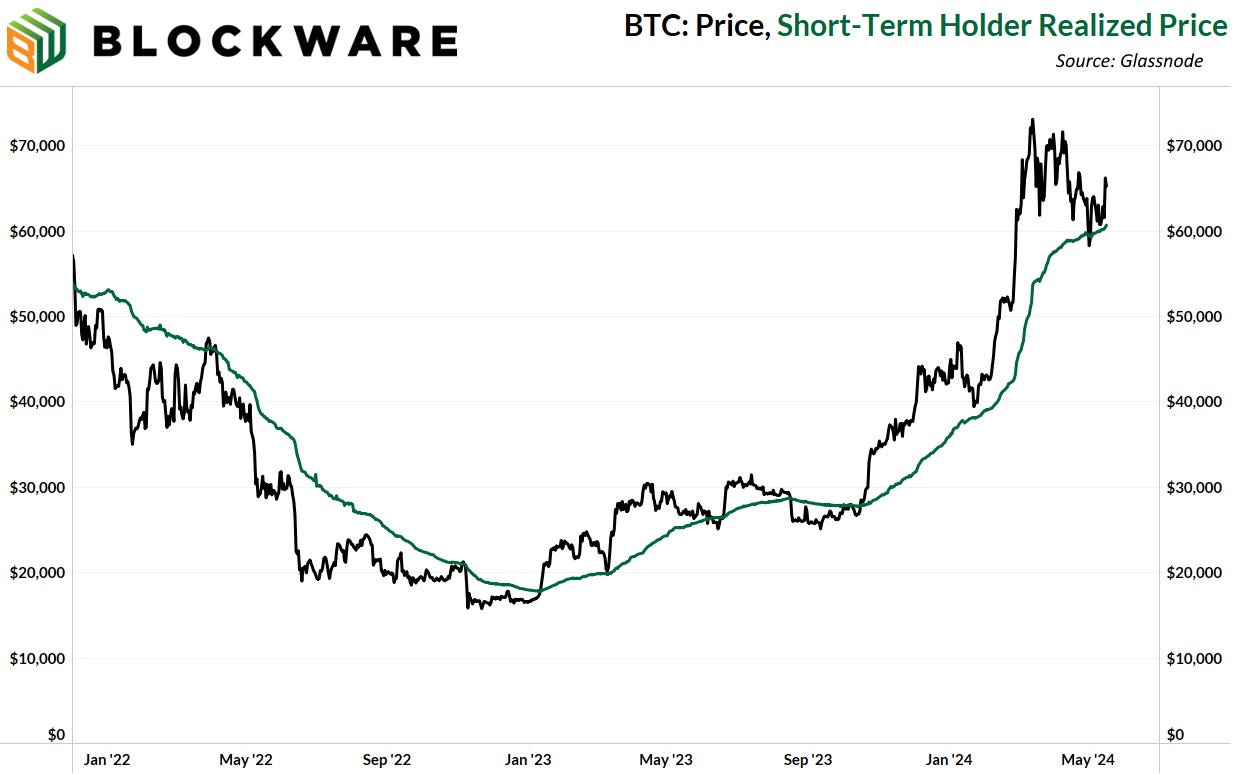

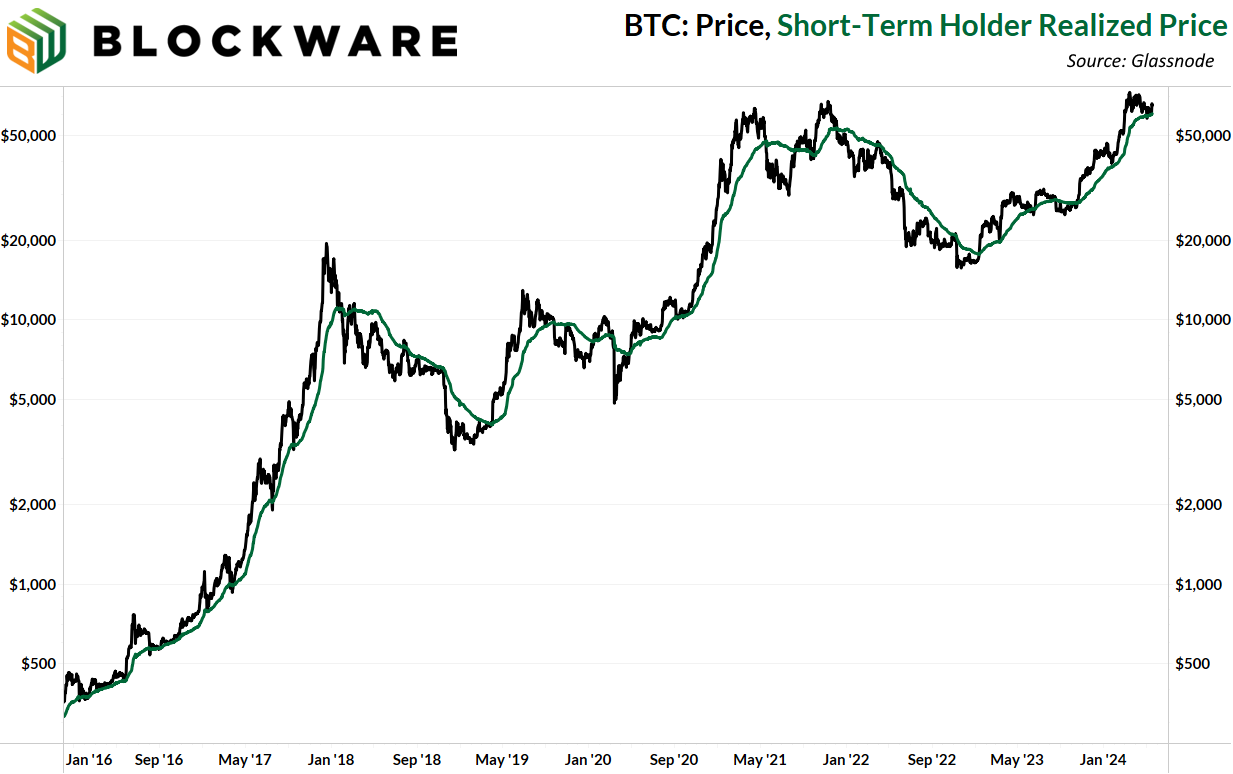

1. Short Term Holder Realized Price

Our favorite on-chain metric proved itself useful; the cost-basis of short-term holders successfully served as support for the price of Bitcoin. What is a short-term holder? Why did this work as support? In on-chain analytics, a “short-term holder” is classified as any address that has moved UTXOs within the past 155 days, or roughly five months. These addresses have a high amount of on-chain activity, ie: they are moving coins frequently, and tend to be traders of the asset. During bull markets, they like to buy when the price of bitcoin hits their cost-basis as that’s a good time to add to their position. As such, the aggregate cost basis of short-term holders functions as support during bull markets; and it does so with astonishingly high historical accuracy. Note the 2017 and 2020/1 cycles.

2. US Senate Passes Bill to Defend Bitcoin & Crypto Custody

The SEC’s Staff Accounting Bulletin No. 121 (SAB 121) would have stopped financial institutions from custodying Bitcoin and other digital assets. In a bipartisan effort, the United States Senate passed a bill to overturn this bulletin, defending the right of institutions to hold Bitcoin. At the forefront of this was none other than Wyoming Senator, Cynthia