Blockware Intelligence Newsletter: Week 87

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/6/23-5/12/23

Blockware Intelligence Sponsors

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin.

No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

Get yours today at:

https://foundationdevices.com/?mtm_campaign=Blockware

Use code: BLOCKWARE for $10 off!

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through May 2023.

Blockware Intelligence Podcast

This week on the Blockware Intelligence Podcast, Joe Burnett is joined by Drew Armstrong, President of Cathedra Bitcoin, a publicly traded Bitcoin mining company, to discuss surviving the 2022 bear market as a Bitcoin miner, preparing for the 2024 halving, Bitcoin mining and energy markets, hyper-bitcoinization, and more!

Check it out!

Summary

April Headline CPI came in at 4.9% YoY and 0.4% MoM.

Spot Bitcoin price has broken down below its previous consolidation range with support likely coming around $25,000.

Short-term holder realized price will likely be tested as support for the second time this calendar year.

Leverage induced volatility sends BTC down to ~$27,000.

Retail sized entities continue to show their willingness to buy the dip.

Transaction fees as a percentage of the block reward remain incredibly high.

Higher fees has resulted in a nice surge to miner revenue, as denoted by Bitcoin energy gravity.

General Market Update

It’s been a fairly quiet week in the markets following last week’s FOMC decision.

On Wednesday we received the CPI numbers for April, which showed a lower-than-expected growth of 4.9% YoY. This was down from 5.0% in March, and below estimates of 5.0%.

On a monthly basis, CPI rose by 0.4% from March, which was in-line with expectations. Core CPI came in at 5.5% YoY and 0.4% MoM, both as expected.

This now marks the second consecutive month where Core CPI has exceeded Headline CPI, showing that declines in energy prices are the main drivers of the disinflation underway in the United States.

PPI numbers also supported the disinflationary narrative, dropping to 2.3% YoY in April from 2.8% in March.

Despite inflation coming down, the market clearly doesn’t expect any rate cuts to come in 2023. The 3-month Treasury’s yield remains at highs, and the 6-month isn’t far below its highs either.

The short maturity Treasuries have been a great indication of rate sentiment in 2023, if rates were expected to head lower in the near-term, their yields would be dropping.

The stock market has also had a pretty strong week, despite the Nasdaq being roughly flat on the week (at the time of writing).

Nasdaq Composite, 1D (Tradingview)

The Nasdaq made a YTD high on Thursday after pulling back to its 21-day EMA last week.

The index is now a bit extended from its longer-term moving averages, so we could see a more sustained pullback in the coming sessions.

Bitcoin Exposed Equities

It’s been an interesting week of price action for Bitcoin-exposed equities. Many of these names have begun to break lower following the weakness in Bitcoin price action.

CLSK vs. BITF, 1D (Tradingview)

Cleanspark is a name that has stood out among the crowd after holding its 10-day EMA. Compare this price structure to that of BITF, for example, and you can see true relative strength at play.

This is not to say that BITF is a “bad” miner, but the market clearly sees something in CLSK that it likes.

IREN, MARA, and BTBT are some other names that appear to be showing strength against the rest of the industry group.

Above, as always, is the excel sheet comparing the Monday-Thursday performance of several Bitcoin exposed equities.

Bitcoin Technical Analysis

This isn’t much to update this week, other than the fact that BTC appears to be breaking down for the short-term. After consolidating for the last several weeks, Bitcoin has broken below its previous range.

Bitcoin / US Dollar, 1D (Tradingview)

As you can see above, the lower trendline supporting the previous range was broken on Thursday. The next major support range we see lies at roughly $25,000.

This is more than likely to be a short-lived hiccup, as current price structure supports the idea that we’re in the bottoming phase of a bear market. However, investors should keep an eye on price in the short-term, as risk appears to be heightened as liquidity is drying.

Bitcoin On-chain and Derivatives

If you recall from last week’s newsletter, we were expecting heightened volatility to commence. We were correct on the front, but unfortunately, the volatility has been to the downside. However, this dip is relatively minor and is no cause for concern. All indicators are still pointing to the idea that BTC is currently in the “bear market recovery” phase of the cycle.

