Blockware Intelligence Newsletter: Week 103

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/2/23-9/8/23

Blockware Solutions Labor Day Special

If you purchase ASIC(s) before 11:59pm EST on Friday, September 8th, you will secure a 7¢ per kWh hosting rate. This will lower your monthly operating costs by 12.5% compared to an 8¢ rate; factor that across a few dozen machines and you’ll save thousands of dollars each month.

Contact sales@blockwaresolutions.com to bulk order machines at a discounted rate.

Blockware Intelligence Sponsors

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

1. Blockware Intelligence Podcast. Joe Burnett is joined by Blockware’s very own On-Chain Analyst, Mitchell Askew. Joe and Mitch discuss money, capitalism, free markets, Bitcoin, the American Revolution, and more!

General Market Update

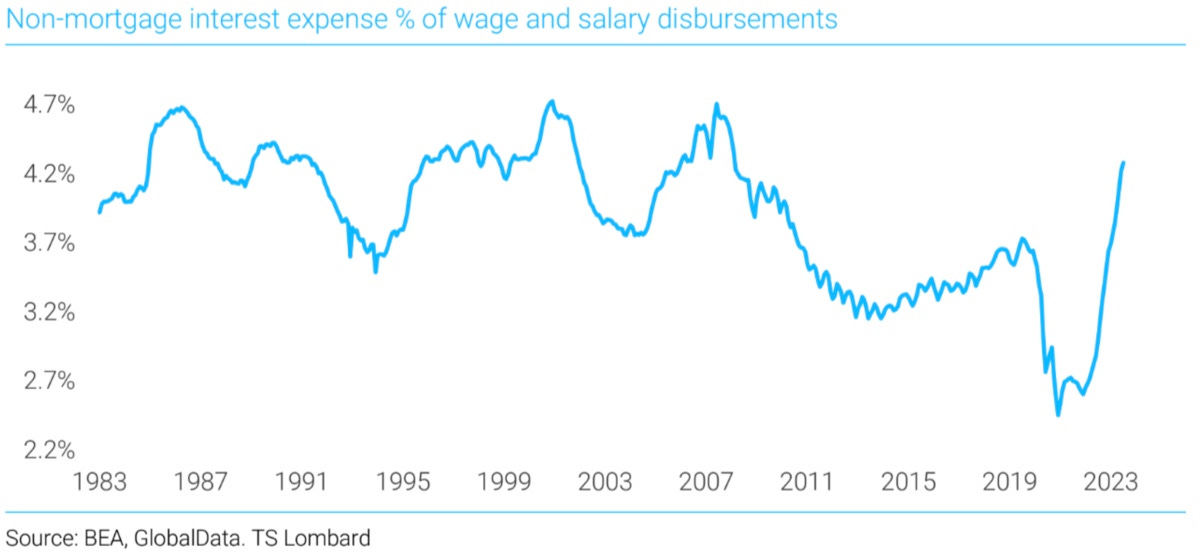

2. Consumer Interest Expense. Interest payments as a percent of total wages have skyrocketed to over 4.2% in recent weeks. This level is now at its highest since the great financial crisis, and is in-line with previous recessionary levels. Despite higher interest rates continuing to take their grip on the American economy and consumer, the market looks ahead to the distinct possibility of higher interest rates to come.

3. C&I Credit Demand. The outlook for banks in regards to demand for C&I credit is now down to its lowest level since 2009. As you can see in 2001 and 2008, large drawdowns in loan demand preceded recession.

4. ISM Services PMI. ISM’s August PMI report showed an unexpected jump from the services PMI to 54.5 from 52.7 last month. This is signaling a stronger-than-expected performance from the services sector and supplies more evidence to the Fed that the economy is running hot. The market has now priced in a significant possibility of another rate hike in November.

5. Nasdaq Composite Index. Despite the pullback we’ve seen from equities this week, the Nasdaq has flashed some signs of underlying strength in the last few days. On Thursday, the index gapped down below short-term moving averages but managed to reverse higher from the open. Heading into the weekend, keep an eye on the 50-day SMA hanging overhead at $13,872.

Bitcoin Exposed Equities

6. Coinbase. There are a few names that have shown some strength this week following the ruling from the FASB (more on this below). COIN is a good example of a name that may be in the beginning stages of building out a rounded base. The FASB ruling is to the benefit of Bitcoin-exposed equities, and several of them have seen a decent week due to the potential for a bump in valuation metrics next bull run driving more capital into the space.

7. Comparison Table. The spreadsheet below compares the Tuesday-Thursday performance of most Bitcoin-exposed equities. ANY, COIN, RIOT and MARA catch our eye this week, all being up roughly 7%, despite BTC being down almost 2%.

Bitcoin Technical Analysis

8. Bitcoin / USD. As we’ve pointed out for the last couple of weeks in a row, Bitcoin price has continued to attract buyers around its year-to-date anchored VWAP. We would of course hope to see this level hold, but a break below could quickly see BTC in the $21.5k range. This weekend keep a close eye on this $25.3k level.