Lummis, who has been the most vocally pro-Bitcoin politician on Capitol Hill. In regards to the bulletin, Lummis commented that the SEC was stepping out of its bounds, to quote: "The SEC should never set policy—over banks, no less, an industry they do not regulate—through a staff accounting bulletin. This is nothing more than this administration attempting to skirt the law,"

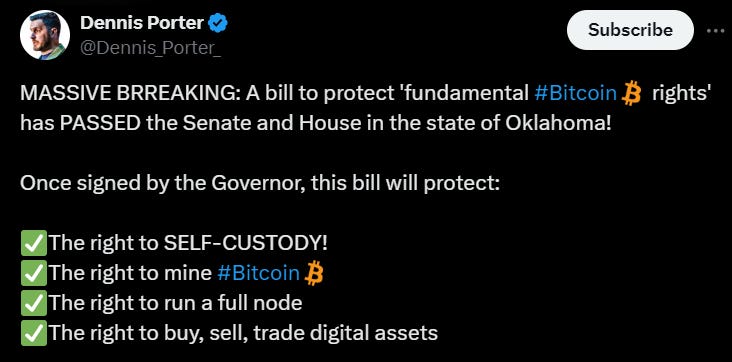

3. Oklahoma Defends the Rights of Bitcoiners

The US State of Oklahoma signed into law a bill that protects the rights of Oklahomans to buy, hold, use, and mine Bitcoin! This is a huge win for Oklahomans and for US citizens in general. There may be friction at the federal level when it comes to Bitcoin adoption, but each of the fifty states are beginning to make their positions clear. States that adopt Bitcoin will attract highly capitalized Bitcoiners, Miners, and Bitcoin businesses, which will bolster their economies and state tax revenues. Oklahoma joins the ranks of Arkansas and Montana who passed similar legislation last year. Game theory is playing out right in front of us: states are vying to position themselves as pro-Bitcoin. You even have state politicians engaging in friendly Twitter banter about whose state is the most “pro-Bitcoin.” We are bullish on Bitcoin adoption within the United States.