Short-term holder realized price has historically been a strong support level during the recovery or bull market stage; and it has already held support once this year. With price just under $27,000 and STH RP just over $25,000, they appear to be headed for another test. If the support holds we could be looking at a nice bounce up.

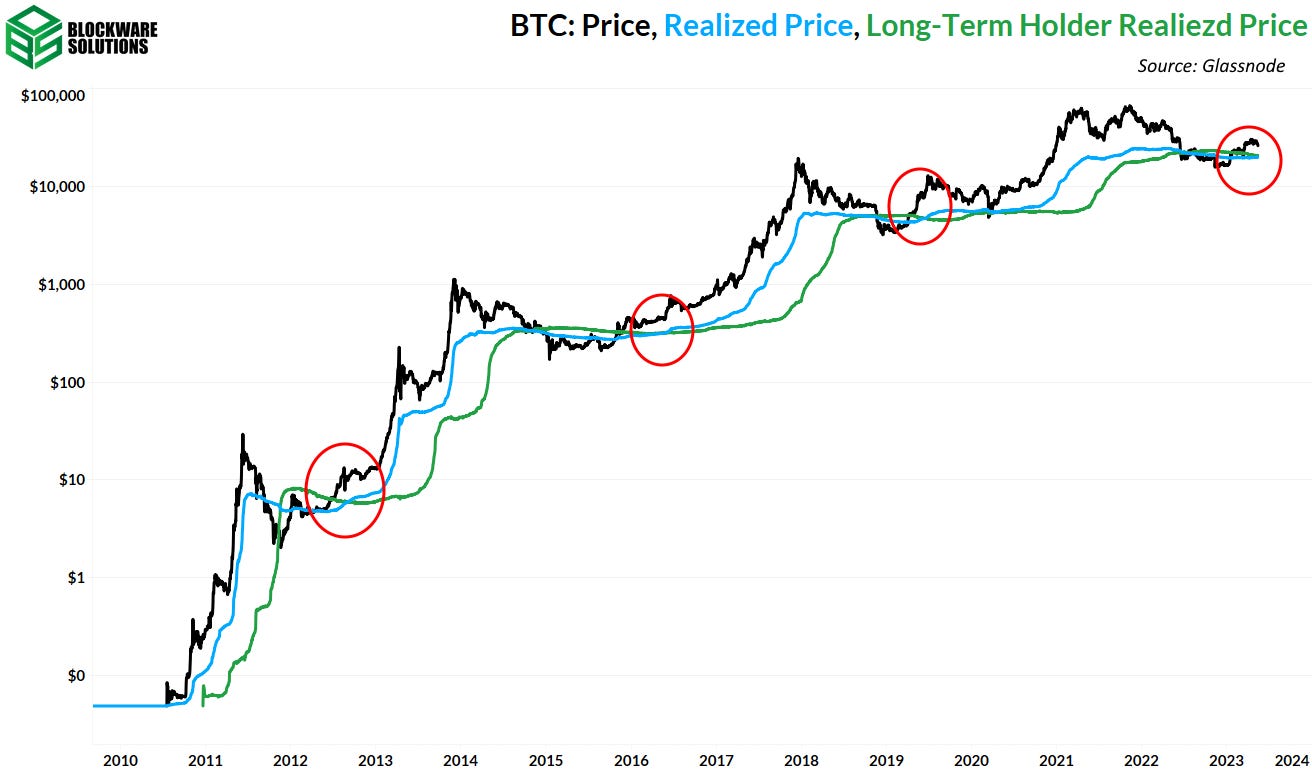

Looking at long-term holder realized price as well as realized price (aggregate cost basis of all market participants), they are nearing a bullish cross which has accurately signaled previous bear market bottoms.

A retest of short-term holder realized price in the near time is potentially likely.

