Blockware Intelligence Newsletter: Week 92

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/19/23-6/23/23

🚨ASIC GIVEAWAY🚨

Complete these steps for a chance to win a FREE S19 Pro (110T).

Follow @BlockwareTeam and RT this tweet.

Sign up for the Blockware Marketplace.

Complete KYC & MPA that you will receive via email after step 2.

The winner is picked on July 4th. Good luck to all participants!

* If you refer a friend to the marketplace before July 4th, you'll receive 1 extra entry per referral that completes all entry requirements. Just be sure your referral tells us that you sent them!

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through June 2023.

Summary:

Chair Powell’s testimony in Congress showed an increased level of hawkishness since we heard from him last.

The 4-week moving average of Initial Jobless Claims has risen for the 3rd week in a row, and is not at a level not seen since 2021.

The major stock indexes have pulled back this week, leaving room for Bitcoin price to break into YTD highs.

Bitcoin miners are curtailing in Texas, stabilizing energy grids, and mildly dropping total network hashrate.

The breakeven electricity rate for a modern Bitcoin ASIC is $0.11/kWh.

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,150 worth of energy to produce 1 BTC.

General Market Update

It’s been an interesting week of price action, after the craziness that was last week.

Powell gave talks on the Hill all week, which showed a level of hawkishness that some may not have expected. The Fed Chair appeared quite confident that at least 2 more rate hikes are in the cards for 2023.

CME Group FedWatch Tool (Dec. 2023 FOMC)

The market is seemingly calling Powell’s bluff, having priced in a 25bps hike in July, and rates ending the year at 5.25-5.50%.

Across the pond, the Bank of England surprised investors with a 50bps hike to their market rate yesterday. This comes on the backs of inflation not coming down at the rate anticipated across the globe.

American Treasury yields moved higher on this news, as the dollar saw a nice uptick in demand versus foreign currencies.

In the labor market, we saw a third week of higher than expected Jobless Claims numbers.

Initial Jobless Claims, 1W (FRED)

Because IJC’s are a volatile metric, we like to look at the 4-week moving average of this number to gauge whether an uptick is just noise. As you can see above in red, the 4-WMA of IJC’s is showing that this uptick in American’s filing for unemployment benefits is significant.

Currently, the 4-WMA of Initial Jobless Claims sits at 255,750, its highest print since November 2021.

Overall, the major stock indexes have pulled back to short-term moving averages this week. After 8 straight weeks of gains for the NASDAQ, it’s looking like that win streak will be snapped today.

Nasdaq Composite Index, 1D (Tradingview)

As you can see on the chart above, the index has pulled back to just below the 10-day EMA. We wouldn’t be surprised to see the index touch the 21-day next week.

Yields also ticked higher this week, as previously mentioned. At this time, it doesn’t appear to be anything to be overly concerned about.

Heading into next week, note that May PCE Inflation is set to be released at 8:30am EST on Friday, June 30th.

Bitcoin Exposed Equities

On the back of the massive week spot Bitcoin has had, it shouldn’t be a shocker to see Bitcoin exposed equities ripping.

A few names in particular that look best are: HIVE, BITF, MARA, BTBT, HUT, IREN, BTDR, and APLD.

This week has made it quite obvious which names the institutions are piling into. The list shown above looks best at the moment, but that doesn’t mean everything else is worthless.

Keep a close eye on all the names listed below to track this industry group.

Bitcoin Technical Analysis

In case you missed it, Bitcoin has had quite the week of price action. Just this morning, Bitcoin broke into YTD highs above $31,000.

BTC/USD, 1D (Tradingview)

As you can see above, a major resistance level looms overhead between $31,900 and $33,000. If we can clear through this level, it looks like clear skies for BTC until the mid-$40k range.

Everyone who’s (theoretically) bought Bitcoin since June of 2022 is now at a profit, so conditions are ripe for a nice run here.

Heading into the weekend, keep an eye on $31,900.

🚨ASIC GIVEAWAY🚨

Complete these steps for a chance to win a FREE S19 Pro (110T).

Follow @BlockwareTeam and RT this tweet.

Sign up for the Blockware Marketplace.

Complete KYC & MPA that you will receive via email after step 2.

