Blockware Intelligence Newsletter: Week 95

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 7/8/23-7/14/23

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through July 2023.

1. Blockware Intelligence Podcast. Blockware Solutions Head Analyst, Joe Burnett, sits down with Shimon Lazarov, Chief Marketing Officer at Unchained Capital. Shimon has multiple years of experience in growing Bitcoin companies and increasing global Bitcoin adoption. Joe and Shimon discuss Bitcoin adoption, the best frameworks for presenting Bitcoin to traditional investors, macro, Bitcoin-self custody, and more! Click the thumbnail below to check it out.

General Market

2. Consumer Price Index. In the month of June, the price of the headline CPI basket grew by 3.0% from last year. This was down from 4.0% YoY growth in April. On a monthly basis, the index grew by 0.2%, an uptick from last month’s 0.1%. Core CPI’s monthly and yearly numbers were 0.2% and 4.8%, respectively.

3. 10-Year Treasury Yield. With inflation metrics continuing to confirm sustained disinflation underway in the US, government bonds saw a rally this week as investors bet on a light at the end of the tunnel for interest rates. The chart of the 10-year (below) now looks like a double top, with yields moving notably lower this week.

4. US Dollar Index. With a drop in yields, we tend to see a corresponding fall in the US dollar’s dominance over foreign currencies. This is generally bullish for equities, as it makes US exports more valuable (dollar is less valuable relative to other currencies, so it takes more dollars to purchase the same goods).

5. Ark Innovation Fund. To give you an idea of how sentiment is looking, take a peek at Ark Innovation Fund (ARKK), which is a heavily tech-focused ETF. ARKK was finally able to clear through $45.50 this week, and volume shows that buyers are strong. This wildly improving sentiment for tech stocks can be seen below, with Bitcoin exposed equities.

Bitcoin Exposed Equities

6. Greenidge Generation (GREE). On the back of improving sentiment in an illiquid stock, we’ve seen a crazy last few weeks for several names, and GREE in particular. Lots of funds are clearly building big positions in this industry group, despite the 2024 halving set to cut their revenue in half. GREE is now up ~175% in the month of July.

7. All Bitcoin Exposed Equities. As always, you can see the Monday-Thursday performance of several Bitcoin exposed equities below. Interestingly enough, only 1 name this week (EBON) was able to outperform Valkyrie's Bitcoin Miners ETF, WGMI. WGMI was up over 23% between Monday’s open and Thursday’s close.

Bitcoin Technical Analysis

8. Bitcoin Price Chart. At the time of writing, Bitcoin’s chart looks solid. Price has emerged from this ~3 week consolidation to the upside, and buy volume was strong yesterday (113% greater than the 50-day average). $31.9-32K is proving to be a strong resistance zone for price, but a break above $31-33K could provide clear skies all the way up to $40K. This should be an telling weekend for BTC.