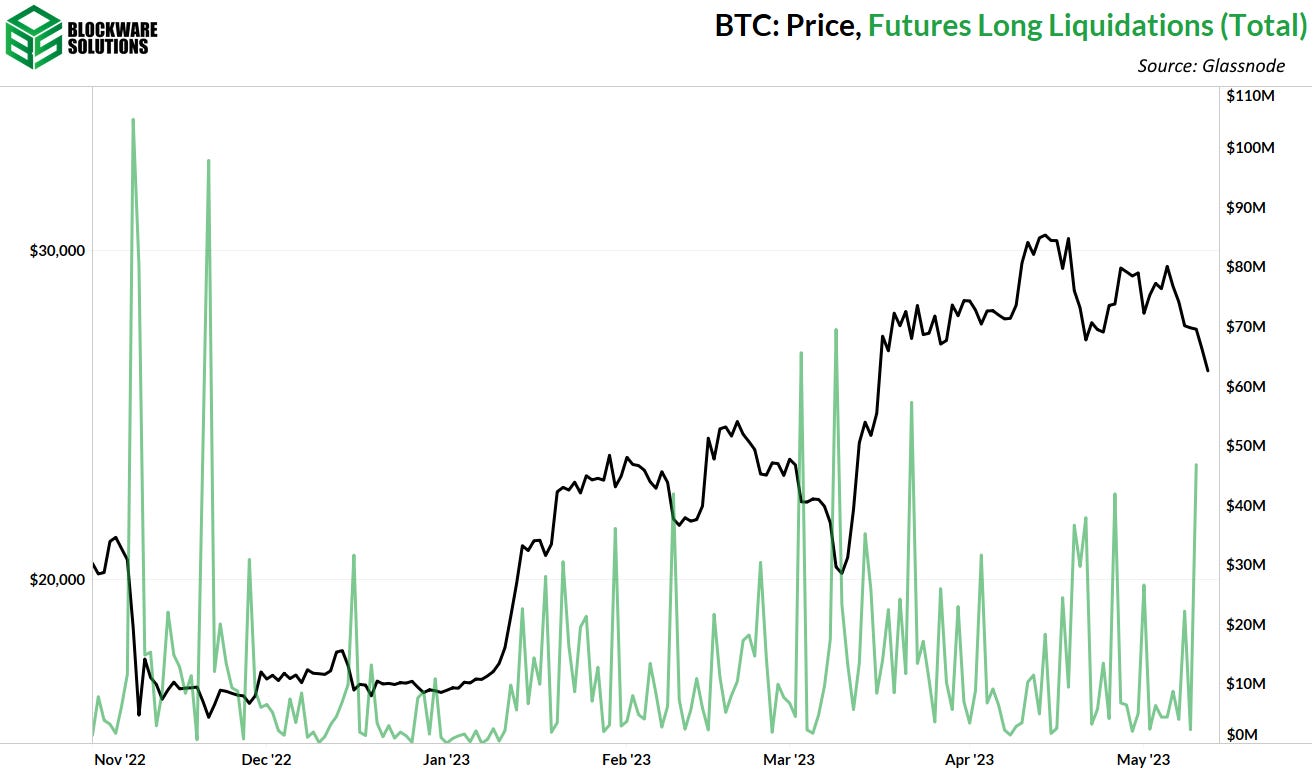

On Wednesday, perpetual futures open interest declined by ~$500,000 as the volatility forcefully liquidated futures traders. Furthermore, price declined again on Thursday, yet, open interest increased, which means the market is taking on more leverage during this period of volatility, which could potentially result in more longs being liquidated in the near term.

Total futures long liquidations on Wednesday reached ~$47,000,000, the highest amount since March of this year. This highlights the short-term impact that leverage can have on the price.

Once again we are going to look at perpetual futures open interest as a percentage of the total BTC market cap. Observing the 30-day change in this metric, we can see that the recent periods of deleveraging are far more significant than the periods in which the market takes on more leverage. Positive values (green) indicate the market is entering a more leveraged position, negative values (red) indicate the market is deleveraging.

The trend we’ve seen so far in 2023, and likely will continue to see, is the following cycle:

Spot bids the price up due to increasing demand and tight supply → excited by the price action, market participants take on leverage → a period of sideways price action with volatility until leverage clears out → now that the market is free of leverage, spot bids the price up higher → rinse and repeat.

Another reason that cycle is likely to continue is because traders have no sense of direction at the moment. Funding has been in a mixed regime for multiple months now.

Funding rates tend to be positive in general as there is an inherent long bias in BTC, but the consistent flips to negative funding, as well as lower highs in positive funding, indicate that this is a mixed regime.

