Blockware Intelligence Newsletter: Week 136

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/8/24 - 6/14/24

🚨Join us for a LIVE webinar: Tuesday, June 18th, Noon EST🚨

Do you want to learn more about hashtag Bitcoin mining?

Here's the agenda:

- Bitcoin Mining

- Mining with Blockware

- Customer Success Stories

- Q&A

We hope to see you there! RSVP below!👇

https://www.blockwaresolutions.com/webinar

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

River

Set up your on-ramp to Bitcoin with a reputable exchange giving you US phone support and top-tier customer service.

Sign up here: partner.river.com/blockware

Bitcoin: News, ETFs, On-Chain, etc.

1. BTC Consolidating

“Sideways summer” has continued for another week as Bitcoin consolidates around $67,000. Prolonged periods of sideways price action can be tiresome, but they don’t last forever. Bitcoin’s realized volatility is now at its lowest level since late February, right before it ripped to new all-time highs. The opportunity to stack at these levels may not last for too much longer.

2. MicroStrategy Issuing $700M in Convertible Debt to Buy Bitcoin

Michael Saylor refuses to take his foot off the gas. In continuation of the largest speculative attack in the history of financial markets, MicroStrategy has announced yet another convertible debt offering, this time to the tune of $700 million, with the proceeds earmarked for additional Bitcoin purchases. Saylor is on a quest to stack as much Bitcoin as possible and he is leveraging every available tool within capital markets. Legendary.

Read the official announcement here.

3. DeFi Technologies ($DEFTF) Adopts Corporate Bitcoin Treasury Strategy

It feels like every time I sit down to write this newsletter we’re covering an announcement of a new business adopting a corporate Bitcoin strategy. This week DeFi Technologies announced its strategic decision to adopt a Bitcoin strategy for their corporate treasury. Their stock is already up 45% since the announcement. $DEFTF has joined the ranks of MicroStrategy, Metaplanet, and Semler Scientific as corporate adopters of Bitcoin. Each of these businesses have seen their stocks perform exceptionally well. Every CFO in markets has been put on notice: adopt Bitcoin and win.

4. President Trump Meets with Bitcoin Miners

Former POTUS Donald Trump met with a delegation of Bitcoin miners this week, further signaling his stance as the “Pro-Bitcoin” candidate. The immersion of Bitcoin into the mainstream political discourse is a sign that Bitcoiners as a constituency are large enough and capitalized enough to be worth appealing to. This is an incredibly bullish sign.

Unconfirmed rumors are circulating on Bitcoin Twitter that the former POTUS is going to make an appearance at the world’s largest Bitcoin Conference taking place in Nashville on July 25-27th. You can get 10% off tickets to the conference by using the code BLOCKWARE at checkout. Click here to get your tickets!

5. Swan Bitcoin Sponsoring Tucker Carlson Live

Speaking of Bitcoin’s emergence into political discourse, Swan Bitcoin is going to be the flagship sponsor of Tucker Carlson Live, a country-wide tour by (arguably) the most popular figure in political media. Swan CEO, Cory Klippsten, had this to say about the sponsorship:

“Swan’s sponsorship of Tucker Carlson’s Live Tour is a massive opportunity to discuss how Bitcoin can help fix some of the world’s most pressing problems with hundreds of thousands of people across the country.”

There are two major details about this sponsorship that are worth highlighting. First: Swan is a Bitcoin-only company. Historically, deals with large, household name figures have come from “crypto” companies. Swan’s education at these events will provide a distinction between Bitcoin and everything else.

Second, it is reported that Tucker was the one inquiring about receiving a Bitcoin-only sponsor. Having previously interviewed Michael Saylor, it’s not surprising that Tucker may be journeying down the Bitcoin rabbit hole. A man with one of the largest platforms in media advocating for Bitcoin and Bitcoin-only will most certainly accelerate Bitcoin adoption.