The winner is picked on July 4th. Good luck to all participants!

* If you refer a friend to the marketplace before July 4th, you'll receive 1 extra entry per referral that completes all entry requirements. Just be sure your referral tells us that you sent them!

Bitcoin Mining

Difficulty Decreasing Due to Demand Response in Texas

The summer heat is here in Texas. As discussed previously on the Blockware Intelligence podcast, it is reasonable to begin expecting seasonality in Bitcoin’s hashrate as miners turn off during periods of extreme hot and cold weather when energy becomes more expensive and the grid stressed.

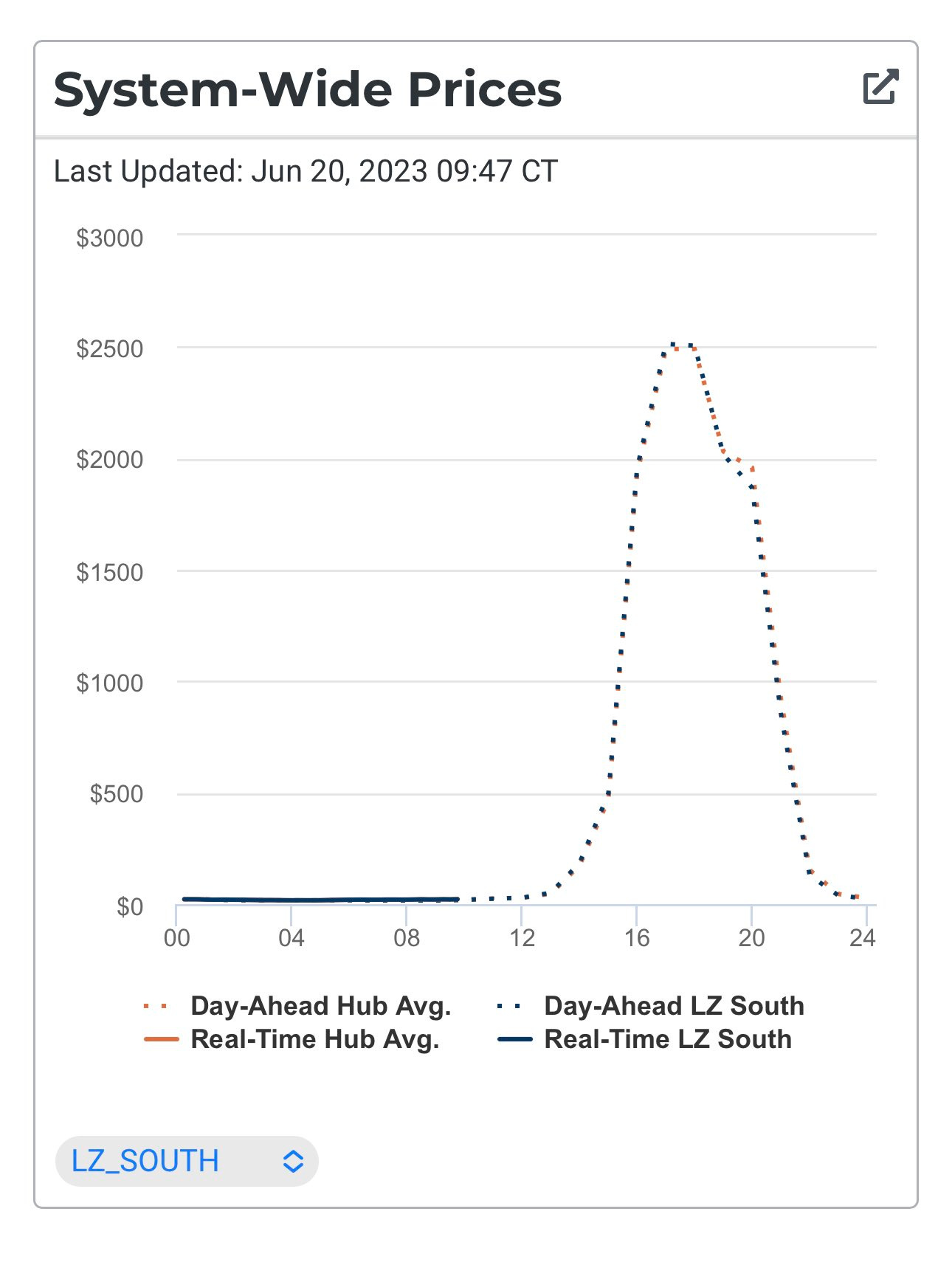

Chart of Texas energy prices on June 21st from @BitcoinPierre, VP of Research at Riot Platforms.