Bitcoin On-Chain / Derivatives

9. FASB Rule Change: The Financial Accounting Standards Board (FASB) changed its policy on how US-based businesses (public, private, and non-profit) are supposed to mark BTC on their balance sheets. This is a highly beneficial change as now businesses are able to mark their BTC at “fair value”, whereas previously BTC was an “indefinite-lived intangible asset” which meant its value on the books had to be marked at whatever the lowest price it reached since the entity acquired the BTC. For example, a business that bought BTC at $20,000 last September would have had to mark it on their books at its November low of ~$15,800, despite BTC now being worth ~$26,000. This is a huge step in incentivizing more large, publicly traded companies to follow in the footsteps of Microstrategy. Check out this clip of Michael Saylor discussing this exact topic on the Blockware Intelligence Podcast. This change will go into effect for the 2025 calendar year.

10. Short-term Holder Realized Price: STH RP, the aggregate cost-basis of BTC that has been moved within the last 155 days, previously serving as support has now flipped into resistance. This level can be resistance as short-term traders may seek to sell at their cost-basis as it would allow them to “break even” on their trade. This is an important level to keep an eye on when attempting to gauge near-term price action.

11. Supply active within the last month: An all-time low of 5.4% of Bitcoin’s circulating supply has been moved within the past month. Price is set at the margin, which means those who trade Bitcoin back and forth drive short-term price action. As supply-side illiquidity continues to increase, as indicated by fewer supply exchanging hands, any demand catalyst will send the price skyrocketing.

12. “Pleb” Accumulation Market Cap Adjusted: Iliquidity is currently a factor on the demand side as well. The change in supply of Bitcoin held by entities with less than 1 BTC (“plebs”) is a good way to measure the demand from hardened, price-agnostic, Bitcoin buyers of last resort. During significant price drops over the past two years these users have “bought the dip” with tremendous force. Adjusting this metric for market cap allows us to compare their buying power from a dollarized perspective; because buying at $16k will of course result in more BTC being accumulated than when buying at $26k with the same dollar amount. A slight uptick in this metric, compared to the drastic spikes during past price dips, indicates a diminishing enthusiasm/demand from the plebs for stacking on dips. Just as sellers are becoming exhausted, buyers appear to be exhausting themselves as well. This could be for a variety of reasons: increased costs of living = less disposable income, stacking cash for fear of recession/job loss, waiting for a bullish catalyst before buying, etc. Fortunately for the bulls, numerous catalysts for demand are looming and there are no indicators that supply side illiquidity will end anytime soon.

13. Hashprice: Miner revenue per terahash is pushing new all-time lows in the face of the recent price drop. Miners being forced to sell a majority of their Bitcoin to cover operating expenses will have a negative effect on the price. If hashprice remains low as we approach the halving, the weakest miners , inefficient machines and high electricity costs, will be forced to capitulate. At that point sell pressure will be greatly reduced and BTC will likely begin rising.