Speaking of Oklahoma, now that the right to Bitcoin has been enshrined in the law, you may be interested in deploying capital into that jurisdiction. Blockware has a partnered hosting facility in Oklahoma, and we have ASICs that are online right now that you can purchase. Head over to our Marketplace and you can pick some up. Below is a picture of our Oklahoma mining facility.

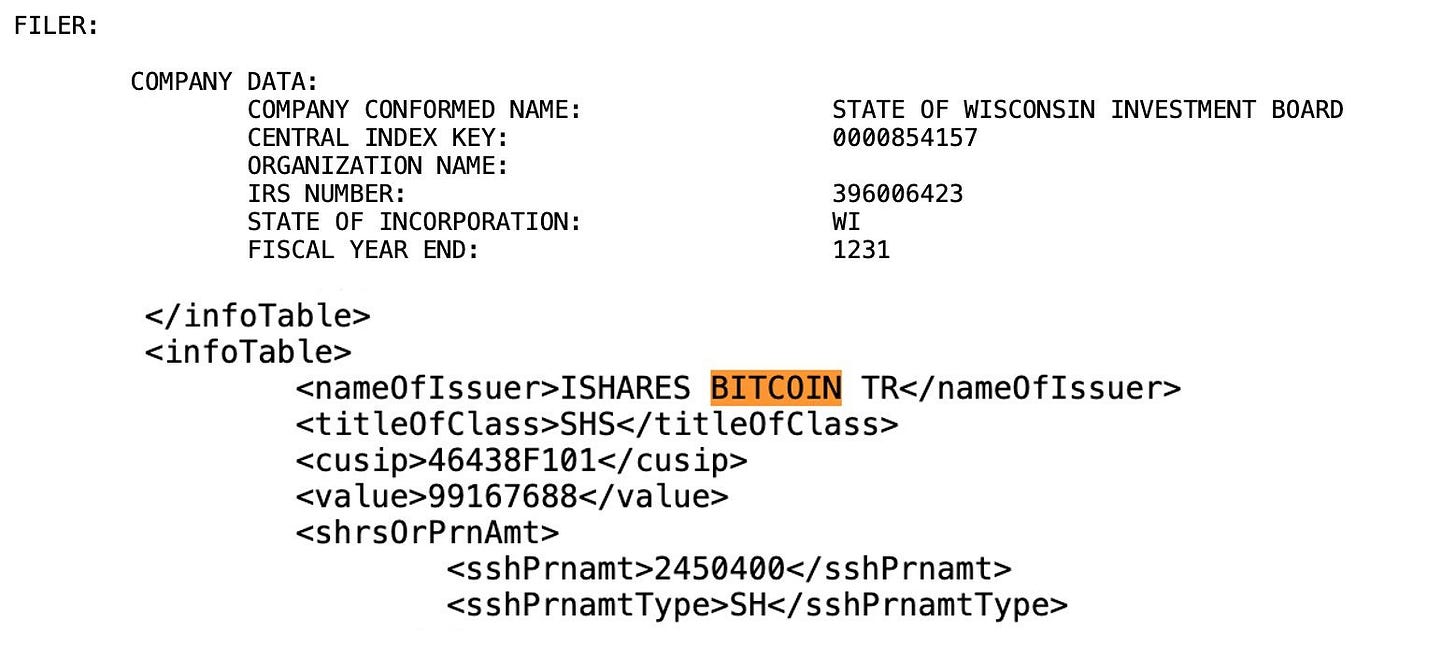

4. Wisconsin Pension Fund Allocates to Bitcoin ETF

Speaking of States, it was revealed in public SEC filings that the State of Wisconsin Investment Board (SWIB) holds nearly $100 million worth of the Blackrock Bitcoin ETF. This is an example of Bitcoin buying that is unlocked by the existence of a spot ETF. Accumulating a position of this size without a securitized vehicle would have otherwise been a years-long process for an institution of this size. This is just the tip of the iceberg for the deployment of institutional capital. For scale: the SWIB manages ~$156 billion in assets. This $100 million allocation is just 0.06% of their assets under management. Institutions are just dipping their toes in now; as they learn more about Bitcoin and as the price continues to increase, they’ll increase their position size.