This lack of directional conviction is playing a role in the mid-term trend of deleveraging.

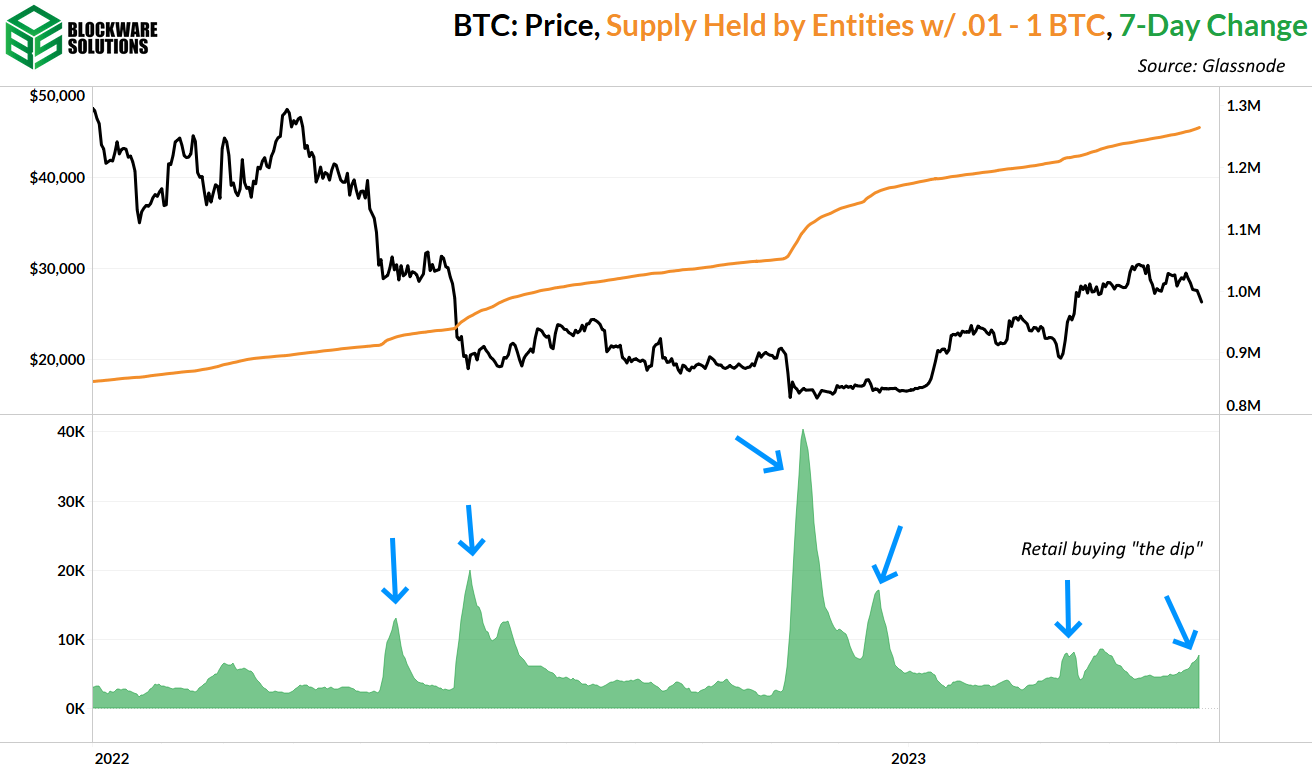

Entities with less than 1 BTC are accumulating at a more aggressive pace during this price dip, continuing a trend we have seen throughout the bear market: when the price dips lower, retail stacks harder.

This level of conviction in an asset, combined with BTC’s absolute and verifiably scarce supply, is why we are incredibly long-term bullish on BTC.

Bitcoin Mining

Bitcoin Transaction Fees

Bitcoin transaction fees as a percentage of the block reward skyrocketed over the past week, topping out at over 40%. The mania has cooled off slightly but fees still remain relatively high at ~17% of the total block reward.

Energy Gravity

The presented chart, which is based on a Blockware Intelligence Report, depicts the correlation between Bitcoin's production cost and its market price. The model facilitates the identification of overbought or oversold market conditions for Bitcoin, making it a valuable tool for visualizing price trends.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Why the sudden drop in production cost?