General Market Update

6. May CPI Data & Fed Meeting

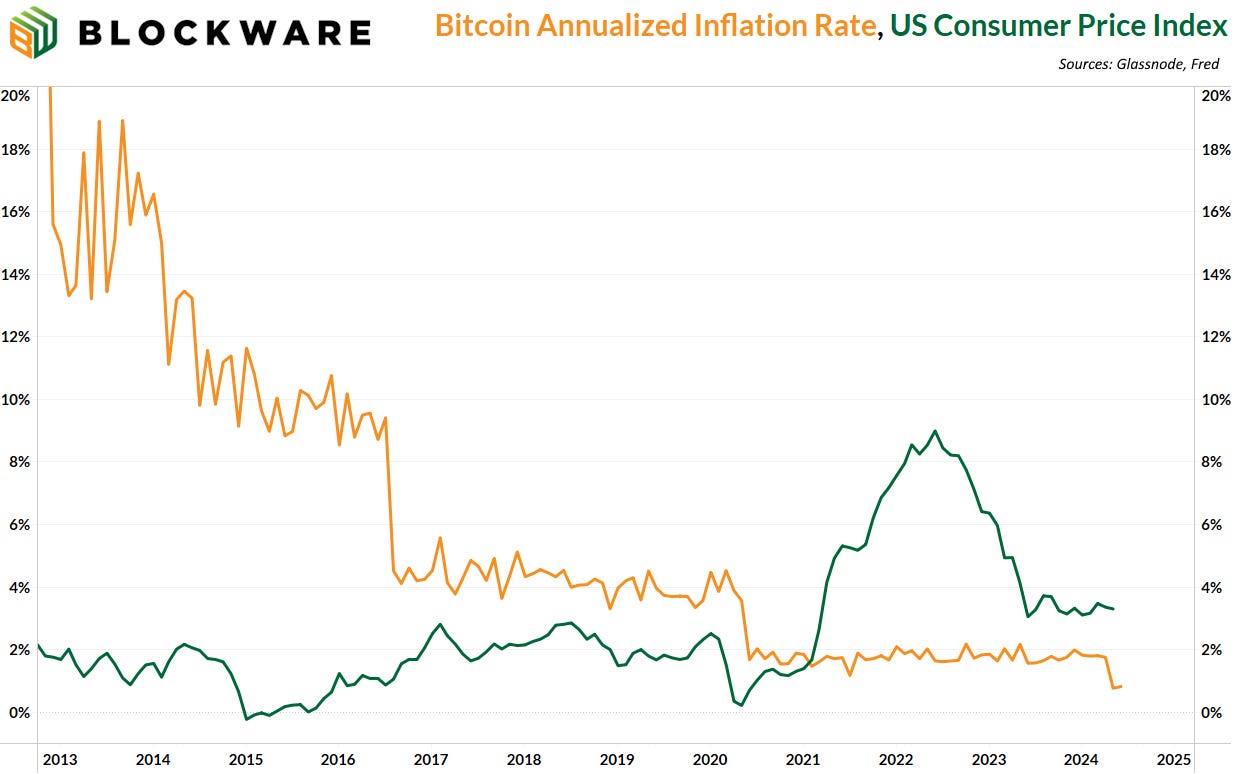

May’s Consumer Price Index was released this week, coming in at an annualized growth rate of 3.3%. “Sticky” is the best way to describe the CPI data; persistently remaining above the Fed’s historical target rate of 2%.

The Federal Open Market Committee (FOMC) concluded its June meeting by keeping the federal funds rate unchanged at 5.25% to 5.50%, marking the seventh consecutive meeting without a rate hike. This decision aligns with the Fed's ongoing efforts to monitor inflation and economic conditions closely before making further adjustments.

The chart below provides an interesting juxtaposition of Bitcoin’s inflation rate compared to the consumer price index. After the most recent halving, Bitcoin has an annualized inflation rate of less than 1%, and that is programmatically designed to drop to zero.

7. End of Petrodollar Agreement

A historic shift is underway as the Petrodollar agreement, which has long underpinned the global oil trade with U.S. dollars, has come to an end. The Petrodollar agreement required that Saudi Arabia only accept payment in US Dollars for Oil for exports. The Saudis have not taken any steps to renew this agreement. Saudi Arabia is currently the world's largest oil exporter, leading the global market with significant dominance. In 2022, Saudi Arabia exported approximately $236 billion worth of oil, which accounted for 16.2% of the world's total oil exports.