General Market Update

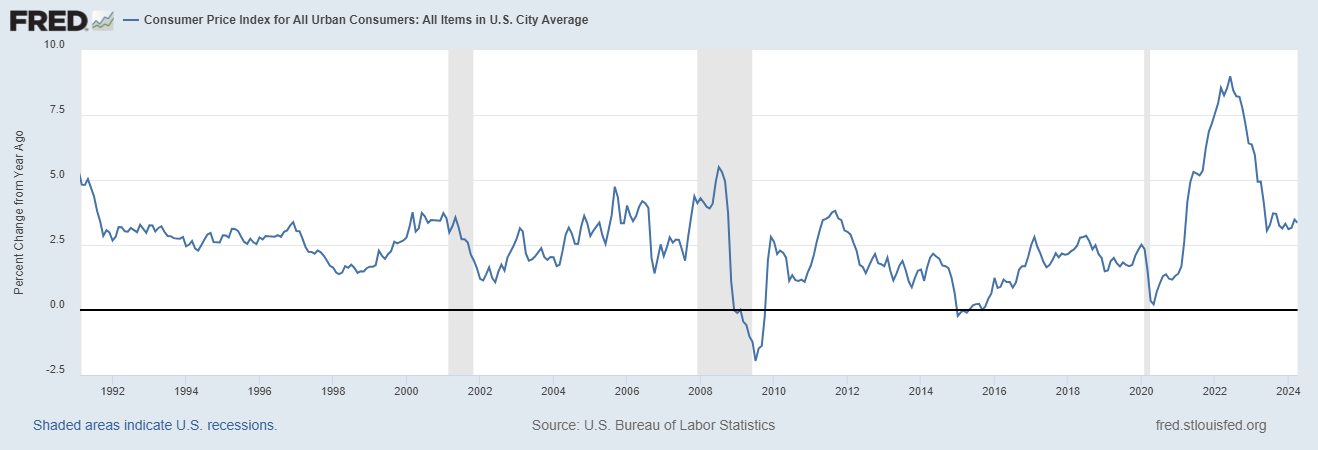

5. April CPI Data

The biggest development on the macroeconomic front this week was the release of the April CPI data. It wasn’t necessarily a development, CPI came in at the expectations which was a 3.4% annualized rise in prices. It has been three and quarter years since CPI was below the Fed’s arbitrary target of 2%. And it has been almost a year since disinflation stopped, and CPI has trekked sideways around 3%.