Bitcoin On-Chain / Derivatives

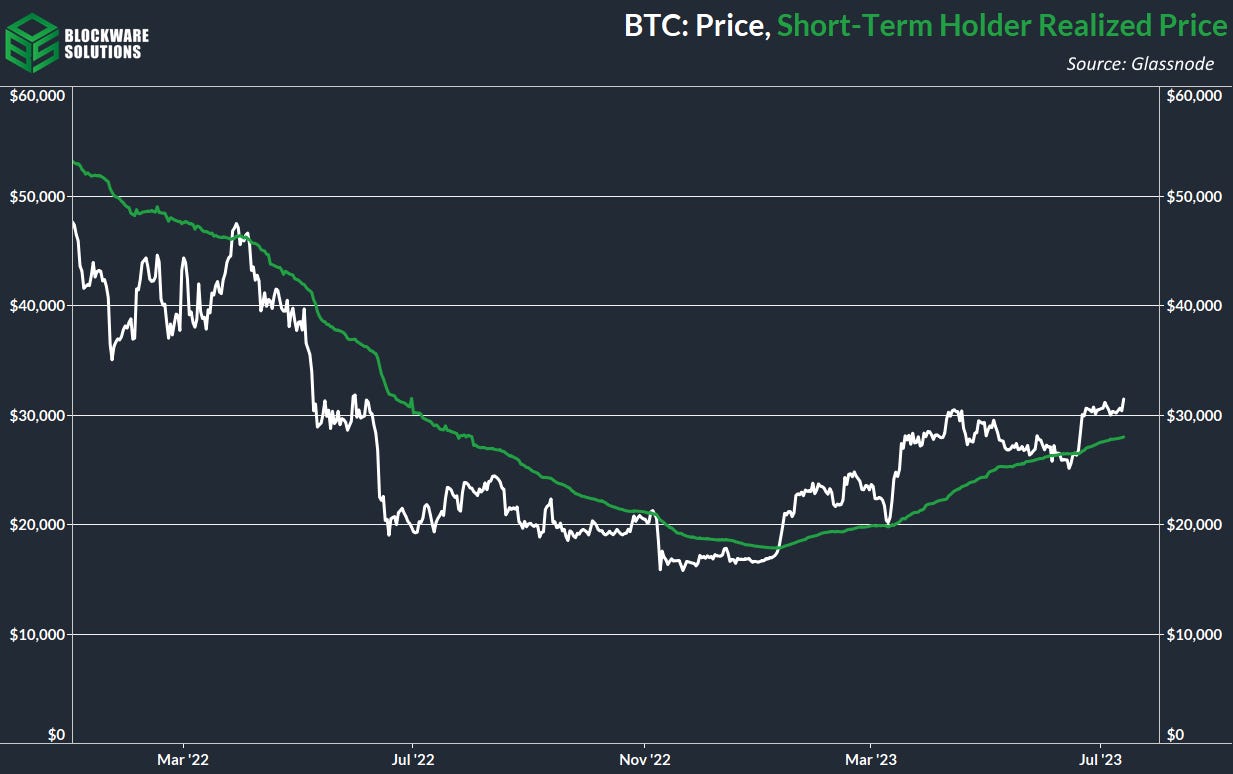

9. Short Term Holder Realized Price. The cost-basis of short-term holders (less than 155 days) is a major on-chain support level. This continues to rise, indicating BTC will likely continue to make higher lows in the foreseeable future.

10. “Pleb Accumulation”. Over the past year, entities with less than 1 BTC have continuously stepped in as buyers of last resort, marking multiple local bottoms. This occurred yet again this week before BTC soared past $31k.

11. Reserve Risk. BTC possesses little downside risk and significant upside potential based on the current price and the supply held by entities with a low probability of selling.

12. Days Since ATH. It has been 613 days since BTC was at an ATH. Should the 4-year cycle trend continue, we will likely surpass the previous ATH sometime in Q4 2024.

