Blockware Intelligence Newsletter: Week 127

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 3/30/24 - 4/5/24

🚨Buy The Latest-Generation of Bitcoin Mining Hardware🚨

Blockware has partnered with a world-class immersion mining facility to bring you the opportunity to mine using the Whatsminer M66s.

288 TH/s (up to 330 EH/s when in “high performance mode”)

19.5 W/Th

Immersion has a few notable advantages over air-cooled mining:

Heat Resistance

Greater Up-Time

Longer Machine Lifespan

Superior Hashrate & Efficiency

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Bitcoin Continues to Coil

BTC has spent another week moving sideways in the upper $60,000’s range; trading at ~$67,700 at the time of writing.

Trading volume has trended down slightly over the past few weeks following the initial pump to new-highs. However, the 2024 halving is not only 2 weeks away. There’s a solid case to be made that, at this point in BTC’s lifetime, the halving is more a demand catalyst than it is a supply shock. 93% of the 21,000,000 BTC have already been mined into existence.

The marginal change in issuance is less impactful on a relative basis now than it was in previous halvings. What’s more likely is that the halving spawns new demand as it reinforces the fundamentals of Bitcoin, scarcity & decentralization. The fundamentals are ultimately what drives price in the long-term, increased awareness and education on the fundamentals is bullish.

That’s not to say that there definitely won’t be a supply shock induced by the halving. The price of any asset is set at the margin; marginally less supply coming in on a recurring basis will have some impact. The question is how much. And given the confluence of bullish catalysts, ETF inflows, impending QE, HODL’d supply, it’s impossible to segment any one thing as the driver of the Bitcoin price; there are many moving parts. Lastly, miners are the only force of consistent sell pressure on BTC. A decrease in the amount of BTC they can possibly sell is definitely not bearish.

2. Bitcoin ETF Flows:

Net ETF inflows for the week were positive yet again. Albeit, not with the same potency as some of the weeks prior. Despite uneventful price action of late, it’s important to view this through a longer-term lens. Just like the halving represents a long-term diminishment in sell-pressure, ETF inflows represent a long-term consistent source of buy-pressure that was previously non-existent.

Source: https://heyapollo.com/bitcoin-etf

3. Grayscale Bitcoin Outflows:

GBTC outflows have remained relatively consistent week-over-week. It’s interesting to note that for five consecutive weeks, GBTC outflows have been the highest on Mondays. The inability to trade ETFs on non-trading days, compared with spot BTC which trades 24/7/365, is a fun dynamic to watch. Volatility on weekends can induce fear or FOMO when the market re-opens.

4. KC Cattle Company Adopts BTC as Treasury Reserve Asset:

While they are nowhere near a company like MicroStrategy in terms of Market Capitalization and brand recognition, the KC Cattle Company made waves online this week as they announced the adoption of BTC as their treasury reserve asset.

Holding wealth in dollars undeniably results in a crippling erosion of wealth due to inflation. Bitcoin offers a life-raft to every business, family, or individual; regardless of balance sheet size.

Expect announcements like this to become commonplace over the next few years.