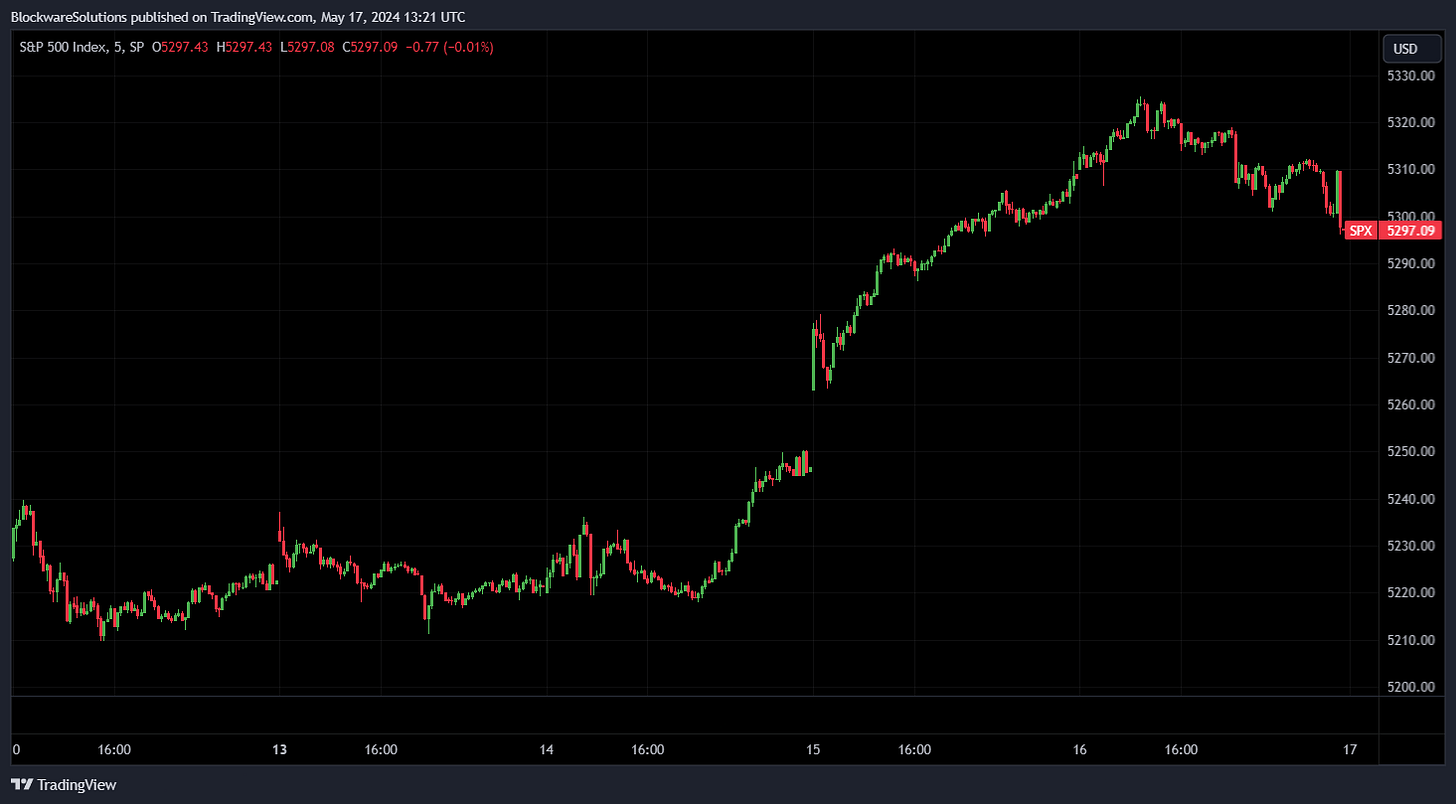

6. S&P 500 Index

Risk was on this week after the CPI drop, with the S&P index rising ~1.3% on the week to a new all-time high north of 5300. Despite the cries of doomers and bears, the US stock market continues to perform exceptionally well, being up 28% year-over-year. Granted, in the same period, Bitcoin is up 143%.

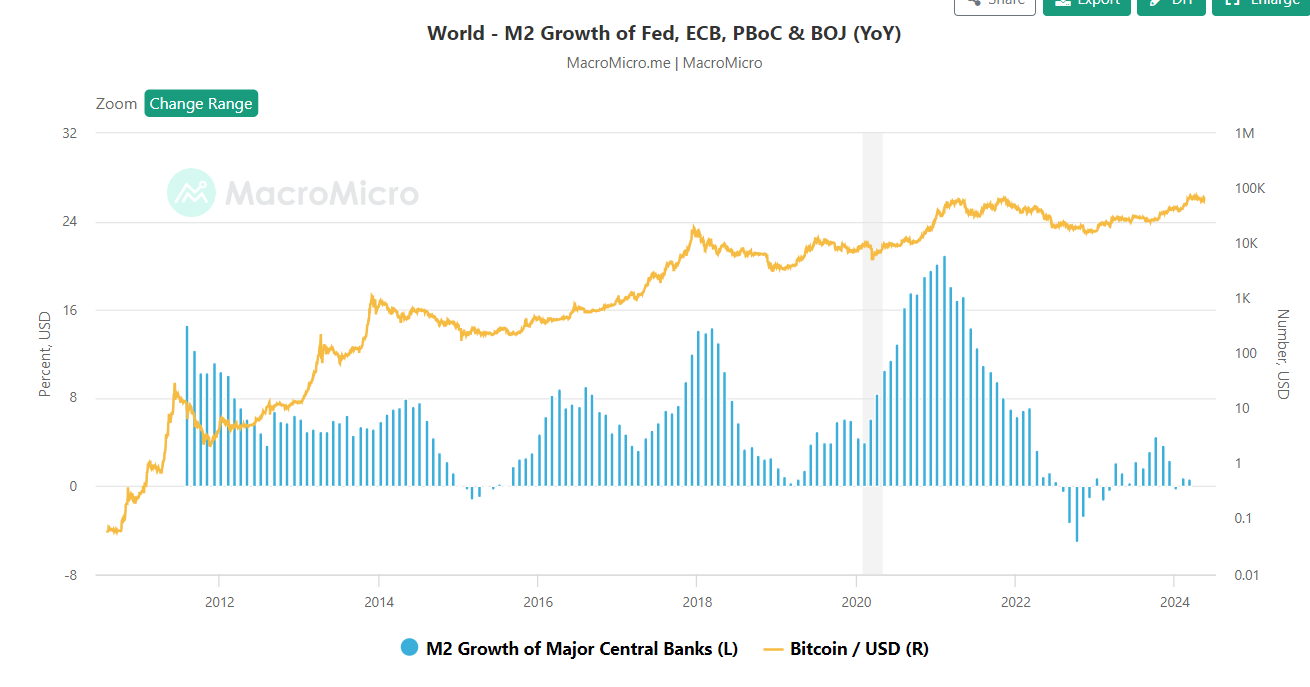

7. Global M2

The primary driver of markets right now is global liquidity. And despite interest rates being at their highest level since 2007, global liquidity is on the rise. Backdoor liquidity injections from programs such as BTFP, the USD/JPY swap line, and deficit government spending have increased the units of currency in the system in spite of positive real interest rates. Growth in the M2 money supply for the four major fiat currencies combined, the Dollar, the Euro, the Yuan, and the Yen, is positive on a year-over-year basis. Bitcoin, being absolutely scarce, globally accessible, and open for trading 24/7, is the most reflexive to changes in liquidity. As we continue in this regime of trillion-dollar government deficits and structurally higher inflation, Bitcoin, and all risk assets, will perform well in nominal terms as the new liquidity ultimately ends up in assets.