Much Needed Transparency is Coming to Hosted Mining

The Blockware Marketplace is becoming the ultimate platform for trading hosted Bitcoin mining rigs. Previously, hosted mining was a bit of a black box. Questions like where are machines running, what is their historical and current performance, whether they are currently online, what is the market price, and more are being answered by the Blockware Marketplace.

Below you can see Blockware has begun integrating 3rd party hosting sites into the Marketplace. On each individual rig’s page, you can learn more details about the company hosting your machine. You also have transparency into how machines have historically performed before purchasing, and once BTC is sent the machine starts hashing to you in minutes.

This is an absolute game changer for the hosted Bitcoin mining industry.

Mempool

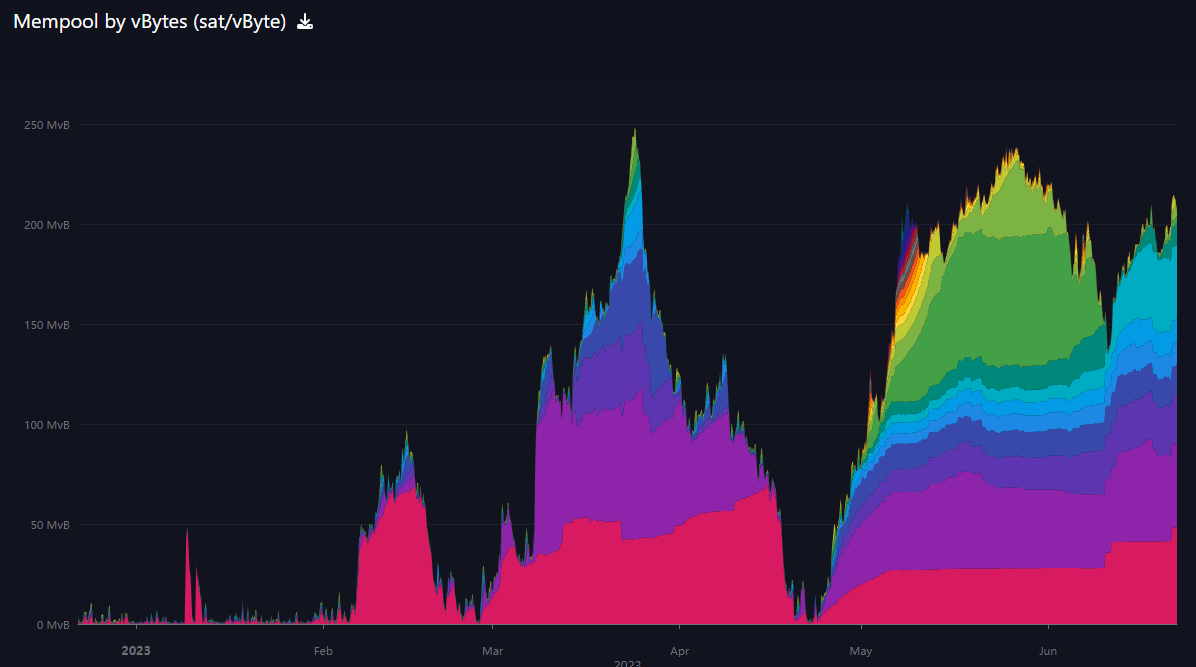

While transaction fees as a percentage of the total block reward has trended down significantly since its May highs, the mempool still remains fairly clogged with plenty of pending unconfirmed transactions.

Energy Gravity

The presented chart, which is based on a Blockware Intelligence Report, depicts the correlation between Bitcoin's production cost and its market price. The model facilitates the identification of overbought or oversold market conditions for Bitcoin, making it a valuable tool for visualizing price trends.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.