General Market Update

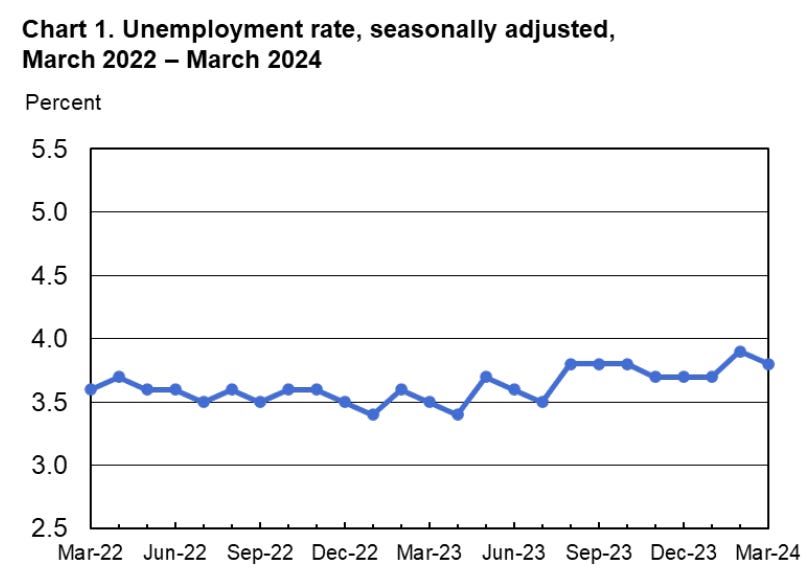

5. Unemployment Rate

The Bureau of Labor Statistics dropped the March employment data this morning. The unemployment rate remained relatively unchanged coming in at 3.8%. This metric, which is one of the Fed’s preferred indicators, is showing resilience in the labor market. Many anticipated a surge in unemployment as inflation decelerated over the past year, but that has yet to take place.

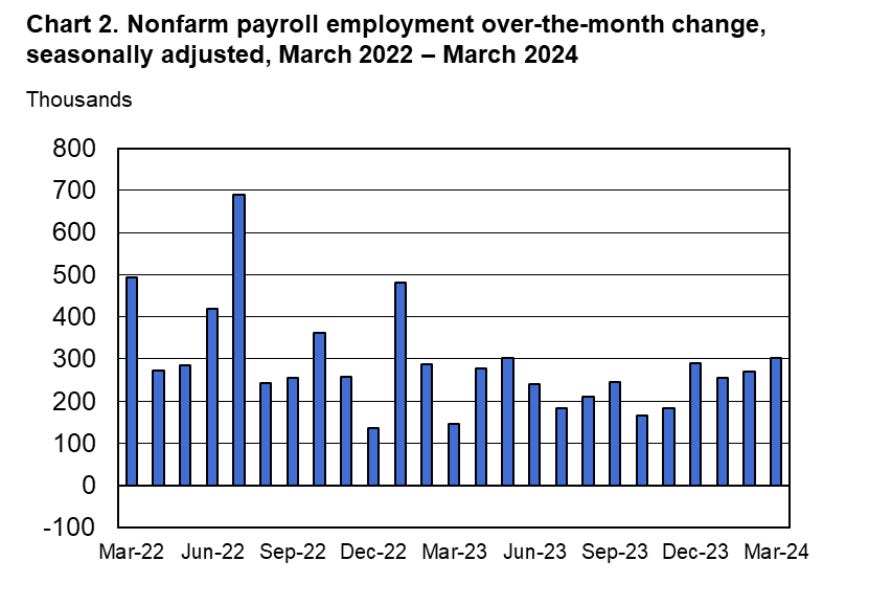

6. Nonfarm Payroll Employment

Nonfarm payroll data is also showing resilience in the labor market; with 303,000 jobs added in the month of march.

7. Fed Funds Futures

In the wake of the continued resilience in the labor market, CME Fed Funds Futures has now all but eliminated the possibility of rate cuts at the Fed’s May 1st meeting.

CME Fed Funds Futures has been shooting airballs when it comes to predicting Fed policy in 2024. In January they priced in less than a 2% chance of the Fed Funds Rate remaining at its current level by the May meeting. And they had over a 60% chance of two rate cuts by May.

8. 3 & 6 Month Treasury Yields

The six-month treasury yield is just beneath the Effective Federal Funds Rate; which is the bond market telling us that it doesn’t expect rate cuts for at least six months. Considering the US Treasury Market is the largest, most liquid, most sophisticated market in the world, it’s probably prudent to listen to what it is saying.