8. US 2-Year Treasury Yield

Bonds sold off during the back half of this week post-CPI data. Rate cuts in 2024, which at the beginning of the year were almost unanimously expected to occur, are beginning to appear more and more unlikely. At this point, it will be unoptical for the Fed to cut interest rates given that CPI has not reached their coveted 2% level. Any issues caused by elevated treasury yields have been managed with alternative facilities. They’ll likely continue to operate this way, keeping rates where they are, plugging holes as needed, and watching the economy unfold until there is a seismic shift in the employment market, at which point they’ll begin cutting rates.

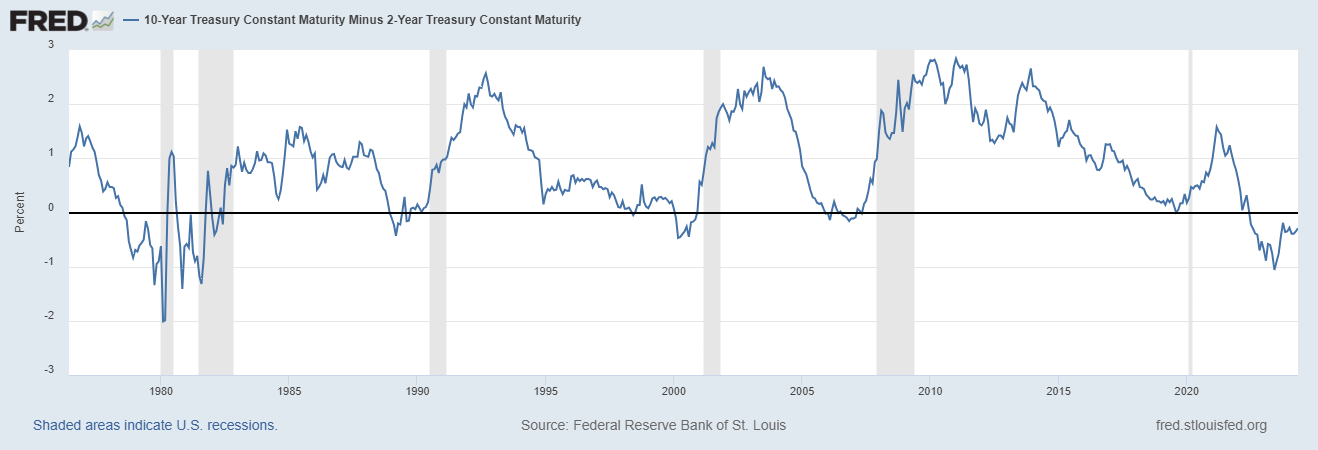

9. 10 Year Yield Minus 2-Year Treasury Yield

The curve of the 10-year yield and 2-year yield remains inverted as it has been for nearly two years now. Re-version of the curve has historically been a recessionary indicator. So far the curve shows no signs of re-version, and it likely won’t as long as the treasury continues to issue more treasuries on the short end of the curve.