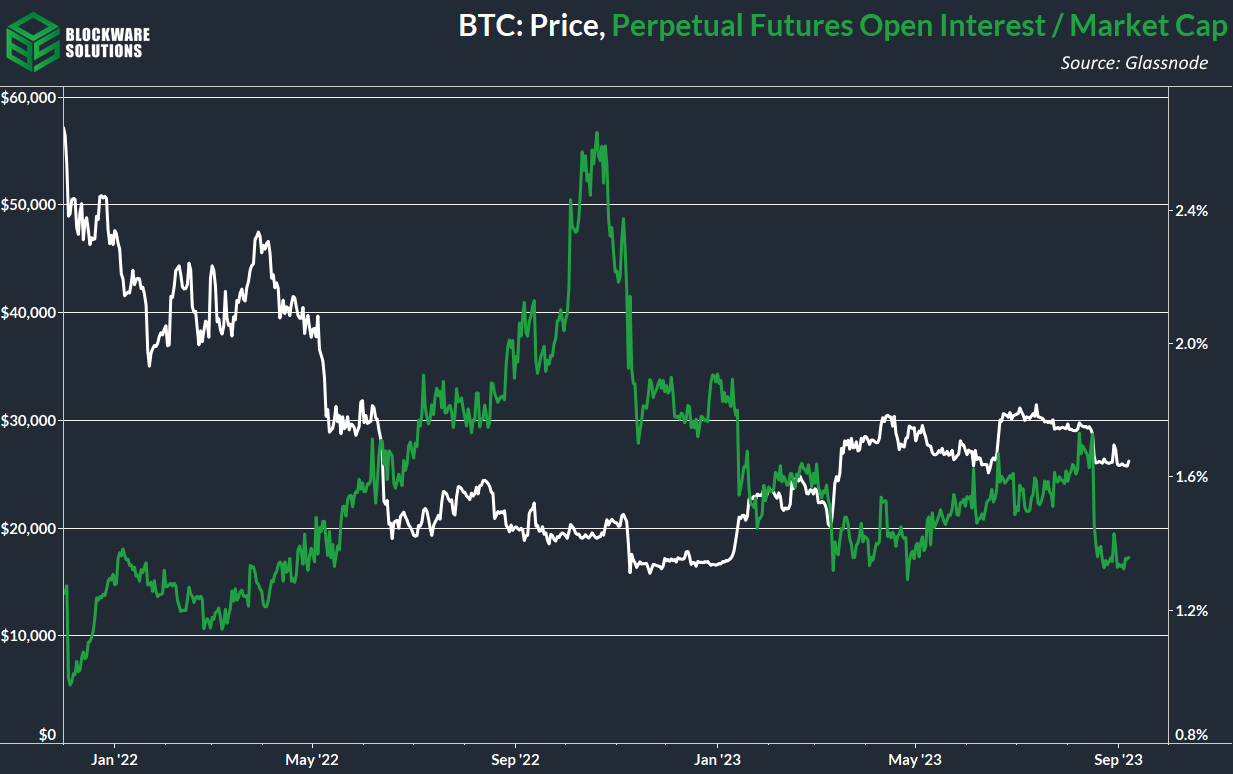

14. Perpetual Futures Open Interest / Market Cap: There has been no change in open interest, nor open interest relative to market cap. After the massive leverage wipeout at the end of August, it appears that futures traders are taking a more cautious approach going forward. These leverage wipeouts are good as it can set the stage for healthy price appreciation.

Bitcoin Mining

15. Texas Curtailment. Miners in Texas like Riot Platforms ($RIOT) and Iris Energy ($IREN) reported a highly profitable month of August due to the Texas energy grid being highly strained. Bitcoin miners powered off and returned energy back to consumers to avoid a blackout.

16. Texas Grid Answers. Pierre Rochard, VP of Research at Riot Platforms, posted these four points that lead to the incredible conclusion of electricity ratepayers end up paying significantly less thanks to Bitcoin miners.

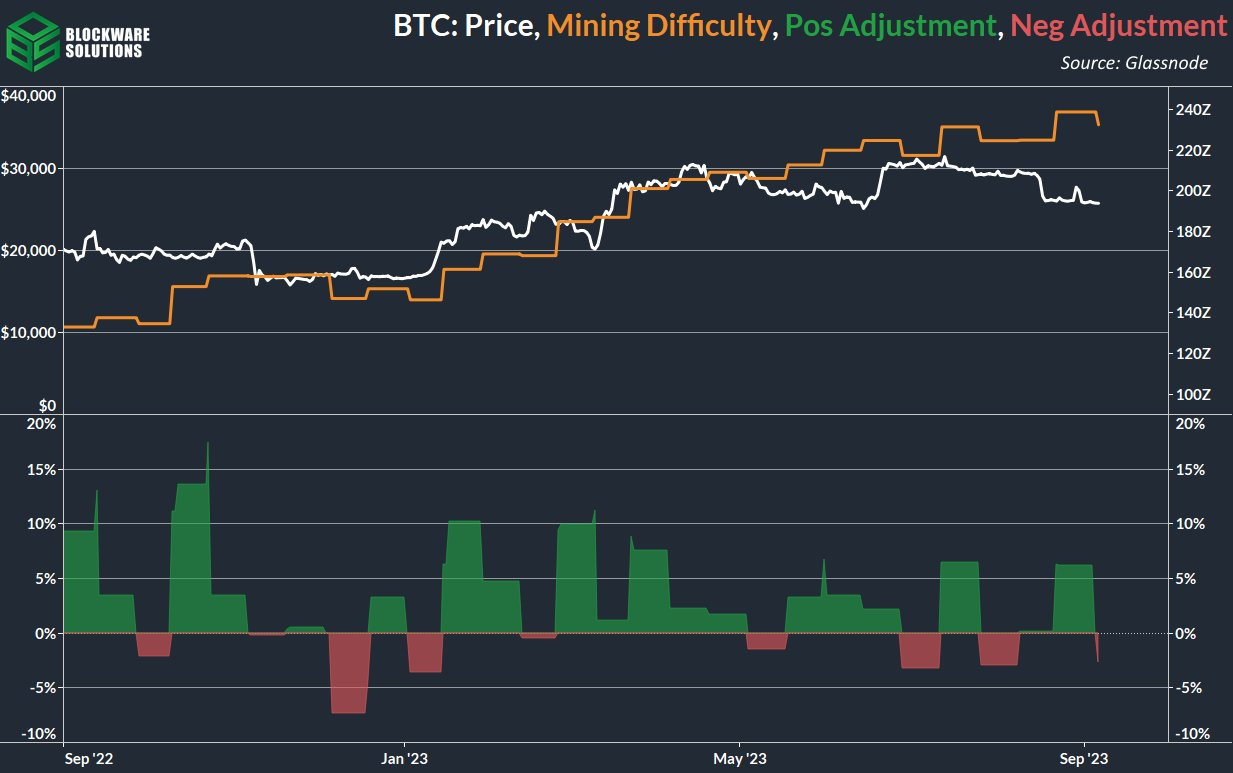

17. Negative Difficulty Adjustment. Earlier this week, Bitcoin miners experienced a slight negative difficulty adjustment of -2.65%. This can be at least partially attributed to the Texas miner curtailment.

18. Energy Gravity. At a typical hosting rate today, new-gen Bitcoin ASICs require ~$18,242 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.