This is yet another sign of decreasing global demand for dollars. This paves the way for other currencies, namely Bitcoin, to rise as a means of trade within global energy markets.

SVRN Energy

SVRN is more than a premium energy drink! It's your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats!

Use Code "BLOCKWARE" for 10% off.

https://svrnenergy.com/?v=f24485ae434a

Bitcoin Mining

8. $WGMI Making Moves

Bitcoin mining stocks have been ripping as of late despite the sideways price action from BTC. $WGMI, the mining stock ETF, is up to ~$21.44 per share, with month-over-month gains of ~52%. Leading the pack has been $IREN, which is up 163% over the same period.

9. Miner Revenue from TX Fees

On-chain transaction fees were volatile this week, providing some nice supplemental income to Bitcoin miners. Transaction fees comprised as much as 41% of the total block reward last weekend.

We’ve received quite a few new readers lately, so let’s refresh how fees are determined on the Bitcoin network. It is purely through the market forces of supply and demand. There is a limited amount of transactional data that can be included in each Bitcoin block. Users bid to have miners include their transactions over others. When demand for block space is high, bids increase and miners earn more BTC as a result.

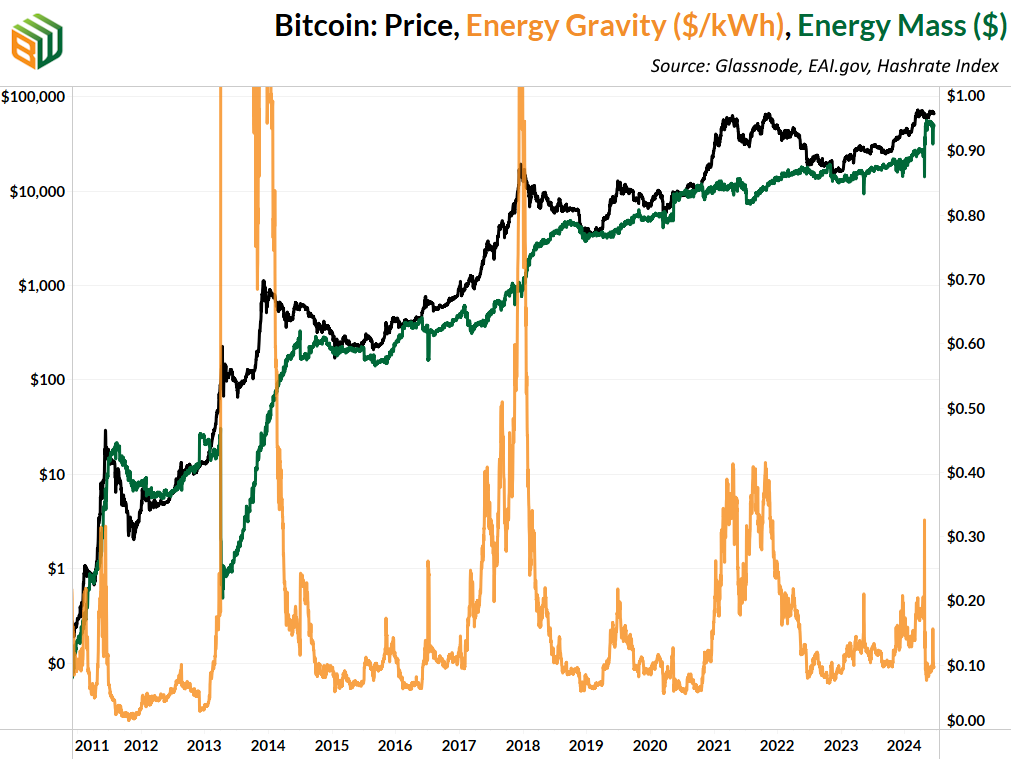

10. Energy Gravity:

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$49,100 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.