Bitcoin Mining

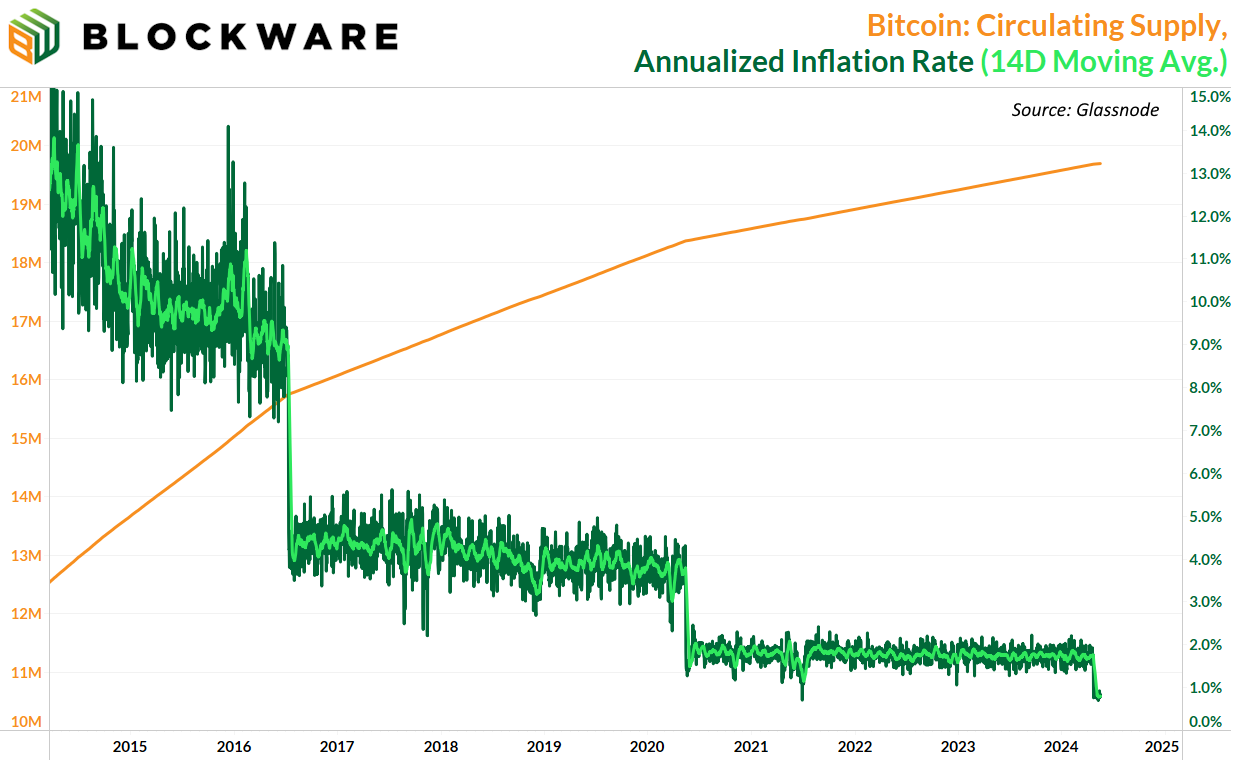

13. Bitcoin Inflation Rate

CPI weeks are always a great time to remind ourselves why Bitcoin is so revolutionary. Rather than the fiat system, whose monetary policy is determined arbitrarily by unelected officials, and results in perpetually rising prices and circulating supply of currency, Bitcoin is programmatically designed to have an inflation rate of 0% over the long term. After April’s halving, Bitcoin's inflation rate has dropped to less than 1%. Every four years, the amount of new BTC that enters circulation on a daily basis is cut in half and there’s nothing anybody can do to stop this trend. By the 2032 halving, 99% of all 21,000,000 BTC will be in circulation. It might not be a bad idea to acquire some before then.