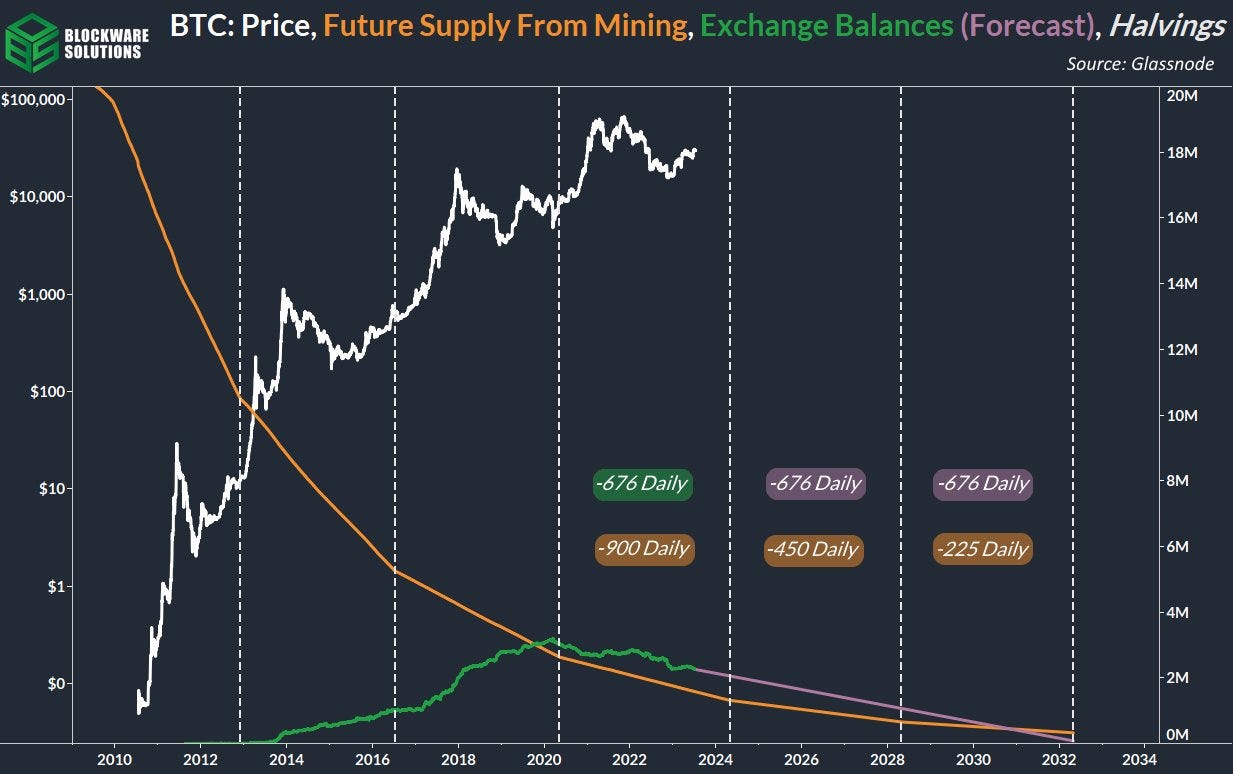

13. Exchange Balances: Exchange balances have declined at a rate of ~676 BTC per day during this halving epoch. Should this pace continue going forward, exchange balances will be under 1m BTC by the end of the next halving epoch.

Bitcoin Mining

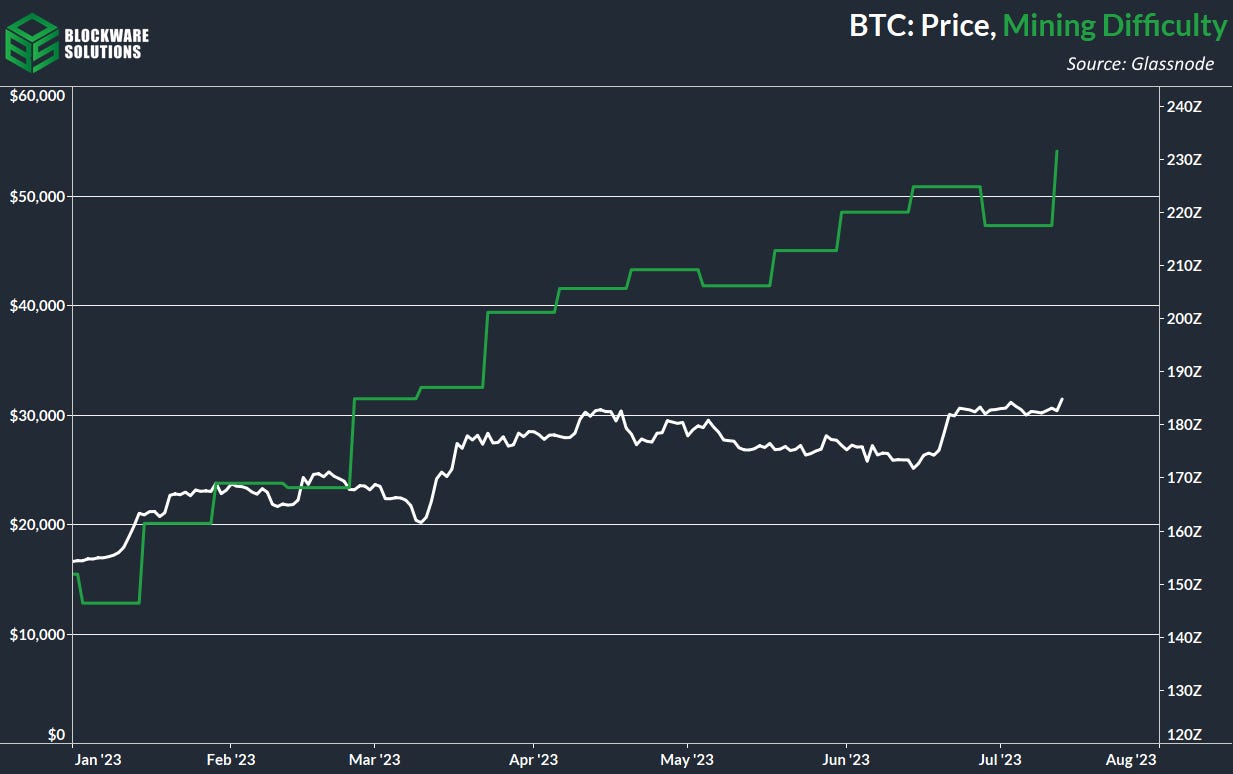

14. Mining Difficulty. A couple of days ago mining difficulty adjusted up +6.45% to new all time highs. While this was a large single upward adjustment, it slightly more than offsets the previous downward adjustment of -3.26%.

15. Next Difficulty Adjustment. A few hundred blocks into this difficulty epoch, difficulty is projected to fall back down, a potential sign of relief for miners.

16. $HIVE AI Pivot. As discussed on the Blockware Intelligence Podcast with Mike Alfred, the bottom was likely to be made when a large public Bitcoin miner rebranded to an AI company. This is now complete.

17. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$17,679 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Thanks for report guys

👏👍