Bitcoin On-Chain / Derivatives

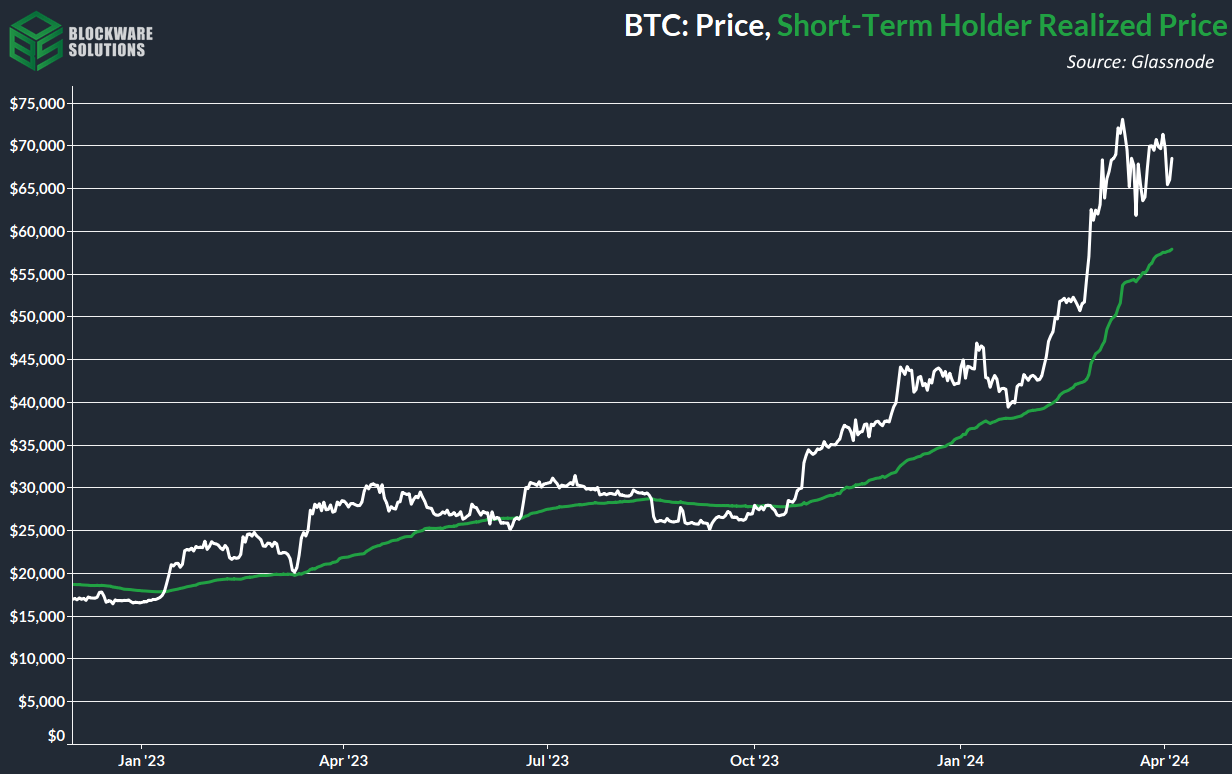

9. Short-Term Holder Realized Price:

As expected, the short-term holder price, the primary on-chain support level we are monitoring, is pushing higher. It now sits at ~$57,000. If the BTC price continues to move sideways for another month, as it has the past month, then the first collision with this metric since January will take place. 4 of the last 5 times this happened the BTC price moved higher, with the past 2 occurrences being rather explosive.

10. ETH / BTC:

ETH/BTC has at long last broken the notorious .05 support level. With large financial institutions acquiring BTC positions, and ETH battling numerous other blockchain platforms for DeFi market share, ETH/BTC will likely continue to decline throughout this cycle.

Bitcoin Mining

11. Countdown to Halving

The 2024 halving is so close you can taste. It’s set to take place two weeks from Saturday on the comical date of April 20th. It’s unlikely that there will be any short-term impact on BTC price. But there will obviously be an immediate impact on Bitcoin miners. Time is running out to upgrade hardware.

12. Hasharate

Hashrate is trickling up as we approach the halving, with the 14-day moving average at ~600 EH/s. The final difficulty adjustment prior to halving is currently projected to take place next week and increase mining difficulty by ~1.7%

13. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$27,700 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.