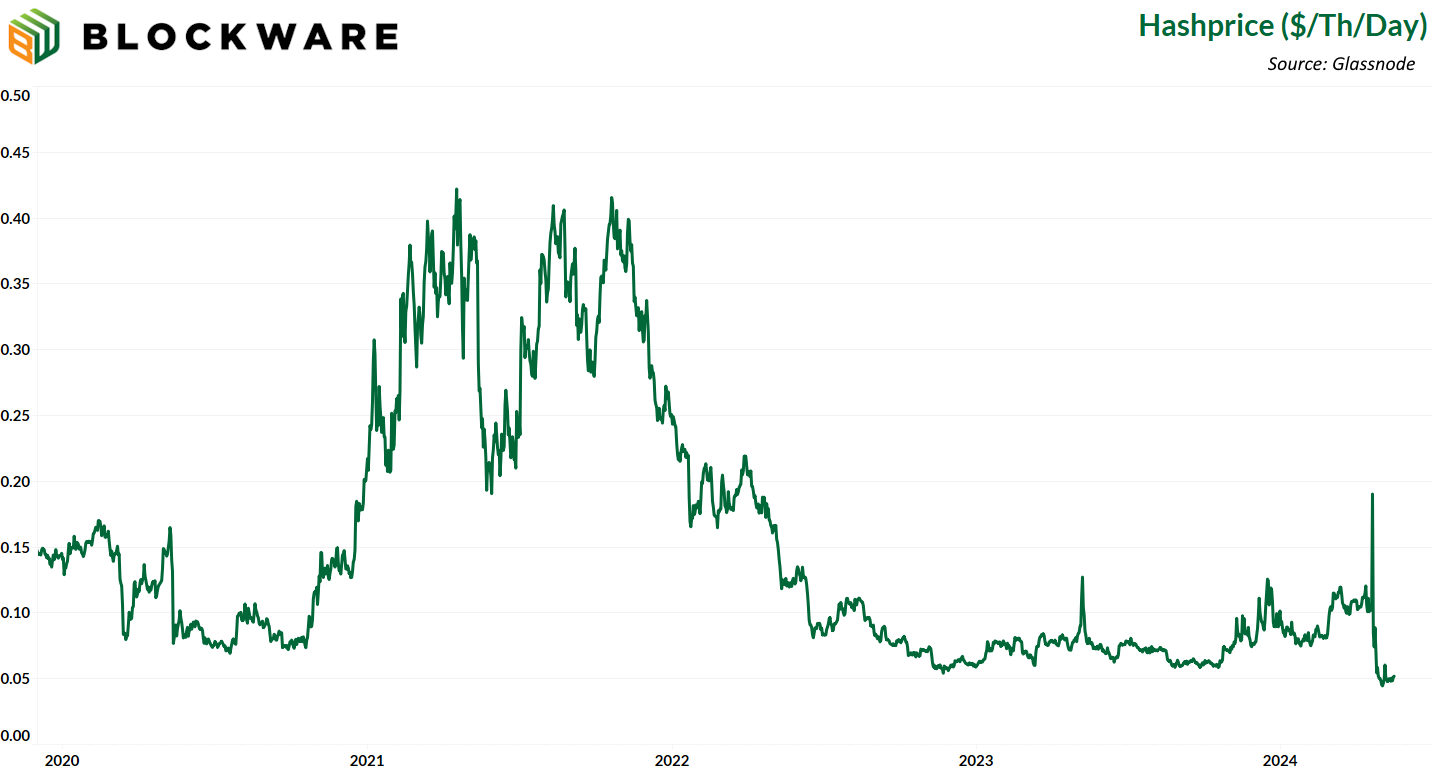

13. Hashprice

Miner revenue per terahash is still as low as it has ever been. After the 2020 halving, hashprice dropped to ~$0.07 where it stayed for a few months until the bull market took hold, at which point hashprice soared with haste. Hashprice likely follows a similar pattern this time around; except bottoming out at $0.05. The miner bloodbath appears to be over as the next projected difficulty adjustment is going to be positive at +0.75%.

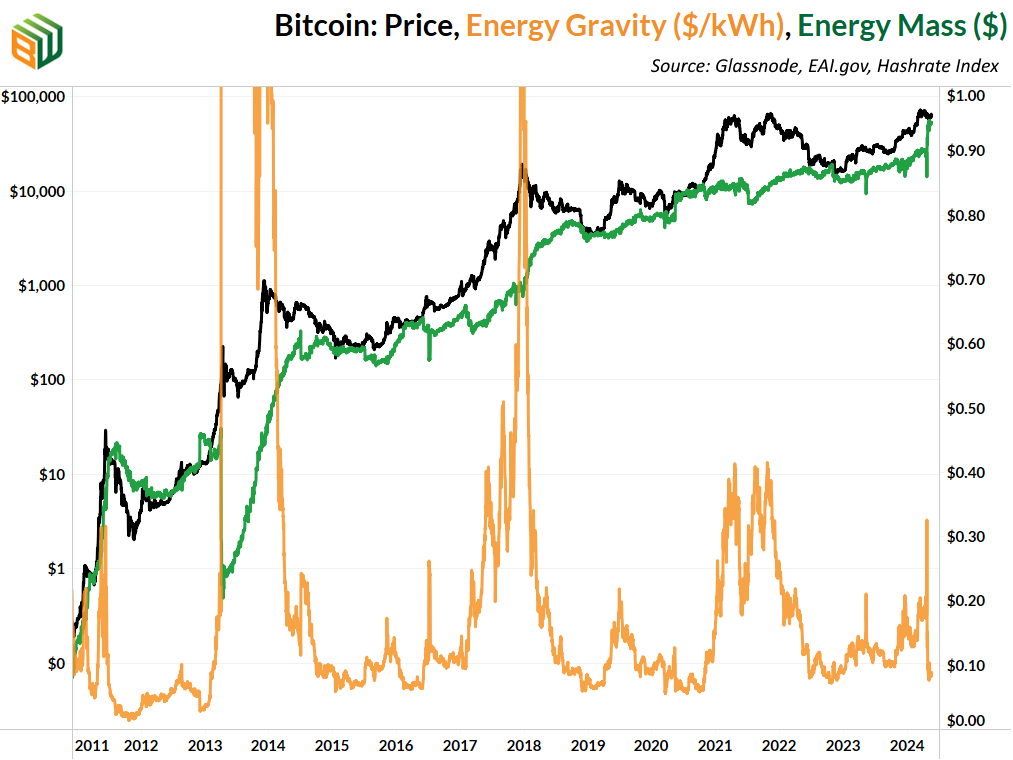

14. Energy Gravity: Although miner revenue is down, miners with new-generation ASICs are able to produce BTC for less than the current market price. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$52,800 worth of energy to produce 1 BTC. Mining is an incredibly competitive industry, using the most efficient ASIC on the market is necessary to remain profitable in the immediate aftermath of the halving, so that you can be online to profit during the bull market.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.